MF3d

Summary

I recommend a buy on Proterra (NASDAQ:PTRA). Investors can possibly make significant returns due to the massive mispricing at the current valuation. It’s a thriving business with exciting plans for the future of electric buses and transportation. The business is equipped with mechanical, electrical, and software engineering expertise, which it uses to vastly advance its products at low cost.

Company overview

Proterra’s mission is to produce the highest quality commercial vehicles in the world in order to accelerate the development of electric vehicle technology. This company has a business model with two divisions (Proterra Powered and Energy and Proterra Transit) and three departments. All three industries work together to form a solid infrastructure for the electrification of commercial vehicles.

Proterra Powered and Energy offers technology solutions to commercial vehicle manufacturers and fleet owners. This business unit consists of two business lines.

- Proterra Power manufactures, develops, sells, and integrates vehicles’ electrification solutions and battery systems. It provides solutions to global commercial vehicle OEM customers who serve in Class III to Class VIII vehicle segments globally.

- Proterra Energy specializes in providing turnkey fleet-scale and integrated high-power charging solutions. These solutions optimize energy consumption and costs and provide vehicle-to-grid performance. It also offers software services, including fleet planning and fleet and energy management software-as-a-service.

Proterra Transit is a business unit in North America that makes, designs, develops, and sells electric transit buses for public transit agencies, universities, airports, and other commercial transportation fleets.

Efficient battery design

PTRA satisfies the needs of each individual customer while still respecting the limitations imposed by each vehicle’s design. The company provides a modular battery platform that can be designed for multiple configurations on a single production line. When it comes to commercial vehicles, PTRA manufactures a wide selection, including a wide range of chassis sizes, weight classes, and frame rail lengths. Instead of spending money on expensive customization or retooling, the company wants to grow its market share by making products for many different kinds of vehicles.

The battery modules are manufactured by PTRA, which employs a simple design and an integrated architecture. In order to accommodate a wide range of frame rails, the company offers its battery packs in two different heights and widths. As a result of the adaptability and scalability of their batteries, the company is able to provide options for a wide variety of commercial vehicle types and sizes. Shuttle buses and vans use 35 kWh battery systems, while long-trail trucks and heavy machinery use 1 MWh or more.

To maximize reliability, energy density, and economics, PTRA designs battery systems from the ground up. The company is able to do this thanks to an efficient design that integrates the module structure, cooling mechanisms, and pack structure into a single component, thereby cutting down on complexity, bulk, and cost. Due to the high energy density of their battery systems, these automobiles are more fuel efficient, have longer ranges, and can carry more people or more cargo.

The company’s main goal is to meet the needs of the most complex and diverse routes for commercial vehicles. The variable-speed transmissions in PTRA’s drivetrains are known for their ability to make the most of both torque and efficiency.

When compared to diesel’s low fuel performance of less than 5 mpg, their electric vehicles can achieve over 20 mpg, which translates to substantial savings. Regenerative braking systems cut down on how often brakes need to be replaced. The low cost of these designs is also due in large part to the fact that they have fewer moving parts and don’t need oil changes.

Unique drivetrain design

PTRA uses cylindrical cells made by a number of different international cell manufacturers, all of which conform to PTRA’s specified form factors. PTRA’s battery design is flexible in terms of both chemistry and manufacturer, where energy density, cycle life performance, cost, acceptable charge rate, and safety are all taken into consideration when selecting the cells used. This technology was developed through teaming up with LG Chem Ltd. Each battery pack, and thus each module, has its own battery management system. These two parts keep tabs on the battery pack and relay data to the automobile.

Most of the energy supplied by the battery pack is used by the drivetrain, which includes the traction motor, controller, inverter, and transmission, to achieve the vehicle’s desired performance. PTRA worked with industry leaders in engineering and production to develop a single-and dual-motor drive system. Three-phase, liquid-cooled, permanent-magnet motors are used in both drivetrains.

When compared to other commercial diesel vehicles of comparable size, PTRA claims that their buses perform better. When compared to a traditional internal combustion engine, the electric motors on the bus provide instantaneous and consistent power, regardless of whether the bus is at rest or traveling at high speeds. Proterra’s drivetrains are much more manageable and lightweight than standard powertrains. The electric motor in the drivetrain weighs 90 kg, while a standard diesel engine weighs over 800 kg. As opposed to the standard diesel engine’s 12-hour removal time, this one only takes four.

Proprietary charging solution optimizes charge time and cost

The challenges of charging a fleet are greater than those of charging individual cars. There are a number of stakeholders who need to be satisfied; battery specifications need to be met; fleet logistics have to be worked out; charging times can vary, and electric utilities have to interact with one another. Creating a reliable charging infrastructure is crucial for expanding the market for electric vehicles used in business.

Charging solutions developed by PTRA take into account several factors such as scalability, high power, and autonomous charging, etc. The firm believes its planning solutions and software algorithms can enable as many as 50% fewer chargers while maximizing charging time and energy The firm believes its planning solutions and software algorithms can enable as many as 50% fewer chargers while maximizing charging time and energy prices.

The larger charging hardware cabinet can be placed up to 500 feet away from the charger dispensers thanks to the company’s charger architecture, making it suitable for business fleet applications. Dispensers can be mounted to the floor, a wall, or a ceiling, depending on the needs of the client.

Integrated technology solution reduces total cost of ownership

PTRA uses the battery and electric drivetrain technology developed by Proterra Powered on its proprietary electric vehicle platform. PTRA’s proprietary commercial EV platform is complemented by Proterra Energy’s fleet-scale and high-power charging infrastructure solutions. Moreover, the technology platform is bolstered by the PTRA Apex fleet and energy management software-as-a-service. The platform’s ultimate goal is to reduce the buyer’s outlay on automobiles by improving control over expenses like fuel and maintenance. Proterra Transit is a positive feedback loop for the PTRA technology platform. It is also an experiment, a proof of concept, and a validation of the technology in the real world.

Valuation

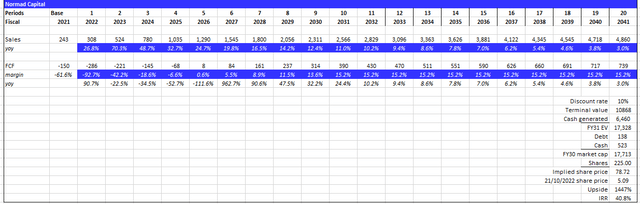

At the current stock price of $5.09 and 225 million shares, the market cap is ~$1.1 billion. I believe the current valuation does not reflect PTRA’s intrinsic value. I expect PTRA to make $4.8 billion in sales in FY31, giving it a market cap of $17.7 billion and a stock price of $78 in FY31 assuming a terminal growth rate of 3% and a discount rate of 10%.

Assumptions:

- Sales: to follow consensus’s estimates in the short-term and reach management FY25 target in FY31, and then slow down after to inflation levels over the next 10 years. Growth should eventually taper down as PTRA has cleared all the low-hanging fruits as it reaches maturity levels.

- FCF margin: Similar to revenue, I used consensus estimates for the first few years and assumed that PTRA would reach management guidance only in FY31.

The key thing to highlight here is that I assumed management would only hit their guidance 5 years later than expected, given the uncertain market conditions today. My model indicates that the market is not pricing in any of this upside.

Risk

Nascent industry

PTRA is actively seeking out new business opportunities in dynamic sectors, such as those influenced by technological and regulatory innovations. It’s tough to estimate how big and when these chances will come up. Producing commercial vehicles requires the cooperation of numerous companies, which presents technological and integration difficulties. Since automotive electrification systems depend on technology from a wide range of companies, these difficulties may impede and postpone their commercialization. PTRA asserts that it may not be possible to use the technology of any of the companies with which it has contracts.

Intense competition

Companies with more market experience than PTRA tend to have more sway in the transit bus industry, which is relationship-driven and dominated by long-standing players. Most of PTRA’s competitors in the market for public transportation buses are well-known transit vehicle integrators that have been selling diesel, diesel-hybrid, and compressed natural gas products to the market for years.

When competing in the electric transit bus market, Proterra faces challenges from both larger, better-funded competitors and more established rivals with proven track records of service. If other well-known bus companies start making their own vehicles or competing zero-emission solutions, PTRA may be at a disadvantage in the market because the other companies have more experience in the transit industry than it does.

The commercial electric vehicle, charging infrastructure, and powertrain markets are all highly competitive. Companies specializing in battery systems, charging solutions, electric powertrains, and similar fields will be too competitive for PTRA to handle. It’s possible that these firms can outperform Proterra in the market thanks to their superior resources or offerings.

Conclusion

I think the current valuation presents an amazing opportunity for investors to take advantage of a huge mispricing. It is an up-and-coming company developing technology for electric buses and related services. The company has technical capabilities in various fields, including mechanical, electrical, and software, enabling it to improve its products and look for cost-reduction measures.

Be the first to comment