tadamichi

Prospect Capital Corporation (NASDAQ:PSEC) reported results for the September quarter a week ago, and the business development company managed to cover its quarterly dividend of $0.18 per share with net investment income.

Prospect Capital’s net asset value fell QoQ to just $10.01 per share, implying that passive income investors should be wary of the company’s book value.

Prospect Capital’s track record speaks for itself, even though the stock is trading at a significant discount to net asset value.

Portfolio Growth And Credit Quality

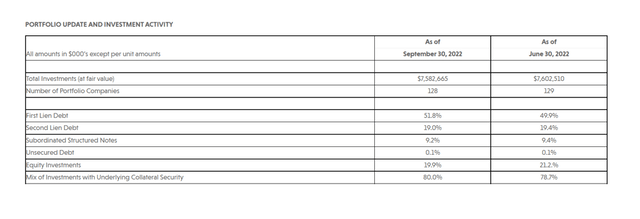

Prospect Capital’s investment portfolio was valued at $7.58 billion in the September quarter, a $20 million decrease QoQ. The portfolio was still overweight in First Lien Debt, which accounted for 52% of the BDC’s investments.

Higher yielding equity investments came in second (20%), followed by second lien debt (19%) and subordinated debt (9%). The changes in portfolio composition were minor, as shown below.

Portfolio Update And Investment Activity (Prospect Capital Corp)

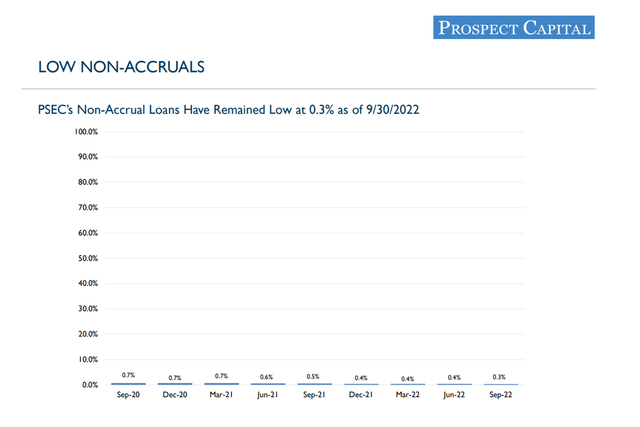

Prospect Capital’s investment portfolio performed well in the third quarter. The degree to which a portfolio performs well is largely determined by the number of non-accruals in the portfolio.

Loans in non-accrual status are those that are not performing as expected, which almost always refers to borrowers in financial distress. The risk with non-accruals is that borrowers will default, forcing Prospect Capital to write off the value of the loan investments.

Prospect Capital kept its non-accrual ratio at 0.3% in the September quarter, down from 0.4% in the previous quarter, indicating both stable and high credit quality.

Low Non-Accruals (Prospect Capital Corp)

Good Dividend Coverage (For Now)

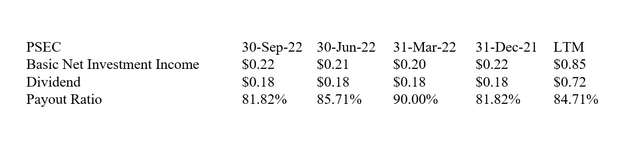

Prospect Capital currently has good dividend coverage, which means that the total quarterly dividend pay-out of $0.18 per share per quarter is covered by net investment income.

Prospect Capital earned $0.22 per share in Q3’22, which completely covered the dividend payout. The dividend payout ratio in the third quarter was 82%, which was slightly higher than the dividend payout ratio in the second quarter (86%) and the previous twelve months (85%).

Dividend (Author Created Table Using Trust Information)

Prospect Capital’s Book Value: A Trail Of Blood

Prospect Capital’s problem as a passive income investment is that the business development company has not been able to grow its net asset value per share for a very long time, as I previously stated. The drop in net asset value has left a blood trail in investors’ portfolios, and I believe many investors are still regretting their decision to invest in the BDC years ago.

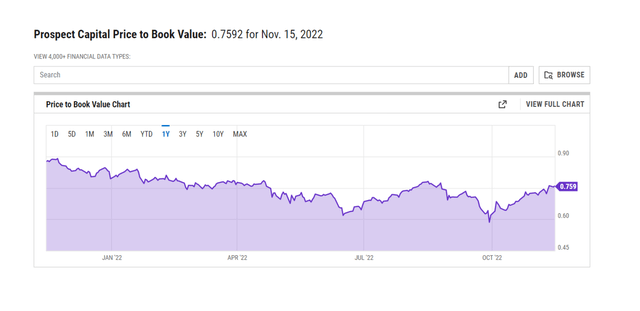

Prospect Capital’s net asset value fell 4.5% QoQ to $10.01 per share in the most recent quarter, owing to net realized and unrealized losses of $0.49 per share.

Prospect Capital’s stock is priced at a 24% discount to net asset value as a result of the QoQ decline in net asset value, reflecting investor concerns that the BDC’s net asset value as a whole cannot be trusted.

Why Prospect Capital Could See A Lower/Higher Valuation

Prospect Capital is not immune to a recession, despite its limited exposure to cyclically exposed industries such as hotels and oil and gas. A recession would almost certainly result in a significant increase in non-accruals and higher net asset value losses for Prospect Capital.

If the United States economy avoids a recession and Prospect Capital’s portfolio keeps performing well, i.e. non-accruals stay as low as they are now, Prospect Capital could see a lower discount to net asset value. Considering that the BDC has destroyed shareholder value over the long-term, however, I think PSEC will continue to trade at least at some discount to net asset value going forward.

My Conclusion

Hope often dies last. Despite the fact that Prospect Capital is trading at a significant discount to book value and with a seemingly appealing 9.5% dividend yield, I would advise against purchasing the business development company because it has a history of falling net asset value, which is an approximation of the BDC’s intrinsic value.

Prospect Capital’s 9.5% dividend yield may appeal to passive income investors, but what good is investing in a BDC if the company has to cut the dividend or has a long history of declining net asset value?

Prospect Capital should be avoided by investors who pay attention to the warning signs.

Be the first to comment