solarseven

Background

The VIX Index is a calculation designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market, derived from real-time, mid-quote prices of S&P 500 index (SP500) call and put options. The ProShares Ultra VIX Short-Term Futures ETF (BATS:UVXY) is a great product for traders looking to both speculate and hedge on short-term volatility. Unlike most volatility products, UVXY aims to provides 1.5x leveraged exposure to the “daily” performance of the S&P 500 VIX Short-Term Futures Index.

Over time, because of contango loss and time decay, UVXY persistently and consistently goes down in price. It is because of this UVXY is not designed for long-term traders. In both neutral and bullish markets, UVXY should fall in value. The UVXY ETF is correlated to VIX Futures and NOT the VIX Index. There a material difference between VIX Futures and VIX Index. Both the VIX Index and VIX futures are negatively correlated to the equity market. The big difference is in performance.

Spot vs Futures

The VIX Index is a spot index. Unlike VIX futures (which UVXY tracks on a leveraged basis), no underlying products (like shares) trade on spot indices. This means that the VIX Index product cannot be owned and therefore does not need to be “rolled” to a different expiration to stay alive. Though options trading does occur on indices, since there is no tradable underlying security, contracts are settled in cash instead of shares.

Since all future contracts expire, they must be “rolled” to the next month. During calm and “normal” market periods, VIX futures contracts often trade at a premium to the VIX Index, resulting in an upward-sloping futures curve. This is known as “contango.” Contango in the VIX futures market causes UVXY to bleed value over time, since near-term positions are closed and rolled-over at higher prices.

Understanding Contango and Backwardation

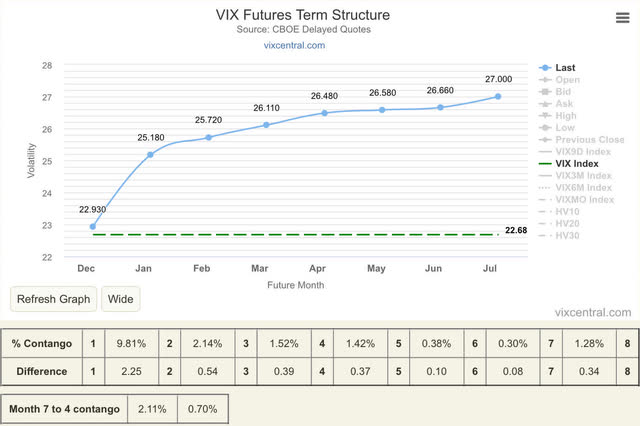

Presented are examples of contango and backwardation. When the VIX futures contracts are trading at a premium to the VIX index, the VIX futures are in contango. The VIX term structure curve typically looks like the graph below. Every month out the VIX value is higher than the month before for it to be in perfect contango.

VIX Term Structure – Contango (CBOE)

If the VIX futures contracts are trading below the VIX index, then the futures are in backwardation. The VIX value are lower as one goes further out in time. This happens when the market senses that near term the risk is higher and market uncertainty drives near month VIX premium higher.

VIX Term Structure – Backwardation (CBOE)

Technical Analysis

The below graph shows the VIX futures curve as at December 2nd, 2022. As you can see, the curve is in contango, based on its upward slope. There are a number of events coming up, including the CPI and PPI reports, as well as the FOMC meeting and press conference, which could cause the VIX to rise if not spike.

VIX Term Structure (VIX Central)

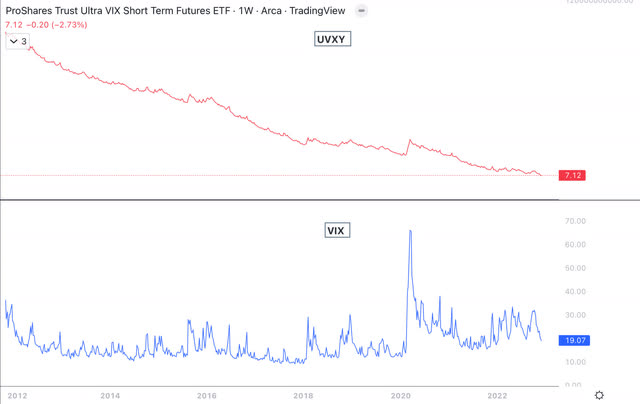

Below is the relationship of the S&P 500 (SP500) to VIX over the past few years. VIX spikes from 2008-2009, 2010, 2011, and 2020 stand out in the chart.

When VIX is flattish then UVXY goes down in value as shown in the chart below. UVXY tracks the daily performance of the two nearest monthly VIX futures. And since UVXY tracks the daily percentage change of a mixture of these two contracts that are steadily losing value when in contango, UVXY loses value.

Below is the chart that displays the relationship between UVXY and VIX. While UVXY does spike when VIX spikes but holding it long term is a money losing strategy.

Buy, Sell or Hold

Regardless of the direction of the stock market, going long UVXY is unlikely to be a winning position when held for more than event risk management. For a speculative investor, going short or purchasing a long-dated put option could be considered. The risks of directly shorting UVXY are extremely high. There are certain parameters within which one might consider the possibility of shorting UVXY as a trade as long as risks are defined through options.

The right way to use UVXY is by trading in the direction of the decay. When VIX is in contango and front-month VIX is below 19, open a credit spread or an iron condor on UVXY would be one way. Link to – Iron Condor: Definition, Strategies & Examples. If one were to use options, then you are defining the amount you could lose if volatility spikes. However, for most traders and investors, it is best to stay away from UVXY.

Be the first to comment