Leonid Sorokin

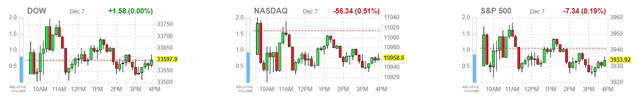

It’s starting to feel like optimistic is a curse word that can’t be used. The major market averages have had a horrible start to December, as any good news for the economy supposedly means that we will have more inflation and higher interest rates for longer from the Federal Reserve. Bad news is just as bad, because it means that a recession is months away. It feels like a no-win situation, as one pundit or corporate CEO after another makes their respective recession call with the only differences being when it strikes next year. The consensus is so broad and confidence in the call so overwhelming that recession expectations are as infectious as Covid-19.

Finviz

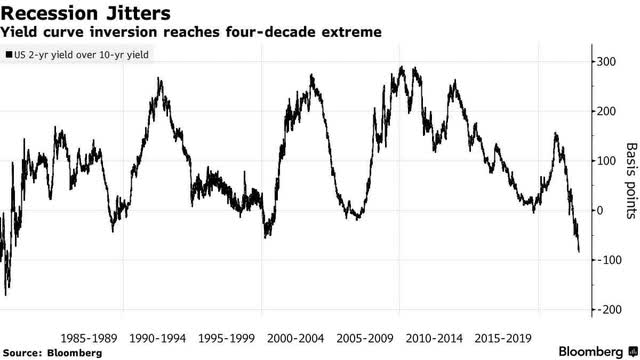

Aside from the high-frequency data not supporting the outlook for an economic contraction today, the degree of certainty from this broad consensus view still has me in the soft-landing camp. Trust me, it would be a lot easier to jump on the bandwagon, but I’m taking what have historically been reliable leading indicators with a grain of salt, given the extraordinarily unusual nature of this business cycle. The most important of these is the inversion of the yield curve, which has reached a level not seen in four decades. This is the bond market telling the Federal Reserve that monetary policy is already sufficiently restrictive, which should weigh on its outlook next week.

Bloomberg

I think the inversion is telling investors that the rate of inflation will fall much faster than the consensus expects, which is supported by the sharp drop in long-term inflation expectations. The 10-year breakeven rate for Treasury inflation-protected bonds has fallen from 2.6% to 2.3% over the past six weeks. Normally, such an inversion would be accompanied by rising unemployment claims, rising real yields, and elevated credit spreads that are continuing to widen. The conundrum for the recession cohort is that none of this is happening. To the contrary, the labor market remains healthy, real yields are not elevated as seen before previous recessions, and spreads are not widening, which speaks to the confidence in the corporate profit outlook.

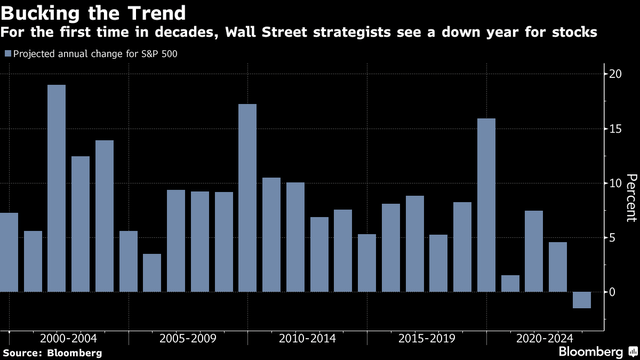

Regardless, sentiment is so bad that for the first time in my 30-year investment career the consensus of Wall Street strategists sees the stock market declining next year. That is astounding. It tells me that investors are wound so tight for the worst case scenario that anything less bad should be support risk asset prices.

Bloomberg

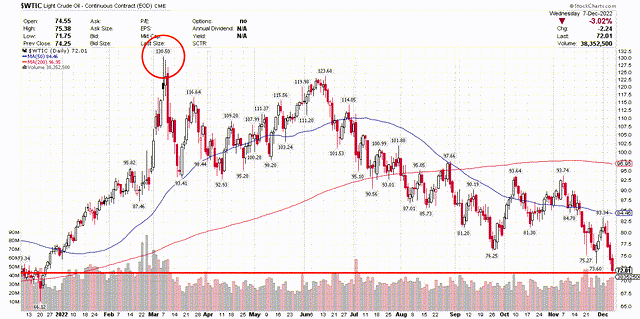

Speaking of less bad, there have been two very positive developments in the past week that have been completely ignored. The first is that oil is finally declining on a year-over-year basis, which is a deflationary factor I have been discussing and anticipating for months, because of its relationship with the Consumer Price Index. The two have a high statistically significant correlation, which suggests that inflation should be heading lower at a more rapid pace in the coming months. While this would have been welcome news not too long ago, today the decline in price is feeding global growth concerns and US recession fears, yet this is an unappreciated positive.

Stockcharts

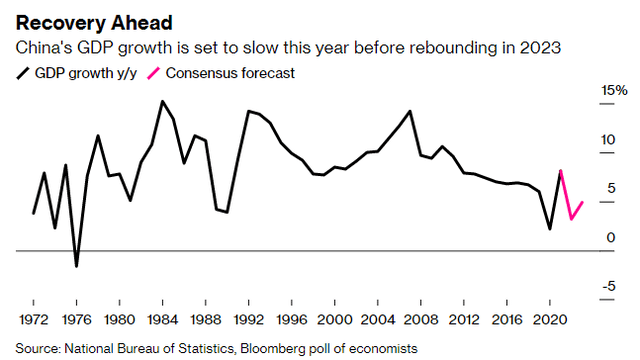

The second is an aggressive easing of China’s Covid-Zero policy restrictions, which should boost the rate of global economic growth next year and further improve the supply-chain issues that put upward pressure on prices. Yet this is now being interpreted as potentially inflationary, because the increase in demand that should result will increase commodity prices. Again, all news is being interpreted as bad news, even when it’s clearly not.

Bloomberg

Psychology plays an important role in a recession because businesses and consumers need to feel enough stress, anxiety, and apprehension that they recoil from investing and spending. While sentiment may be extremely depressed as of late, due to inflation, we should see a rapid decline in prices during the next six months that dramatically improves the outlook. More importantly, the conditions necessary to cause enough stress to see a recoil in activity do not exist. This is why I do not yet see a recession on the horizon.

Be the first to comment