jozzeppe/iStock Editorial via Getty Images

Investment Thesis: I take a bullish view on Marriott International due to strong revenue performance, as well as an attractive P/E ratio and reduction in total debt.

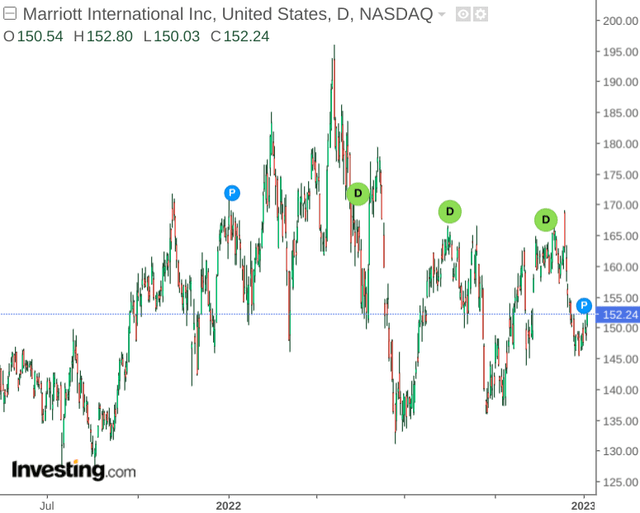

In a previous article back in July 2021, I made the argument that Marriott International (NASDAQ:MAR) might see limited upside going forward as a result of a lull in earnings growth as well as concerns over COVID-19 at the time.

However, the stock has since seen growth – up by over 16% since my last article:

The purpose of this article is to assess whether Marriott International could see further upside from here.

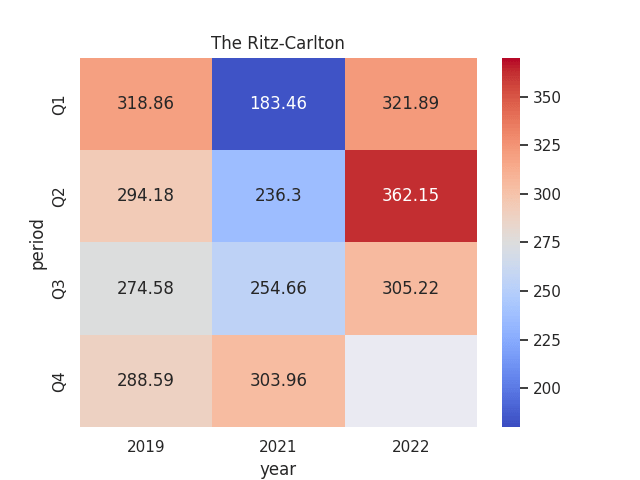

RevPAR Trends

When analysing RevPAR trends (revenue per available room) for 2022 as compared to 2019, we can see that the average RevPAR by brand from Q1 to Q3 has rebounded to, or in some cases exceeded that of 2019 levels – particularly for The Ritz-Carlton, which showed the highest average RevPAR across both these periods (Q4 2019 RevPAR was excluded for comparison purposes with 2022). The below tables were calculated using SQL – full calculations and original data as sourced from historical quarterly reports can be found here.

2019 RevPAR (Q1 to Q3)

| Brand | Average RevPAR from Q1 to Q3 |

| Courtyard | 104.78 |

| Residence Inn | 130.04 |

| Sheraton | 148.49 |

| Marriott Hotels | 157.46 |

| Westin | 160.32 |

| JW Marriott | 216.34 |

| W Hotels | 239.64 |

| The Ritz-Carlton | 295.87 |

Source: Average RevPAR calculated by author using SQL using data sourced from historical quarterly reports for Marriott International (2019, 2021 and 2022).

2022 RevPAR (Q1 to Q3)

| Brand | Average RevPAR from Q1 to Q3 |

| Courtyard | 99.39 |

| Residence Inn | 140.13 |

| Sheraton | 140.89 |

| Marriott Hotels | 142.61 |

| Westin | 163.34 |

| JW Marriott | 200.59 |

| W Hotels | 227.90 |

| The Ritz-Carlton | 329.75 |

Source: Average RevPAR calculated by author using SQL using data sourced from historical quarterly reports for Marriott International (2019, 2021 and 2022).

It is interesting to analyse the RevPAR fluctuations of The Ritz-Carlton across quarters from 2019 to the present (2020 was excluded due to artificially low figures as a result of the COVID-19 pandemic). We can see that RevPAR figures for the three quarters of 2022 exceeded that of 2019 – particularly in Q2.

Figures sourced from previous Marriott International Quarterly Reports. Heatmap generated by author using Python’s seaborn library.

What is also encouraging is that even for Q4 2021 (from October to end of December) – we can see that RevPAR still exceeded that of the same quarter for 2019. This indicates that even with seasonality pressures (lower demand in winter months) and inflationary pressures – RevPAR for The Ritz-Carlton has continued to climb – indicating that the brand continues to see demand from less price-sensitive customers.

In this regard, I expect that this trend could continue for Q4 2022 and Q1 2023 – and this would put the company in a strong position to withstand potential pressures on revenue across other brands if macroeconomic concerns continue to linger.

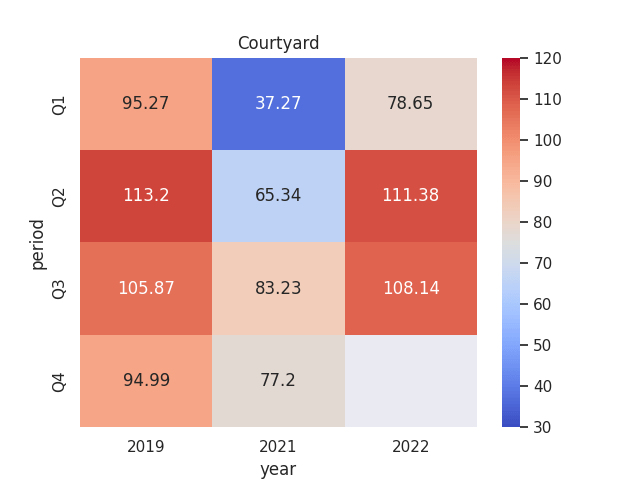

With that being said, the Courtyard (the lowest yielding brand by RevPAR) has also rebounded to 2019 levels in the most recent quarter:

Figures sourced from previous Marriott International Quarterly Reports. Heatmap generated by author using Python’s seaborn library.

This demonstrates that even in spite of significant inflationary pressures in 2022 – Marriott International continues to see growth across the company’s mid-priced brands.

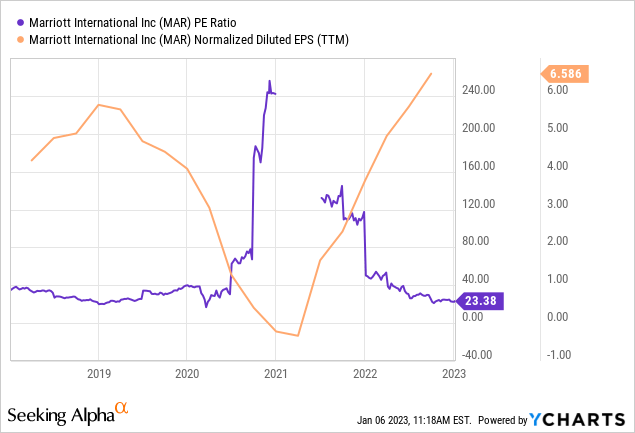

Financials

From an earnings standpoint, we can see that earnings per share has recovered to highs seen pre-2020, while the stock’s P/E ratio has descended to a similar level:

ycharts.com

In this regard, I take the view that Marriott International is in a good position to see further revenue growth on the basis of recent performance, and I expect that earnings growth should have further room to run from this standpoint.

Additionally, the company has also reduced its total debt to $9.4 billion at quarter-end, down from $10.1 billion for the year ended 2021. With total debt of $10.7 billion for the quarter ended Q3 2019, total debt has been decreasing and is lower than that of pre-pandemic levels.

Should we see this trend continue, then I take the view that the stock is poised to see further upside from here.

Conclusion

To conclude, Marriott International has shown strong revenue growth in the face of inflationary pressures – both across higher-end brands as well as mid-priced offerings.

In this regard, I take the view that Marriott International is in a good position to continue bolstering its revenue in spite of macroeconomic pressures. Additionally, given the company’s attractive P/E ratio and reduction in total debt, I take a bullish view on the stock.

Be the first to comment