Klaus Vedfelt/DigitalVision via Getty Images

Thesis

ProShares UltraPro Short Dow 30 (NYSEARCA:SDOW) is a leveraged inverse ETF. As per the fund’s literature, SDOW

[..] seeks a return that is -3x the return of its index (target) for a single day, as measured from one NAV calculation to the next. Due to the compounding of daily returns, holding periods of greater than one day can result in returns that are significantly different than the target return and ProShares’ returns over periods other than one day will likely differ in amount and possibly direction from the target return for the same period.

The target index in this case is the Dow Jones Industrial Average. SDOW achieves its stated goal via swaps and futures and is up more than +60% year to date. As any leveraged product, the ETF is a short term trading tool rather than a buy and hold investment. Given the stock market, over longer periods of time, is upwards sloping, leveraged inverse products like SDOW are bound to lose value as buy and hold investments. To that end SDOW is down more than -80% during the past three years.

We are now officially in a bear market for the S&P 500, with the Dow Jones very near one (the Dow is down only -17.5% as of the writing of this article). Nothing goes down in a straight line, and the current bear market has already seen a very furious rally. There are more to come as conditions become oversold in stocks, but the general direction is down. In order to immunize one’s portfolio without realizing capital gains and to maximize capital efficiency, the SDOW product can be used. For example, an investor who holds $150,000 of DIA, can hedge any further down move via a $50,000 purchase of the SDOW. Clear targets and exit points need to be set since over longer periods of time SDOW tends to lose money and it only represents a trading tool rather than a buy-and-hold investment.

Market Environment

It has been a tough market this year with inflation soaring and the Fed forced to raise rates in a decelerating economic environment as per economic leading indicators. Inflation in our view is not going to abate soon with the summer travel season in high gear and the supply side of oil and agricultural commodities not solved. The Fed is forced to do something, and the “something” is increasing unemployment and fending off the demand side of the equation. We do not think this will be a V-shaped recovery and it will take time for the tightening financial conditions to make their way through the economy and into inflation numbers. This is likely to keep the Fed raising rates even if the economy under-tide is softening. A bear market is a downward price action that moves in waves rather than a straight line. An informed reader can pick where we are in the cycle:

Bear Market Cycle (DailyFx)

We believe we are now experiencing another bear market rally that is going to fizzle out soon enough as inflation data comes in “hot” and economic leading indicators come in soft.

Performance

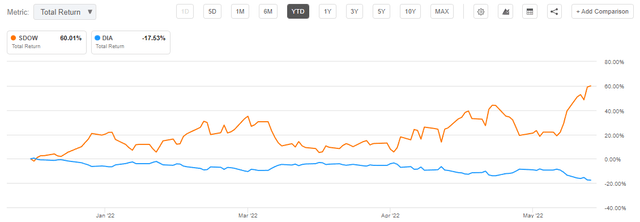

SDOW is up more than +60% on a year to date basis:

YTD Return (Seeking Alpha)

To note that it does not represent an exact -3x performance versus the Dow Jones Index (DIA) due to the inverse return based on daily total returns. Due to the compounding effect and different basis the results are diverging from a pure -3x performance this year on the positive side for an investor in SDOW. The Dow Jones is down -17.5% year to date (as of the writing of this article), hence the SDOW would have been 3 x 17.5% = +52.5% up on a clean 3x performance basis.

Its leveraged nature also exposes the massive volatility embedded in this product. We can see how the total return went from +44% to +20% in a week during the last bear market rally. Do not expect a straight line performance here in the SDOW. Also do expect that once the market bottoms out at some point in time in 2022 the ensuring short covering rally can be very violent and wipe out a significant portion of SDOW’s gains. Set clear entry and exit targets in mind for SDOW and stick with them.

On a 3-year basis the ETF is down more than -80% which illustrates why SDOW is a short-term trading tool rather than a long term portfolio construction instrument:

3-Year Total Return (Seeking Alpha)

Like any leveraged product SDOW is not suitable for long time periods. A retail investor needs to set clear targets and time-frames for entering and exiting the product with a well defined strategy in place. Over long periods of time the stock market has proven it has an upwards trajectory, which means that SDOW will always lose value if held as a buy-and-hold instrument for 2+ years.

Holdings

The fund achieves its stated goal by utilizing swaps and index futures:

Holdings (Fund Website)

Given the fact that most swaps are done via clearing houses the counterparty risk is fully mitigated. The default (very improbable) of one of the counterparty banks would not result in an impact to the vehicle.

Conclusion

SDOW is a leveraged inverse ETF offering -3x of the daily Dow Jones index performance. From a capital standpoint, SDOW represents an efficient manner to immunize an investor’s portfolio from the next potential leg down in the current bear market. SDOW is a short-term trading tool rather than a buy-and-hold investment and a retail investor should set clear entry and exit targets for the instrument.

Be the first to comment