Adrian Vidal/iStock via Getty Images

Another month, another step towards financial freedom!

It’s great saying that, especially after May, which was an incredibly volatile month.

April was a pretty terrible month, in terms of total returns, with the S&P 500 falling roughly 8%. That negative volatility continued for much of May, with the market breaking down through the -15% and the -20% threshold (with regard to intraday lows on the S&P 500 relative to its all-time highs). Towards the end of May, we saw a bit of a resurgence with the major averages moving higher. Unfortunately, throughout June, we’ve seen those gains canceled out by more selling related to the May CPI print. But, throughout all of the ups and downs that we saw during the month of May, I continue to sleep very well with my dividend growth portfolio because while the near-term price action in the market is unpredictable and might seen scary to some, my passive income stream continues to grow and compound at a very strong rate, meaning that I am closer now to retirement than I was when the month began.

During May, my portfolio tracked the S&P 500 fairly closely. The SPY ended up posting essentially flat returns during the month overall (due to the short-lived end-month rally). My personal index saw its value fall by 0.36% during the month whereas the S&P 500 saw its value rise by 0.01%. The same thing can be said of my index on a year-to-date basis; at the end of May, my personal index was down 14.06% while the S&P 500 was down 13.53%. From a total return perspective, this means that I’m fairly even (due to the fact that my portfolio’s yield is higher than the SPY’s). But, as I always say, I’m not all that interested in near-term total returns. Frankly, I believe that they’re irrational and therefore, don’t make a great benchmark to track. That’s especially the case these days when I’m seeing so many wonderful companies trading with irrationally low premiums attached. The market is full of fear these days and eventually, I expect to see nice bounce back rallies from many of my largest holdings (which largely exist in the technology sector). The fundamentals of companies like Apple, Alphabet, QUALCOMM, etc., continue to improve and eventually – channeling my inner Benjamin Graham – I believe that the fundamental “weighing” machine will overcome the “voting” machine that is market sentiment in the near-term.

But, until that mean reversion occurs, I’m content to focus on my passive income stream (which currently sits at an all-time high).

Not only are dividends more predictable than short-term total returns, but they’re more reliable…and, as I’ve said many times, in retirement I don’t plan on selling shares to pay my bills, but instead, living off of the strength of my passive income stream, and therefore, the compounding of my dividends in my #1 concern in the market because this is what will enable me to eventually reach financial freedom.

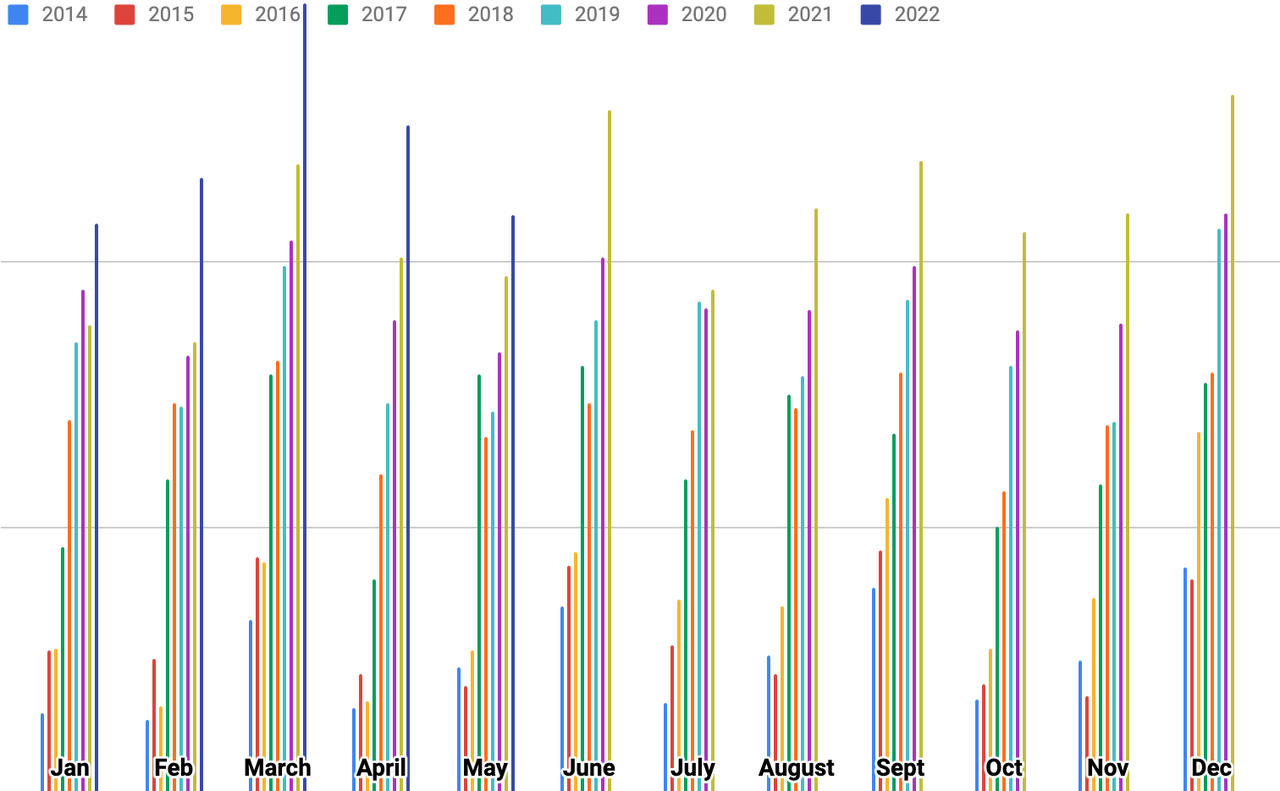

During May, my dividends posted 11.82% y/y growth.

Nick’s dividends (Nick’s data)

This was my worst monthly performance thus far throughout 2022 (and the first month of the year that my year-over-year dividend growth was less than 20%), but I was actually very pleasantly surprised with the double digit growth because coming into May I was worried that AT&T’s (T) big dividend cut would really hurt me during the month (May was the first month that cut was factored into my results).

Knowing that the cut was on the horizon, I’ve spent the last 6 months or so adding other high yielding shares to my portfolio to make up for the T losses (T was by far my largest single dividend payer) and when I tallied up the results, I couldn’t have been happier that my work there paid off nicely.

With May’s 11.82% y/y growth in mind, we move along to my year-to-date dividend results for 2022…

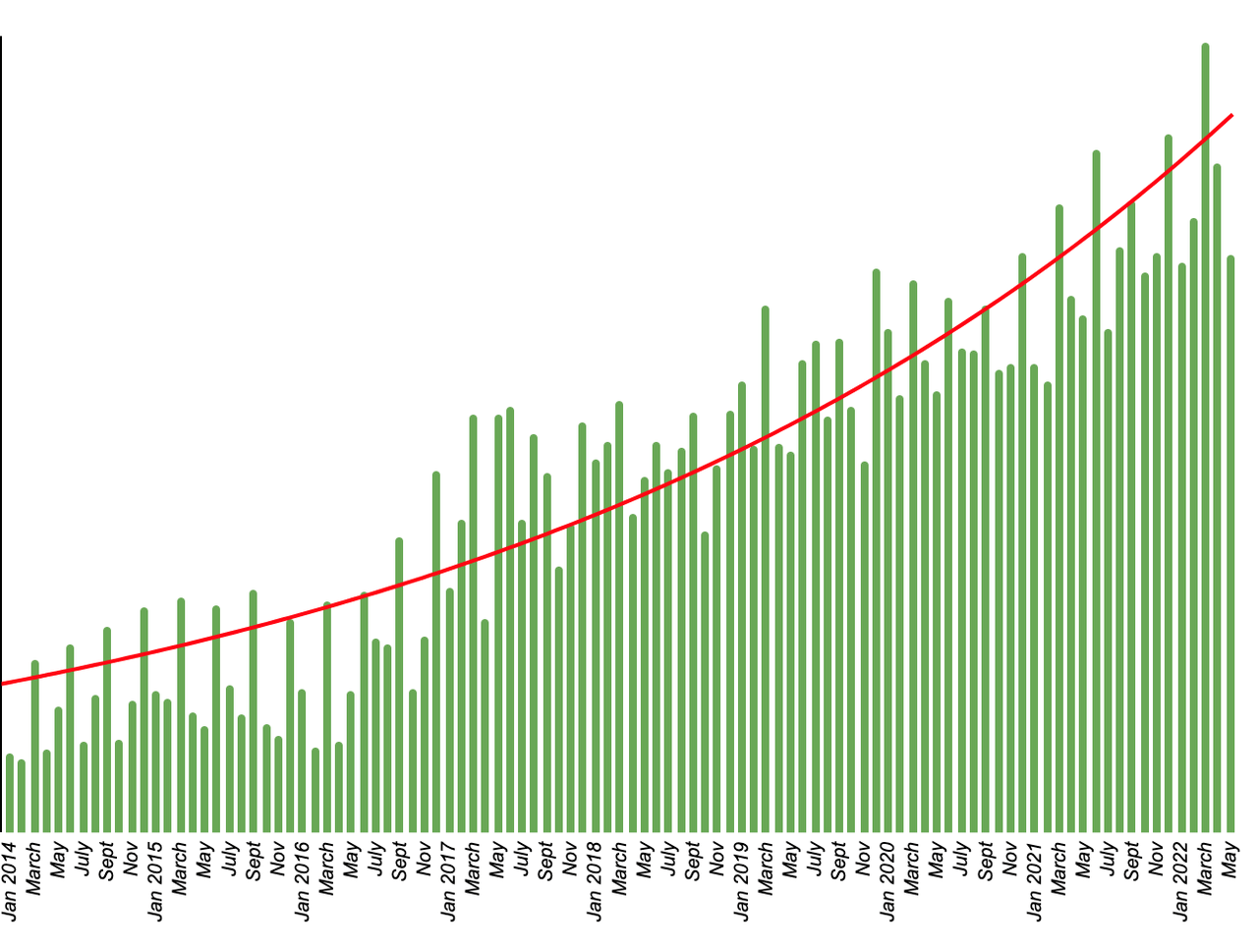

Nick’s monthly dividends (Nick’s data)

Compared to the first 5 months of 2021, my 2022 dividend growth is now up 23.89%.

Although I’m coming up against tough comps (during the last 7 months of 2021, my portfolio generated y/y dividend growth of 27.57%, 3.76%, 21.1%, 19.91%, 21.00%, 23.59%, and 20.30%, respectively) I believe that I can maintain this 20%+ growth rate throughout the remainder of 2022.

My forward-looking expectations are based, largely in part, on the significant capital additions that I made to the portfolio during May (when the S&P 500 hit those -15% and -20% thresholds, allowing me to move bear market savings into my brokerage accounts).

The combination of monthly savings and my bear market additions has resulted in large capital inflows to my brokerage accounts in recent months and the dividend growth stocks that I’ve purchased with these shares should fuel high y/y dividend growth for the next several quarters (at least).

In particular, when it comes to my dividend growth outlook, I’m really looking forward to the June results, because June 2021 was my second largest single dividend month of last year and there is a chance that with enough dividend growth, in June 2022, my passive income stream could cover my mortgage payment (which has never happened before).

Knowing that my dividends could potentially pay my mortgage if I needed them to would further reduce financial stress/anxiety and that would be a really nice milestone to achieve as I attempt to become financially free with my dividend income stream.

This is what financial freedom means to me: checking off boxes of bills that I must pay every month as my passive income stream grows. I’m not to the point (yet) where my passive income stream meets all of my lifestyle’s spending needs, but when that occurs, I will truly be financially free.

Time will tell in that regard, but until it’s time to actually tally up my June results, let’s move along to the trades that I made last month in the portfolio…because there were quite a few.

May Portfolio Trades

May was a very busy month for me. I made 30 trades in total…29 of which were buys.

Since there is a lot to discuss from that perspective, I’ll do my best to be concise here.

In general, these trades can be divided up into 4 separate categories:

-

Monthly Selective Dividend Re-investments

-

The investment of monthly cash savings

-

Active portfolio management (buying low, selling high, and buying low again)

-

The investment of my -15% bear market cash bucket

-

The investment of my -20% bear market cash bucket

For those who aren’t already familiar with my bear market plan for success, which involves the consistent allocation of cash from a bear market fund that I’ve built in recent years, here is an article that I wrote describing my mindset.

In short, I took steps to prepare for the environment that we’re seeing today (a rainy day, per say) when the sun was shining from late 2020-early 2022. When the market was at all-time highs during the post-2020 rally, I began to build cash know that eventually, we’d see another macro sell-off and after the success that I had buying into the COVID-19 crash weakness, I knew that I wanted to have dry powder available to take advantage of the next significant sell-off. Coming into 2022, my cash position was slightly above average, at ~7.5% or so. And now that we’ve entered bear market territory, I am regularly allocating my cash position into the equity space, ensuring that I capitalize on the deals that today’s bear market is presenting.

It was a bit of a coincidence that two of these bear market baskets (the -15% and the -20%) triggered during the same month. But the idea of this plan is not to worry about if/when the buy triggers occur, but to simply stick to the plan regardless, to ensure that emotion is being removed from the equation and that I am putting dry powder to use as the market dips.

In the past, investors who bought blue chip equities during periods of significant market weakness were greatly rewarded when the major indexes eventually bounced back and experienced rebounds. Bear markets can make or break investors’ lives, when it comes to dictating when/if they reach financial freedom. Buying and holding into weakness, instead of selling low and locking in losses, can truly accelerate one’s timetable when it comes to reaching retirement.

Personally, I’ve seen this play out in late 2018 and early 2020. And, while I can’t say for certain that we’ll bounce back front his sell-off (I don’t have a working crystal ball and I’ll be the first to admit that I cannot accurately predict the future), I do know this: the world only ends once…and when that does occur, it won’t matter what financial steps I took to prepare, so therefore, I’m happy to buy the dip, assuming that this sell-off will play out like every other bear market that we’ve seen throughout the history of the U.S. stock market.

And, if I’m right about the long-term trajectory of the S&P 500 remaining in place (up and to the right…with some volatility/dips along the way) then the moves that I made during May (and continue to make as macro weakness occurs) should accelerate my journey towards financial freedom due to the dollars that I’m investing today going much further than they would have 6 months ago.

But, before I highlight the stocks that I bought with those -15% and -20% bear market buckets of cash, let’s go in order and discuss the stocks that I bought when I selectively re-invested all of my April dividends on 5/2/2022.

On 5/2/2022, I used my April dividends to continue to build positions in Prologis (PLD) at $156.75, NVIDIA (NVDA) at $189.15, Deere (DE) at $378.64, Air Products and Chemicals (APD) at $235.25, Coca-Cola (KO) at $60.09, Enbridge (ENB) at $43.89, Palantir (PLTR) at $10.48, and Owl Rock Capital (ORCC) at $14.32.

With regard to the strategy at play with these re-investment decisions, here’s the trade alert that I sent out to Dividend Kings members on 5/2 highlighting these purchases:

“This morning, I put those April dividends to work, adding to my positions in PLD at $156.75, NVDA at $189.15, DE at $378.64, APD at $235.25, KO at $60.09, ENB at $43.89, PLTR at $10.48, and ORCC at $14.32. For the most part, all of these moves are addressing asset allocation concerns (adding to positions that were/are underweight relative to my desired targets). Several of them are currently overvalued in my estimation; however, that’s what my selective re-investment strategy is all about (ignoring valuation and instead, focusing on quality metrics and rebalancing goals). I was pleased to add to the DE dip now that those shares are once again trading at a discount to my $409 FV estimate. I was also happy to pick up more ORCC well below its most recently reported NAV. KO’s Q1 results were very strong, so I was happy to add there, even with shares near all-time highs. I continued with my monthly plan of slowly, but surely, accumulating a PLD position (regardless of valuation) due to the high quality of that REIT. I wanted to take advantage of NVDA’s huge sell-off recently and although that stock remains speculative valued, I’m always happy to add to my position. APD remains underweight, so I’m happy to slowly build that share count, especially with the share price sitting right around my cost basis. And I’m underweight energy, so adding to ENB was an easy decision.”

Now, we’ll highlight the stocks that I bought during May with my monthly cash savings. When making selective re-investments, I often ignore valuation and focus on asset allocation because I like to use that process as a way to constantly re-balance my holdings. However, when it comes to putting cash to work, I always pay very close attention to valuation and do my best to accumulate shares of the highest quality companies in the market with fair (or better yet, discounted) valuations attached.

With regard to the investments that I made with my monthly savings during May, I bought shares of Intercontinental Exchange (ICE) at $105.29 and Brookfield Asset Management (BAM) at $49.23 on 5/5/2022, Chipotle (CMG) at $1298.41 on 5/9/2022, Deere at $309.58 on 5/20/2022, and Prologis at $126.40 on 5/31/2022.

BAM is a long-held position for me, and I was happy to have the opportunity to continue to add shares after they’d fallen double digits from their recent $62.47 52-week highs. I really like the value-oriented management strategy that CEO Bruce Flatt and company use, I like the fact that unlike other value-oriented asset managers/conglomerates (I’m looking at you, Berkshire Hathaway), BAM pays a growing dividend, and I like the unique exposure to hard assets that my BAM position provides me. In short, I always feel good about adding more BAM shares to the portfolio when they’re trading at a discount.

Both ICE and CMG were new positions for my portfolio. They’re both companies that I’ve had on my watch list for quite some time…

ICE is a wonderful dividend growth stock which has a very reliable fundamental and dividend growth track record. In the ~$105 area, ICE shares were trading for approximately 19x forward earnings estimates (well below their 10-year average P/E ratio of ~23x). This was a price point that I felt comfortable with, in terms of initiating a long-term position in ICE. And, as you’ll see in a moment, as shares continued to sell-off throughout the remainder of the month, I added again in the $95 area.

CMG is an interesting play in the food space which offers both growth (strong double digit EPS growth prospects) and defensive aspects, related particularly to pricing power and consumer demand metrics in an inflationary environment. I’d been watching the stock’s sell-off for a while and as CMG’s price dipped below the $1,300 threshold, which corresponded with the ~40x forward earnings threshold, I decided to initiate a small position.

Both DE and PLD were existing positions in my portfolio which simply got too cheap in late May (in my humble opinion).

At ~$310/share, DE was trading for 13.5x this year’s earnings estimates. I believe a multiple in the 16-17x range is appropriate here and therefore, $310 represented a wide margin of safety.

PLD is a position that I’d been averaging into via selective re-investment for several months now. But, when shares dipped into the $125 area, I felt comfortable allocating cash savings towards the position as well, as PLD’s forward P/AFFO multiple dipped down towards the 28.5x range, which is in-line with the stock’s trailing 10-year average P/AFFO premium.

Moving onto active management, on 5/11/2022 I made a trade, trimming my position in Bristol-Myers Squibb (BMY) – which was the only sale that I made during May – and using the proceeds to buy shares of Intercontinental Exchange, Realty Income (O), and Enbridge.

Regarding this trade, here’s the trade alert that I provided with Dividend Kings subscribers shortly after making the move:

“Moments ago I made several trades in my personal portfolio…I sold roughly 21% of my BMY position at $76.50, locking in profits of 55.4% on shares that I bought on 3/15/2019 at $49.22. BMY shares are up roughly 23.6% on a year-to-date basis and while I still think they’re attractively valued, I wanted to take advantage of this relative outperformance and trim back on my position because BMY’s weighting had risen to roughly 2.6% of my portfolio, which is above my target for bio-pharma stocks. After the trade, BMY’s weighting is 2.06% – still overweight, but more in-line with where I want my high conviction healthcare picks to be. I immediately put these proceeds to work, adding to existing positions in ICE at $95.21 (more than doubling down on my recent purchase there at $105.30), O at $63.46, and ENB at 43.24. The buy basket weightings here are: ICE at 49.87%, O at 25.32%, and ENB at 24.81%. This move not only helps diversification, but it increases passive income by 25.9%. All in all, I’m happy with the move…and, by doubling down on ICE here, it sort of frees up the rest of my monthly savings (I have ~55% left) to target other beaten down blue chips with (since ICE was at the top of my watch list and now, I’m not looking to buy more unless shares fall down into the mid-$80’s). Right now, stocks like MSCI, SPGI, PLD, XYL, AVB, ESS, TGT, SBUX, APD, CMI, and PH are all stocks hovering around the top of my watch list.”

And finally, we come full circle, arriving at the two bear market bucket purchases that I made during May…

On 5/2/2022 the S&P 500 sunk down below the -15% threshold (on an intra-day level) and therefore, I allocated that bear market bucket of cash into my portfolio. Here’s the post I made on Dividend Kings regarding the shares that I bought:

“All ..after patiently waiting…I finally got my -15% threshold (at 4091.90 just minutes ago, the market dipped below that mark)! Therefore, I moved the next batch of my bear market savings into the brokerage accounts. I used the funds to buy shares of PH at $269.03, BX at $103.98, PYPL at $89.68, SQ at $102.21, O at $67.18, WPC at 78.53, and GOOGL at $2288.86. The weightings of this basket was: PH 42.4%, GOOGL 32.8%, WPC 6.75%, O 6.7%, BX 6%, SQ 2.9%, and PYPL at 2.6%. Overall, I think this is a solid basket of beaten down stocks…some blue chip/core-type holdings, some cyclical growth, some secular growth, and some speculative growth. The average dividend yield of this basket (including the non-dividend payers) was 1.76%. I still have 100% of my May savings ready to work throughout the next 30 days or so, so I’ll be watching the market closely for further weakness. And, if we hit -20% on the S&P 500, I’ll transfer over the next batch of bear market savings (S&P would have to hit 3850 or so for that to happen). Best wishes all!”

Then, less than 3 weeks later, the -20% threshold (once again, on an intra-day basis) hit as well. On 5/20/2022 I provided this trade alert to DK members, highlighting the shares that I purchased with my -20% basket:

“All…I just put my -20% (on the S&P 500) bear market funds to work. I bought shares of ESS at $279.16, AVB at 198.16, ECL at $155.62, PH at 256.66, DE at $321.80, and SPGI at $336.37. SPGI and ECL are new positions for me. I’ve been waiting to buy both into weakness – they were on my bear market watch list, and I’m pleased to finally have exposure to both blue chips. The weighting of the overall basket goes as such: SPGI at 21.5%, DE at 20.6%, ECL at 19.9%, PH at 19.7%, ESS at 10.7%, and AVB at 7.6%. The average yield of this basket was 1.74%.”

I want to note that I was very pleased to take this opportunity to buy both ECL and SPGI, new positions for my portfolio, that I’d had on my watch list for quite some time. Both are very high-quality companies with long histories of fundamental and dividend growth…that have historically traded with high valuation premiums (which I wasn’t willing to pay). But the bear market that we’ve entered into recently has finally bought their premiums down to levels where I felt comfortable accumulating shares and today, both ECL and SPGI remain near the top of my personal watch list as I hope to continue to average down into these blue chips and establish meaningful long-term positions in my portfolio.

That wraps up all of the trades that I made during May. And now, with that in mind, here is where my portfolio currently sits, regarding my positions, their weightings, and their cost basis:

Nicholas Ward’s Dividend Growth Portfolio

|

Core Dividend Growth |

57.82% |

||

|

Company name |

Ticker |

Cost basis |

Portfolio Weighting |

|

Apple |

$24.26 |

13.81% |

|

|

Microsoft |

$60.71 |

4.30% |

|

|

Broadcom |

AVGO) |

$234.30 |

3.18% |

|

QUALCOMM |

$75.78 |

2.47% |

|

|

Johnson & Johnson |

$114.02 |

2.24% |

|

|

BlackRock |

$413.84 |

2.08% |

|

|

Cisco |

$32.67 |

1.78% |

|

|

Starbucks |

$48.10 |

1.74% |

|

|

Bristol Myers Squibb |

$49.47 |

1.66% |

|

|

Cummins |

$217.77 |

1.50% |

|

|

Merck |

$73.71 |

1.42% |

|

|

PepsiCo |

$93.35 |

1.37% |

|

|

Lockheed Martin |

$346.87 |

1.29% |

|

|

Raytheon Technologies |

$78.18 |

1.29% |

|

|

Brookfield Renewable |

$33.49 |

1.19% |

|

|

Coca-Cola |

$40.07 |

1.17% |

|

|

Brookfield Asset Management |

$35.58 |

1.13% |

|

|

Honeywell |

$126.18 |

1.11% |

|

|

Deere & Co. |

$347.85 |

1.11% |

|

|

Amgen |

$136.07 |

1.09% |

|

|

Texas Instruments |

$95.19 |

0.90% |

|

|

Pfizer |

$30.48 |

0.90% |

|

|

Brookfield Infrastructure |

$39.19 |

0.88% |

|

|

Illinois Tool Works |

$130.90 |

0.77% |

|

|

Northrop Grumman |

$376.97 |

0.61% |

|

|

Parker-Hannifin |

$255.96 |

0.60% |

|

|

Intel |

$32.26 |

0.55% |

|

|

Essex Property Trust |

$228.98 |

0.53% |

|

|

AvalonBay Communities |

$156.60 |

0.51% |

|

|

Intercontinental Exchange |

$99.33 |

0.50% |

|

|

Diageo |

$107.91 |

0.49% |

|

|

Digital Realty |

$49.87 |

0.47% |

|

|

Alexandria Real Estate |

$130.96 |

0.45% |

|

|

Medtronic |

$73.94 |

0.44% |

|

|

Stanley Black & Decker |

$142.03 |

0.44% |

|

|

Air Products and Chemicals |

$237.16 |

0.39% |

|

|

Hormel |

$42.76 |

0.39% |

|

|

Sherwin-Williams |

$218.31 |

0.32% |

|

|

McCormick |

$35.71 |

0.30% |

|

|

Ecolab Inc. |

$156.22 |

0.24% |

|

|

Prologis |

$132.93 |

0.21% |

|

|

High Yield |

15.48% |

||

|

Realty Income |

$62.24 |

2.27% |

|

|

W. P. Carey |

$65.23 |

1.78% |

|

|

Altria |

$49.68 |

1.73% |

|

|

AT&T |

$37.68 |

1.62% |

|

|

Agree Realty |

$65.85 |

1.44% |

|

|

AbbVie |

$79.08 |

1.41% |

|

|

British American Tobacco |

$37.89 |

0.80% |

|

|

Enbridge |

$35.90 |

0.79% |

|

|

Federal Realty Investment Trust |

$115.13 |

0.66% |

|

|

Philip Morris |

$96.12 |

0.65% |

|

|

National Retail Properties |

$36.57 |

0.61% |

|

|

STORE Capital |

$22.91 |

0.56% |

|

|

Verizon |

$45.20 |

0.40% |

|

|

Prudential |

$100.58 |

0.39% |

|

|

Pinnacle West |

$81.67 |

0.37% |

|

|

High Dividend Growth |

11.97% |

||

|

Visa |

$74.29 |

2.34% |

|

|

Comcast |

$38.54 |

1.88% |

|

|

Lowe’s |

$148.28 |

1.59% |

|

|

NIKE |

$59.52 |

1.56% |

|

|

Home Depot |

$250.58 |

1.03% |

|

|

Mastercard |

$81.40 |

1.03% |

|

|

L3Harris Technologies |

$185.82 |

0.74% |

|

|

Domino’s Pizza |

$355.20 |

0.63% |

|

|

Booz Allen Hamilton |

$75.49 |

0.38% |

|

|

Roper |

$418.69 |

0.34% |

|

|

S&P Global |

$336.38 |

0.23% |

|

|

ASML Holding |

$643.47 |

0.22% |

|

|

Non-Dividend |

8.79% |

||

|

Alphabet |

$838.11 |

5.24% |

|

|

Amazon |

$1,757.25 |

1.32% |

|

|

Adobe |

$484.48 |

0.64% |

|

|

Meta Platforms |

$180.50 |

0.38% |

|

|

Netflix |

$304.53 |

0.35% |

|

|

Salesforce |

$213.13 |

0.34% |

|

|

Chipotle |

$1,298.41 |

0.19% |

|

|

PayPal |

$201.72 |

0.18% |

|

|

Block |

$170.31 |

0.15% |

|

|

Palantir |

$16.16 |

<0.10% |

|

|

Special Circumstance |

4.60% |

||

|

Walt Disney |

$91.69 |

1.86% |

|

|

NVIDIA |

$35.23 |

1.53% |

|

|

Constellation Brands |

$172.19 |

0.41% |

|

|

Owl Rock Capital |

$14.94 |

0.25% |

|

|

Blackstone |

$106.71 |

0.24% |

|

|

Scotts Miracle-Gro |

$153.56 |

0.11% |

|

|

Carrier |

$20.97 |

0.10% |

|

|

Otis |

$58.65 |

0.10% |

|

|

Crypto |

Diversified Basket |

n/a |

0.46% |

|

Cash |

0.88% |

||

|

Most |

Recent |

Update: |

6/22 |

Conclusion

Markets continue to experience weakness on a macro level (the S&P nearly hit the -25% level last week, which would have triggered my next bear market bucket purchases) and with that in mind, I remain content…no, happy…to continue to buy blue chip equities into weakness. Every time that I make a purchase, I take note of the dividend income that the shares are adding to my overall passive income stream. And while it can be daunting to buy stocks while share prices are plummeting, I continue to take solace in the fact that every purchase that I make brings me one step closer to my ultimate goal of using dividend income to fund my (hopefully early) retirement!

Be the first to comment