nespix/iStock via Getty Images

Elevator Pitch

I have a Hold rating for SoFi Technologies, Inc. (NASDAQ:SOFI). I touched on SOFI’s recent M&A in my earlier article published on March 4, 2022.

Please find below a list of the key pros and cons relating to a potential investment in SoFi Technologies’ shares:

Pros

- Cross-selling synergies will continue to boost SOFI’s top line and bottom line.

- There is good demand for cryptocurrency-related products, and SOFI is optimizing its offerings to tap into this opportunity.

- The bank charter’s potential EBITDA contribution has yet to be fully reflected in the sell-side analysts’ forecasts, leaving room for upside surprises.

Cons

- The federal student loan moratorium might potentially be deferred again from May 2022 to 2023, which could translate to lower-than-expected student loan revenue for SOFI.

- There are client concentration risks relating to SoFi Technologies’ technology platform segment or Galileo.

- Investors continue to be negative on FinTech and growth stocks, so it is uncertain if SOFI’s valuations have bottomed.

I decided to retain my Hold rating for SOFI. The company’s shares have not done well despite better-than-expected fourth-quarter results. After assessing its pros and cons, I don’t think SoFi Technologies is either a strong Buy or a strong Sell. Instead, a Hold rating is justified based on expectations of short-term headwinds persisting while being appreciative of the company’s long-term growth potential.

SOFI Stock Key Metrics

The key metrics for SOFI relate to the company’s most recent Q4 2021 earnings.

SoFi Technologies disclosed its Q4 2021 financial results in a press release issued on Mar 1, 2022 after trading hours. I view the company’s financial performance in the fourth quarter of last year as satisfactory.

SOFI’s non-GAAP adjusted net revenue jumped by +54% YoY from $182.0 million in Q4 2020 to $279.9 million in Q4 2021, and this was is in line with the company’s earlier guidance of fourth-quarter top line falling in the $272-$282 million range. Furthermore, SoFi Technologies’ Q4 2021 non-GAAP adjusted EBITDA of $4.6 million was at the high end of its prior EBITDA guidance of between $2 million and $5 million.

The company also did well on certain key operating metrics. SOFI’s personal loan originations expanded by +168% YoY to $1.6 billion in the recent quarter. This was a new historical high in terms of quarterly personal loan originations and the Q4 2021 figure was more than twice the pre-COVID numbers achieved in Q4 2019. Separately, the company’s total product additions increased by +105% YoY and +51% QoQ to 906,000 in Q4 2021, and this represented the sixth quarter running that SOFI had managed to deliver YoY total product growth of over +100%.

But SoFi Technologies’ good Q4 2021 financial and operating performance did not translate into significant positive share price momentum. Although SOFI’s shares rose as much as +15% pre-market on March 2, 2022 post-results announcement, the company’s stock price eventually only increased by +3% to close the trading day at $11.58. Subsequently, SOFI’s share price fell by -33% to a 52-week and all-time low of $7.74 during intra-day trading on March 14, 2022. SoFi Technologies’ shares last closed at $9.77 as of April 4, 2022, which is still -16% lower as compared to its post-results announcement stock price.

It is important to look beyond the headline metrics for SOFI and try to understand the bullish and bearish investment angles for the stock which I cover in the next two sections.

Pros Of Buying SoFi Stock

Cross-Selling Synergies Are Still Intact

A key component of the investment thesis for SOFI is that the cross-selling synergies between its different businesses and products will continue to drive the company’s growth in the intermediate to long term.

SoFi Technologies’ recent quarterly disclosures imply that the company’s cross-selling synergies remain unchanged. SOFI revealed at its Q4 2021 results briefing that the penetration rate of new products among its members was higher than 33% in the recent quarter, and the number of products cross-bought by members set a new record high exceeding 380,000.

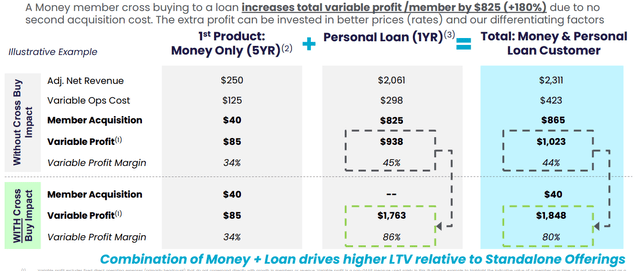

Cross-selling drives both top line growth and profitability improvement. SoFi Technologies disclosed at the company’s fourth-quarter earnings call that its customer acquisition cost contracted by -17% last year thanks to cross-selling. The chart below also indicates how an increasing number of members buying multiple products grows SOFI’s profits on a per-member basis.

An Example Of How Cross-Selling Contributes To Higher Contribution Per Member

SOFI’s January 2021 Investor Presentation

Cryptocurrency Growth Potential Yet To Be Fully Tapped

On March 22, 2022, SoFi Technologies announced that the company launched a “zero-fee cryptocurrency feature to let members buy automatically” in a recurring manner using their salaries, which “builds on SoFi’s offerings for checking and savings accounts.”

SOFI disclosed at its Q4 2021 results call on March 1, 2022 that it already offers around 30 cryptocurrencies at the end of 2021 for investors to choose from. But the company also stressed at the recent investor briefing that cryptocurrency is among the products that “have opportunities” and where SOFI “can differentiate a lot more.” It is clear that the recent new product feature involving cryptocurrencies that was launched will enable SoFi Technologies to “differentiate” its cryptocurrency offerings in a meaningful way.

Notably, demand for cryptocurrencies or other digital assets is growing. SOFI mentioned at the UBS (UBS) Digital Asset Day 2022 that it is “seeing significant cross buy from folks coming in either via our robo business or our active Invest business into digital asset accounts.”

Bank Charter’s Potential Contribution To Future Earnings Not Reflected In Consensus Numbers

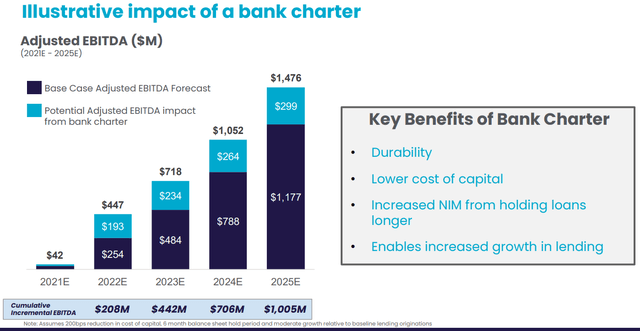

In January 2021 prior to securing the bank charter, SOFI provided the company’s guidance on the company’s future EBITDA incorporating synergies relating to the bank charter, as presented below.

SoFi Technologies’ Expectations Of EBITDA Accretion From Bank Charter

SOFI’s January 2021 Investor Presentation

SoFi Technologies eventually obtained the national bank charter approval in January 2022. But the current consensus FY 2023, FY 2024 and FY 2025 EBITDA estimates for SOFI are $385 million, $589 million and $809 million, respectively which are much lower than the company’s prior expectations from EBITDA contribution from the bank charter.

I believe that there is upside to SOFI’s future EBITDA, assuming that SoFi Technologies executes well on driving synergies relating to the bank charter. At Bank of America’s (BAC) ’22 Electronic Payment Symposium, SOFI revealed that it is “on track to deliver” on the original timeline “in terms of loans being originated from the bank itself”, and it also noted that “funding costs are much lower.” In view of management’s comments, it is likely that there could be upside surprises going forward relating to the actual synergies derived from the recent national bank charter approval.

Cons Of Buying SoFi Stock

Student Loan Moratorium Catalyst Possibly Deferred

A Seeking Alpha News article published on March 16, 2022 citing a report from Morgan Stanley (MS) noted that the MS analysts are of the view that “the federal student loan moratorium now looks like it will extend beyond May 2022” and they expect the student loan moratorium to be lifted in “Q1 2023” instead.

Earlier, there were expectations that SOFI could benefit from a sharp increase in student loan originations and student loan revenue in 2022 as federal student loan borrowers refinance their loans with the expiry of the loan moratorium in early-2022. If the Morgan Stanley analysts turn out to be right, this implies downside risks to SoFi Technologies’ fiscal 2022 revenue and earnings.

SOFI highlighted in its Q1 2022 results press release that “the negative impact of the unexpected extension of the federal student loan payment moratorium to May 1, 2022” is expected to amount to “$30 to $35 million of revenue and $20 to $25 million of contribution profit” in Q1 2022. A further extension of the student loan payment moratorium to 2023 will be a significant negative for the company.

Concentration Risks For Technology Platform Segment Or Galileo

SoFi Technologies’ technology platform segment or Galileo added nine new customers to bring its total client base to 44 as of the end of 2021, as the company had disclosed in its Q4 2021 earnings press release.

But this particular business segment still suffers from substantial risks relating to client concentration, notwithstanding a further diversification of the company’s customer base in Q4 2021.

According to the company’s fiscal 2021 10-K filing, the top five customers for the technology platform business contributed an outsized 63% of total revenue for this segment. If SOFI loses any single one of its largest customers going forward, the future revenue growth for Galileo might come in below expectations.

Weak Investor Sentiment For FinTech And Growth Stocks

SoFi Technologies’ consensus forward next twelve months’ price-to-sales multiple has de-rated from 15.5 times as of November 4, 2021 to 5.9 times as of April 4, 2022. During this period, SOFI’s shares have dropped by -58% from $23.29 to $9.77.

Investors’ aversion towards owning FinTech and growth stocks in recent months have driven a sharp valuation de-rating for SoFi Technologies. There is no indication that investor sentiment towards this group of stocks will change anytime soon.

A March 18, 2022 Seeking Alpha News article noted that the “short interest as a percentage of total float” for SOFI rose. For the week ended March 25, 2022, “fintech names underperformed the most” in the financials sector based on a March 26, 2022 Seeking Alpha News update.

Is SOFI Stock Worth Investing In?

The long-term prospects for the stock relating to the bank charter and cross-selling synergies are great. But SoFi’s continued share price weakness and valuation de-rating suggest that the short-term headwinds are far from over.

Assuming that the federal student loan moratorium is really deferred again to the first quarter of 2023 or even later as the Morgan Stanley analysts predict, there could be another round of selling for SOFI’s shares. In addition, investors are still very cautious about investing in high-growth, FinTech stocks at the moment as I highlighted in the prior section. While SoFi’s mid-single digit forward price-to-sales multiple is much lower as compared to history, it is not exactly cheap on an absolute basis.

As such, while SoFi Technologies does not warrant a Sell rating considering its current valuations, it is also not worth investing in the stock right now as well.

Bottom Line

SoFi Technologies’ Hold investment rating remains unchanged as per my prior March 4, 2022 article. I view the current risk-reward for SOFI to be balanced after reviewing the pros and cons of a potential investment, which supports a Hold rating for the company’s shares.

Be the first to comment