dszc/iStock via Getty Images

This article appeared Saturday the 13th of August in the Daily Drilling Report.

Introduction

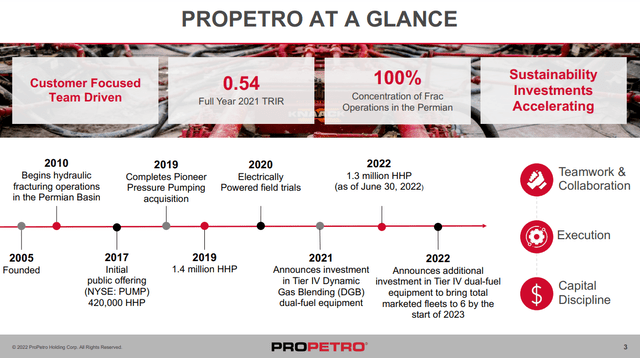

ProPetro Holdings, (NYSE:PUMP) is one the leading independent fracking companies splitting shale rock for oil and gas. They are solely focused in the Permian basin, the dominant play for U.S. producers. I have covered them twice before, and here is a link to past articles which can be a useful guide for new readers.

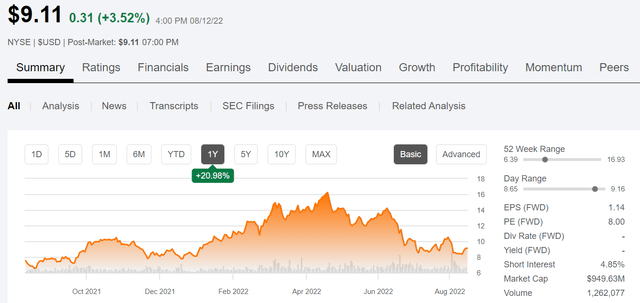

Price Chart for PUMP (Seeking Alpha)

The announcement they would be taking a near ~$60 mm charge for their Durastim efrac fleet, combined with the June sell off across the oilfield, has taken their share price down 50%. This leaves them without an efrac offering in the works, and could be a competitive disadvantage down the road.

Their new ESG focus is the acquisition and deployment of Tier IV Dynamic Gas Blend, DGB fleets, of which they will have six-6 as we start the new year. DGB will comprise about 1/4 of their available horsepower with the balance being legacy Tier II diesel fleets.

Snapshot of PUMP (Seeking Alpha)

In this article we review Q-2, 2022 for PUMP, and the general conditions for growth affecting the fracking business at large. As noted in prior articles PUMP provides an array of ancillary field services: Cementing, Coiled Tubing, and Wire Line work. These are not broken out on their 10-Q.

The company is selling for 3X forward OCF and carries no debt. This is pretty good story to tell, as there is ample room for multiple expansion as we close out 2022 and head in to 2023.

Analysts are split on the company with an overweight rating and price targets from $12-19.00 per share with the average being $15.00. If all we get is the analysts average, an investor entering at $9.11 (the current price) would see a return of 60%, making them fairly attractive at the current multiple for risk tolerant investors.

The investment thesis for PUMP

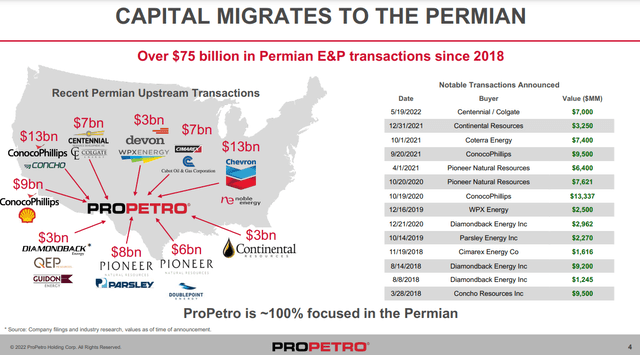

It is fairly straight forward. The Permian is the nation’s primary shale basin for producing oil and gas. It has been on a growth trend thanks to higher prices, and is the primary liquids focus area for the biggest shale drillers to many of the smaller companies. Current daily output from the Permian basin is ~4.9 mm BOEPD, contributing over half of America’s roughly 9 mm BOEPD from shale. Most of the key companies we follow, Devon Energy, (DVN), Pioneer Natural Resources, (PXD), Occidental Petroleum, (OXY), and a host of others including the top Super Majors, Chevron, (CVX), and Exxon Mobil, (XOM), have their short-cycle growth plans hitched to the Permian. These companies all have multi-year investment plans baked into the Permian, which assures PUMP of a sustained level of increasing activity at present prices.

Capital flow toward Permian (Seeking Alpha)

Sam Sledge, CEO of PUMP made the same sort of bullish commentary that we’ve heard from other service companies this quarter:

In the North American pressure pumping market, we see continued evidence of an effectively sold-out market. This is most obvious in the recent trajectory of spot pricing for vintage Tier 2 equipment, where we see robust inquiries for future deployments.

Moreover, we see bifurcation in demand for pressure pumping services where our ability to reduce risk and bring forward the present value of high-priced oil production in a predictable manner is priced at a premium. Because of these variables and others, our forward view of pricing for our services and for the whole field service sector — the whole field services sector remains positive.

With 15 active fleets and 1.3 mm HHP, PUMP is a medium sized player across the entire market, but with its Permian focus has the critical mass to maintain its customer base. Most of its equipment is Tier II diesel, but the conversion to Tier IV DGB and eventually electric is underway. With 1.3 mm HHP available, there are probably another 10 Tier II diesel fleets available for upgrade as market conditions warrant.

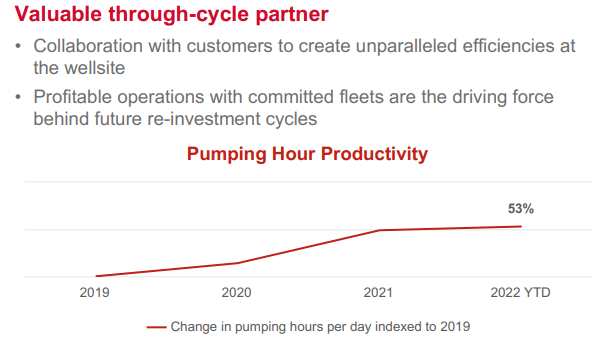

Finally, PUMP is a service oriented player as opposed to a technology player, like Halliburton, (HAL) or Liberty Energy Services, (LBRT). This drives strong partnerships, like the one they forged with Pioneer Natural Resources, (PXD) years ago. (For more on the relationship between PUMP and PXD read my first article on them.) Strong relationships lend themselves to optimized fleet utilization and cost control through the full cycle.

PUMP equipment utilization (Seeking Alpha)

Q-2, 2022

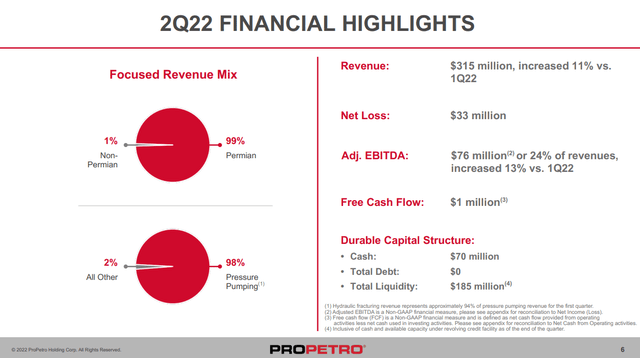

PUMP’s relatively clean balance sheet is a major plus for the company. They grew revenues 11% from increased pricing primarily, and expect to continue doing that as equipment tightness drives pricing. PUMP has $70 mm of cash on the books, total liquidity of $185 mm, with no long term debt.

PUMP Financial Highlights (Seeking Alpha)

The $57 mm writedown of the Durastim fleet threw the company into a paper loss for the quarter, but is a one-off. From commentary in the 10-Q it appears that the manufacturer was unable to support the Durastim equipment development at PUMP.

Given current market conditions, continued supply chain disruptions, inflation, and other factors impacting further development of DuraStim® technology, we do not currently anticipate deploying our DuraStim® equipment in its current form, and accordingly, we evaluated our DuraStim® equipment in its current form for potential impairment. (10-Q)

Risks for PUMP

Not having an efleet solution in development is a concern. Three years ago they were going to leverage their entire future around efracking. This probably caused a delay in going the DGB route. Management says they are pursuing an offering here, and we will just have to wait for an announcement, hopefully in the near future.

There’s a regulatory cloud over the Permian basin. The EPA has sharpened its ozone focus and this could lead to it declaring the Permian area as “non-attainment” of ozone targets. Actions that could lead to curbs in drilling. This one to watch, but realistically I can’t imagine a curtailment with the present market forces at work. Of course this risk is a across the board and not just for PUMP.

Your takeaway

There is no question PUMP is a buy zone presently, if you buy the tight oil supply narrative we endorsed in a recent article. As noted above, on an adjusted basis they are on track to deliver $325 mm of OCF in 2022. I can see that easily rising to $375-$400 mm in 2023 with the advent of their 4-new DGB fleets, knocking the present multiple into the low 2’s. To keep the multiple in the 3 range the stock would need to hit $13 per share. Easily obtainable in this market. Sector momentum that is sure to return this fall could even take it toward a 4X, landing the stock in the $16’s.

As I say, PUMP is a buy at current levels. The 2022 new build capex should drop off in 2023, and if they can get a handle on their supply chain issues pointed out in the call, additional money should fall to the bottom line.

All of that said, if I was going to open a position-I’m not, I am already long HAL and LBRT, it would be at $9 or lower, and if it got above $13, I’d place a stop. PUMP isn’t a company I want to hold long term, but the current discount to value might tempt me if I wasn’t already invested in the fracker space.

Be the first to comment