Marcus Lindstrom

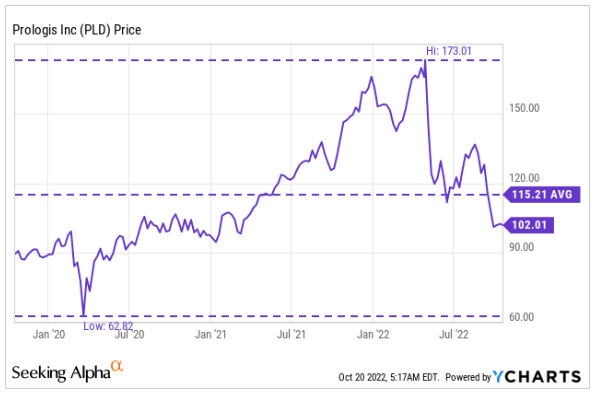

Prologis, Inc (NYSE:PLD), the global leader in logistics real estate, just reported results for the third quarter ended September 30, 2022. With shares already down nearly 40% YTD, double the losses in the broader S&P 500, much already seemed priced-in prior to the earnings release.

Yet, shares dipped another 3.5% following disappointing guidance. Though the stock is still off their 52-week lows, they are trading at early 2021 pricing. This is despite reporting over +$1.0B in adjusted funds from operations (“FFO”) during the quarter, a feat not achieved in earlier periods.

YCharts – PLD’s Recent Share Price History

Then, the stock would have commanded a 25x forward multiple. But that has since compressed to 20x. While some would argue that this is still too much of a premium in relation to the overall real estate sector average, which is currently about 13x, I think it is fair pricing considering their dominant market positioning in one of the most supply constrained sectors.

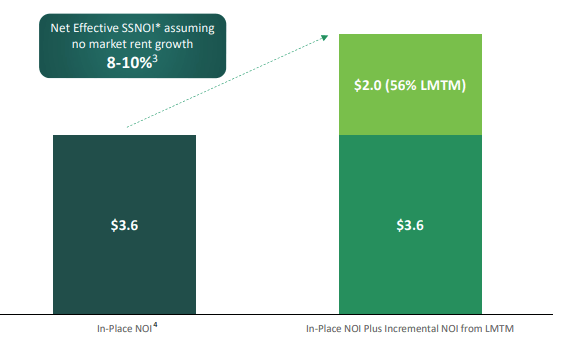

Though a slowdown is likely, PLD has an extended runway for continued growth. Even with no assumed market rent growth, for example, net effective same store net operating income (“SSNOI”) is still projected to grow in the high-single digits for several years as leases continue to roll to market.

For investors seeking to add to their core long-term portfolio holdings, PLD is one of the few worth the premium dollars.

PLD Q3FY22 Earnings Recap

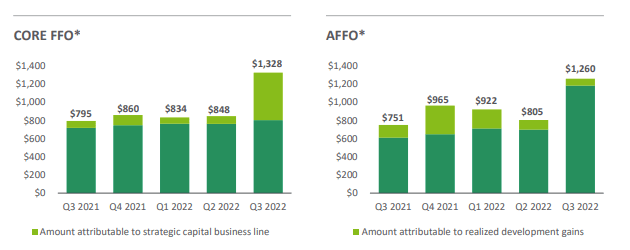

In the current quarter, total core FFO/share came in about 12% higher than the same period last year when excluding the contributions from net promote income (“NPI”), which added $0.57/share in the current period and $0.01/share in 2021.

Q3FY22 Investor Supplement – Reported Core FFO And AFFO Over Last Five Quarters

The sizeable variance in NPI in the current period was expected, as annual guidance previously called for a $0.60/share contribution, driven principally by their PELP venture in Europe. Since most of the NPI contribution was expected in Q3, it’s unlikely PLD will hit their target for the year. And this would be due primarily to a nearly 5% write-down of European asset values during the quarter. Despite the write-down, however, the fund still logged an annualized internal rate of return (“IRR”) in the high teens over its 3-YR performance period.

During the quarter, PLD also closed on their acquisition of Duke Realty Corporation, whose portfolio covered 19 U.S. markets with over 150M square feet (“SF”) of operations and 11M SF of development in progress. Following the acquisition, the absorption of Duke’s portfolio deepened PLD’s penetration into the most supply constrained markets of Southern California and New Jersey.

Total overall occupancy ended the quarter at 97.8%, which would be up sequentially by 10 basis points (“bps”) and 70bps YOY. Within the Duke portfolio, occupancy held at 99%. Contributing to overall occupancy in the current quarter were gains in Europe, which saw occupancy tick up 60bps to 98.6%, offset by 80bps of weakness in Asia, which fell to 95.1%.

Rising vacancies in Asia, however, is expected to be partially offset by pricing strength due to the impacts of weakened currencies on construction costs, particularly in Japan, where rising costs have severely constrained new supply.

Near-full occupancy levels are supported by retention rates that remain stable despite significant rent growth that came in at 60% on a net effective basis and nearly 40% on a cash basis. This drove SSNOI higher by 8.3% and 9.3% on a net effective and cash basis, respectively, continuing a trend of upper-single digit SSNOI growth over the last several quarters.

In addition, PLD’s lease mark-to-market (“LMTM”) stood at about 62% at period end, supported by the scarcity of available space in their markets and historically low vacancy rates. In the years ahead, this can provide about +$2.0B in incremental NOI.

September 2022 Investor Presentation – Net Effective SSNOI Growth Assuming No Market Rent Growth

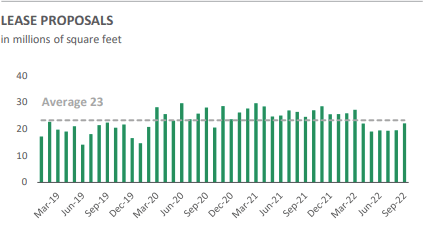

Despite the strong operating results, PLD is proceeding with caution due to the volatile macroeconomic environment. Deceleration in development activity across their markets, for example, was noted on the conference call. And the true months of supply metric is now 22 months, up from 18 months last quarter. Lease proposals have also returned to 2019 levels, which indicates less urgency to renew space far ahead of expiration.

Q3FY22 Investor Supplement – Lease Proposal Trends

In response to moderating activity levels, PLD lowered their starts guidance and reoriented the composition to 60% build-to-suit. They also announced a pause in contributions to their open-ended funds. Still, they increased their expectations for core FFO, excluding promotes, and same-store NOI, while maintaining guidance for average occupancy.

Post-Earnings Insights

PLD is still reporting material rent growth on near-full occupancy levels. While growth rates will inevitably slow, the runway remains long, as evidenced by the embedded mark-to-market opportunity, which is over 60% due to the sector’s favorable supply dynamics.

Though supply did rise in the current period to 22 months, it is still below the company’s expectation of reaching into the 30 months range. And even at that level, supply would still be absorbed in less than two years and would still be well under the minimal level necessary to maintain positive real rental growth, which would be 50 months of supply.

Concerns over increased vacancies also appear to be overdone. Across the U.S., average warehouse vacancy rates ticked up to 3.2% in the third quarter from 3% in the second quarter, the first increase in two years. But that is far below the 5% rate in 2020. Additionally, vacancies are market dependent.

In Los Angeles and New Jersey, for example, there are essentially no vacancies, while in other areas, it can be in the 5-6% range, which is still low by historical standards. PLD is, of course, exposed to both markets in their geographically diversified portfolio, but at nearly 98% occupancy levels, vacancy risks for them are negligible.

Much has also been speculated regarding Amazon’s (AMZN) plans to sublet warehouse space. As PLD’s top tenant, this is of particular interest. But even this is having a muted effect on operations, as it was noted that Amazon hasn’t pulled out of any of its PLD’s buildings or projects. In fact, they’ve even taken on new space. Furthermore, e-commerce companies, overall, have been adding new space to catch up after having fallen behind AMZN for a number of years.

This is not to say a slowdown isn’t inevitable. Management did convey a cautious tone on the conference call and lowered their guidance for new development starts, while also noting that leasing activity has softened.

But even if a slowdown were to occur, normalization would very likely be at levels that would be above pre-pandemic benchmarks due to the heightened level of awareness on supply chains, whose vulnerability was exposed over the last two years, forcing many companies to reevaluate the resiliency of their warehousing footprints.

Overall, the fundamental outlook isn’t bleak enough to justify a significant compression in PLD’s premium multiple, which is appropriate given their dominant market position in a severely supply constrained sector. Barring any significant declines in rent spreads and LMTMs, PLD should retain a market premium that is commensurate with its market leadership.

By 2024, PLD is expected to generate $5.80 in FFO. At 20x-23x that estimate, shares would have embedded upside of approximately 10%-30%. Including the dividend, which is growing at a 3-YR compound rate of 13%, PLD makes for a well-qualified core portfolio holding.

Be the first to comment