Tetiana Strilchuk/iStock via Getty Images

Co-produced with Treading Softly

I love the idiom: “Don’t put all your eggs in one basket.” It speaks a simple truth in a folksy way.

When I envision it, I imagine a toddler carrying a metal pail or wicker basket filled with fresh eggs, they bumble across an open field carrying their precious cargo enthusiastically.

As they travel, they stumble, and a few eggs fall to the ground, breaking upon contact. “It’s OK!” their parent calls out, coaxing them to keep on coming. They continue with childish delight, excited to show off their hard work gathering eggs.

As the distance to their parent gets smaller, their speed increases. Less care is given to the eggs as excitement takes over. More eggs go flying in varied directions as they close in on Mom or Dad.

With only mere steps left, they stumble and fall. The basket goes flying, and so do the varied colored eggs. Into the air, they fly, landing with a splat like a rain shower that stops as suddenly as it starts. Instead of wet grass all around, we are left with a sticky, yolky mess.

The mistake? Entrusting all your eggs into the basket carried by a toddler. I’ve been there. I have chickens, and I have had multiple toddlers over the years. I know you shouldn’t trust them with eggs if you want to have any eggs to eat. Then again, even with a careful adult carrying a basket of eggs, accidents happen.

Splitting up your income into various streams can help ensure that it gets from the company to your coffers with a greater degree of success and safety. You don’t want your capital being entrusted to a carefree toddler. But even with the most careful investment, you must consider that the unexpected happens. You don’t want your nest egg dependent on one company.

One route to gain “instant” diversification is to use various funds which invest in a swath of companies or investments from a wide-ranging scope in a particular sector. This type of diversification can make it easy to have exposure to an area you are less familiar with while leveraging the skills and experience of portfolio managers with decades of experience.

Let’s dive in on two funds that can provide significant income and instant diversification.

Pick #1: PFFA – Yield 10.5%

2022 is continuing to etch its place in history as one of the “worst” years for fixed income in decades. As interest rates rise, the prices of fixed-income investments fall. Why? Because fixed-income investments compete directly with U.S. Treasuries.

What defines fixed income is that the expected return is pre-determined. With common equities, you’re always projecting, guessing, and hoping. There’s no guarantee and no promise from the company.

Preferred shares come with promises. The company issuing the shares will pay a pre-determined dividend. If they choose to redeem the preferred, it will occur at a predetermined price. If the company fails to meet its promise, there are consequences, usually in the form of cutting off the common shares from dividends until what’s owed is paid.

Preferred shares come with more certainty, but that also means that the upside is not unlimited. When you buy a preferred share, you know what the dividend will be, and that’s what it is. No matter how great the company beats expectations or how much profit it makes, you will receive the predetermined dividend.

Treasuries come in the same format. The day you buy a Treasury Note, you know precisely what your total return will be at maturity. You will receive $X in interest and $Y at maturity. Period. Your return will not be higher or lower if you hold until maturity. Preferreds trade at higher yields than Treasuries because the promise of a company is less certain than the promise of the U.S. government. Investors demand a “risk premium” for all fixed income that can be measured as a spread over Treasury rates.

However, just because the total return is guaranteed does not mean that Treasury prices are flat. Prices on Treasury Notes change, and you can lose money on a Treasury Note if you decide to sell it in the secondary market.

So when the price of Treasuries falls, investors can get a higher yield from buying Treasuries. This impacts all fixed income. If I can get a 4% guaranteed yield from the U.S. government, I will prefer that over a 4% yield from any corporation. So the prices of all fixed income fall so that investors are getting a “risk premium” they view as enough.

Prices fall, and yields on new fixed-income investments go higher. For fixed-income investors, the opportunity to roll repaid principal into new investments at a higher yield without taking on additional risk necessarily results in higher total returns in the future. So while the price movements might not be fun in the near term, in the long run, fixed income will have much higher total returns when interest rates are high than it could ever hope to have when they are low!

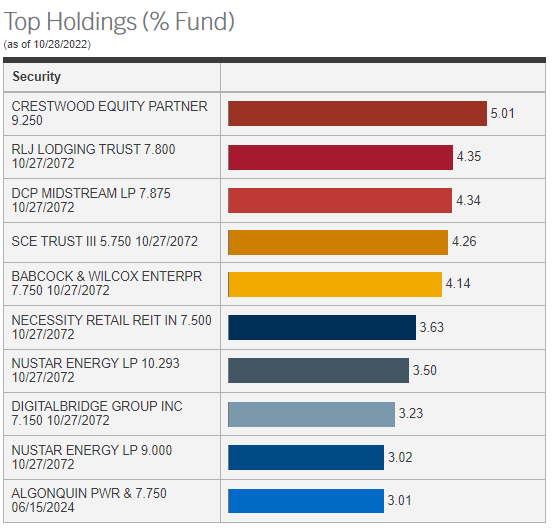

When it comes to investing in preferred and baby bonds, we have a large portfolio. For those who want to increase exposure, Virtus InfraCap U.S. Preferred Stock ETF (PFFA) is our ETF of choice. If HDO were to operate a preferred ETF, it would look a lot like PFFA. Just look at their top 10 holdings:

PFFA

Most of these are in the HDO Model Portfolio.

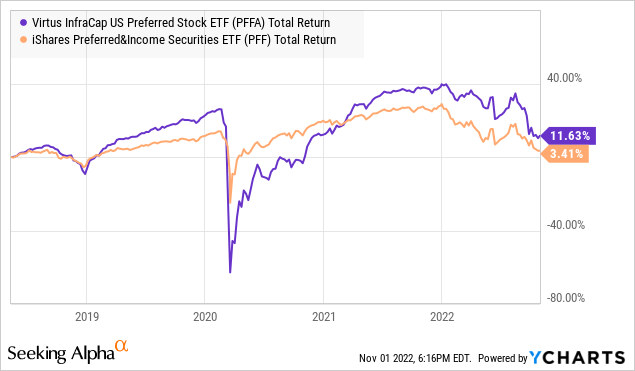

What separates PFFA from other preferred ETFs is its active management and use of leverage. While other preferred funds like PFF were paying well above par for preferred shares when prices were high, PFFA remained strategic – focusing on higher-yielding, lower-priced opportunities.

Like HDO, the managers of PFFA concluded that energy and real estate were two sectors with significant opportunities in the preferred space.

The use of leverage amplifies returns in both directions. It creates the risk of more downside when prices are falling, and creates more upside when prices are rising.

Thanks to active management, PFFA has managed to hold up very well over the past year despite the use of leverage. The decline has not been as sudden and disruptive as it was during COVID.

PFFA rebounded strongly after COVID, and we expect it will rebound strongly when the Treasury markets stabilize. Adding to its long-term outperformance relative to traditional ETFs like PFF.

If you want a quick and liquid way to increase your exposure to the types of preferred in the HDO Model Portfolio, PFFA is a great option!

Pick #2: BIZD – Yield 10.2%

One advantage of investing in funds like ETFs is that they can provide instant diversification and exposure to various companies in the same sector. You want to invest in an ETF when you believe that an entire sector will see strong results.

It’s hard to imagine a sector that is better positioned for the current economic environment than BDCs. Business Development Corporations have a business model where they make floating-rate loans to small to medium-sized businesses. Typically, BDCs borrow money using fixed-rate debt. As a result, you have floating-rate assets and fixed-rate liabilities. When interest rates are rising, that’s pure profit heading straight to the bottom line.

We’ve already seen a few BDCs report earnings for Q3, and unsurprisingly, we’ve already seen some dividend hikes. Ares Capital (ARCC) announced a 12% dividend hike to $0.48/quarter. Hercules Capital (HTGC) announced a 3% hike plus a $0.15 supplement. We expect that by the time BDCs are done announcing earnings, we will see many more hikes and supplements throughout the sector.

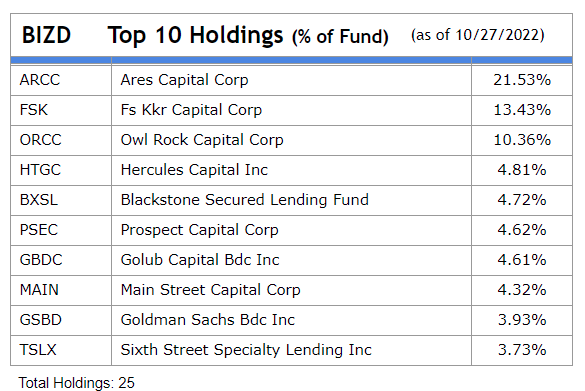

VanEck Vectors BDC Income ETF (BIZD) is our preferred ETF in the BDC space. BIZD weights BDCs based on market cap, which means it has exposure to the largest and most successful BDCs. Source

BIZD

We have several individual holdings in the BDC space, but when an entire sector is outperforming, adding exposure with an ETF is a great way to double down.

The BDC sector has sold off with the rest of the market, but the earnings that BDCs are posting are proving the bears wrong. BDCs are making a ton of money, and they will make a lot more in the future.

Conclusion

With PFFA and BIZD, we get instant diversification across both the preferred and BDC sectors, all while enjoying +10% yields. I love to hold individual top-notch preferreds and BDCs, and I do hold many of them. However, I also like to gain exposure to a wider array of options without having to go out and buy a bunch of individual positions. These funds allow me to do that with the ease and liquidity that rarely can be matched.

This way, I can augment the exposure I get through them with my individual holdings.

For those who do not like to tinker and optimize, BIZD and PFFA are easy solutions to get exposure and income, something we all can benefit from. These funds send out many egg gatherers and collate them together to provide us with a strong stream of income.

While those managers worry about managing their portfolios, I can manage my retirement calendar. Is today golf with my friends, or is it dinner at the ocean-side steak place? I guess I’ll keep double-checking my calendar, which I use to keep track of the various experiences my dividends are paying for!

Until next time, keep on collecting those dividends!

Be the first to comment