Maks_Lab/iStock via Getty Images

Introduction

This piece will serve to accurately define inflation and discuss the CPI’s inaccuracy in measuring it. Then, I will discuss some of the developments in the bond markets and my advice to investors to navigate the current climate.

What is Inflation?

An expansion in the supply of money.

Today, almost everyone universally defines inflation as a rise in prices. This is a misleading definition as prices do not inflate or deflate – they can only rise and fall. The money supply is what inflates and that happens every time the Federal Reserve conjures a new dollar bill into existence.

This new dollar dilutes the already existing pool of dollars. As a result, people bid for goods and services with more dollars, which drives up the price of those goods and services. Inflation is not a rise in prices; inflation causes prices to rise.

Here is a definition of inflation from a 1913 copy of a Webster’s dictionary:

True Definition of Inflation (Schiff Gold)

The reason the government changed the definition of inflation to a ‘rise in prices’ was to shift blame to private sector greed as opposed to public policy waste. Under the correct 1913 definition, inflation is clearly a monetary phenomenon. If you define inflation as an expansion in money supply, the blame lies in bad monetary/public policy. If you define inflation as a rise in prices, it shifts blame to greedy business owners trying to price gauge their customers. It is simply more expedient for politicians to blame the rich rather than themselves for sacrificing the country’s best interest in order to gain popularity and votes.

Inflation’s History

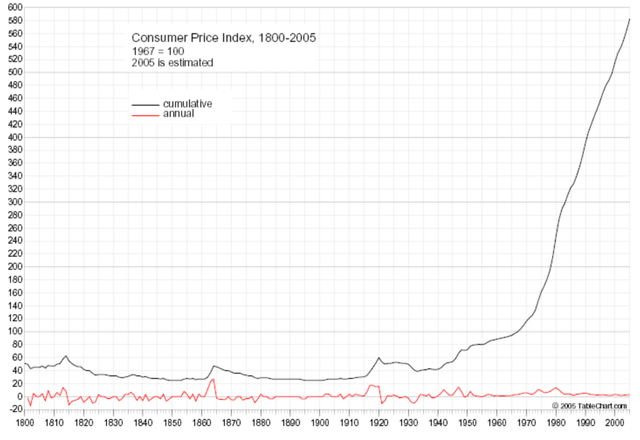

CPI 1800 – 2005 (Charts, Graphs, Diagrams)

Here is a chart of the CPI (Consumer Price Index) going back to 1800. There will be more to follow on the CPI itself in the next section, however, I want to draw investors’ attention to one particular century.

Prices in 1900 were half of what they were in 1800. According to conventional wisdom, this should have spelled disaster – except the opposite happened. In this deflationary environment, the Industrial Revolution took place, which exponentially increased the standard of living for Americans. Immigrants flooded the country, and despite this significant demand shock, prices still fell. The country was producing so much stuff that it was able to accommodate tens of millions of people entering the country.

However, once the Federal Reserve was created, prices began to spiral out of control. What was originally created to ensure stable prices, became an engine of inflation. The Federal Reserve constantly moves the goal post of their target level of inflation.

In reality, the Federal Reserve is a board of economists and advisors who are there to cheerlead the economy and instill confidence under all circumstances. Every member of the board is intelligent. They all know inflation is bad, but they cannot simply admit that, because unfortunately, inflation also has a psychological component to it. When business owners and consumers expect prices to increase, they adjust their behavior accordingly, and buy more stuff at a faster rate. This increase in velocity drives prices up even faster and the problem only gets worse.

Note: A lot of people wonder why did not prices increase faster throughout 2000–2020, when interest rates were at 0% and the Federal Reserve started its ritual of Quantitative Easing (a euphemism for printing money). When the supply of money expands, that sets the groundwork for prices to go up. The rate/degree to which prices increase depends on the velocity of money, which is how quickly each dollar is turned over (spent). Velocity of money also has a psychological component to it – that is why it is hard to predict inflation. If the Fed creates a trillion dollars and buries it, prices will be unaffected. If the Fed creates a trillion dollars and injects it into the banking system, prices will go up slower while that money is being eased into the economy. If the Fed creates a trillion dollars and direct deposits it into the bank accounts of citizens, prices will shoot up.

CPI

The consumer price index is the overall price of a predetermined basket of goods and services. This basket price is then compared over each year to see how prices are moving.

Done honestly, this metric would accurately track how prices move over time. However, the CPI as it stands today (it was more honest in the past) is probably the most manipulated economic measurement. Starting with the Boskin Commission, I think the CPI has essentially been reverse-engineered to always understate inflation.

Through substitutions, the Boskin Commission was able to claim that the CPI overstated inflation and in reality, times were not as bad as they seemed. There are obvious problems with the commission’s findings.

Substitutions in the CPI occur when one good or service is substituted for another of similar characteristics.

For example, let us assume the price of chicken and beef is $1 per pound. If the price of beef goes up from $1 to $100 per pound the next year (and chicken stays the same), the overall price level has dramatically increased in this basket of goods. However, if the government can simply substitute beef with more chicken, then they can keep the CPI the same since the basket of goods still averages $1 per pound. The government claims prices have not risen because consumers are still able to eat dinner at $1 per pound. This is completely disingenuous and should not be allowed.

Hedonics in the CPI occur when a good or service increases in quality and the CPI “adjusts” for that quality by absorbing the price increase.

For example, let us assume a laptop costs $1,000 today. However, the company makes an improvement in the device and charges $1,500 next year. Hedonics would quantify the change in quality and factor that in to the price increase. If the government deems the increase in quality is worth $500, then they can claim there is no price inflation. Again, this is totally disingenuous because value is subjective to the buyer and not all improvements in quality are realized. There are limitations. For example, if a laptop has a nicer keyboard, that does not necessarily increase the speed at which I can type. I am still limited by the speed of my fingers.

Another issue with Hedonics is that it (conveniently) never works in the opposite direction. The government does not factor in goods or services which have decreased in value. An example of this is the airline industry. Does the government factor in all the declines in the quality of air travel over the last twenty years? All of the following have changed: the long lines at TSA, no more lunch/dinner on planes, no more cheap/free seat upgrades, no more substantial snacks (they are all miniature), no more free bags to check in. The government completely ignores these facts, looks at the price of the ticket, and duplicitously concludes that the price of airline tickets has not changed.

Lastly, another huge issue with the CPI is owner’s equivalent rent. OER, which makes up about ¼ of the CPI, is determined by a monthly survey that asks current homeowners to estimate how much money their home would rent for monthly. The rent portion of the CPI is not even based on actual rents (the rents tenants are actually paying). It is based on a fictional estimate conducted via survey. OER was incorporated in order to falsely showcase that rent has not increased and thus, causes the CPI to be understated.

Why Understate the CPI?

The rise in prices the CPI determines is indexed to annual payment increases such as, Social Security, interest rates, and other retirement and compensation programs. The CPI also affects consumer behavior and confidence. Therefore, the government has incentive to publish the lowest number possible in order to reduce the financial burden of increased commitments to the public and maintain consumer confidence.

The Bond Market

The bond market is finally starting to sense the impending recession as the yield curve recently inverted.

US Treasuries

Here are the rates for three of the most common treasury maturities:

US 5Y = 2.44%

US 10Y = 2.35%

US 30Y = 2.48%

For readers who are not familiar with bonds, longer maturity bonds carry higher interest rates because there is more uncertainty with each passing year. Thus, the investor needs to be compensated more for the increase in risk. However, in today’s market, the US 5Y is 9bps higher than the US 10Y and 4bp lower than the US 30Y.

So, Why is This?

The bond market believes that if the Fed keeps raising rates, there will be a recession. Bond investors believe this short-term recession will cause the Fed to reverse course and cut rates again, and this expectation of future rate cuts is now being built into the yield curve. In addition, the bond market believes the recession will extinguish inflation regardless of future rate cuts. The implications of both these beliefs leads to an inverted yield curve. The expectation of future rate cuts and no inflation (distinguished by the recession) would explain why the 5Y rate is higher than the 10Y and equal to the 30Y rate.

Note: I do not believe a recession will cure inflation as inflation is caused by the central bank and can only be cured by deflating the supply of money – by definition. The yield curve should not be inverted and the yields of the 10Y and 30Y should be significantly higher.

TIPS Spread

The spread between the yields of same maturity US Treasuries and TIPS (Treasury Inflation Protected Securities), is the market expectation of future inflation.

For example, the current yield on a 30Y TIPS is -.02%. and the current yield on the US30Y is 2.48%. Therefore, the TIPS spread is 2.5%, which means investors expect inflation to average 2.5% for the next thirty years.

If inflation averages 2.5% over the next thirty years, why would anyone buy a US30Y bond that yields 2.48%? People lend their money out to make a positive return – if all you get back in thirty years is the exact same amount you lent out, why even lend the money in the first place? You gain a higher utility by simply spending the money today rather than waiting thirty years to buy the exact same amount of stuff.

The only reason people defer consumption is due to the expectation they will consume more in the future. If they expect to consumer the same, then rationally, they will spend the money today.

Risk Free Rate or Return Free Risk?

US Government Bonds are thought of as “risk free” meaning there is no risk of default. In other words, if you buy a US Bond, you will always get your money back. However, US Bonds are in reality, one of the riskiest financial instruments that an investor can buy. If my goal was to lose as little money as possible and my only two choices were between putting all my money in stocks and all my money in bonds… I would pick stocks.

US Bonds carry tremendous inflationary risk. If you loan money to the government for 30 years at 2.48%, you are at extreme risk of losing significant purchasing power. The economic data points to inflation averaging much more than 2.48% over the next thirty years and current bond yields do not provide enough compensation to offset the increase in risk.

Even worse is the foreign currency risk investors abroad assume when they buy a US 30Y treasury. Not only will inflation erode the value of their bond in real terms, but if the value of the dollar falls, then the purchasing power returned is even further diminished as those dollars will convert into a lesser amount of the investors home currency.

Takeaway

Investors must be aware the CPI dramatically understates inflation and that treasuries have negative real rates. Equipped with this knowledge, investors can divert funds from securities which will diminish their purchasing power over time. Treasuries are one of the riskiest investment vehicles out there and investors should steer clear. The upside risk if inflation averages less than 2.5% is minimal while the downside risk if inflation averages more than 2.5% is substantial.

As always, the best remedy for inflation is hard assets, precious metals, and high-quality stocks. Real estate, gold/silver, and undervalued stocks will preserve purchasing power during periods of high inflation and negative real rates.

Be the first to comment