Diego Thomazini

This article was first released to Systematic Income subscribers and free trials on Aug. 21.

Welcome to another installment of our Preferreds Market Weekly Review, where we discuss preferreds and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the third week of August.

Be sure to check out our other weekly updates covering the BDC as well as the CEF markets for perspectives across the broader income space.

Market Action

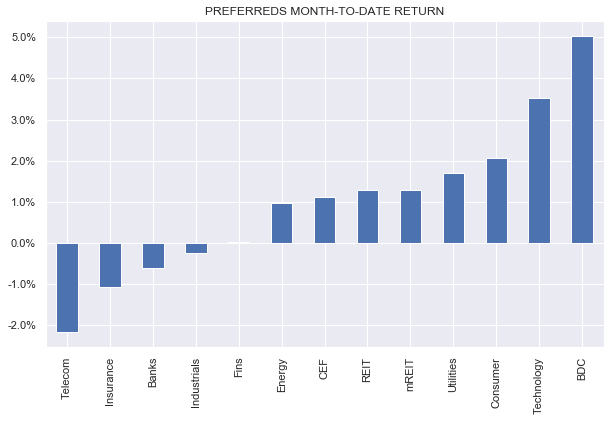

Preferreds hit the wall this week as the Fed tried hard to convince the market that they are nowhere done in tightening financial conditions. Month-to-date, about two-thirds of preferred sectors are still in the green.

Systematic Income

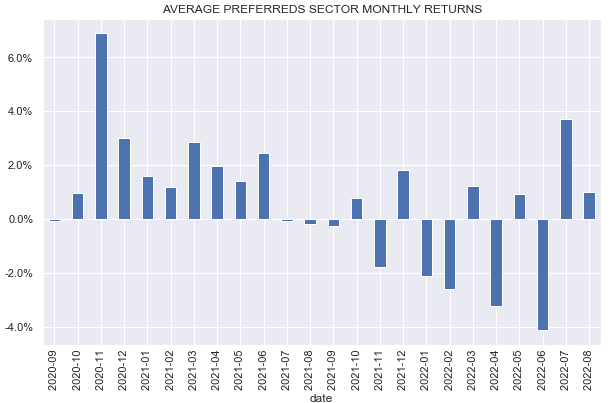

Preferreds are up around 1% over the month of July.

Systematic Income

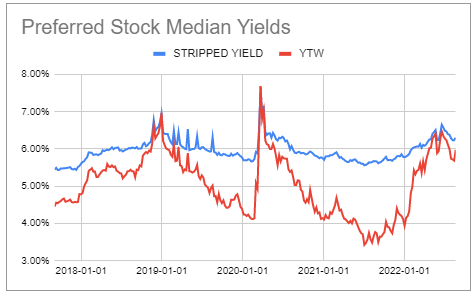

The median yield-to-worst has moved back up to 6% though it remains well off the 6.5% reached at the recent peak.

Systematic Income Preferreds Tool

Market Themes

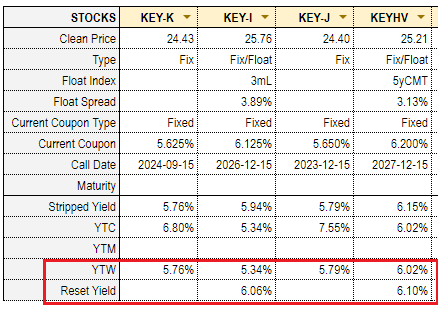

Lower yields have brought new issuance out of the woodwork. Key Bank is out with a 6.2% reset preferred (KEYHV) (reset coupon = 5Y Treasury yield + 3.132% from 2027), which looks the most attractive across the 4 preferreds suite by virtue of its highest yield-to-worst, highest reset yield and moderate duration given its highest coupon and reset profile (i.e. if/when it floats in 2027, its duration will be capped at a maximum of 5 and will roll down until each five-year coupon reset). KEYHV is split-IG rated by Moody’s (Baa3) and S&P (BB+).

Systematic Income Preferreds Tool

Morgan Stanley is out with a 6.5% fixed-rate (MS.PP). The coupon on the stock seems extremely high – 6.5% is about the peak yield that was reached by the entire sector and MS preferreds are higher quality than the average. It’s odd that they pressed ahead with the issuance at such a high coupon rather than waited. Very likely this was because the funding provided by the preferred is just a rounding error in the broad scheme of things for the bank. It is now trading at a 5.4% yield, $26.22 dirty price. It is less attractive than some of the other MS preferreds such as (MS.PF), which would be our pick in the suite. MS preferreds are IG-rated by both Moody’s and S&P.

Finally, a small bank Midland States Bancorp is out with a 7.75% reset preferred (MSBSV) (reset = 5Y Tsy yield + 4.713% in 2027). It is unrated (by the major agencies) and boasts one of the highest yields in the sector.

Market Commentary

The SLM Corp Series B (SLMBP) came up on the service. The stock has a coupon of 3-month LIBOR + 1.7%, which equates to a coupon of around 4.66% today. SLMBP trades at a stripped price of around $58.40 (it has a $100 “par” amount), which equates to a yield or roughly 8%. Its current coupon accrual will differ from this given that at the start of the accrual period Libor would have been lower.

One advantage of SLMBP is its high yield beta to rising Libor. Specifically, because it trades at 58% of its “par” amount each 1% increase in Libor equates to around a 1.7% increase in the yield. At the likely peak in Libor of around 3.5%, the stock will have a yield of around 9% at the current price.

That’s an attractive headline yield, however, there are two things to keep in mind. First is the stock’s Ba3 rating (BB- equivalent). That’s not a disastrous rating by any means, but it’s not a good one for a financial preferred to have (Sallie Mae unsecured rating is a BB- equivalent – the highest sub-investment-grade rating).

And two, what goes up fast can go down fast as well. The Libor multiplier due to the stock’s very low dollar price (as a function of its “par” amount) also means that its yield will fall sharply if the Fed decides to ever reverse its hikes. A small position, in our view, is not obviously dumb but we would rather overweight either higher-quality floating-rate bank preferreds we have discussed a number of times recently or mortgage REIT soon-to-float stocks like NLY.PF or AGNCN which will also have a yield of 8.5-9% at the peak in Libor. The recent recovery in agency MBS valuations should improve equity coverage of these preferreds going forward.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis – sign up for a 2-week free trial!

Be the first to comment