jetcityimage/iStock Editorial via Getty Images

Investment Thesis

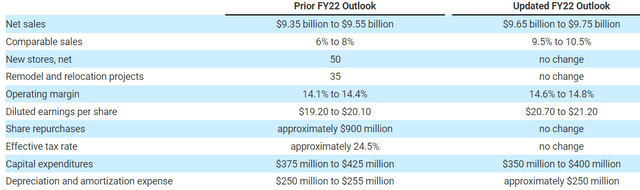

Ulta Beauty (NASDAQ:ULTA), the much-loved retailer of beauty products with more than 1,300 stores in the US, announced yet another quarter of impressive results on August 25. For Q2 2022, Ulta’s non-GAAP earnings were $5.69 versus $4.52 expected, while revenue of $2.3 billion beat by $100 million. Comparable store sales were up 14.4% Y/Y and the company raised its 2022 outlook across the board, giving investors a nod of confidence in what is expected to be a tough macroeconomic environment.

ULTA 2022 Outlook (ULTA Q2 2022 Earnings Release)

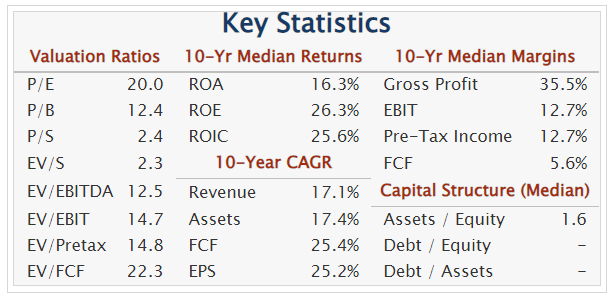

While I’m encouraged to see positive quarterly results from Ulta, I focus primarily on the long term. If the past is any predictor of the future, Ulta looks to be an attractive investment candidate. I fully expect growth to wane in the coming years, but you can’t deny the enviable results of the past 10 years.

ULTA 10 YR Performance (Quickfs.com)

Investors who’ve spent any time studying Ulta have noticed that shares typically trade at a premium. Seeking Alpha pegs Ulta’s 5YR AVG GAAP P/E at 34 while non-GAAP clocks in at 27. With a current P/E of 20 (GAAP and non-GAAP), Ulta looks attractive from a historical perspective. However, I think Ulta needs to deliver on a couple of key drivers, those being revenue growth and share buybacks, to warrant taking up a position. I believe Ulta has a good chance of delivering on both, which is why I think shares won’t get much, if any, cheaper from here.

A Resilient Business

I’m an owner of Ulta shares; my cost basis is $367. There were two primary factors that led me to the business and taking up a position. Firstly, Ulta screens unbelievably well on just about any Stock Screener. Like many of you, I screen for growth in revenue, cashflow, and EPS. I also screen for high ROE and ROIC, low debt-to-equity ratios, and mid to low P/E ratios (<30). The chart above is pretty self-explanatory on how Ulta showed up on my radar.

Secondly, my family is a habitual, satisfied customer of Ulta. Like many women out there, my wife has a strict daily facial regimen. I swear, she must have about 10 different bottles of facial product that, according to her, all have a specific purpose, schedule, and sequence in which they must be applied. Now, she’s beautiful even without the product, which is why I feel it’s a little excessive. But where I see $100 a month in discretionary face cream, she sees an item comparable to milk and bread – it’s a must-have. She finds great satisfaction and fulfillment in her daily regimen, so I’m happy to support her in it. Did I mention I also have young kids coming into the pre-teen years? We’ve already started purchasing products for them as well.

That is what I mean when I say Ulta has a resilient business. There are essentials and then there are non-essentials. In my house, Ulta is an essential. Even in today’s current macroenvironment, where my family is being more prudent with our expenses, Ulta hasn’t even made the list of potential items to cut. Netflix (NFLX), gone. Apple TV (AAPL), see ya. Seeking Alpha, never (ha)! If I were a betting man, I’d say many other households are similar to mine which means Ulta is likely to hold up well during economic hard times. Ulta’s 2022 outlook somewhat affirms this.

Revenue Growth

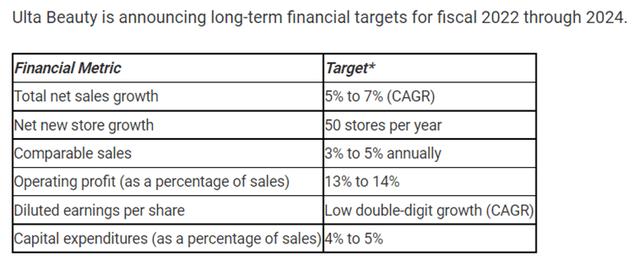

Fortunately for investors, I don’t think Ulta needs to post extreme revenue growth to perform well as an investment. I definitely don’t think Ulta will grow revenue at a +17% CAGR like it has the previous 10 years. In fact, the company’s revenue guidance is quite unimpressive, with net sales expected to be in the 5% to 7% range through 2024.

This revenue guidance is quite doable, and I don’t mind seeing such a low bar which I think can easily be jumped. It wouldn’t surprise me to see Ulta handily beat this guide, but I don’t think it’s a necessity for the investment thesis. What is a necessity though, is share buybacks.

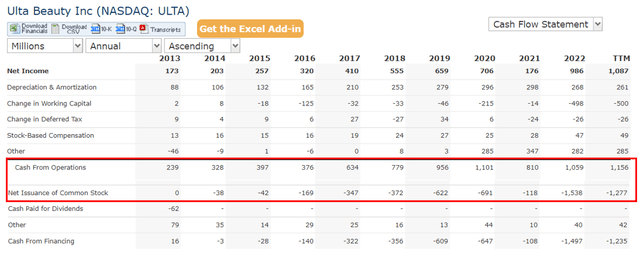

Share Buybacks

One thing I love about Ulta is it throws off a ton of FCF and returns nearly all of it to shareholders in the form of share buybacks. Also, Ulta’s share repurchase program isn’t a ploy to net-out Stock Based Compensation, which is one of the practices I despise most. Ulta’s program actually reduces total number of shares outstanding.

ULTA 10YR Cashflow (Quickfs.com)

Ulta has a long history of share buybacks and management has given no indication they intend to halt this practice going forward. It’s for this reason I decided to pick up shares when I did. Here’s Ulta’s update from their Q2 2022 earnings release:

During the second quarter of fiscal 2022, the Company repurchased 797,994 shares of its common stock at a cost of $301.6 million. During the first six months of fiscal 2022, the Company repurchased 1.1 million shares of its common stock at a cost of $434.4 million. As of July 30, 2022, $1.6 billion remained available under the $2.0 billion share repurchase program announced in March 2022.

Ulta’s resilient business, solid fundamentals and history, and share repurchase program make me a buyer of the stock in today’s market. If the market continues to push shares lower, I’d only buy more.

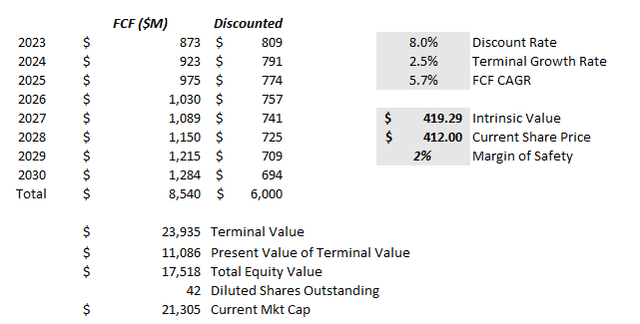

Valuation

At $412, I think Ulta is fairly valued, but I just don’t see it getting much cheaper due to the reasons outlined above. Anything less than $400 I think is highly attractive.

From a DCF perspective, I arrive at an intrinsic value of $419. I used an 8% discount rate, 2.5% terminal growth rate, 5% revenue CAGR, and 5.7% FCF CAGR. I also assumed a 3% annual reduction in shares outstanding, which is just shy of Ulta’s 5YR average of 3.6%.

ULTA DCF Valuation (Author’s personal data)

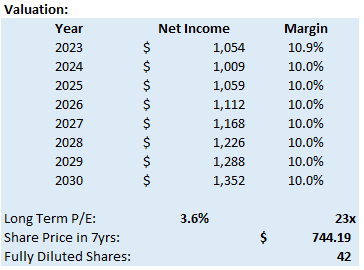

Using the market multiple approach, I arrive at a 2030 target price of $744, which equates to around an 8.8% CAGR from today’s price of $412. I assumed 5% growth in annual revenue, net margins of 10%, 3% annual reduction in shares outstanding, and a P/E of 23.

ULTA P/E Valuation (Author’s personal data)

Bear Case

My bear case for Ulta centers around a longer than anticipated recession, which is likely to have a broad impact on nearly all companies. In such an environment, Ulta won’t be spared. I fully expect Ulta to survive in economic hard times, but with consumers pinching pennies, it’s possible the company halts its share repurchase program. EPS growth is sure to take a hit if this happens and, while not negating the thesis altogether, it certainly increases the amount of time needed for it to play out.

Conclusion

For me, Ulta checks all the boxes I’m looking for in an investment. It has decent growth ahead of it, a resilient business, strong fundamentals, is shareholder friendly, and is a company in which I’m a satisfied consumer. Ulta is undervalued from a historical P/E perspective and, at $412 per share, I just don’t think it’ll get much cheaper.

Do I think Ulta will trounce the S&P 500 over the long term? No, but I think it has a decent chance of beating the market by a few percentage points each year. And a few percentage points over 5 to 10 years equates to a substantial amount of money.

Be the first to comment