shapecharge/iStock via Getty Images

This article was first released to Systematic Income subscribers and free trials on Apr. 4

Welcome to another installment of our Preferreds Market Weekly Review where we discuss preferreds and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the last week of March.

Be sure to check out our other weekly updates covering the BDC as well as the CEF markets for perspectives across the broader income space.

Market Action

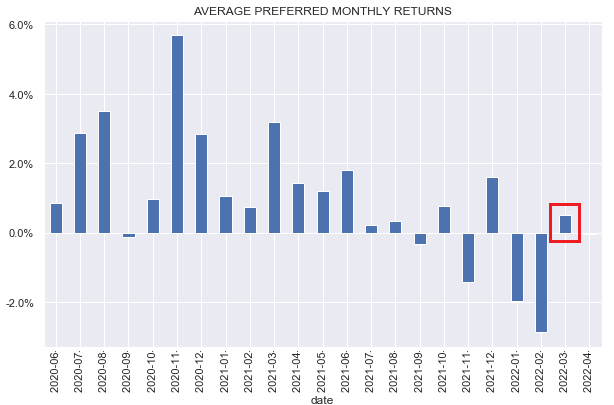

It was a strong week for the preferreds sector kicked off by a string of 4 positive days. All sectors rallied this week to close out a relatively poor quarter.

On a monthly basis, March started out poor but finished strong. And although the overall return was only a small positive, it was a welcome reprieve from two big down months in a row.

Systematic Income

The recent strength in the sector was primarily driven by a reversal in credit spreads. Longer-term Treasury yields are about 0.10-0.15% below their recent highs but around 0.8% above the levels where they started the year. This is why we don’t expect the year-to-date weakness to fully reverse itself – a lot of the current capital losses are baked in.

Market Themes

An interesting recent market theme in the preferreds space is what looks to be a turn away from retail preferred issuance towards institutional issuance.

Gabelli – a prolific historic issuer of retail preferreds for their equity CEFs – has recently closed a private placement of a $100 4.25% GAB Series M to redeem their $25 5.45% Series J. The Gabelli Equity Trust (GAB) used to have 8 preferreds trading and only 3 remain at the moment.

The Ares Dynamic Credit Allocation Fund (ARDC) last year issued three series of mandatory redeemable preferreds with coupons ranging from 2.58% to 3.03% for a total of $100m.

The XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) did something unusual – it issued $26m of its Series 2026 preferred (XFLT.PA) in Q1 of 2021 and in early September it issued an additional $10m privately at a price of $25 even though the stock was trading at $25.85 at the time. It’s odd that the fund didn’t simply do an at-the-market offering – perhaps the calculation was that, net of underwriter fees, the outcome would have been the same anyway and, as it closed a common offering a few months before, it just wanted to get on with leveraging the additional equity it got. Needless to say the buyers of the private issuance got a great deal.

The OFS Credit Co (OCCI) carries two very small private preferreds, in addition to its two exchange-traded series (OCCIO) and (OCCIN).

During the COVID drawdown period the BDC, TCG BDC (CGBD) issued $50m of a 7% convertible preferred to a Carlyle affiliate as liquidity support. In retrospect this was enormously attractive, not just because of the healthy coupon but the conversion feature which is now deep in-the-money (though the CEO insists conversion is not in the cards).

Finally, BDC Prospect Capital issued a 5.5% private preferred Series M in addition to its 5.35% exchange-traded Series A (PSEC.PA). Series M offers a number of very attractive features such as having $25 reflected on client account statements (very attractive to investment advisors who don’t have to take panicked calls from clients) and a death put. And even though PSEC.PA now trades at a much higher 6.67% yield Series M will be attractive to advisors, creating an obvious agency issue.

Overall, the popularity of private / institutional preferreds issuance is very likely to continue and increase. It certainly appears that this form of issuance is not only quicker (the issuer is typically ultimately dealing with a smaller number of buyers, very often just a single one, making execution much quicker) but also cheaper (not having to pay the underwriter). This is clearly unfortunate as it will limit the available pool of securities for retail investors but understandable.

Market Commentary

There was a subscriber question about (OZKAP) – the Bank OZK 4.625% preferred. OZKAP dipped below $20 a couple of times last month but has managed to partially claw back to $21. At the lows the stock was down around 20% since its IPO. Given there is nothing obviously wrong with the company, what’s going on?

The answer it seems is that the OZKAP preferred structure is unfortunate on two fronts. First, it got issued before the recent move higher in rates when overall credit yields were very low which allowed the company to issue at such a low coupon despite being a fairly non-descript bank. Its low coupon increased the stock’s duration profile and caused it to underperform in the recent move higher in Treasury yields. The second feature that exacerbated its underperformance is its Fixed-rate structure – Fix/Float stocks have held in a bit better.

It’s also important to say that investors expecting strong future capital gains from the stock are likely to be disappointed. In short, the price drop is unlikely to be fully reversed. If it does happen it will only be because longer-term yields have moved much lower. This could happen but it won’t be easy since it requires risk-free (i.e. Treasury) rates to move a lot lower and credit spreads to remain stable. The easiest way for Treasury yields to move lower is if we have a recession however in that case credit spreads will likely move even higher. This means that the path for OZKAP to fully retrace the drop back to $25 is a low-probability one – if it does happen it will likely take a long time.

Ultimately, perpetual preferreds aren’t like bonds – there is no mathematical reason for them to move back to any kind of “par” level. A bond that drops to $90 will mature at $100 unless it defaults whereas a perpetual $25-“par” preferred that goes to $20 can stay at $20 for eternity just fine.

Stance And Takeaways

Despite the recent recovery in the sector, higher long-end rates remain a significant risk. For this reason we continue to like higher-coupon preferreds from relatively strong issuers such as the ones we highlighted last week: (WFC.PL) and (LBRDP), trading at a 5.69% and 6.19% yield respectively as well those form consumer-oriented sectors such as hybrid mREITs including the MFA Financial 7.5% Series B (MFA.PB), trading at a 7.64% yield. We also like Fix/Float preferreds with relatively high reset yields (i.e. stripped yields past the first call date) which tend to be those featuring high spreads over Libor.

Be the first to comment