ronstik/iStock via Getty Images

The global apparel industry is one of the highly affected industries by the Covid-19 pandemic that forced many companies to shut down their stores. Two years after struggling to contain the pandemic, we are now seeing an improvement in global cases as a result of the widespread vaccination. This aids the industry’s recovery, with experts forecasting a 5.5% compound annual growth rate from 2021 to 2026.

The Gap, Inc. (NYSE:GPS) is well positioned to capitalize on the growing Millennial and Gen-Z population. One of the key highlights of the company is its investment in two tech companies named CB4 and Drapr; such investments are expected to help the company enhance competitive edge in digitalization and skin in metaverse. Additionally, the company expects that this will help enhance customer experience and support top line growth especially in its online sales. Its efforts to boost online sales and increase operational efficiency acts as major catalysts, given that GPS operating stores remain below the pre-pandemic level of 2,835 as of fiscal 2021. Its Power Plan 2023 strategy continues to provide meaningful improvement for the company, opening 32 Navy stores and 28 Athleta stores. On top of that, GPS also improved its liquidity, alleviating risk from uncertainties from temporary inflated input cost. GPS is trading at a potential over-ripe bearish trend and is cheap at 19.87x trailing P/E compared to its 7.11x forward earnings.

Improving Top Line

GPS ended its fiscal year 2021 with record sales of $16,670 million, a 20.8% increase over the previous year. This is quite impressive, especially given its current store count of 2,835 (down from 3,100 last year). This is thanks to its strong online sales, which is growing at a rate of 20% per year.

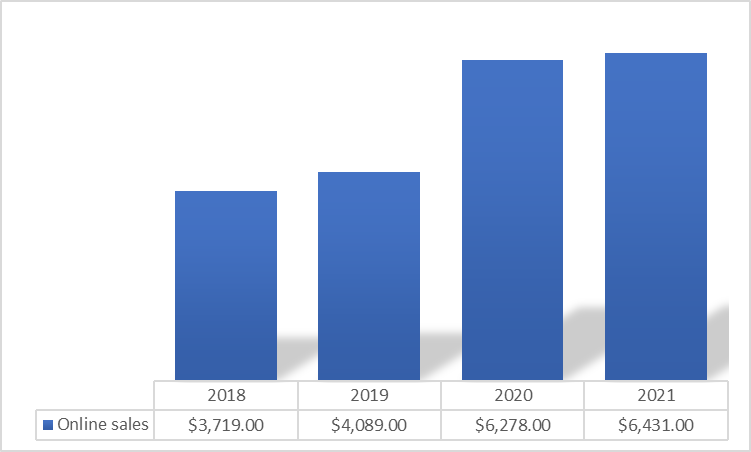

GPS: Online Sales Trend Analysis (Source: Company Filings. Prepared by InvestOhTrader. Amounts in Millions)

Online sales now account for 39% of GPS’s total revenue, up from 25% in fiscal 2019. According to management, their active customer base increased to 54 million in Q4 2021, up from 45 million the previous quarter. With the ‘digital first’ approach by the management and continued reopening of its operating stores, I believe GPS is set to capitalize on its growing projected top line by analysts.

Strong Operating Margin

The management also reassures its investors that they are managing their operating margin through aggressive restructuring:

Over the last two years, we have undertaken significant restructuring necessary to become a more nimble and focused company. With that, we’ve completed over 70% of our North American fleet rationalization with 250 store closures, transitioned our European business through capital-efficient partnerships and divested smaller non-strategic brands. All while we leaned into a digital-first mindset. This has resulted in reductions in fixed costs in both road and store expenses. Source: Q4 2021 Earnings Call

The company is on track to free up a meaningful portion of their margin by focusing more on its profitable brand segment such as Old Navy and Athleta.

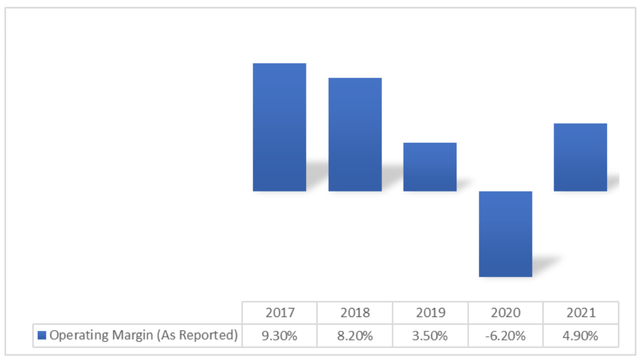

GPS: Operating Margin Trend Analysis (Source: Company Filings. Prepared by InvestOhTrader)

The company’s operating margin has increased significantly to 4.9%, up from 3.5% in fiscal 2019. As a result of the successful implementation of its Power Plan 2023 strategy and the expectation of additional store closures, the company provided a bullish outlook for its operating margin, which it expects to be between 6.3% and 6.8% next fiscal year, despite an inflated cost environment and supply chain issues. Contrary to its bearish catalysts of excessive supply chain disruption in China and high interest rates to combat inflation, the company is fine, as revenue from the Asia region accounts for only 4.37% of its total top line and the company has actually improved its debt level, lowering future interest payments.

Improving Debt Level

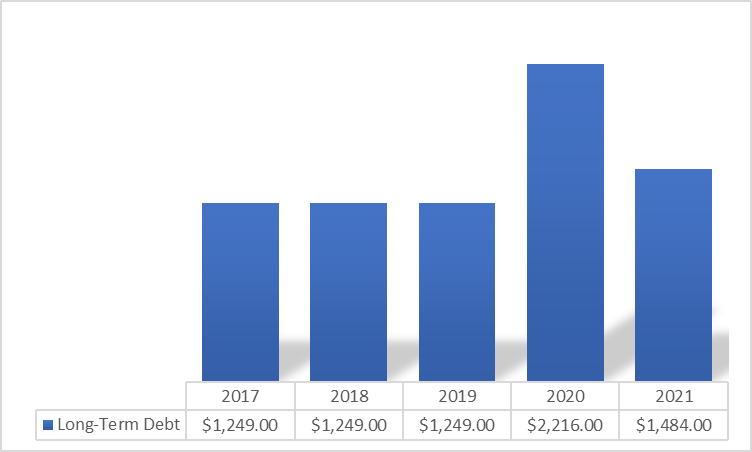

GPS: Improving Long-Term Debt (Source: Data From Seeking Alpha. Prepared by InvestOhTrader. Amounts in Millions)

GPS managed to lower its long-term debt to $1,484 million, from its 2020 figure. As a result, it helped the company generate an improving debt to equity ratio of 2.3x, better than 2.93x last year. Additionally, GPS doesn’t have long-term debt maturing until 2029 making it less susceptible from rising interest rates. In fact, the management provided a better outlook on its net interest expense to be around $70 million next fiscal year, an improvement from today’s $162 million.

Cheap GPS

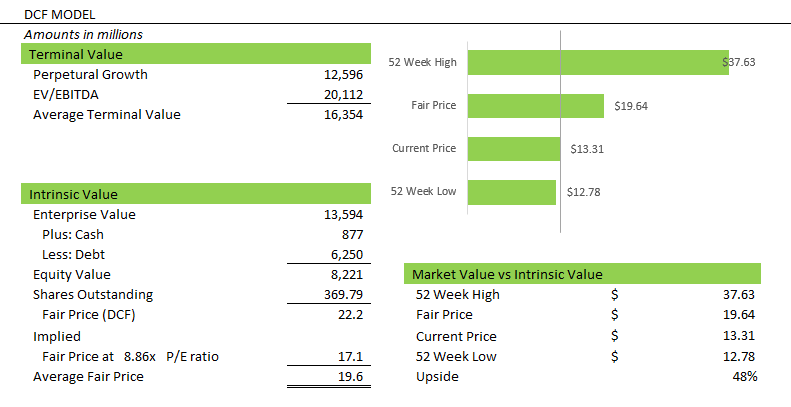

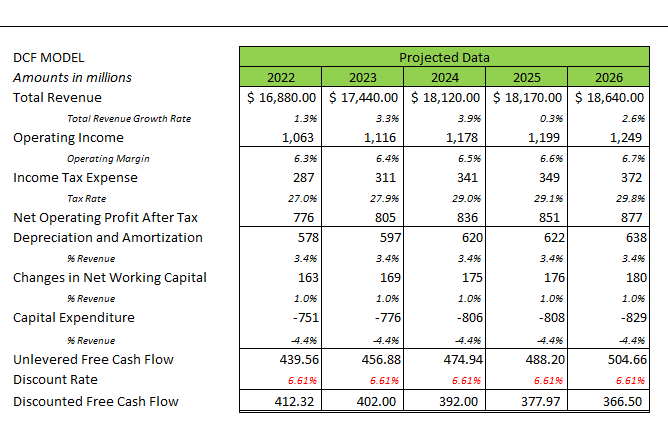

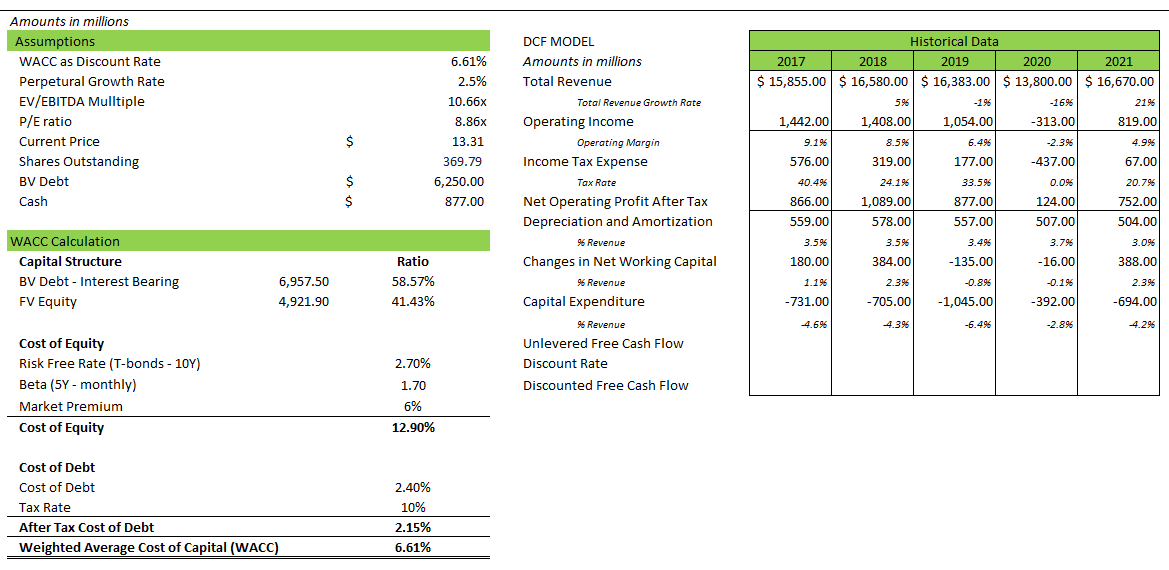

GPS: DCF Model (Source: Prepared by InvestOhTrader)

According to my DCF model, GPS has a fair price of $22.2. This implies a good potential upside at today’s price of $13.31 per share. After a huge decline from its 2022’s high of $37.63, GPS currently trades at a cheaper 0.30x trailing P/S ratio than its 5-year average of 0.57x. Additionally, it is trading cheaply at its trailing P/E ratio of 19.87x and forward earnings of 7.23x. As of this writing, an implied P/E ratio of 8.86x less than the current sector’s median of 12.99x can also provide significant upside, as illustrated in the image above. Additionally, taking both into consideration and averaging the two results in a potential upside of 48% at today’s price.

GPS: DCF Model (Source: Prepared by InvestOhTrader)

I completed my DCF model with the assistance of a forecast from an expert. I expect its operating margin to continue to improve to 6.7% at the end of the model. A miss on its fiscal 2022 margin of 6.3% will have a negative impact on my model, which investors should monitor. In fact, the management projected an aggressive growth compared to its 5-year average of 3.94% (as reported figures). I projected an increasing effective tax rate of 29% in 2024 under the assumption of a lesser impact on future divestiture.

GPS: DCF Model (Source: Data from Seeking Alpha and Yahoo!Finance. Prepared by InvestOhTrader)

Above are my assumptions, WACC calculations, as well as the selected 5-year historical data that I used to complete the model.

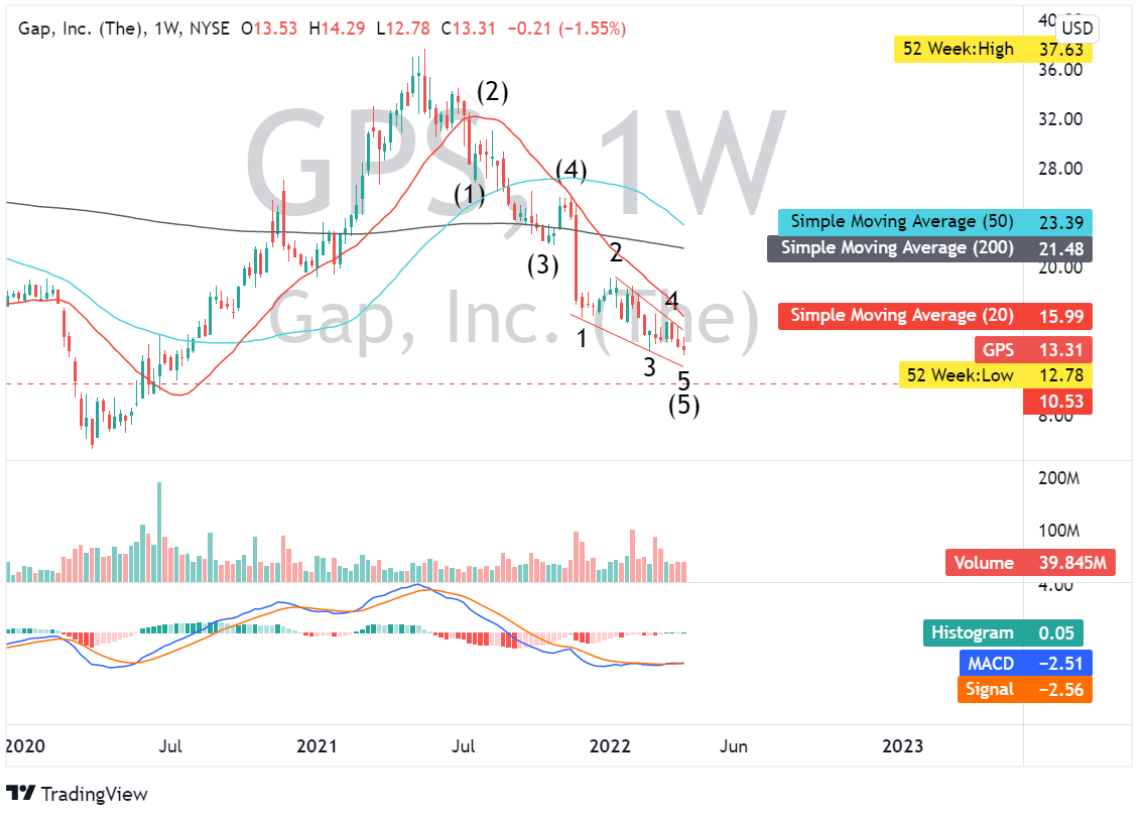

Potential Bear Exhaustion

GPS: Weekly Chart (Source: TradingView.com)

GPS is currently on its potential 5th wave as shown in the chart above. According to the Elliott wave theory, the 5th wave is already a maturing trend and basically tells investors and traders that we might see a corrective wave before another rally sets in. A break of its $15ish will break strong bearish structure and we might see a shift of sentiment from bearish to bullish. In this case, I believe GPS is set to print a bullish setup and its 1st impulse wave at around $18ish. In my opinion, a drop below $10.5 is a strong demand zone to monitor. Looking at its simple moving average indicator, we might see its price reverse to its 20-day simple moving average and a break of it may imply bullish price action which will add confluence in my bullish thesis. GPS also already printed a MACD bullish crossover, indicating a weakening bearish price action in the coming trading weeks. Currently, GPS has an improving short interest, however, remains high at 15.27% as of today.

Final Key Takeaways

Despite its short-term headwinds, GPS has maintained its liquidity, which in my opinion, is a positive catalyst in today’s uncertain environment. Its strong catalyst in its growing online sales and the successful implementation of its Power Plan 2023 will enable the company to grow its margins while maintaining a consistent and growing top line. Based on its projected cash flow and cheap valuation, this company has a favorable upside potential. Lastly, GPS is trading at a logical support level and offers a strong risk-reward ratio, making this stock worth taking a risk on.

Thank you for reading. Cheers!

Be the first to comment