imaginima

About six months ago, I analyzed the risks of Precession Drilling (NYSE:NYSE:PDS). Since then, the stock has underperformed the energy sector by a remarkably wide margin, as it has declined 15% whereas the Energy Select Sector SPDR ETF (XLE) has gained 7%. On the bright side, the company has been reducing its debt and thus it has become less risky. On the other hand, the stock remains unattractive due to the secular headwinds facing its business.

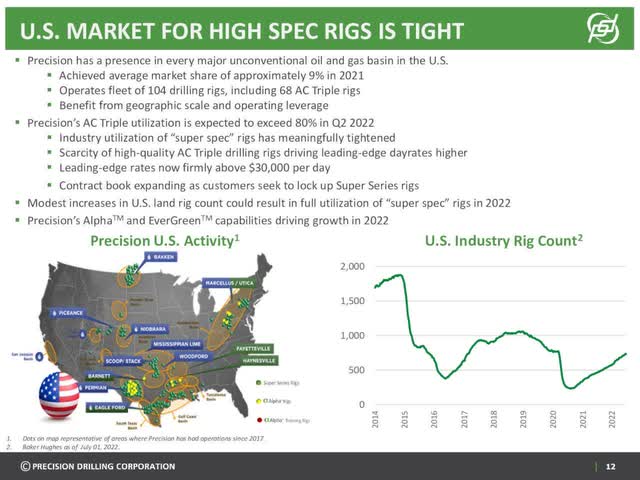

Precision Drilling provides rigs and services to onshore producers of oil and gas. It is present in every major unconventional oil and gas basin in the U.S. and generates nearly all its revenues in the U.S. and Canada. In the first six months of the year, 49% of the rig utilization days came from the U.S., 46% of the rig utilization days came from Canada and the remaining 5% came from international markets.

Precision Drilling was severely hurt by the coronavirus crisis. In 2020 and 2021, it incurred aggregate losses per share of $16.33, which correspond to 27% of the current market capitalization of the stock. However, the business landscape has greatly improved this year thanks to the sanctions of the U.S. and Europe on Russia for its invasion in Ukraine. Before the sanctions, Russia used to produce approximately 10% of global oil output and about one-third of natural gas consumed in Europe. Due to the sanctions, the global oil and gas markets have become extremely tight and thus the prices of oil and gas have rallied to 13-year highs this year. Consequently, North American oil and gas producers have a great incentive to increase their production and offset the reduction in the output of Russia.

Indeed, the active rig count in the U.S. is recovering strongly from the pandemic.

Precision Drilling Business (Investor Presentation)

This is a strong tailwind for the business of Precision Drilling, as its revenues and earnings are closely tied to the utilization of its rigs and the revenue per utilization day, which depends on the tightness of the rig market.

The positive effect of the recovery of the active rig count has already shown up in the performance of Precision Drilling. In the second quarter, the company grew its revenue 62% over a depressed level in the prior year’s quarter amid the pandemic thanks to a 38% increase in North American drilling activity, a 25% increase in U.S. drilling day rates and a 30% increase in drilling day rates in Canada.

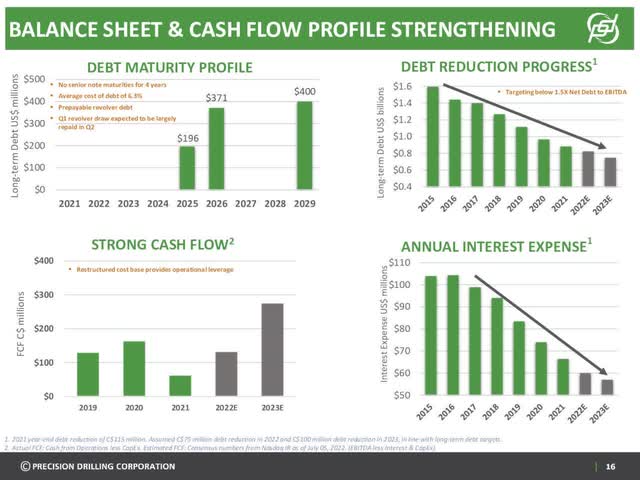

Thanks to its positive business momentum and the prioritization of a healthy balance sheet, Precision Drilling has reduced its debt and its interest expense significantly in recent years.

Precision Drilling Debt (Investor Presentation)

Its net debt (as per Buffett, net debt = total liabilities – cash – receivables) currently stands at $900 million. This amount is 109% of the market capitalization of the stock and hence it is high but manageable if business conditions continue to improve.

Thanks to the sustained decrease of debt and interest expense, the stock of Precision Drilling has become much less risky than it was at the core of the coronavirus crisis. Management should be praised for putting so much emphasis on strengthening the balance sheet, as a healthy balance sheet is paramount in this notoriously cyclical business.

Nevertheless, despite the great improvement in its business fundamentals, Precision Drilling still posted a loss per share of -C$1.81 in the second quarter. That loss marked a significant improvement from the loss of -C$5.71 posted in the prior year’s quarter but it is still disappointing given the strong business tailwinds prevailing. Analysts expect Precision Drilling to incur a loss per share of -$2.36 in the full year.

It is also important to keep in mind that Precision Drilling has incurred hefty losses for eight consecutive years (including this year), with the exception of 2019, when the company reported a minor profit of $0.45 per share. During the period 2015-2019, the U.S. oil production reached unprecedented levels but Precision Drilling kept posting losses.

The poor performance of Precision Drilling was caused by the great technological progress that has taken place in the production process of oil. Thanks to these technological advances, oil producers can now extract more oil from a given number of rigs. This is a great development for producers, as it has pronouncedly reduced their production cost, but it is a strong headwind for the business of Precision Drilling, which generates much lower revenues and earnings at a given production level than it did in the past. The impact is clearly reflected in the first chart of the article. While the U.S. oil production has recovered to all-time highs lately, the active rig count is less than half of the active rig count in 2014. This secular headwind is a major risk factor for Precision Drilling in the long run.

The other major risk factor is the high cyclicality of the oil industry. While business conditions are ideal for Precession Drilling right now thanks to the sanctions of western countries on Russia, investors should never forget the dramatic boom-and-bust cycles of this business.

Most countries are currently going through an unprecedented energy crisis due to the war in Ukraine, which has triggered a steep rally of the prices of oil and gas. As a result, these countries are trying to diversify away from oil. Norway, Sweden and Finland have shown the way, as they are immune to the energy crisis thanks to their unparalleled focus on clean energy projects for years. Most countries are now working at full throttle to imitate the Scandinavian countries and thus a record number of renewable energy projects is in development phase right now. In a few years, these projects will undoubtedly take their toll on global oil consumption and hence they will have an impact on the business of Precision Drilling.

Whenever the market shifts its focus on the record number of renewable energy projects under development, the price of oil is likely to enter its next downcycle. In fact, the price of oil has already fallen below its level at the time of the invasion of Russia in Ukraine. In other words, the markets signals that the shift from fossil fuels to clean energy projects and the risk of an upcoming recession more than offset the lost barrels from Russia. This is a clear bearish signal for the price of oil in the upcoming months. If the price of oil indeed enters a strong downtrend, it will exert great pressure on the stock price of Precision Drilling.

Final thoughts

Precision Drilling is doing its best in the factors of its business it can control while its management should be praised for prioritizing a healthy balance sheet. In addition, the company enjoys a strong tailwind this year thanks to the sanctions of western countries on Russia, which have triggered an impressive rally of the prices of oil and gas.

However, it is critical to remember the highly cyclical nature of the oil industry. There is a record number of renewable energy projects, which are likely to weigh heavily on the business of Precision Drilling when they come online. Moreover, the company suffers from a secular headwind, namely the rising production from a given number of rigs thanks to technological advances. This secular threat, which has caused Precision Drilling to incur excessive losses in 7 of the last 8 years, should not be underestimated. Overall, Precision Drilling has become less risky thanks to its debt reduction but it remains unattractive from a long-term perspective.

Be the first to comment