Artem Peretiatko/iStock via Getty Images

Precision BioSciences (NASDAQ:DTIL) has been on the candidate list for my Compounding Healthcare “Bio Boom” Portfolio for several months now, but I have yet to find a pressing reason to find a spot for this speculative ticker. The company’s intriguing platform technology prospects have demanded my attention for months, but I have always found an excuse to hold off on finding a spot in the portfolio. Now, Precision is slated to present azercabtagene zapreleucel “azer-cel” (PBCAR1091) data at the 64th American Society of Hematology “ASH” Annual Meeting running from December 10th through the 13th, which could reveal how one of the company’s lead programs is performing. What is more, DTIL is trading at an attractive risk-reward with a negative enterprise value. This could be a great opportunity to find a spot for DTIL in my Bio Boom Portfolio and build a position before the ASH presentation.

I intend to provide a brief background on Precision BioSciences and will discuss why I believe DTIL deserves a spot in the Bio Boom Portfolio. In addition, I present why I am looking to build a position in the near term ahead of the ASH presentation.

Background on Precision BioSciences

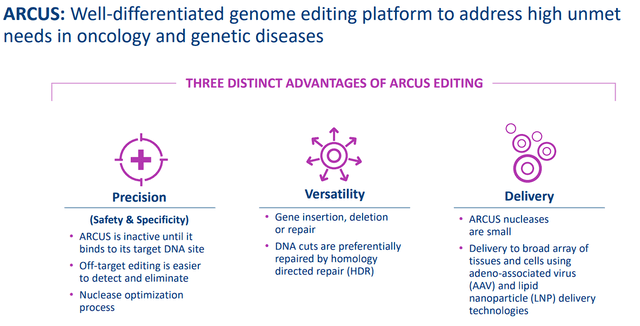

Precision BioSciences is a clinical-stage biotechnology company that is focused on leveraging their ARCUS genome editing platform to develop multiple “off-the-shelf” CAR-T therapy and in vivo gene therapy candidates. The company’s ARCUS Editing Platform is distinguished by its ability to utilize the homing endonuclease I-CreI, a naturally occurring gene-editing enzyme that is expected to allow for safer treatments due to its integrated safety control to uncouple. Moreover, ARCUS is inactive until it arrives at the target DNA site in order to perform a single DNA edit, which should prevent off-target editing, thus, improving both the safety and precision of their therapies.

Precision BioSciences ARCUS Overview (Precision BioSciences)

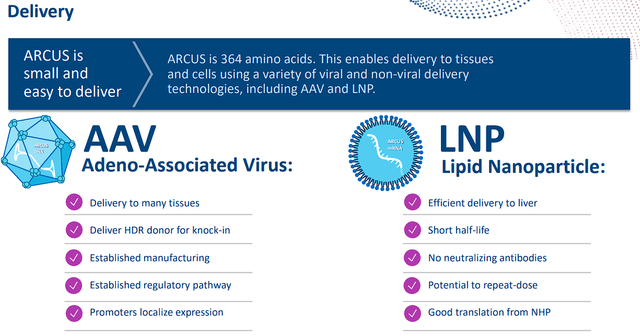

In addition to safety and specificity, Precision believes their ARCUS Editing Platform has some advantages including the ability to perform gene editing, gene deletion, and gene repair. In addition, the ARCUS nucleases are small at 364 amino acids, which improves delivery using adeno-associated virus “AAV” and lipid nanoparticle “LNP” technologies.

Precision BioSciences ARCUS Delivery (Precision BioSciences)

The flexibility in delivery could optimize their therapies in order to take advantage of infrastructure or improve the durability of the therapy.

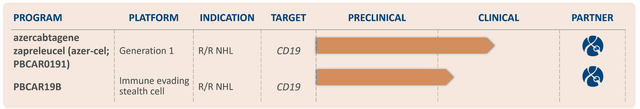

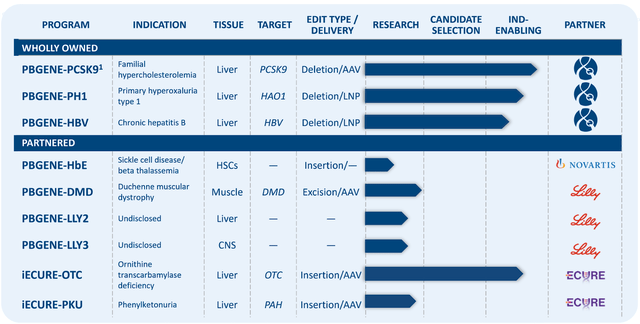

Precision has two pipelines that are in the early stages of development. First, is their off-the-shelf CAR-T therapies, and the other is the in vivo gene editing.

Precision BioSciences Off-the-Shelf CAR-T Immunotherapy Pipeline (Precision BioSciences)

Precision BioSciences In-Vivo Gene Editing Pipeline (Precision BioSciences)

Lead Programs

PBCAR0191 is an investigational allogeneic chimeric antigen receptor T-cell therapy in development for non-Hodgkin’s lymphoma “NHL” and B-cell acute lymphoblastic leukemia “B-ALL”. Azer-cel, also known as PBCAR0191, is an allogeneic “donor-derived” chimeric antigen receptor T-cell “CAR-T” therapy that is created from T cells altered with the company’s ARCUS genome editing technology to recognize the CD19 surface protein on the tumor cell. Azer-cel is expected to thwart graft-versus-host disease “GvHD”, which is a serious side effect that can arise in donor-derived cell therapies, such as CAR-T. Azer-cel has the FDA’s orphan drug designation for ALL and MCL, in addition to the Fast Track Designation for B-ALL.

Azer-cel is the company’s lead pipeline program, which is targeting NHL and B-ALL. Azer-cel is in a dose-escalation and dose-expansion phase I/IIa clinical trial for adults with R/R NHL. This study intends to evaluate the safety, efficacy, and optimal dosage of PBCAR0191 in patients who have already relapsed after a previous CAR-T therapy. Not only have they relapsed CAR-T, but they have also received on average 5 previous lines of treatments.

So far, azer-cel has revealed that it could attain high response rates in R/R patients, which means the treatment has shown to be effective in some of the hardest-to-treat patients… including patients who already had a CAR-T therapy. In June, the company released data from a few dose levels and lymphodepletion. The company reported that azer-cel had a 100% (11/11) ORR, with 8 out of 11 achieving a complete response. Six out of the eleven patients had an ongoing response for 18+ months at that time.

Again, these patients have failed multiple lines of therapy, including autologous CAR-T, so showing positive responses with acceptable safety is encouraging. Keep in mind, patients in this line of therapy do not have an approved standard of care that they can rely on, which can be a significant commercial opportunity for azer-cel. NHL had over 81K cases diagnosed in 2021, and ~673K people living with or in remission from NHL, so the overall market is substantial. In fact, the global Non-Hodgkin’s Lymphoma market is expected to reach $14.4B by 2029.

PBCAR19B is the company’s next-gen, immune-evading “stealth cell” candidate for patients with CD19-positive malignancies, for example r/r NHL. This CAR-T therapy is intended to improve the persistence of the allogeneic CAR-T by reducing rejection by the patient’s own immune system, thus, improving the durability of the response.

Precision BioSciences’ in vivo gene editing has the potential to cure genetic diseases. ARCUS is expected to be a flexible genome editing technology with the ability to delete, insert, or correct disease-causing DNA in a variety of genetic diseases.

Precision BioSciences In Vivo Gene Editing Types (Precision BioSciences)

Precision is taking aim at several different genetic disease types including liver, muscle, HSCs, and CNS. Currently, most of these programs are in the early stages of development, but some are getting ready to hit the clinic. Positive results from one of their leading gene editing programs could validate the company’s technology and improve the outlook for the gene editing pipeline.

Powerful Partnerships

Not only does the company have some intriguing platform technology, but they also have an impressive list of partnerships with big pharma. The biggest agreement is a research collaboration and license agreement with Eli Lilly (LLY) where Precision received an upfront payment of $100M, along with an equity investment of $35M. Moreover, Precision is eligible for $420M in milestones per product, along with mid-single digits to low-teens royalties. Precision is responsible for pre-clinical research and IND-enabling activities, while Lilly will be responsible for clinical development and commercialization.

Recently, Precision closed a licensing deal with Novartis (NVS) for the company’s ARCUS in vivo gene editing technology, which provided a $75M upfront payment with up to $1.4B in milestones, as well as tiered royalties on sales. Precision will develop a custom in vivo gene insertion product for sickle cell disease and beta-thalassemia, but the partnership can expand to additional hemoglobinopathies. Novartis will be responsible “for all subsequent research, development, manufacturing, and commercialization activities.”

Financials

In terms of cash, Precision finished Q3 with roughly $212.1M in cash and cash equivalents which is expected to last until the end of 2024. Currently, DTIL’s market cap is about $152M with ~$27M in debt, thus, DTIL has a negative enterprise value of -$32.58M. Admittedly, the company is projected to burn cash in the coming years as they develop their young pipeline, so we should expect that enterprise value to change over time.

The company reports several million a quarter in partnership revenue with an occasional outlier from a major milestone or upfront payment, however, the company’s expenses far outweigh this income. In fact, the company’s quarterly R&D expenses range from about $20M to $37M, with total OpEx ranging from $30M to $47M.

Bio Boom Candidate

The Bio Boom Portfolio contains healthcare companies that are usually not profitable and are very speculative, however, they offer substantial upside thanks to a strong upcoming catalyst, estimated revenue growth, or a potential turnaround. Normally, these are small to mid-cap companies with volatile tickers that will permit recurring trading opportunities to help generate sizeable profit while escalating a “house money” position over time. These tickers are traded provided they are still in play or until the company graduates to the “Bioreactor” growth portfolio.

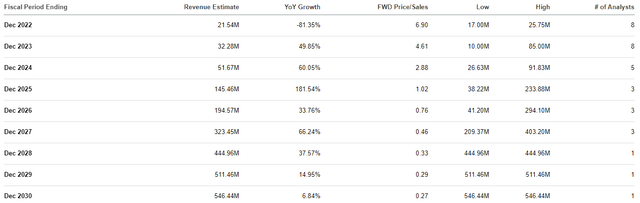

I believe DTIL does have a number of Bio Boom characteristics that point to notable upside potential from these current prices. First and foremost, I believe DTIL is trading at a discount for its projected revenues. The company’s partnership deals are expected to provide significant revenue in the coming years as the company hits milestones. In fact, the Street expects Precision to report strong double-digit growth for the remainder of the decade and roughly $500M in revenue in 2029.

Precision BioSciences Annual Revenue Estimates (Precision BioSciences)

The company’s market cap is about $152M, so that would be a roughly 0.3x forward price-to-sales. Considering the industry’s average price-to-sales is 4x-5x, we can say DTIL is trading at a discount for its forward revenue estimates. If DTIL was to be priced in line with its peers, we could see the shares trading around $22.50 in several years. Indeed, the company will most likely have to perform some form of dilution, and we don’t know if the company will ever hit these estimates… however, these numbers do illustrate DTIL’s upside potential, which is a key characteristic of a Bio Boom ticker.

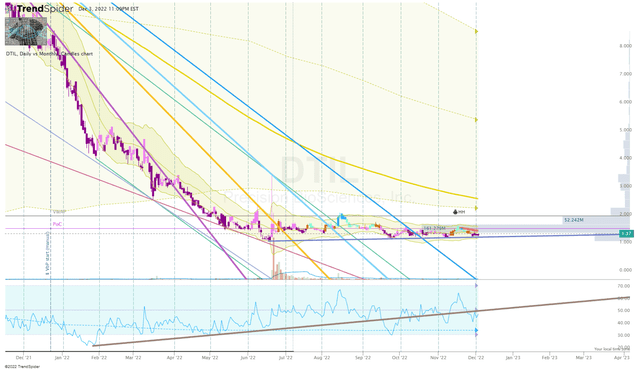

Another characteristic to consider is the ticker’s oversold state thanks to the market-wide sell-off. Like many small-cap healthcare stocks, DTIL has lost more than 80% of its value over the past twelve months and has been trading outside the Monthly Keltner Channel since April. If these small-caps get a “snapback” mean reversion move in the coming months, DTIL might come along for the ride.

DTIL Daily Chart (Trendspider)

A potential snapback move could provide an opportunity to book significant profit and move the position to a “house money” status.

In addition, to the valuations and technically oversold characteristics, DTIL also has long-term investment potential. Precision appears to have the prospects to be a strong competitor in gene editing and cell therapies, with intriguing platform technology and a broad pipeline. Precision also has an impressive list of partnerships that could provide billions in revenue down the road. I would not claim that Precision is perfectly positioned to become a market leader, however, having a unique platform, broad pipeline, big pharma partnerships, and robust cash position does bode well for the company’s long-term prospects and possibly emerge as an acquisition target.

Basically, DTIL has the components to experience a solid reversion move for a quick profit but has the fixings to be a potential multi-bagger in the future… a prime Bio Boom candidate.

ASH Presentation

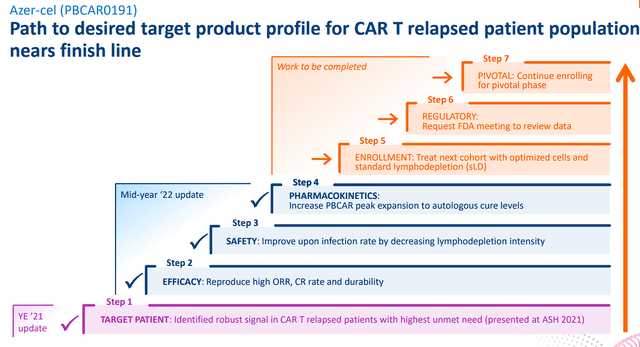

The company is slated to present a poster on the cell dose and functional attributes of azer-cel in R/R B-cell lymphoma at the 64th ASH Annual Meeting between December 10th and 13th. The company intends to highlight “the first analysis of an allogeneic CD19 CAR T product composition to demonstrate that strategies intended to maximize stem central memory T-cell fraction “CCR7+” while limiting CD4+ CCR7+ differentiated fraction may improve safety and efficacy of CAR T therapy.”

I believe it is important that we see additional data from azer-cel in the CAR-T relapsed population in order to defend its ability to generate high and durable complete response rates while managing the level of lymphodepletion required to elicit these responses. Last December, azer-cel’s data was lackluster despite reporting a 71% remission rate in 17 patients. Unfortunately, durability became an issue when 8 of those 12 responding patients had already relapsed by 6 months with another patient relapsing at 9 months. So, any indication the company has formulated a solution to the durability could be a strong catalyst for the stock as investors realize azer-cel is not a lost cause.

Azer-cel Development Path (Precision BioSciences)

Keep in mind, DTIL was trading around $9 per share in December of last year, and is now trading around $1 per share… so, there is some potential for a snapback reversion in share price if the ASH data reveals azer-cel still has promise.

Downside Risks

DTIL has multiple risks that investors should consider when establishing and managing their positions. First, Precision’s competition who have their own cutting-edge platforms and products. What is more, some of their competition have superior resources and a more mature pipeline compared to Precision. DTIL’s cell therapy pipeline has solid competition from numerous small-cap and private biotechs developing cutting-edge technology. The company also has stiff competition from larger players including Bristol-Myers Squibb (BMY) and Roche (OTCQX:RHHBY). The company’s gene therapy pipeline has similar issues with other outfits developing next-gen platforms, while big pharma continues to have the pick of the litter to acquire and develop. These competitors could simply outperform Precision in the clinic or on the market, which could hurt DTIL’s long-term outlook.

Second, DTIL is reporting losses, which will most likely weigh on the ticker for the foreseeable future. Investors need to accept there is a possibility the market will need to see definitive evidence that the company has a program that has a strong probability of approval before it starts bidding the ticker up to a premium valuation.

Finally, the company is going to have to deal with regulatory setbacks. The company did report disappointing data for azer-cel that put the therapy’s durability into question. Precision could produce data that addresses the issue, and the company’s next-gen CAR-T program, PBCAR19B, is expected to avoid the durability concern. Still, investors should expect the market to be apprehensive until one of the company’s programs is close to approval.

Considering these points above, I have set DTIL’s conviction level to 2 out of 5.

My Plan

Indeed, I don’t anticipate making DTIL a principal component of the Bio Boom Portfolio, nonetheless, I am willing to grow a position ahead of their ASH presentation. My goal is to book some profits on a snapback move, or potential mean reversion move that could offer an opportunity to book some profits at my Sell Targets, and perhaps transition my DTIL position into a “house money” state for a long-term investment. This way I will have exposure to DTIL’s upside potential, but the original investment has been removed leaving only profits left on the table.

Investors need to accept that DTIL is a speculative small-cap stock with major risks at this time. It is imaginable an investor could lose the majority or the entirety of their investment.

Be the first to comment