Luke Chan/E+ via Getty Images Legal & General logo (L&G IR homepage)

Investment Thesis

In my last article on Legal & General Group Plc (OTCPK:LGGNY) (LGNNF), back in March this year, I concluded that its strong position and ability to synergize within the group should enable it to continue to grow operating profits and cash flow generation going forward.

The share price saw a rally of about 15% since July this year but has really struggled to move above the present level for the last 7 years.

This 186-year-old British financial services and asset management company has just published its first half of 2022 financial results, so it is a good time to assess its progress and whether my previous buy stance is intact

FH 2022 Financial Results

LGNNY delivered an 8% growth in operating profit in FH this year compared to the same period last year. It came in at GBP 1.16 billion.

This works out to an EPS of 10.28 pence

As a result of this, they have decided to increase the dividend per share by 5% from what they paid as the interim dividend last year. A dividend of 5.44 pence will be paid to shareholders on 26 September 2022.

Based on a 12 months’ trailing dividend and the present share price, the yield is 6.87%

Its cash generation, which in my opinion is more important than earnings, grew by 22% year on year to GBP 1 billion.

ROE is slightly lower in FH 2022 at 21.3% from 22% but is still a very attractive ROE.

Book value per share has also gained considerably from GBP 1.64 at the end of FH last year to GBP 1.86 at the end of FH this year. However, their P/NAV of 1.46 is not what makes this company so attractive as a value proposition. It is more related to its excellent ROE, P/E of just 6.9, a generous dividend policy, and last but not least a strong balance sheet.

On the topic of the balance sheet, LGGNY’s solvency II surplus has increased from GBP 8.2 billion at the end of last year to GBP 9.2 billion at the end of FH 2022. As such their solvency coverage ratio is 212%. That is up from 182% in the same period last year.

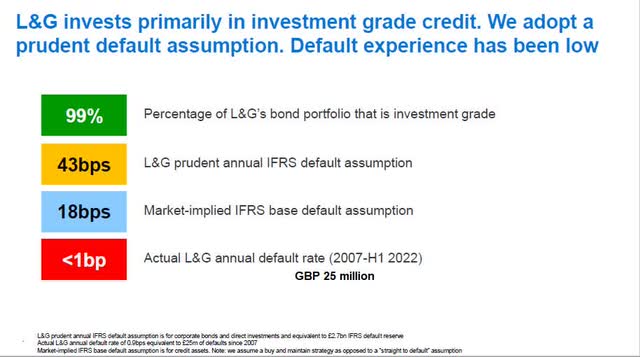

Their investment portfolio holds a very large portion of their credit in high-quality investment-grade paper. This has resulted in low defaults over the period since 2007 which includes the GFC of 2008.

Low default rate (L&G FH 2022 Presentation)

Business Development

LGNNY recently raised awareness about the pension gender gap that exists in the UK.

By using data from over 4 million workplace members, they found that women’s pensions at retirement are half the size of men’s regardless of the sector they work in. The average for men is GBP 26,000 while women only have GBP 12,000

The reason for the large gap ranges from women holding fewer senior positions and being paid less, resulting in lower pension contributions. Some also take career breaks due to caring responsibilities. Still, some things should be done to close this gap. To achieve this, they have come forward with suggestions to regulators and companies that can change the dynamics of this.

In the past, I have commented on their potential growth in Asia including Australia. During the Q&A session, I asked for an update on how this part of their business is progressing.

They are still working on providing customers in Asia with long-term savings products and they are also investing in solutions that can tackle some of the challenges around climate change.

Within LGIM (Investment Management division), they are clear on their strategy and ambitions of growing internationally. Over the last 5 years, AUM has doubled to reach GBP 468 million, which is 26% of AUM. In terms of how much of this comes from Asia and Australasia is not clear. No specifics are given as to what kind of geographical percentage there is. All they say is that they are well placed to deliver growth in Asia and that they are expanding their distribution footprint across key markets and channels.

I do think the landscape for their services in Asia is very competitive, so I would be interested to see if LGGNY can give more details on this business in the near future.

Conclusion

As a steady dividend-growing stock, LGGNY looks both secure and promising over the next few years.

They should also be quite resilient against a longer recession should that be the outcome. The Bank of England is warning that the U.K. economy will enter its longest recession since the GFC and some market commentators seem to be painting a rather gloomy outlook for the UK economy. It will be interesting to see what happens.

One would think that it is reasonable to expect that if LGGNY’s growth targets are met and the dividend continues to grow roughly 5% a year, the share price could also start to reflect this growth.

It is still a buy in my opinion, and I may add to my position from time to time.

Be the first to comment