RHJ

Source: Own Processing

Precious metals royalty and streaming companies represent a very interesting sub-industry of the precious metals mining industry. They provide some leverage to the growing metals prices, similar to the typical mining companies; however, they are less risky in comparison to them. Their incomes are derived from royalty and streaming agreements. Under a metal streaming agreement, the streaming company provides an upfront payment to acquire the right to future deliveries of a predefined percentage of metal production of a mining operation.

The streaming company also pays some ongoing payments that are usually well below the market price of the metal. They can be set as a fixed sum (e.g., $300/toz gold) or as a percentage (e.g., 20% of the prevailing gold price), or a combination of both (e.g., the lower of a) $300/toz gold and b) 20% of the prevailing gold price). The royalties usually apply to a small fraction of the mining project production (usually 1-3%), and they are not connected with ongoing payments. They can have various forms, but the most common is a small percentage of the net smelter return (“NSR”). The NSR is calculated as revenues from the sale of the mined products minus transportation and refining costs.

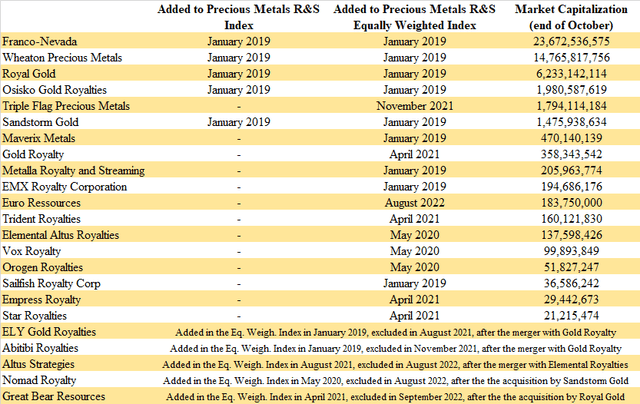

To better track the overall performance of the whole sub-industry, I created a capitalization-weighted index (the Precious Metals Royalty and Streaming Index) consisting of 11 companies (in June 2020, expanded to 15). Later, based on the inquiries of readers, I also introduced an equal-weighted version of the index. Until March 2021, both indices included the same companies and were calculated back to January 2019.

However, some major changes occurred in April 2021. Due to the boom of the royalty and streaming industry and the emergence of many new companies, the indices experienced two major changes. First of all, the market capitalization-weighted index was modified to include only the 5 biggest companies: Franco-Nevada (FNV), Wheaton Precious Metals (WPM), Royal Gold (RGLD), Osisko Gold Royalties (OR), and Sandstorm Gold (SAND). The combined weight of these 5 companies on the old index was around 95%, therefore, the small companies had only a negligible impact on their performance. The values of the index were re-calculated back to January 2019, and between January 2019 and March 2021, the difference in the overall performance of the old and the new index was only 2.29 percentage points. The second change is related to the equally weighted index that was expanded to 20 companies.

The previous editions of the monthly report can be found here: May 2019, June 2019, July 2019, August 2019, September 2019, October 2019, November 2019, December 2019, January 2020, February 2020, March 2020, April 2020, May 2020, June 2020, July 2020, August 2020, September 2020, October 2020, November 2020, December 2020, January 2021, February 2021, March 2021, April 2021, May 2021, June 2021, July 2021, August 2021, September 2021 (extended), October 2021 (extended), November 2021 (extended), December 2021 (extended), January 2022 (extended), February 2022 (extended), March 2022 (extended), April 2022 (extended), May 2022 (extended), June 2022, June 2022 (extended), July 2022, July 2022 (extended), August 2022, August 2022 (extended), September 2022, September 2022 (extended), October 2022 (extended).

Source: Own Processing

Some changes occurred in the ranking of the precious metals R&S companies by market capitalization. The big three consisting of Franco-Nevada, Wheaton Precious Metals, and Royal Gold still dominates the industry. However, Osisko Gold Royalties outgrew Triple Flag Precious Metals (TFPM) and ranks as the fourth biggest company now. Similarly, Metalla Royalty & Streaming (MTA) jumped over EMX Royalty (EMX). And due to the impressive more than 50% share price growth, after long months, Empress Royalty (OTCQB:EMPYF) isn’t placed at the very bottom of the ranking anymore. Star Royalties (OTCQX:STRFF) with a market capitalization only slightly above $21.2 million is the smallest of the tracked companies now.

Source: Own Processing

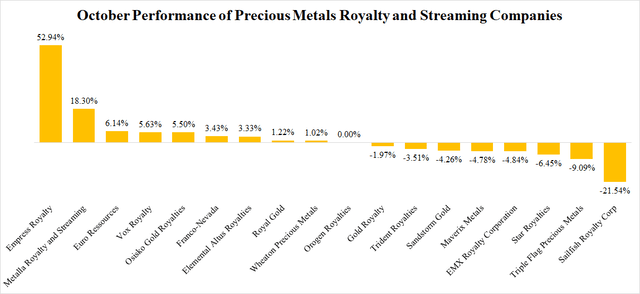

Out of the 18 companies, 9 recorded share price growth, 8 recorded share price decline, and 1 remained flat in October. The absolutely best performance was achieved by Empress Royalty whose share price grew by nearly 53%. The growth had two phases. The first one began in late September when Empress announced the completion of the first tranche of the private placement. The investors were probably pleased by the fact that Rick Rule became a shareholder of the company. The second phase of growth took place after October 20, however, without any apparent reason. On the other hand, over recent months, Empress announced that the Manica royalty and Tahuehueto silver stream started generating cash flows, without any market reaction. The great October performance may be only a delayed reaction to the recent positive developments. Also Metalla Royalty & Streaming recorded very nice gains of nearly 20%, however, there is no evident reason, as the company hasn’t made any news release since August 16. The worst performance was recorded by Sailfish Royalty (OTCQX:SROYF). Its share price declined by more than 20%, although the company made no news release in October. The poor performance was a continuation of the negative trend that began back in September when Sailfish lost more than 30% of its value. This helped Sailfish to become much more attractive, as shows the scoring system in the extended edition of this article, available exclusively for the members of the “Royalty & Streaming Corner“.

Source: Own Processing

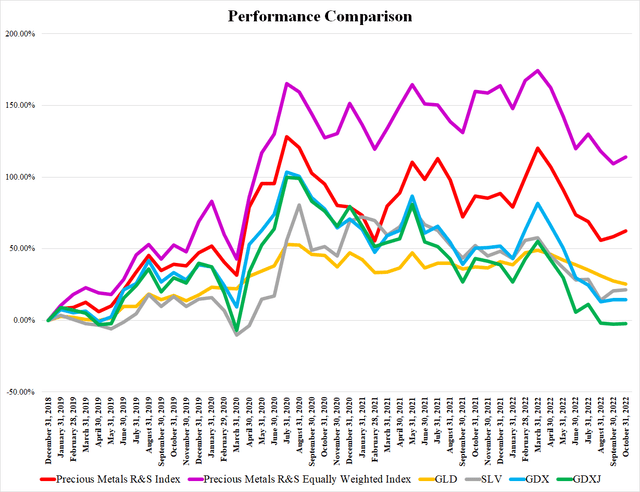

In October, the precious metals R&S companies did surprisingly well given the poor performance of gold. The share price of the SPDR Gold Trust ETF (GLD) declined by 1.78%. Silver did slightly better, and the share price of the iShares Silver Trust ETF (SLV) grew by 0.69%. The gold miners remained almost flat. The VanEck Vectors Gold Miners ETF (GDX) grew by 0.17%, and the VanEck Vectors Junior Gold Miners ETF (GDXJ) grew by 0.14%. The precious metals R&S companies outperformed all these assets, as the Precious Metals R&S Index grew by 2.43%, and the Precious Metals R&S Equally Weighted Index grew by 2.28%. The market capitalization-weighted index was supported especially by the good performance of Franco-Nevada, its main component. The equally-weighted index was supported especially by the great performances of Empress Royalty and Metalla Royalty and Streaming.

The October News

There was not much news in October. The industry seems to be in a waiting mode, trying to adjust to the changed market conditions. As a result, there were no meaningful deals closed in October. The companies focused on reporting some preliminary Q3 operational results, and updates related to assets held in their portfolios. The most active was Trident Royalties which announced important developments at four of its key assets.

Franco-Nevada announced that it will release its Q3 financial results on November 7, before the market open.

Wheaton Precious Metals will release its Q3 financial results on November 3, after the market close.

Royal Gold announced that it sold 56,100 toz of gold equivalent (43,700 toz gold, 614,100 toz silver, 1,200 tonnes of copper) in Q3. As of the end of the quarter, it held inventories of approximately 31,500 toz of gold equivalent. Royal Gold will release its Q3 financial results on November 2, after the market close.

Osisko Gold Royalties reported that it earned 23,850 toz of gold equivalent in Q3, which is a new record high. The preliminary revenues amounted to C$53.7 million ($39 million). Moreover, during Q3, Osisko purchased for cancelation 1.3 million of its own shares. Osisko will release its Q3 financial results on November 9, after the market close.

Triple Flag Precious Metals announced that it sold 19,523 toz of gold equivalent (61% gold, 31% silver, 8% other) in Q3. The revenues amounted to $33.8 million. Triple Flag will release its Q3 financial results on November 7, after the market close.

Sandstorm Gold announced that it sold approximately 22,600 toz of gold equivalent, and recorded preliminary revenues of $38.9 million in Q3. Both numbers represent a new record high.

On October 13, Sandstorm released some updates regarding its asset portfolio. The main news is that Hod Maden received forestry permits and early works construction is underway. Moreover, Equinox Gold’s (EQX) Greenstone project is 46% complete and remains on track for the first gold production in H1 2024.

The company also completed the bought deal financing. It issued 18.055 million new shares and received gross proceeds of approximately $92 million.

EMX Royalty announced a $3 million milestone payment from Arizona Sonoran Copper Company (OTCQX:ASCUF), as it outlined resources of more than 200 million lb copper on the Parks-Salyer property. EMX holds a 1.5% NSR royalty on Parks-Salyer.

Trident Royalties (OTCPK:TDTRF) announced that the Nevada district court scheduled an oral hearing regarding the Thacker Pass lithium project for January 5, 2023. This should be the final hurdle in the permitting process. Trident holds an efficient 1.05% gross revenue royalty on the project.

On October 21, Trident announced that Equinox Gold released an updated feasibility study for the Los Filos mine expansion. After the expansion is completed, the mine life should be expanded to 14.5 years, and the annual production should average 360,000 toz gold between 2025 and 2030, which is more than double the 2022 guidance (155,000-170,000 toz gold). Trident holds an off-take agreement on 50% of Los Filos’ gold production, with a cap of 1.1 million toz gold (approximately 770,000 toz remaining).

On October 24, Trident Royalties announced that Ganfeng Lithium (OTCPK:GNENY) plans to increase the Sonora Lithium mine stage II capacity by 43% compared to the previous studies (to 50,000 tonnes of lithium hydroxide per year). Stage I construction is well underway. Trident estimates that at the current lithium hydroxide prices, its 1.5% Gross Revenue Royalty would generate $24 million per year during stage I and $60 million per year during stage II. This news further confirms Trident’s huge upside potential.

And on October 27, Trident announced that the first copper production from Moxico Resources’ Mimbula mine is imminent. Moreover, a feasibility study for the expansion of the production from the initial rate of 22 million lb copper per year to 123 million lb copper per year has been completed recently. Trident owns a 1.25% Gross Revenue Royalty (soon to be reduced to 0.3%) on Mimbula.

Vox Royalty (VOXR) reported preliminary Q3 revenues of $2.976 million. The 2022 guidance remains unchanged at $7.8-9.4 million.

The company also announced that its shares were approved for listing on NASDAQ. They started trading on NASDAQ, under ticker VOXR, on October 10.

Elemental Altus Royalties (OTCQX:ELEMF) announced that at the Karlawinda gold mine, the reserves increased to 1.34 million toz gold. This should be sufficient for another 12 years of mining at the current production rate of 110,000-120,000 toz gold per year. Elemental Altus owns a 2% NSR royalty on Karlawinda.

Orogen Royalties (OTCQX:OGNRF) optioned the Pearl String gold project to Barrick Gold (GOLD). Barrick can acquire 100% of the property by paying Orogen $1.5 million and expending $4 million on exploration over the next 5 years. Orogen will retain a 2% NSR royalty.

Empress Royalty announced the closing of the second tranche of the private placement. Empress raised an additional $1 million by selling 4,316,666 shares as well as warrants. Based on the statement of the CEO, it looks like Empress will make a new acquisition soon.

The November Outlook

The news flow is going to increase in November, due to the earnings season. However, it is hard to say whether the activity of the R&S companies is going to improve as well. Last year, numerous deals of various sizes were announced in November and December. However, right now, the markets are much more turbulent, and it seems like the R&S companies are waiting for better opportunities. The gold price declined to the $1,650/toz area only recently. Moreover, there are growing inflationary pressures that together with the decreased metals prices make economic studies obsolete. The miners are probably hoping that the metals prices will return back up soon, and so they expect better financing terms than the current market conditions warrant. On the other hand, for the R&S companies, it may be better to wait a little longer, hoping that the expectations of the miners will adjust to the new market conditions. As a result, it may take several more months before the deal activity returns to the previous levels.

Be the first to comment