Precious metals royalty and streaming companies represent a very interesting sub-industry of the precious metals mining industry. They provide some leverage to the growing metals prices, similar to the typical mining companies; however, they are less risky in comparison to them. Their incomes are derived from royalty and streaming agreements. Under a metal streaming agreement, the streaming company provides an upfront payment to acquire the right to future deliveries of a predefined percentage of metal production of a mining operation.

The streaming company also pays some ongoing payments that are usually well below the market price of the metal. They can be set as a fixed sum (e.g., $300/toz gold) or as a percentage (e.g., 20% of the prevailing gold price), or a combination of both (e.g., the lower of a) $300/toz gold and b) 20% of the prevailing gold price). The royalties usually apply to a small fraction of the mining project production (usually 1-3%), and they are not connected with ongoing payments. They can have various forms, but the most common is a small percentage of the net smelter return (“NSR”). The NSR is calculated as revenues from the sale of the mined products minus transportation and refining costs.

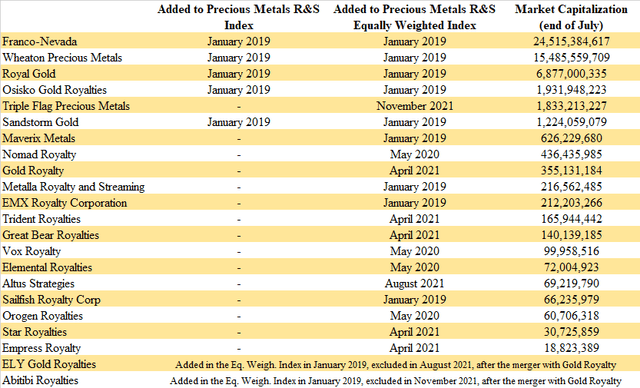

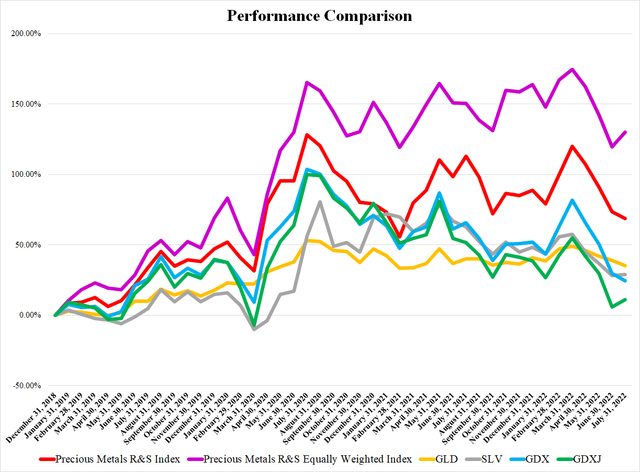

To better track the overall performance of the whole sub-industry, I created a capitalization-weighted index (the Precious Metals Royalty and Streaming Index) consisting of 11 companies (in June 2020, expanded to 15). Later, based on the inquiries of readers, I also introduced an equal-weighted version of the index. Until March 2021, both indices included the same companies and were calculated back to January 2019.

However, some major changes occurred in April 2021. Due to the boom of the royalty and streaming industry and the emergence of many new companies, the indices experienced two major changes. First of all, the market capitalization-weighted index was modified to include only the 5 biggest companies: Franco-Nevada (FNV), Wheaton Precious Metals (WPM), Royal Gold (RGLD), Osisko Gold Royalties (OR), and Sandstorm Gold (SAND). The combined weight of these 5 companies on the old index was around 95%, therefore, the small companies had only a negligible impact on their performance. The values of the index were re-calculated back to January 2019, and between January 2019 and March 2021, the difference in the overall performance of the old and the new index was only 2.29 percentage points. The second change is related to the equally weighted index that was expanded to 20 companies.

The previous editions of the monthly report can be found here: May 2019, June 2019, July 2019, August 2019, September 2019, October 2019, November 2019, December 2019, January 2020, February 2020, March 2020, April 2020, May 2020, June 2020, July 2020, August 2020, September 2020, October 2020, November 2020, December 2020, January 2021, February 2021, March 2021, April 2021, May 2021, June 2021, July 2021, August 2021, September 2021 (extended), October 2021 (extended), November 2021 (extended), December 2021 (extended), January 2022 (extended), February 2022 (extended), March 2022 (extended), April 2022 (extended), May 2022 (extended), June 2022, June 2022 (extended), July 2022 (extended).

The list of the precious metals R&S companies will become shorter soon. The reason is the upcoming merger of Elemental Royalties (OTCQX:ELEMF) and Altus Strategies (OTCQX:ALTUF), as well as Royal Gold’s acquisition of Great Bear Royalties (OTCPK:GBRBF), and Sandstorm Gold’s (SAND) acquisition of Nomad Royalty (NSR). In comparison to the previous month, the list of the precious metals R&S companies ordered by their market capitalization remains almost unchanged. The sector is dominated by Franco-Nevada, Wheaton Precious Metals, and Royal Gold. And the smallest of the companies remains Empress Royalty (OTCQB:EMPYF) with a market capitalization of less than $19 million.

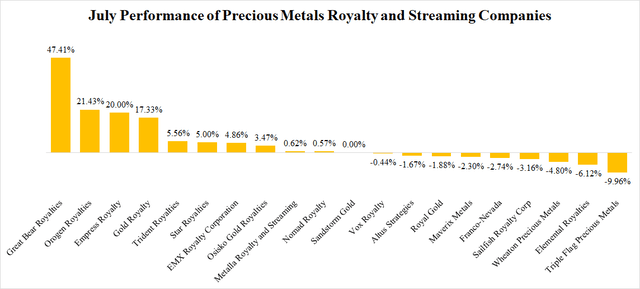

In comparison to the previous months, the look at the chart of performances of individual stocks looks much more positive. Out of the 20 companies, 10 recorded positive returns, 9 recorded negative returns, and Sandstorm Gold remained flat. The best performance was recorded by Great Bear Royalties. Its share price grew by nearly 50%, mainly due to the abovementioned takeover offer by Royal Gold. Very nice 20% gains were recorded by Orogen Royalties (OTCQX:OGNRF) and Empress Royalty. In the case of Empress, the market finally started to recognize the hidden value, as two of its assets started generating cash flows. On the other hand, the worst performance was recorded by Triple Flag Precious Metals (OTCPK:TRFPF). Its share price declined by nearly 10% without any apparent reason.

The share price of the SPDR Gold Trust ETF (GLD) declined by 2.59% in July. On the other hand, silver did notably better. The share price of the iShares Silver Trust ETF (SLV) grew by 0.32%. What is interesting, the large-cap companies were outperformed by the mid-, and small-caps, as the shares of the VanEck Vectors Gold Miners ETF (GDX) declined by 4.05%, while the shares of the VanEck Vectors Junior Gold Miners ETF (GDXJ) grew by 5.06%. Something similar could be seen also in the precious metals R&S industry. The Precious Metals R&S Index which consists of the 5 main players, declined by 2.81%, while the Precious Metals R&S Equally Weighted Index which contains all the 20 companies grew by 4.66%.

The July News

Several important deals were announced in July. First of all, Royal Gold is acquiring Great Bear Royalties. Franco-Nevada provides a $352.5 million financing package to G Mining Ventures (OTCPK:KANAF) to fund the Tocanzintinho mine construction. Moreover, several companies reported the first revenues generated by some of their assets.

Franco-Nevada announced a $352.5 million financing package to G Mining Ventures to develop the Tocanzintinho Project. The package consists of a $250 million gold stream, $75 million secured term loan, and $27.5 million equity investment. The gold stream will entitle Franco-Nevada to purchase 12.5% of Tocanzintinho’s gold production at ongoing payments equal to 20% of the prevailing spot gold price. After 300,000 toz gold is delivered, the stream will be reduced to 7.5%. The term loan will be available for 3.5 years, and it will bear an interest of 3-Month Term Secured Overnight Financing Rate + 5.75% p.a. Its amortization will begin in December 2025 with equal quarterly repayments followed by a final 25% repayment upon maturity in June 2028. For the $27.5 million equity investment, Franco-Nevada should receive 44,687,500 shares of G Mining Ventures, This private placement is a part of the bigger $116.4 million private placement prepared by the company. After it is completed, Franco-Nevada will own 9.9% of G Mining Ventures. A detailed analysis of this financing package can be found here.

The company also announced that it will release its Q2 financial results on August 10, after the market close.

Wheaton Precious Metals announced that as a part of Hecla’s (HL) acquisition of Alexco Resources (AXU), it agreed to terminate the silver stream on Alexco’s Keno Hill Silver District. As compensation for the termination, Wheaton will receive Hecla’s shares worth $135 million. Subsequently, Wheaton should own approximately 5.6% of Hecla. The whole transaction is conditioned by Hecla’s successful closing of the Alexco acquisition. A detailed analysis of Wheaton’s deal can be found here.

The company also decided to add a sustainability-linked element to its existing undrawn $2 billion revolving credit facility. Wheaton Precious Metals will release its Q2 financial results on August 11, after the market close.

Royal Gold reported Q2 sales of 56,100 toz of gold equivalent (40,200 toz gold, 550,000 toz silver, 1,800 tonnes copper). Royal Gold will release its Q2 financial results on August 3, after the market close.

And, more importantly, Royal Gold will acquire Great Bear Royalties for C$199.5 million. It will pay Great Bear shareholders C$6.65 per share which represents a 43% premium over the 20-day volume weighted average trading price. This way, Royal Gold will acquire Great Bear Royalties’ only asset, the 2% NSR royalty on the Dixie project.

Osisko Gold Royalties recorded attributable production of 22,240 toz of gold equivalent in Q2. It means a new record high. The revenues amounted to C$51.5 million ($39.6 million). Osisko will release its Q2 financial results on August 9, after the market close.

Triple Flag Precious Metals recorded sales of 19,507 toz of gold equivalent (59% gold, 34% silver, 7% other) in Q2. The revenues amounted to $36.5 million. Triple Flag will release its Q2 financial results on August 9, after the market close.

Sandstorm Gold announced that it reached record-high attributable gold equivalent production (19,200 toz) and revenues ($36 million) in Q2. The company also declared a quarterly dividend of C$0.02 ($0.016) that was paid on July 29, to shareholders of record as of July 19. Sandstorm Gold will release its Q2 financial results on August 11, after the market close. The company also advised its shareholders to vote for the Nomad Royalty acquisition.

On July 12, Sandstorm reported the closing of the Basecore portfolio acquisition announced back in May.

Nomad Royalty filed a Circular for the Special meeting of shareholders that will be held on August 9. The main aim of the meeting is to approve Nomad’s acquisition by Sandstorm Gold.

Gold Royalty (GROY) announced that it will release its Q2 financial results on August 15, after the market close.

EMX Royalty (EMX) announced that the Gediktepe mine entered commercial production from oxide gold mineralization. EMX owns a 10% NSR royalty on oxide gold production from Gediktepe. The oxide production should amount to 35,000-45,000 toz gold per year over the next 3-4 years. It should generate cash flows of around $7 million per year for EMX. EMX owns also a 2% NSR royalty on non-oxide production at Gediktepe. Moreover, it is entitled to milestone payments of up to $10 million. The company also reported that it repaid SSR Mining (SSRM) the $7.85 million debt. Moreover, it sold two Norwegian projects to Minco Silver (OTCQX:MISVF). The Sagvoll and Sulitjelma polymetallic projects will be sold for a negligible cash consideration, however, EMX will retain a 2.5% NSR royalty on the projects.

TRIDENT ROYALTIES (OTCPK:TDTRF) provided updates regarding the Sonora lithium royalty. Among other things, as part of the litigation process, the hearing of Bacanora Minerals’ appeal will be held on January 13, 2023.

The company provided also an update regarding its Thacker Pass lithium royalty. According to Lithium Americas (LAC), the feasibility study, as well as early construction works, remain on track for H2 2022. All the necessary permits are in place, and a hearing regarding an appeal is scheduled for August 11.

Great Bear Royalties announced the abovementioned Royal Gold’s C$199.5 million takeover offer.

Elemental Royalties announced that the 50% gold stream from the Ming mine generated the first 408 toz gold in Q2. Moreover, the 1% NSR royalty on the Mercedes Gold Mine became payable. Sailfish Royalty (OTCQX:SROYF) reported the Q2 financial results. Sailfish earned 345 toz gold and generated revenues of $646,859. The company recorded a net loss of $885,833, but what is positive, it repurchased and canceled 499,100 common shares. Sailfish also announced a normal course issuer bid. Between July 14, 2022, and July 13, 2023, Sailfish will be enabled to acquire up to 5% of its issued and outstanding shares.

Orogen Royalties reported the closing of the acquisition of the Kenyan royalties announced back on June 9.

Empress Royalty announced that it received the first silver from the Tahuehueto mine. However, no specific numbers were provided. Empress owns a 100% silver stream on the Tahuehueto mine until 1.25 million toz silver is delivered, and 20% silver stream thereafter. The stream will terminate after 10 years. The ongoing payments equal 20% of the spot silver price. Tahuehueto’s silver production is estimated at 453,952 toz per year on average, over 9-year mine life.

Only three days later, Empress Royalty announced that the Manica mine poured its first gold. Empress owns a 3.375% gold royalty on the first 90,000 toz gold produced at the mine, and 1.125% thereafter.

The August Outlook

The markets seem to be stabilizing, which should be good for the precious metals R&S companies. It is possible to expect some new deals, but probably smaller than in July. Moreover, the earnings season is here. Royal Gold released the Q2 financial results on August 3. It will be followed by Osisko Gold Royalties and Triple Flag Precious Metals on August 9, Franco-Nevada on August 10, Wheaton Precious Metals and Sandstorm Gold on August 11, and Gold Royalty on August 15.

Be the first to comment