dem10

Investment Thesis

DigitalOcean (NYSE:DOCN) is a cloud computing platform specialising in infrastructure and platform tools, with a focus on serving small and medium sized businesses (aka SMBs). This SMB segment has been largely ignored by the cloud behemoths of Amazon (AMZN), Microsoft (MSFT), and Google (GOOGL), with these enterprise-focused solutions being overly complex and too opaque for smaller companies. That is where DigitalOcean differentiates itself, by offering cloud infrastructure and platform technologies that can be implemented quickly, intuitively, and independently – with extremely affordable and transparent prices. The good news is that, as these SMBs have grown in size, they have expanded their spend substantially with DigitalOcean, since the company does benefit from some high switching costs.

DigitalOcean 2022 Investor Day

Yet it’s been a difficult 2022 for DigitalOcean’s shareholders; in fact, it’s been a difficult 2022 for most tech-focused investors, but DigitalOcean has been hit extra hard. Shares are down 65% from their 52-week highs, which is particularly interesting since the market has seen strong performances from cloud providers such as AWS.

The issue with DigitalOcean is its focus on SMBs, since these companies are more likely to struggle in a recession. The enterprise customers of AWS might cut back spending on advertising, for example, whereas the SMBs in a recession will be cutting back everything they can just to survive. SMBs are also more likely to go bankrupt, meaning that DigitalOcean is likely to feel more downside from this recession than the cloud giants.

My investment thesis for DigitalOcean is fairly simple, although I laid it out in more detail in a recent article: the company is serving an underserved segment of the market when it comes to cloud services, and it is doing this successfully. Cloud adoption is even more nascent in SMBs, giving DigitalOcean a huge runway & the ability to scale alongside its customers. Basically, it just needs to keep capturing the opportunity in front of it.

Investors like myself are now looking to DigitalOcean’s Q2’22 earnings in order to provide a bit more insight into how badly the company is feeling the macroeconomic pressures, and whether or not my investing thesis are on track.

So, how did DigitalOcean perform? Let’s take a look.

Earnings Overview

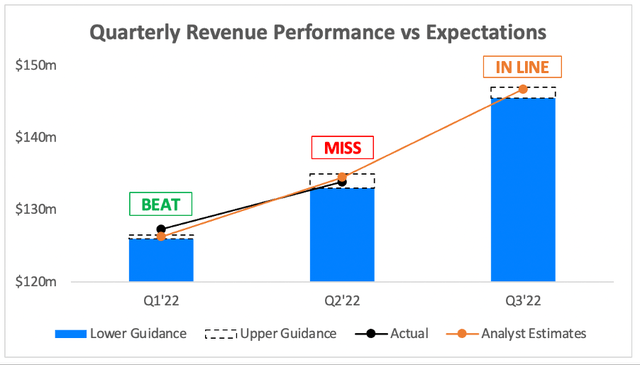

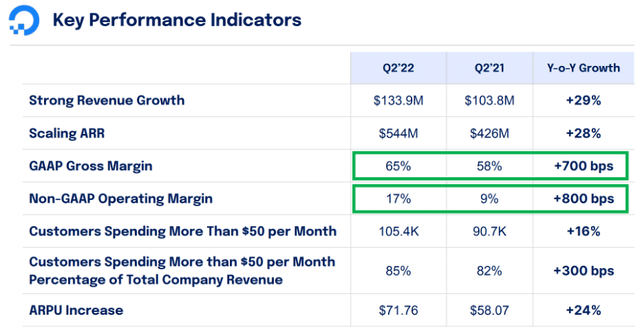

DigitalOcean’s revenue grew 29% YoY to $133.9m, falling just short of analysts’ expectations of $134.5m but coming in line with management’s $133-$135m guidance. In terms of outlook for Q3, management guided for revenue of $145.5-$147m, in line with analysts’ estimates of $146.8m and representing ~31% YoY growth at the midpoint.

Investing.com / DigitalOcean / Excel

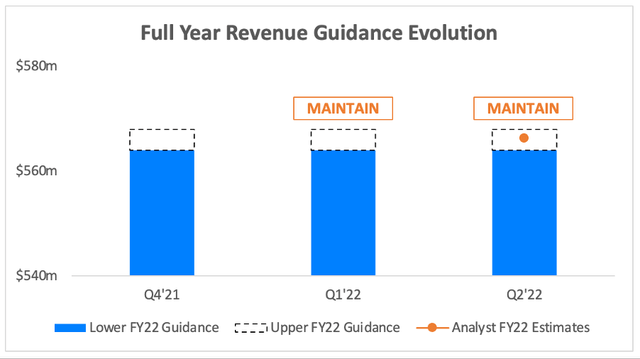

In terms of full year revenue guidance, it took me slightly by surprise that DigitalOcean maintained its guidance of $564-$568m; perhaps I have got a little bit too used to companies cutting guidance this earnings season. This was in line with analysts’ current expectations of $566m, so I class that as a win.

Seeking Alpha / DigitalOcean / Excel

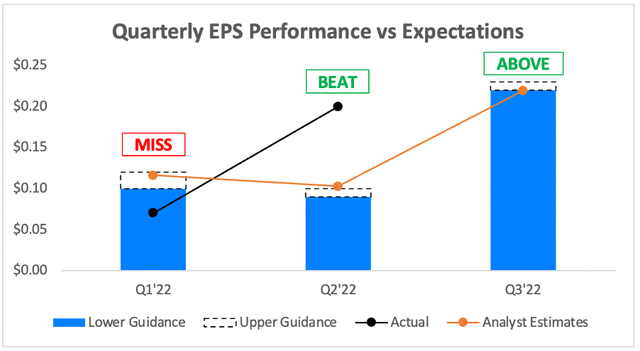

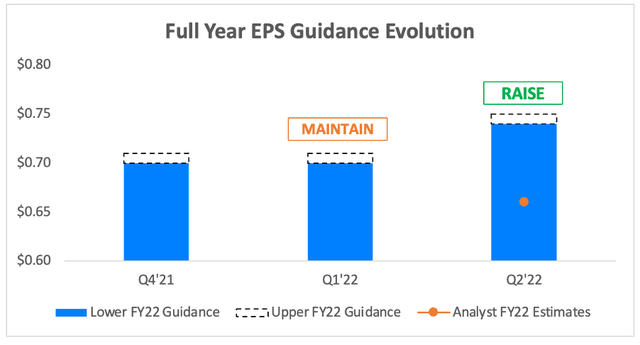

Where this story gets a bit brighter is on adjusted EPS. DigitalOcean delivered EPS of $0.20, beating analysts’ estimates of $0.10 & also beating management’s guidance of $0.09-$0.10. The outlook for Q3 was another tick, as DigitalOcean’s guidance of $0.22-$0.23 was above analysts’ estimates of just under $0.22.

Investing.com / DigitalOcean / Excel

The good news continued on the earnings front, as quite surprisingly DigitalOcean raised its full year outlook for EPS, bumping its guidance up from $0.70-$0.71 to $0.74-$0.75 and coming in above analysts’ estimates of $0.66.

Seeking Alpha / DigitalOcean / Excel

Given the difficult macroeconomic environment that would hit DigitalOcean’s customers particularly hard, I am incredibly pleased with these results. Maybe I’ve just been around too much negativity over the past few weeks of earnings, but the fact that DigitalOcean’s revenue guidance was in line with expectations, and it maintained its full year revenue outlook, and the company raised its full year EPS guidance put a big smile on my face.

Investors have seen many companies fall victim to the recession faced by economies around the world, and DigitalOcean is no different – but it appears to be more resilient that I had anticipated going into this earnings report.

Customer Resilience & Improving Financial Profile

The big issue with DigitalOcean is its customers, and the fact that they are more sensitive to economic downturns – so I was particularly interested to see what the total customer number was for DigitalOcean.

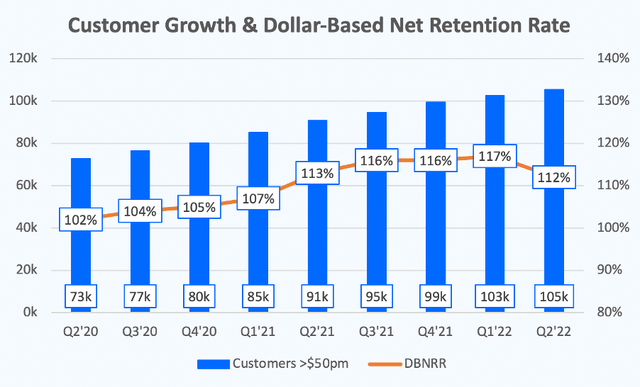

Before diving into this, I should highlight that DigitalOcean used to report its total customer number; now, it is only reporting customers who spend more than $50 per month. I’m guessing this means that DigitalOcean’s total customer numbers didn’t look too pretty in this quarter, and once again I’m not surprised – customers who spend a semi-significant amount on DigitalOcean’s platform (>$50 per month in this case) are likely to be slightly larger, more resilient businesses, but are also more likely to be needing DigitalOcean’s services regardless of the economic environment.

With that caveat out of the way, let’s now take a look at the trend in these customers spending >$50pm & the company’s dollar-based net retention rate.

Despite the difficult macroeconomic climate, DigitalOcean still managed to add an additional ~2,900 customers into this >$50pm bucket during the quarter – note; these are not necessarily new customers, they may be existing customers who have started spending more than $50pm. Either way, it’s a positive sign in a tough time, with this number of 105k customers representing a 16% YoY increase.

The dollar-based net revenue retention rate of 112% fell to its lowest point since Q1’21, but once again it was relatively strong when you consider the backdrop to this quarter. DigitalOcean is always going to have a lesser DBNRR than enterprise-focused SaaS (or PaaS, or IaaS) companies, just because its customers are more likely to leave since SMBs have a greater risk of bankruptcy – this is through no fault of DigitalOcean. I’m glad that this figure stayed above 110%, although don’t be surprised if it continues to fall in the coming quarters.

I was particularly impressed, however, by DigitalOcean’s ability to improve margins and profitability – as we already saw with its boosted EPS guidance.

DigitalOcean Q2’22 Investor Presentation

DigitalOcean’s gross margins increased from 58% one year ago to 65% in the current quarter. In fact, since this company started reporting results in Q1’20, its gross margins have improved without fail every single quarter – showing just how much impact scale has on profitability in this industry. The company also boosted its non-GAAP operating margin, another demonstration of its focus on ensuring financial strength over this difficult period.

CEO Yancey Spruill said the following to this effect in the Q2 earnings press release:

We are taking a number of actions in the second half to deliver 30% growth with improving profitability and cash flow despite an uncertain environment driven by macroeconomic factors beyond our control

This seems like a sensible move, and I applaud management’s prudent approach; I also applaud management for not cutting guidance unlike other management teams (ahem, Palantir (PLTR)), as this gives me confidence that despite being in a difficult market, CEO Yancey Spruill & his team remain on the ball.

Valuation

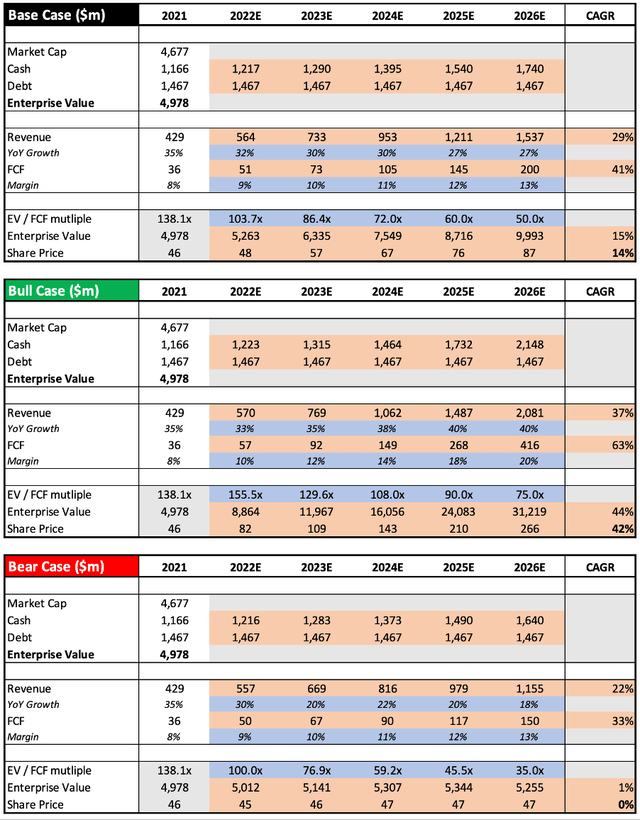

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether DigitalOcean is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

In my base case scenario, I assume that revenue for 2022 comes in at the low end of management’s guidance, and that FCF also comes in at the low end of management’s 9%-10% margin guidance. I have assumed steady 30% growth for a couple of years, following which growth trails off slightly & margins continue to steadily improve. I’ve used what I believe to be an appropriate final EV / FCF multiple given the potential for growth and margin expansion beyond 2026.

In my bull case scenario, I assume that DigitalOcean’s revenue growth accelerates through to 2026, eventually hitting 40% YoY growth with margins that scale along with it. It is possible to achieve such acceleration with a company such as DigitalOcean, particularly given the huge opportunity ahead of it & the secular tailwinds driving cloud adoption forward.

In my bear case scenario, I assume that growth will continue stumbling through to 2026 & never really recovers from the hit that SMBs will take in this recession. As such, margins remain suppressed due to a lack of scale & the EV / FCF multiple reflects these lowered expectations.

Put all that together, and I can see DigitalOcean shares achieving a CAGR through to 2026 of 0%, 14%, and 42% in my respective bear, base, and bull case scenarios.

Investment Thesis: On Track

Although it was by no means a stellar earnings report, it was a half-decent one, and I will certainly take that in this environment. DigitalOcean continued to show signs of promise, with more customers reaching that $50pm price point & DBNRR still being above 110%. The short-term headwinds faced by this company should come as a surprise to nobody, but the long-term opportunity is still very much there – and I feel even more confident about DigitalOcean after this quarter.

Be the first to comment