NiseriN/iStock via Getty Images

Thesis

The Putnam Premier Income Trust (NYSE:PPT) is fixed income CEF from the Putnam suite of closed end funds. The vehicle has current income and NAV stability as its main goals. The fund has a high concentration of agency pass-throughs and CMBS securities which gives it an overweight investment grade credit profile, however the vehicle tries to juice up its returns by allocating high balances to high yield bonds and emerging markets debentures The CEF is currently trading at a -8% discount to NAV and has been captured by the recent fund manager announcement regarding shares repurchases:

Putnam Investments announced today that the Trustees of the Putnam Funds have authorized the Putnam closed-end funds to renew the current share repurchase program, allowing each Putnam closed-end fund, during the 365-day period beginning October 1, 2022 and ending September 30, 2023, to repurchase at a discount to net asset value up to 10% of its outstanding common shares (based on common shares outstanding as of September 30, 2022) in open market transactions.

PPT being a CEF trading at a discount will directly benefit from this announcement.

Holdings

The fund is a multi-asset CEF:

Portfolio (Fact Sheet)

We can see the vehicle has a high concentration in mortgage securities, both Agency and Non-Agency. It is interesting to note the dispersion of the holdings across a variety of asset classes for this name.

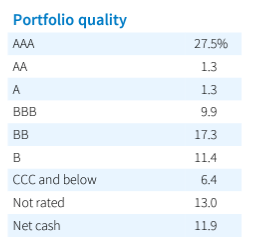

The credit risk profile is reflective of that barbell allocation with significant concentrations in the “AAA” and “BB” buckets:

Ratings (Fact Sheet)

Why is Putnam doing this?

If we take a step back we need to understand why Putnam is doing this – as a large asset manager, perception is very important for Putnam. Persistent discounts to NAV for CEFs signal investor discomfort with the asset manager, and ultimately result in business divestitures as we have seen with the Delaware Asset Management CEFs. To combat this the asset manager does not have many options. Among them are share repurchases, fund liquidations or mergers. Putnam is actively choosing the share repurchase programs so that it supports its CEFs trading at discounts.

We think this is ultimately beneficial to investors since a good asset manager can choose discounted entry points to purchase back shares. Basically as it stands Putnam can take advantage of a theoretical move in the PPT discount to -10% on the back of a risk-off move to undertake the share repurchases. This would create value for the fund since it can generate profits by buying shares at a -10% discount and retiring them at NAV, thus giving shareholders an extra 10% for the retired amount.

While the ultimate impact to PPT is small, we like this program and feel large, well run platforms expose this kind of behavior for CEF platforms, having maximum thresholds for discounts to NAV. We have seen that small platforms that do not manage this aspect for their funds ultimately close shop, as we have seen with the Delaware Management Company CEFs. As a retail investor in PPT you do not need to do anything, but it should provide more comfort that you bought into a well run platform.

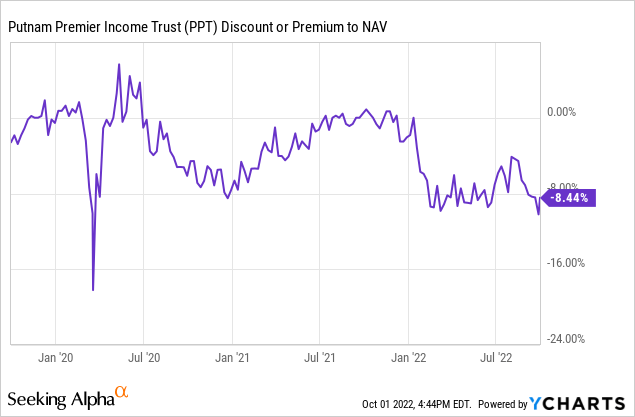

Premium/Discount to NAV

The fund tends to trade at discounts to NAV:

We can see from the above chart that the discount to net asset value tends to widen out significantly during risk-off events. From that angle the recent announcement is beneficial for the shares since it should provide an additional bid for the fund and a natural mechanism to bring the market price closer to the fair value of the collateral.

If the fund had persistent trading patterns where the market price would be above NAV then we would expect Putnam to forgo such a corporate action because it would not make sense from a financial standpoint.

Fund Performance Drivers

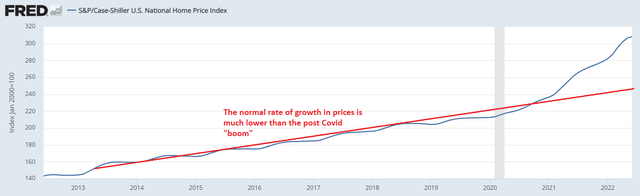

PPT has a high allocation to mortgages and high yield securities. Both forms of credit have been hit hard in 2022 from rising rates and higher spreads in the case of high yield. Due to the zero rates environment, the housing market has seen ever-increasing prices:

As we can see from the above graph the post-Covid Fed policy resulted in a massive acceleration in house prices, significantly outside the normal growth rate witnessed in prior years. Prices will come down towards the normalized growth rate. Nothing goes up parabolically.

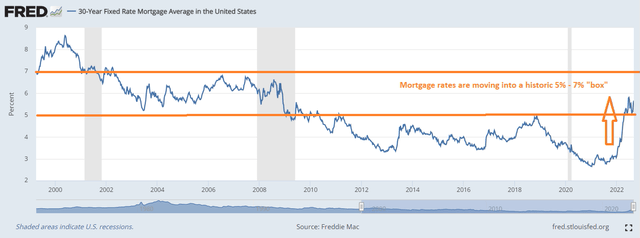

Mortgage rates have risen significantly, and we anticipate them to stay elevated:

We can see from the above chart that post the Great Financial Crisis, mortgage rates moved below the 5% threshold and stayed there. In the new higher inflation for longer macro environment, and with an overbought housing market, we expect mortgage rates to re-establish a 5% to 7% range for the next few years. This results in tighter financial conditions and fewer people re-financing.

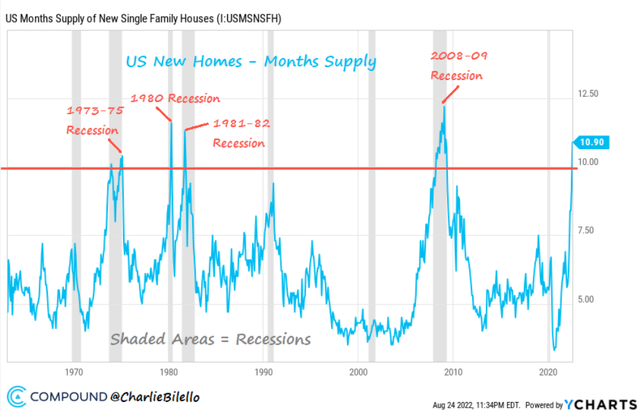

We are already starting to see the tighter financial conditions feedback in the housing market:

Supply of new homes (Compound Capital)

Higher mortgage rates have resulted in fewer people buying houses, which in turn have started to create a glut of unsold homes. This will translate into lower prices next.

Conclusion

Putnam Premier Income Trust is a fixed income CEF that takes a multisector bond approach. The vehicle has been negatively affected by the rising rates environment in 2022 and is currently trading at a -8% discount to NAV. The fund manager (Putnam) has just announced a share repurchase program that should help put a soft lower barrier on the fund’s discount. We like these types of corporate actions from asset managers because they speak well to the platform’s robustness and the ability to convey trust in portfolio managers’ ability to generate value long term. When an asset manager has CEFs trading at significant discounts to NAV for prolonged periods of time it is basically the first sign of a dying business. IPO-ing new CEFs when the track record shows that the market does not value one’s expertise is quasi impossible. The share repurchase announcement is a small positive for PPT in an otherwise tough 2022.

Be the first to comment