jetcityimage/iStock Editorial via Getty Images

On Wednesday afternoon, PPG Industries (NYSE:PPG) reported earnings, which sounded the alarm bell for a global recession. The company has made great strides in bringing up prices to negate cost inflations, and supply chain issues are past their worst. However, management is warning about significant demand headwinds. Down over 25%, the stock was already discounting much of this, but the dour outlook pushed shares down another 1% after-hours, and it still does not appear to be time to get into PPG.

In the company’s third quarter, PPG earned an adjusted EPS of $1.66, which beat by a penny. That was down about 2% from last year. Revenue rose 2% to $4.47 billion. Prices rose 12% while foreign currency was a 6% drag, and volume was down 3%. In particular, management called out “slowing demand in Europe and China.” Raw material prices are up 40% over the past two years, and during the quarter, PPG’s sales price increases finally matched total input costs, alleviating much of the pressure on the bottom line.

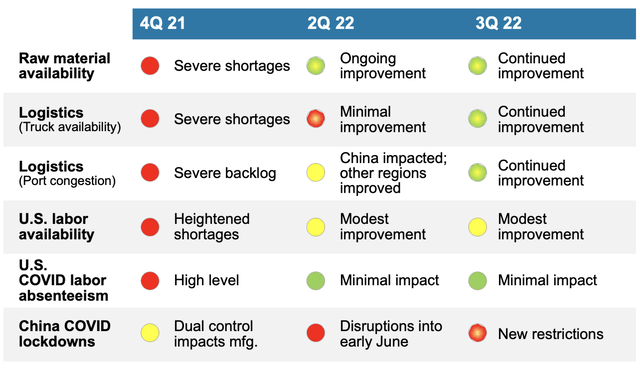

For the past two years, PPG has not only dealt with higher prices, but also a scarcity of materials, shipping problems, and labor shortages. Fortunately, raw material availability has improved and is expected to continue in Q4. PPG’s problems were a harbinger of broader supply chain issues, but fortunately as you can see below, there was substantial improvement in Q3. At the end of last year, nearly every category was flashing red. Today, most are improving. The one area of concern is China where operations are at risk of further disruptions given COVID-zero policies.

Unfortunately, just as supply issues are getting better, demand problems are worsening as PPG’s outlook for economic activity darkens.

Its performance coating unit (60% of the business) saw sales fall 2% and segment income decline 11% to $362 million as margins contracted 150bp. Volumes fell 6%, which price increases could not fully offset given currency headwinds. Management is seeing less demand in architectural do-it-yourself work (DIY) and marine, a China-centric segment. Conversely, auto refinish hit a record, and US aerospace improved, given Boeing’s (BA) normalizing activity.

The company still has a similar backlog as at the end of Q2. This backlog is not sufficient to support the current level of activity though as PPG expects Q4 volumes to be down mid-single-digits due to weakness in architectural DIY around the world. It also warned that logistics prices remain elevated, and higher energy prices a headwind.

Its other unit, industrial coatings (40% of the business), was a bright spot as it generated 9% sales growth. This translated to 37% profit growth to $192 million as margins widened by 220bp. The unit is benefitting from rising auto production, which remains below pre-COVID levels. As a consequence, volumes overall rose 2%

That relative strength made the guidance all the more jarring. In Q4, management expects volumes to fall “mid-single-digits,” a significant slowdown from Q3. This is largely due to weakness from consumer-related products. It sees weak industrial activity in Europe and China continuing. This decline comes even as management still expects a modest increase in auto builds. Energy costs are also increasing, and management has made contingency plans for a sharper contraction in EU industrial activity in case high natural gas prices cause further disruptions.

PPG frequently warned about Europe and China in its commentary, and as a reminder, the US and Canada account for about 45% of sales, Europe, the Middle East and Africa, 30%, Asia Pacific 15%, and Latin America 10%. This is largely a non-US business with very significant Europe/China exposure. During the third quarter, US/Canada sales volumes were flat thanks to gains in aerospace and autos, offset by housing weakness. Europe and Asia Pacific were each down mid-single digits, driving the overall volume decline. It should also be noted PPG facilities have been impacted by China lockdowns in September, which is why it continues to flag potential restrictions as a risk.

While the third quarter was decidedly mixed, things are forecast to get worse. In Q4, management expects company volumes to be down “mid-single-digits” with inflation also being “mid-single-digits.” PPG also faces a $280 million headwind from currency. That backdrop will lead to EPS of $1.05-$1.20 well below the analyst consensus of $1.24. Last year, the company earned $1.24 in Q4, so at the midpoint, earnings will be down 9%, a worsening pace from Q3.

Even as the company is no longer facing as much of a margin squeeze, demand problems in Europe, China, and US housing will reduce profitability. In response, the company is undertaking a $70 million cost cutting program. It also paid down $400 million of debt during the quarter with its $500 million of operating cash flow. PPG is carrying $1.1 billion of cash, giving it the liquidity and balance sheet strength to navigate through a worsening economic cycle.

For the full year, PPG is set to earn about $6, leaving it with a 19x P/E. Given the US housing market is still weakening (as seen by Wednesday’s housing starts), the strength in the auto sector may be fading considering Ally’s (ALLY) earnings, China is not moving away from COVID-zero, and the worst effect of higher natural gas prices in Europe will be felt over this winter, it does not appear the business is near its bottom. 19x earnings for a company that appears likely to have 2023 earnings lower than 2022 earnings is a pricey multiple.

The message from PPG’s management was clear: the environment is getting worse. Until it appears that the end is within sight or the stock is trading at particularly cheap levels, it is too soon to get in. Given its guidance, I expect there will be a wave of downward analysts revisions, and $5.40-$6 in 2023 EPS, depending on how the economy develops is a good central case. I would be a seller of PPG, and I would want to see shares trading below $100 or less than 17x earnings before even considering entering the stock. When management says things are getting worse, sometimes it is best to listen to them and avoid their stock.

Be the first to comment