ablokhin/iStock Editorial via Getty Images

Potbelly (NASDAQ:PBPB) has impressed with its sales performance, delivering +17.2% same-store sales growth in Q2 2022. This was partially driven by the tailwinds from the foot traffic in the Central Business District and Airport areas largely recovering to pre-pandemic levels. While Potbelly cannot count on foot traffic in those areas continuing to increase significantly higher, it is already at a point where its total revenues are higher than pre-pandemic (2018/2019) levels and its per store sales are around 20% higher than that pre-pandemic period.

Potbelly has exceeded my expectations for sales growth, although it still faces some challenges in improving shop-level margins. Ingredient cost inflation and the higher wage environment have contributed to its shop-level margins remaining several percent below pre-pandemic levels recently. This is despite Potbelly’s strong efforts to mitigate cost inflation and despite the efficiency benefits from increased per store sales.

The strong sales performance boosts my estimate of Potbelly’s value to $6 to $7 per share though.

Excellent Sales Performance

Potbelly has been doing quite well in terms of being able to drive sales growth, with its Q2 2022 revenues coming in at the high-end of its guidance as it reported record average unit volumes.

Potbelly reported +24.4% same-store sales growth in Q1 2022, followed by +17.2% same-store sales growth in Q2 2022. It also appears to expect approximately +12% same-store sales growth in Q3 2022.

Potbelly’s same-store sales growth has been particularly driven by strength in its Central Business District and Airport shops which had +61.3% and 27.9% same-store sales growth respectively. This makes sense given how those areas were the most affected by the pandemic and are now recovering.

Potbelly’s year-over-year growth is slowing as sales in those areas normalize, but its total sales seems to be stabilizing at a much higher level than pre-pandemic.

For example, Potbelly reported $116 million in revenues in Q2 2022 compared to $106 million in Q2 2019 and $110 million in Q2 2018. As well, Potbelly also had approximately 10% more company-operated shops in Q2 2018 and Q2 2019 than now, so the average store generates close to 20% more revenue now.

Inflationary Pressure

Potbelly’s shop-level margins have also improved to 11.4% in Q2 2022, better than its guidance for 9.0% to 11.0% shop-level margins for the quarter. Inflationary pressure is hampering Potbelly’s ability to significantly increase its shop-level margins further though. Potbelly’s guidance for Q3 2022 is for 9.0% to 12.0% shop-level margins, which is only slightly better than its guidance for Q2 2022. As well, the 11.4% shop-level margins for Q2 2022 would end up near the higher end of its Q3 2022 guidance.

Potbelly is dealing with a higher wage environment, although its labor expenses are actually going down as a percentage of revenues due to the strong sales performance. Potbelly also noted that its food, beverage and packaging costs (typically adding up to a mid-to-high twenties percentage of its revenue) is seeing up to 18% inflation in 2022.

Potbelly reported 15% shop-level margins in 2019 and 16.7% shop-level margins in 2018, although it made accounting changes in Q1 2022 to put some advertising and marketing expenses at the shop level. This change reduces its shop-level margins by approximately 1%, so based on current accounting its shop-level margins would have been around 14% in 2019 and 15.7% in 2018.

Potbelly has done a good job to mitigate the impact of inflation so far, but the inflationary pressure will slow its ability to return its shop-level margins to 2018/2019 levels.

Notes On Valuation

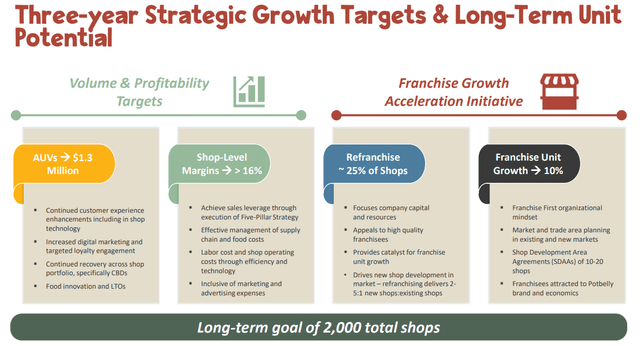

I am generally skeptical about Potbelly’s ability to reach its 2024 targets, which appear to involve another 15% to 20% in same-store sales growth from current levels, along with 16+% shop-level margins. The concerns around consumer spending and inflation will likely prevent Potbelly from achieving those target.

Potbelly Long-Term Targets (potbelly.com)

However, I do believe Potbelly is capable of growing same-store sales at least modestly from current levels. Combined with a return to near 2019 shop-level margins, this would result in an estimated value of around $6 to $7 per share. It may take a bit of time to get back to 2019 shop-level margins as Potbelly continues to work on mitigating rising costs, but that would be an appropriate 2024 target in my opinion.

Conclusion

Potbelly has exceeded my expectations in terms of sales growth, getting revenues to above 2018/2019 levels despite having around 10% fewer company-operated stores now. Potbelly’s year-over-year sales growth is slowing as the recovery for its CBD and Airport stores provide less tailwinds going forward. However, current sales levels (or modestly higher sales levels) work well for the company if it can boost its shop-level margins.

I am assuming that Potbelly will not reach its target of 16+% shop-level margins in 2024, but do believe that 13% to 14% is achievable. This results in an estimated value of $6 to $7 for its stock.

Be the first to comment