Editor’s note: Seeking Alpha is proud to welcome Shark Value Investing as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

imaginima

I am going to provide you with an investment idea about Portland General Electric (NYSE:NYSE:POR). The crisis in Ukraine and Russia has affected all of us with higher energy prices, and the need for greener and safe energy has become more apparent than ever.

In this backdrop, I think it is fair to say that safe investments such as utilities have become more important now. With a year-on-year even growth rate and safe dividend payout ratio, POR is a good investment in your retirement portfolio. The current share price, however, is a little high for me at this stage. I would advise you to wait for the share price to drop, before jumping in and buying the shares of POR.

Let’s get to the analysis now.

Introduction

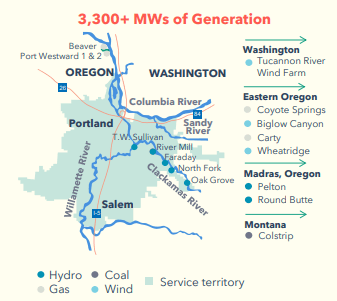

Portland General Electric is an energy company that serves over 900,000 customers and is based in Portland, Oregon. The population of the company’s service area is about 2 million spread over 51 cities. POR has delivered safe, affordable, and reliable energy to Oregonians for over 130 years.

POR’s main business is to produce, transport, and distribute electricity to customers. The company has over 28,000 miles of distribution lines all over the service area. Roughly 75% of Oregon’s industrial and commercial activity takes place in its service area.

PGE service area (Portland General Electric)

Additionally, POR is leading the way toward clean energy in Oregon. By 2030 they want to reduce 80% of their greenhouse gas emissions, 95% by 2035, and 100% by 2040.

Some of the key financials of Portland General Electricity are as stated below:

- 2021 revenue: $2.396 billion, or $26.78 per share;

- 2021 earnings per share: $2.73;

- Average last 5-year revenue growth: 4.17%;

- Average last 5-year EPS growth: 4.26%.

The company has promised the following in the years to come:

- 4% to 6% long-term GAAP EPS growth, with 2019 as base year;

- 5% to 7% long-term dividend growth;

- 1.5% long-term load growth.

Growth in population is naturally leading to an increase in POR’s customer base. Since 2010 Oregon’s population has grown around 12%. The core service area, which is Portland, supports the region by creating new jobs.

Strategy of Portland General Electric

POR is working toward at least an 80% reduction in greenhouse gas emissions by 2030 and a 100% reduction by 2040. This will help the company become more profitable because the cost of greenhouse gases is increasing over time.

Strategic priorities (Portland General Electric Earnings Conference Call Second Quarter 2022)

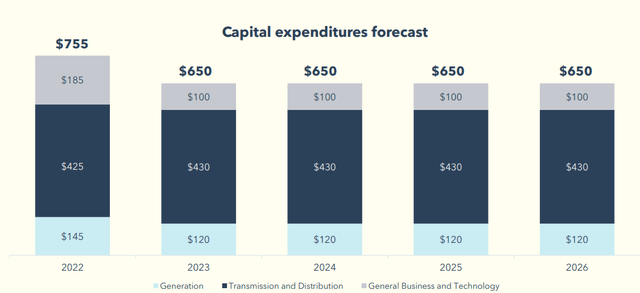

Portland General Electric is investing heavily in themselves, especially in the generation, transmission and distribution, technology and general business. As the picture below points out, over half of their investments go to the transmission and distribution section. Electrical power generation gets around 20% of the capital expenditure and business and technology gets 25% of the investment.

Capital expenditure forecast (Portland General Electric)

The investments that are being put into transmission and distribution include taking the power lines under the ground. A part of these also go toward regular maintenance work, which includes trimming trees and managing the vegetation near power lines to prevent disruptions. To add to that, the company is focusing on hardening the system with fire-resistant iron poles in priority wildfire areas.

Portland General Electric has installed over 1 gigawatt (1,000 MW) of clean, sustainable energy, which is enough to power 340,000 homes. The green energy power comes mainly from 3 wind farms:

- Wheatridge renewable energy facility with combined wind, solar (350 MW), and battery storage (30 MW);

- Tucannon wind farm with a total installed capacity of 267 MW;

- Biglow Canyon wind farm with an installed capacity of 450 MW.

POR also has 5 hydroelectric plants and several gas-powered plants. Gas-powered plants help POR to provide an efficient, steady, and reliable source of energy that can be used when wind and solar are not available.

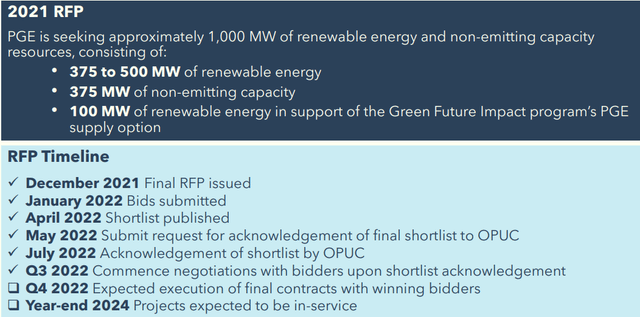

By 2024 POR wants to add between 375 MW and 500 MW of renewable energy, which is a lot considering that right now they have installed over 1,000 MW of green energy.

Request for Proposal (Portland General Electric Earnings Conference Call Second Quarter 2022)

Adding clean energy to the portfolio will reduce the need for power generated from coal or gas. In addition the clean energy is usually self-sufficient and energy independent, which leads to savings on operating expenses. In fact, after construction, many solar energy projects can generate power at about half the cost of fossil fuels, and this is projected to get cheaper in the future as solar power becomes more common.

Dividend policy

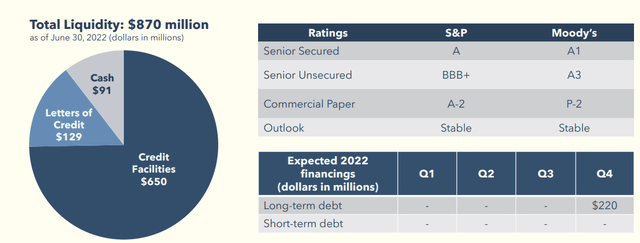

POR has a total liquidity of $870 million as of June 30, 2022. They are expecting financing in Q4 2022 of $220 million. The company will take on debt to fund the green financing framework.

Liquidity and financing (Portland General Electric)

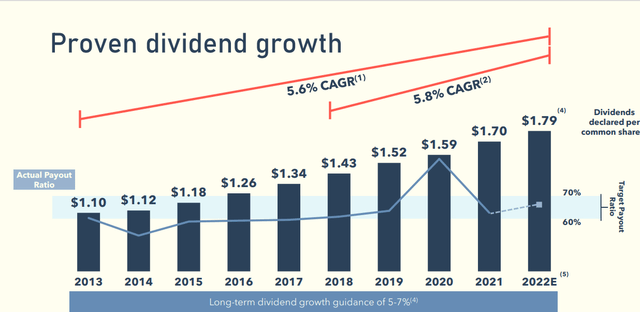

While the cash on hand is decent and outlook grades by S&P and Moody’s are rated stable, we can look at the dividend policy. POR’s dividend payout ratio in 2021 was 61.48%, which is within target. The company has pointed out that the long-term dividend growth guidance is 5-7%.

Dividend growth from 2013 to 2022 (Portland General Electric)

POR has paid dividends since its debut in 2006. The dividends have grown at a 5.6% CAGR from 2013 through 2022, and at a 5.8% CAGR from 2018 through 2022. The current dividend yield is slightly over 3.1% while the shares are traded at around $55. If we were to take a conservative position in a dividend growth of 5%, then by investing today, the annual payout would be $2.95 per share by 2032 and the yield would be 5.39%.

However, if we would take an optimistic position in a dividend growth of 7%, then the annual payout would be $3.56 per share by 2032 and the yield would be around 6.45%.

Portland General Electric – Valuation

POR is trading at around 19X forward earnings while the sector median is 21X, which leaves some room for the share price to grow. Also, the historical tendency for the company is to trade around 21X P/E. When the PE returns to the historical levels the share price should be $59.01, which means an approximately 6% return, plus the dividend of 3.15%. This gives us an altogether approximately 9% return.

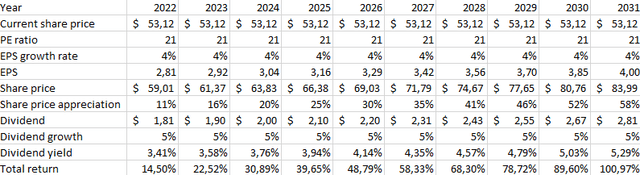

POR total return (Excel)

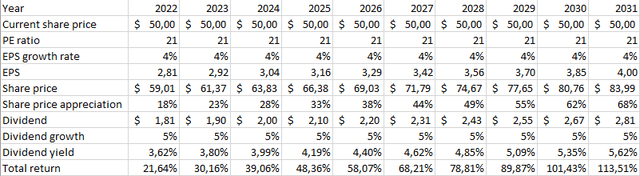

Buying POR right now would give 7.2% annual return over the next decade. This is in the scenario where the PE ratio stays around 21 and the company is able to grow its earnings by at least 4% per year.

While we want to take into consideration the margin of safety, I think the fair margin rate should be around 10%, since energy distribution companies have a strong position in the market. That is because no one will build another power line next to an existing one. Taking everything into consideration I think the buying price for POR is under $50, which would give us 17.72X earnings and a dividend yield of over 3.6%.

Wall ST. Analysts rate the stock as a hold, with 3 buys, 7 holds, and 2 sell positions. The average price target for POR is 52.5, which is lower than the price right now.

If POR can grow EPS by 4% and increase dividends by 5% annually, then it could bring back a total return of 113% by the end of 2031. That is the most conservative scenario, if we rely on the promises Portland General Electric’s board has given to the investors.

Conservative scenario (Excel)

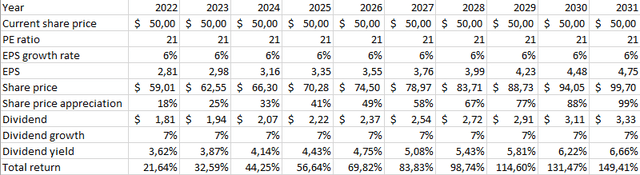

However, the most optimistic scenario is where the company stays at the historical 21X earnings, grows EPS by 6%, and increases dividend payout by 7% per year. The total return then would be 150% with dividends, or a 9.5% annual return.

Optimistic scenario (Excel)

Conservatively speaking, I would buy POR for under $50, but right now I think it is valued fairly. That is why I rate POR as a “Hold”.

How the competitors are doing

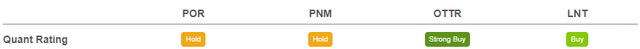

In this section, let’s take a look at how the competitors are doing. For the research, I am using Seeking Alpha Quant Ratings. The Quant ratings show unemotional evaluation of each stock. Quant Ratings use a company’s financials, stock performance, and analysts’ estimates and compare them with other stocks in its sector. In this context, the sector is utilities.

I will compare POR with 3 other companies such as PNM Resources, Inc. (PNM), Otter Tail Corporation (OTTR), and Alliant Energy Corporation (LNT). PNM is ranked 28 out of 40, which is the lowest rank in the comparison, in the Electric utility industry. OTTR is ranked third, LNT 8th, and POR 13th.

Quant Rating (Seeking Alpha)

Right now, POR and PNM are rated as “Hold”, with LNT ranked as a “Buy” and OTTR with “Strong Buy” ratings.

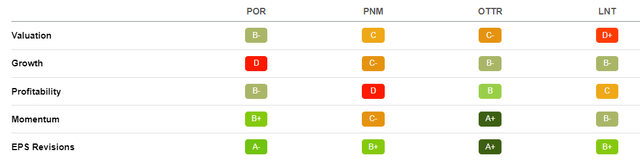

The Quant Grades assess five different factors – value, growth, profitability, momentum, and EPS revisions. The grades show how the company is rated with the sector median and it takes into consideration market sentiment.

Quant Factor Grades (Seeking Alpha)

As we can see in the table above, Portland General Electric is valued with the best grade in comparison with peers. With a B- rating we could say that POR is a buy compared with other utility sector companies.

The growth rating for POR is D, which I think is mainly due to a significant drop in the EPS for 2020, the year in which the company incurred energy trading losses. Profitability, momentum, and EPS revisions are rated B- or better, which in my opinion is pretty good for an old company like POR.

Risks

The main risk with Portland General Electric is that if they don’t achieve their clean energy goals and they don’t get their wind farms running, they will have to pay a lot for greenhouse gases, and it will affect their earnings quite a bit in the future.

Another risk for the company is that if the EPS growth is slower than 4%, then the long-term dividend growth will be under 5%. We must also consider the geographical risk here, because if the wildfires in Oregon escalate over time, then the population will start to thin out, which means Portland General Electric will lose some of its customers. Also, the wildfires could take down power lines, which will cause some disruption and impact POR’s balance sheet due to the loss of income.

Conclusion

I rate Portland General Electric as a “Hold” because its shares are trading at around 19X earnings while the historical PE ratio has been 21X, which could mean that the risk is too high right now for taking a position. However, it is important to keep in mind that EPS and revenue have been growing steadily in the past, which supports the increase in dividend payouts.

I would consider taking a position when the share price would drop under $50, which would give me a solid 3.6% dividend yield now and nearly 6% in ten years time, with a dividend growth rate of 4% annually.

Be the first to comment