bhofack2

Just over two months ago, I wrote on Portillo’s (NASDAQ:PTLO), noting that the stock was getting ahead of itself short-term, and the rally above $25.50 was an opportunity to book profits in the stock. Since then, the stock has seen a drawdown of more than 20%, hit by general market weakness and a public follow-on offering at $23.75, which killed the stock’s upward momentum. At a share price of $21.00, PTLO is one of the worst-performing restaurant names this year, and in a more difficult economic environment, I still don’t see enough margin of safety in the stock just yet. Let’s take a closer look below:

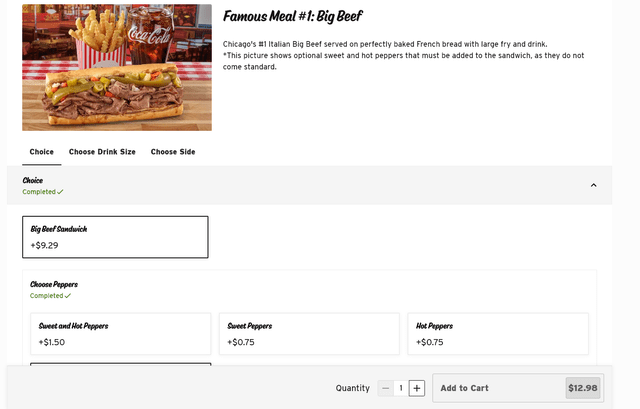

Portillo’s Menu (Company Website)

Q2 Results Recap

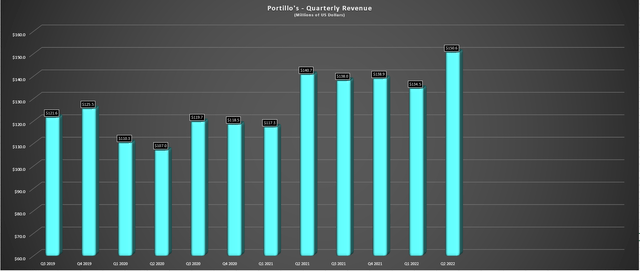

Portillo’s released its Q2 results in early August, reporting quarterly revenue of $150.6 million, a 7% increase from the year-ago period. The company noted that same-restaurant sales were able to positively lap extremely difficult comps of 25.0% from Q3 2021, with the company’s two-year stacked growth rate coming in at 26.9%. Overall, this was an impressive performance, especially during a quarter where consumers were getting hit from every angle (rising gas, mortgage, and grocery costs). Meanwhile, the company opened a new restaurant in St. Petersburg, Florida, and continues working on new locations in Schererville, Indiana, and The Colony, Texas.

Portillo’s – Quarterly Revenue (Company Filings, Author’s Chart)

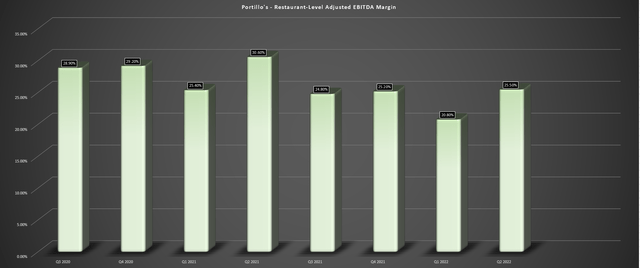

Unfortunately, although the sales performance was decent, especially considering that the company priced below some of its peers in fast-casual (6.8% pricing), the margin performance left much to be desired. As shown below, adjusted restaurant-level EBITDA margins slid to 25.5% from 30.6% in the year-ago period, and H1 2022 margins came in below 24.0%, a more than 400 basis point decline from 28.2% in H1 2021. This was attributed to the higher cost of goods sold due to commodity inflation which the company noted is tracking at the higher portion of its previously guided range of 13-15% for FY2022 (Q2 2022: 15.2%). The result was that COGS increased to 34.4%, up 440 basis points year-over-year in Q2 2022.

Portillo’s – Restaurant-Level Adjusted EBITDA Margins (Company Filings, Author’s Chart)

Meanwhile, from a labor standpoint, the company saw de-leveraging here as well, with labor up 70 basis points to 25.2%. The good news is that the company is back to pre-COVID-19 staffing levels, is very confident in its labor position, and is focused on remaining competitive in an industry where labor tightness remains an issue. The bad news is that this labor cost increase was despite productivity gains, and the company made additional investments in labor in Q3 2022, suggesting a sharp decline in margins in the upcoming quarter, even if commodity inflation may have moderated a little.

Overall, I saw this as a somewhat disappointing report, with the company executing well from what it can control but clear margin compression present due to the inflationary environment.

Industry-Wide Trends

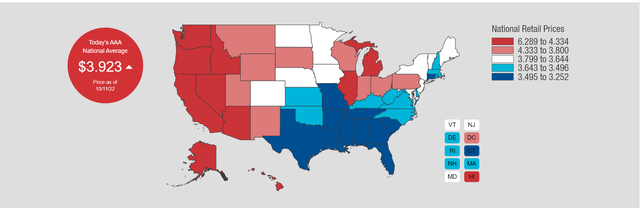

If we look at industry-wide trends, the industry saw very weak traffic in June and July (negative 5%). However, traffic did improve meaningfully on a sequential basis in August, with comparable traffic down just 1.9%, a 200 basis point improvement from July levels. This was likely related to the sharp pullback in gas prices, which provided a much-needed win for consumers and could have spurred an additional dine-out/take-out visit. Unfortunately, gas prices have begun to trend higher, off their lows at $3.70/gallon, though still well below their highs. Meanwhile, grocery costs remain elevated, and mortgage/rent costs continue to climb, so any relief from gas prices is somewhat more psychological than meaningful from a savings standpoint.

August Restaurant Data (Black Box Intelligence)

The bigger piece that doesn’t seem to be discussed as much is the reverse wealth effect, with many consumers staring down red ink in their investment/crypto accounts and, for some, realizing that housing prices are teetering. When consumers feel richer, they are more likely to spend in a discretionary manner and support the economy, but at a time when consumers are the tightest they’ve been in years, and suddenly their non-liquid assets have plummeted in value as well, we could see a further pullback in consumer demand in Q4, impacting restaurant traffic. This is because many consumers are already cash-strapped, personal savings rates are at multi-year lows, and many must budget for the expensive holiday season.

This negative backdrop is certainly not favorable for casual dining stocks, with a decent portion of their guests in the sub $70,000 household income range. However, it could benefit quick-service restaurants such as McDonald’s (MCD), Burger King/Popeyes (QSR), and Taco Bell/KFC (YUM). While Portillo’s noted that it is a trade-down beneficiary and the company certainly offers a nice mix of high-quality food with value/convenience, I’m not sure that it will be as much of a beneficiary with meals priced near above $11.00, a little richer than some other cheaper fast-food options, even if the alternatives are lower-quality and less tasty.

Portillo’s Menu (Company Website)

That said, the company thinks it’s getting trade-down consumers, and its overall satisfaction scores are at two-year highs, meaning it’s doing a lot right. I believe this can be attributed to the company’s more conservative pricing vs. other fast-casual options like Chipotle (CMG), with Portillo’s willing to take a small hit on margins to ensure it’s introducing more people to its addictive food and not taking advantage of its loyal customers. In Chipotle’s case, the company has been much more aggressive with pricing, and this could lead to lower guest satisfaction scores over time and even lost customers if they feel taken advantage of with dizzying price increases or they try another alternative and decide it’s similarly good but at a more competitive price.

So, while Portillo’s has seen margin compression, I think it’s doing the right thing by being conservative with pricing and ensuring it treats its customers right. In a difficult environment, this could mean that it gets one less visit, but it keeps its core customer wanting more when they can afford to get out for a meal. Hence, I don’t see a slightly negative bias for the business like others that have priced too aggressively, prioritizing margins over customer satisfaction.

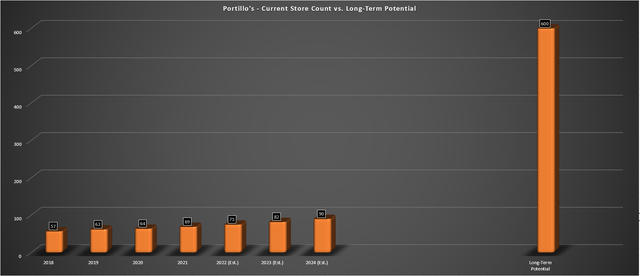

Long-Term Growth

Moving over to growth, Portillo’s remains an industry leader, set to finish 2023 with 80+ restaurants (FY2021: 69 restaurants), representing double-digit unit growth. This makes the company one of the highest-growth stocks in the industry, and with strong guest satisfaction scores and staffing at optimal levels with competitive wages, the company shouldn’t have any issue continuing to grow (or justifying its growth). Long-term, the company believes the concept could support 600 restaurants, an appealing proposition for investors anxious to get into a high-growth story in the early innings.

Portillo’s – Store Count & Forward Estimates (Company Filings, Author’s Chart)

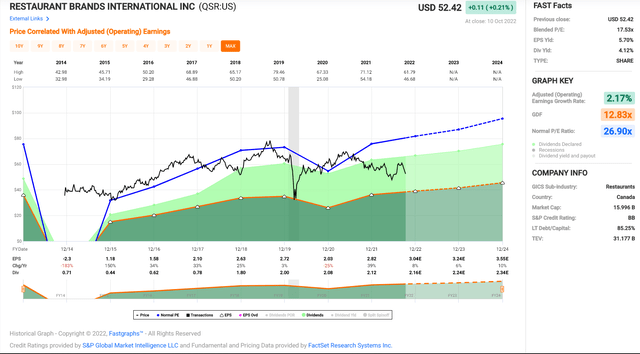

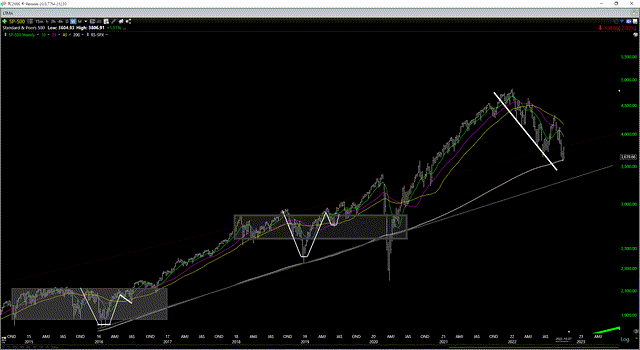

That said, in a recessionary environment with rising rates and a cyclical bear market for the S&P 500 (SPY), growth stocks are seeing multiple compression, and it’s as important as ever to buy with a large margin of safety. In my view, this is still not present in Portillo’s stock, even after its 30% decline from its recent highs. So, while the stock might become more palatable at $15.70, where I noted it would enter a low-risk buy in my June article “Valuation Improving After The Drop“, I currently see much more relative value elsewhere. One example is Restaurant Brands International, benefiting from a 99% franchised model, paying a 4.0% dividend yield, and trading at 16x FY2023 earnings estimates. Let’s take a closer look below:

QSR – Earnings Multiple & Dividend Yield (FASTGraphs.com)

Valuation & Technical Picture

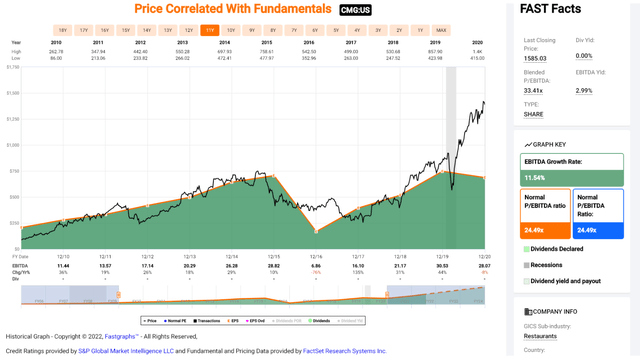

Based on ~72 million shares outstanding and a share price of $21.00, Portillo’s trades at a market cap of ~$1.51, or an enterprise value of ~$1.78 billion. Assuming the company generates ~$78 million in EBITDA in FY2022, the company is trading at an EV/EBITDA ratio of 22.8. In my view, this is a very steep valuation, given that even some of the best concepts have struggled to command multiples this high, including Chipotle, which is a much more proven concept. Besides, this was Chipotle’s multiple pre-COVID, and the industry continues to struggle with a tight labor market that’s pressuring wages, elevated commodity costs even if they are moderating, and, more recently, a much weaker consumer, which is hitting the demand side.

Chipotle – Historical EBITDA Multiple (2010-2020) (FASTGraphs.com)

Given the current backdrop coupled with Portillo’s attractive growth profile and what appears to be strong customer loyalty, I believe a more reasonable multiple is 17.5x EV/EBITDA. If we multiply this figure by FY2023 EBITDA estimates of $94 million, this translates to a fair value of $1.38 billion on an enterprise value basis. After dividing this by 72 million shares, this translates to a conservative fair value of $19.20 per share. However, I prefer to buy at a minimum 25% discount to fair value regarding small-cap growth stocks. So, after applying this discount, Portillo’s would need to dip below $15.00 to become interesting from a valuation standpoint.

This doesn’t mean that the stock must drop this low, but with the S&P 500 below its key moving averages, it makes sense to pay the right price (a massive discount to fair value) or pass entirely. Besides, Portillo’s remains well above its next support level at $15.20, meaning it doesn’t meet my criteria from a technical standpoint yet, either. To summarize, I would view any rallies above $25.00 as a gift before year-end, and I would view this as a profit-taking opportunity. From a buying standpoint, I would be setting alerts near $15.20 at support.

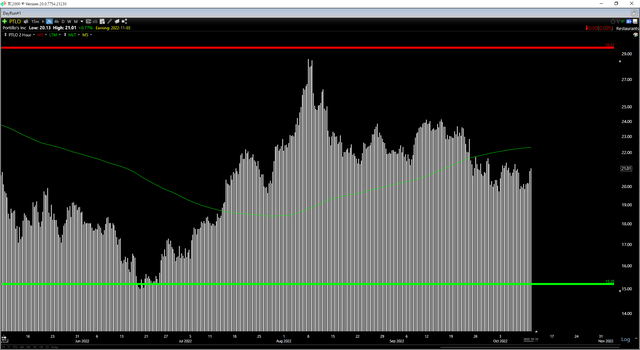

S&P 500 Weekly Chart (TC2000.com) PTLO – 6-Month Chart (TC2000.com)

Summary

Portillo’s may be a solid concept in the early innings of its growth phase and could even be a slight trade-down beneficiary vs. family dining. However, the landscape remains difficult for restaurant operators. In a bear market, there’s no need to commit capital unless one is being paid a nice price to wait (a high dividend with coverage) coupled with an attractive valuation to make it worth putting one’s money at risk. I believe Restaurant Brands International is one name that fits this bill, and McDonald’s would become interesting below $218.00. However, Portillo’s doesn’t offer nearly enough margin of safety to justify paying up above $21.00 here, in my view.

Be the first to comment