Yagi Studio

Overview

This post serves as an update to my coverage in early October.

I believe Portillo’s (NASDAQ:PTLO) is still 60% undervalued. When PTLO demonstrates that it can meet its guidance, I believe the market will recognize its intrinsic value. Given that it is still a relatively small player with plenty of room to grow, it should be able to maintain unit growth of 10%+ and same-store sales in the low single digits as guided. I believe PTLO will meet its long-term targets, and the stock price will eventually reflect the company’s worth.

Performance review

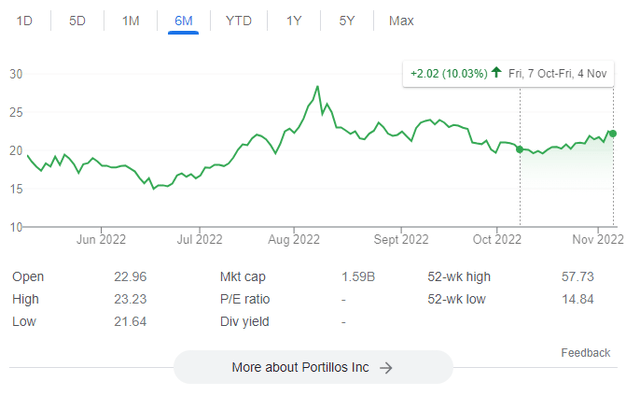

PTLO’s share price has increased by 10% since my initial post, which I think is a positive indicator that the market has recognized PTLO’s business stability due to its pricing strategy and also its ability to continue growing as management guided.

Earnings review

Sales beat supports my bull thesis

Sales comparables in the third quarter of 5.8% blew past the consensus estimate of 2.9% and surged to 10.6% on a 3-year basis. I believe that if 4Q pricing holds at 8% and traffic is down but trends up, SSS could see further gains. I’ve said before that PTLO’s low-priced strategy should protect it during a recession. With this strategy (prices that are lower than many competitors), PTLO may be able to protect its value proposition and revenue stream from a possible drop in traffic.

Digging deeper into 3Q22 sales that were up 5.8% year over year, it is the result of a 3.3% drop in traffic despite a flat number of served entrees, an 8.2% increase in pricing, a 2% decrease in product sales mix, a 2.8% increase in profit from the reclassification of 3P delivery pricing previously reflected in COGS, and a 0% increase in entrée count. (It’s important to note that when PTLO makes this change in December, the benefit from the realignment of 3P delivery pricing will drop to 2% in the fourth quarter.)

More importantly, despite the positive results, PTLO is vulnerable to a slowing consumer, just like other fast-casual chains. However, I continue to believe that it could benefit from a trade-down from full-service, given its low price point and the experiential nature of its stores.

Margin pressure from commodity prices

With commodity inflation remaining high and higher utility and maintenance costs impacting the opex line, PTLO generated a restaurant-level margin of 22.6%, indicating they are still under pressure. Commodity inflation hit 15% in the 3Q22 and is forecast to stay at that level throughout the next quarter. Back-of-the-house productivity initiatives implemented earlier in the year appear to be paying off, making labor a bright spot despite an increase in wages early in 3Q22. Based on the new information and analysis, I expect food prices to go up in the fourth quarter of 2022, as commodity inflation stays high and PTLO catches up with the change in accounting for delivery prices in December.

Though no formal guidance has been provided for FY23, I anticipate inflation to moderate from current levels, likely to the mid- or high single digits. Management guided toward the upper end of its 13-15% commodity inflation guide for FY22.

Unit growth outlook

For the time being, PTLO’s target of 7 restaurant openings in FY22 remains intact, with all 5 slated for 4Q close to opening, but management has acknowledged that one store may slip into early FY23 due to ongoing permitting delays. With the majority of these stores opening late in the quarter, I expect the 4Q revenue impact from new units to be adequate but not spectacular. Next year, the company plans to open nine stores, the majority of which will be 2H loaded. The significance of these openings is related to a long-term key debate-brand portability-and the performance of stores in new markets will provide insight into this.

Model update

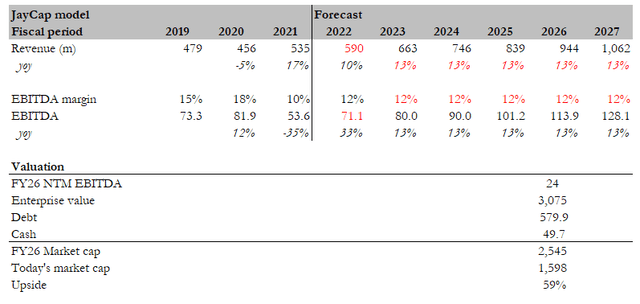

There is no particular change to my model. I still believe in the long-term story of PLTO and management’s ability to achieve its revenue targets of high single-digit to low double digits.

Long-term revenue growth is based on the lower range of the management’s forecast: 10% unit growth and 2.5% same-store sales growth. Margins may improve due to fixed-cost leverage, but I conservatively forecast them to remain flat in FY22.

The same intention remains, I want to show readers here that even at the lower range of the guidance, PTLO is still an attractive investment opportunity that could generate good returns.

Post earnings, PTLO still trades at 24x forward EBITDA. Based on the above assumptions and an NTM EBITDA of 24x, I believe PTLO is worth a $2.5 billion market cap in FY26, which is 60% above its current level.

Red Flags

Change in consumer preferences

It’s hard to predict, but if people’s tastes in fast food changed, PTLO would suffer. Plant-based meat alternatives are widely consumed as an illustration of this trend.

Levered balance sheet

PTLO has a greater amount of debt (Net debt/EBITDA) than other rapidly expanding restaurants. This isn’t necessarily a bad thing, but it could force PTLO to issue equity during a prolonged economic downturn so that they can keep the lights on.

Conclusion

Despite a 10% increase in share price since my coverage, I think PTLO remains undervalued at its current price. It’s still true that PTLO is a minnow in the industry and has a lot of room to expand. Additionally, it has a well-liked brand among customers, which is crucial in the highly competitive food industry, where brand recognition is a major differentiator.

Be the first to comment