Tramino

We recently commented about Exor and its latest development as an ‘automotive’ holding company and so today, we are back focusing our attention on Porsche Automobil Holding SE (OTCPK:POAHF; OTCPK:POAHY). Last time, we provided to clarify those uncertain points surrounding our readers and the Porsche investor community. Our buy case recap was based on the Sum-of-the-Parts valuation backed by the 31.9% value of Volkswagen AG’s market capitalization and Porsche 911’s new IPO, considering also the premium paid for the control over the entities. As a reminder, we suggest checking our previous publications:

Q3 results

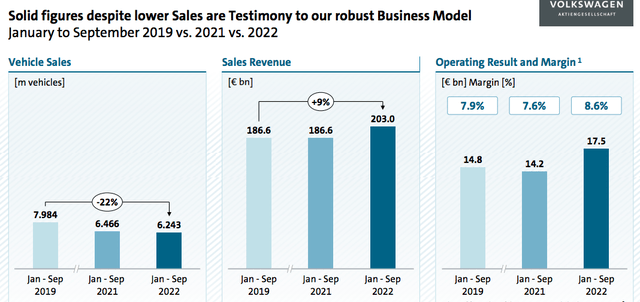

Last week, the company released its Q3 accounts. And without a doubt, Porsche Automobil Holding SE is heavily influenced by Volkswagen AG’s performances. Speaking of numbers, Volkswagen recorded positive results at the nine-month aggregate (even higher than the pre-COVID-19 level). Despite lower volumes, the company confirmed its positive trend in margins, reaching €17.5 billion in operating profit with a margin of 8.6% compared to last year’s result which stood at €14.2 billion and 7.6% respectively. Important to note is the fact that the company reaffirmed the guidance on margins at the high end of its range (7%-8.5%).

Volkswagen financials in a snap (Volkswagen AG Q3 results presentation)

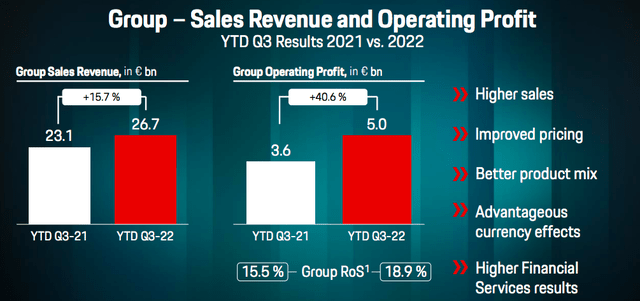

Going to P911 investment, Porsche delivered an EBIT of more than €5 billion compared to the €3.59 billion achieved in the same period last year. In number, this was an increase of more than 40%, higher than revenue growth which reached a plus 15.7%. This was supported by P911’s operating leverage, better product mix, and also a return to volume growth (despite the crisis). As for Volkswagen, even Porsche confirmed its 2022 outlook.

P911 financials in a snap (P911 Q3 results presentation)

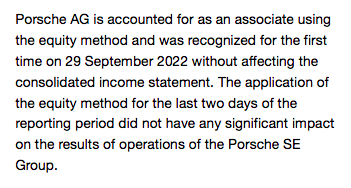

Looking at the Porsche Automobil Holding SE numbers, as already mentioned, is heavily reliant on its equity accounts investments. Following Volkswagen’s quarterly release, results from investments were 11% higher compared to last year and reached €3.78 billion. However, this positive development was not influenced by P911 accounts, given the fact that the company was accounted as equity investment at the end of September (see figure below).

Equity investment (Porsche Automobil Holding SE Q3 press release)

Conclusion and Valuation

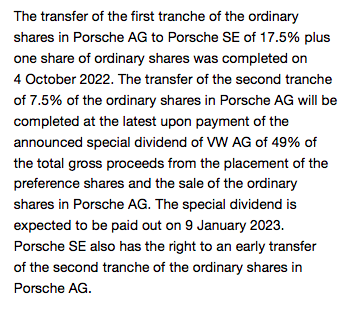

Last time, we anticipated that Porsche Automobil Holding SE was offsetting the premium paid for P911 control with the IPO dividend payment. However, looking at the press release, Porsche SE’s special dividend will be approximately €3.1 billion, and will be able to fully pay the P911 second investment tranche (higher than what we anticipated). Looking at the Volkswagen press release, the company announced that “our shareholders participate directly in this successful transaction with the distribution of a special dividend of €19.06 per share. The payout is expected to take place on January 9, 2023“. In our conclusive paragraph, we said that just the 31.9% value of Volkswagen AG’s market cap is higher than Porsche Automobil Holding SE’s equity value. If we include the fact that P911 is already up by 30% since the IPO, Porsche Automobil Holding SE’s market value should be even higher. Even applying a 40% NAV discount (as the market is implying for Exor), we derive a 46% upside from the current value. Our buy rating is confirmed.

Porsche second tranche (Porsche Automobil Holding SE Q3 press release)

Be the first to comment