Joe Raedle

Earnings of Popular, Inc. (NASDAQ:BPOP) will most probably dip this year relative to last year on the back of higher provisioning and operating expenses. On the other hand, decent loan growth and some margin expansion will support the bottom line. Overall, I’m expecting Popular to report earnings of $10.61 per share for 2022, down 7% year-over-year. Compared to my last report on the company, I’ve barely changed my earnings estimate as the upward revision in loan growth estimate cancels out the upward revision in expense estimates. The year-end target price suggests a high upside from the current market price. Therefore, I’m maintaining a buy rating on Popular.

Investment Plans to Act as a Catalyst for Loan Growth

Popular’s loan portfolio continued to grow strongly through the second quarter of 2022. Loan growth will likely continue to remain robust in the coming quarters, thanks to the management’s plans and efforts. Popular has significantly increased its budget for investments. As mentioned in the conference call, the management is planning additional investments in digital offerings. Further, it is launching other early-stage initiatives to enhance customer experience.

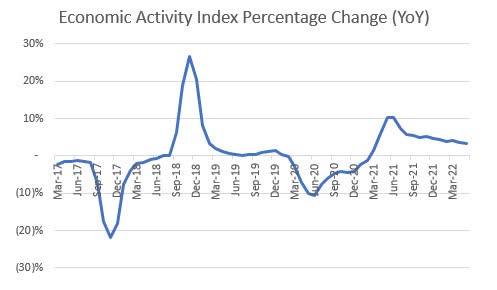

Moreover, Puerto Rico’s continued economic strength will support loan growth in the coming quarters. The economic activity index of the Economic Development Bank for Puerto Rico continues to remain strong, which bodes well for loan growth. The index was up 3.3% year-over-year in May 2022.

Economic Development Bank of Puerto Rico

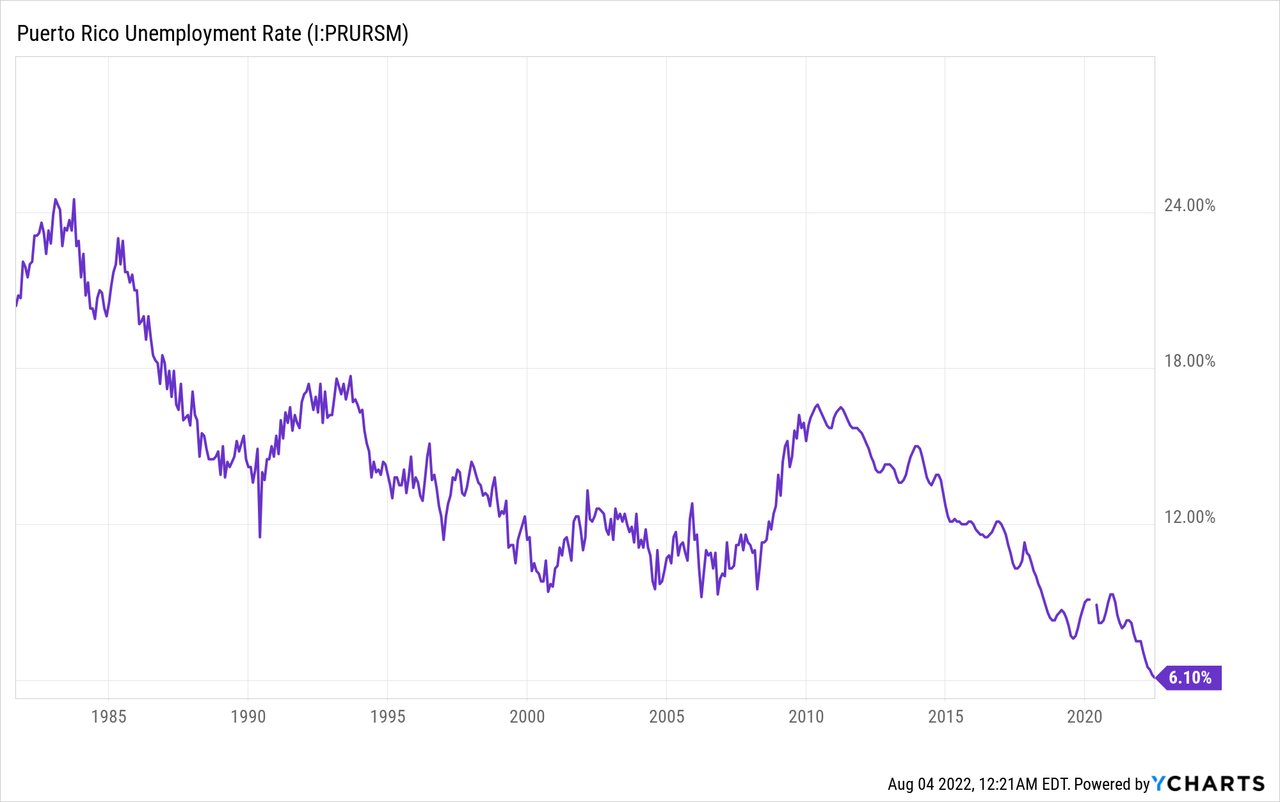

Moreover, the unemployment rate was down to 6.1% in June 2022, which is an astonishing improvement in a historical context.

Considering these factors, I’m expecting the loan portfolio to grow by 6.6% in 2022. In my last report on Popular, I estimated loan growth of 4.3%. I’ve revised upwards my loan growth estimate due to the second quarter’s performance as well as a better economic outlook.

Deposits will likely not fare as well as loans in the coming quarters. The management mentioned in the conference call that it expects public deposits to drop to $11 billion to $15 billion by the year-end from $17 billion at the end of June 2022. Further, commercial deposits will also decline as companies will chase yields and shift their cash at the bank into treasury securities.

Further, the equity book value will take a hit from rising interest rates. Popular has a large balance of debt securities, which made up almost 40% of total assets at the end of June 2022. The value of these securities will go down as rates rise. Consequently, the equity book value will decline. The tangible book value per share has already dipped from $51.16 at the end of March 2022 to $46.18 at the end of June 2022. As mentioned in the earnings presentation, the dip in equity book value was mainly driven by the $563 million increase in accumulated unrealized losses on fixed-rate debt securities available for sale.

The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Financial Position | ||||||||||

| Net Loans | 25,939 | 26,929 | 28,489 | 28,549 | 30,436 | 31,672 | ||||

| Growth of Net Loans | 7.2% | 3.8% | 5.8% | 0.2% | 6.6% | 4.1% | ||||

| Other Earning Assets | 17,818 | 21,268 | 33,594 | 42,796 | 38,417 | 39,779 | ||||

| Deposits | 39,710 | 43,759 | 56,866 | 67,005 | 66,311 | 68,323 | ||||

| Borrowings and Sub-Debt | 1,538 | 1,295 | 1,346 | 1,155 | 978 | 988 | ||||

| Common equity | 5,385 | 5,967 | 6,007 | 5,947 | 4,574 | 5,230 | ||||

| Book Value Per Share ($) | 53.1 | 61.5 | 71.6 | 74.7 | 60.0 | 68.6 | ||||

| Tangible BVPS ($) | 46.2 | 54.3 | 63.3 | 65.6 | 50.3 | 58.9 | ||||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

Higher Investments to Lift Non-Interest Expenses

The management has significantly revised upwards its non-interest expense guidance. Previously, it was expecting quarterly non-interest expenses of $415 million for 2022, as mentioned in the conference call. Now the management is expecting non-interest expenses of $445 million in the last two quarters, which will bring up the full-year non-interest expense estimate to $425 million.

Part of the higher guidance is attributable to the planned investments discussed above. Further, Popular intends to give pay raises to retain its workforce and remain competitive. I’m now expecting Popular to report non-interest expenses of $1,697 million in 2022. In my last report on the company, I estimated non-interest expenses of $1,652 million.

Provision Expense to Rise to a Level Just Short of the Historical Average

After five consecutive quarters of net provision reversals, Popular posted a small net provision expense for the second quarter of 2022. Provisioning will likely return to close to a normal level from the third quarter of 2022 till the end of 2023. This is because of heightened interest rates that will result in financial stress for some borrowers. Moreover, Popular may want to bolster its loan loss reserves due to the chances of a recession. Currently, the allowances are only 142.65% of non-performing loans, as mentioned in the earnings release.

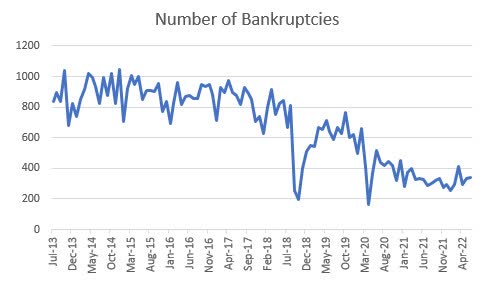

However, due to the significant economic improvement in Puerto Rico, provisioning is unlikely to fully return to the pre-pandemic level. As shown below, bankruptcies in Puerto Rico are near record lows.

Economic Development Bank of Puerto Rico

Overall, I’m expecting the net provision expense to make up around 0.24% of total loans in 2022 and 0.51% of total loans in 2023. In comparison, the net provision expense averaged 0.64% in the last five years.

Expecting Earnings to Dip by 7%

Earnings will most probably dip this year due to higher provisioning and operating expenses. On the other hand, decent loan growth will likely support the bottom line. Further, higher interest rates will boost the net interest margin. The results of the management’s interest-rate sensitivity analysis given in the first quarter’s 10-Q filing show that the top line is only moderately sensitive to rate changes. According to the analysis, a 200-basis points hike in interest rates could boost the net interest income by 4.14% over twelve months. Therefore, I’m expecting the net interest margin to increase by around 15 basis points in the second half of 2022. Moreover, I’m expecting the margin to remain stable in 2023 as I’m expecting interest rates to rise further in the second half of 2022 before falling in 2023.

Overall, I’m expecting Popular to report earnings of $10.61 per share for 2022, down 7% year-over-year. For 2023, I’m expecting earnings to grow by 1.7% to $10.80 per share. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Income Statement | ||||||||||

| Net interest income | 1,735 | 1,892 | 1,857 | 1,958 | 2,164 | 2,223 | ||||

| Provision for loan losses | 228 | 166 | 293 | (193) | 74 | 160 | ||||

| Non-interest income | 652 | 570 | 512 | 642 | 629 | 647 | ||||

| Non-interest expense | 1,422 | 1,477 | 1,458 | 1,549 | 1,697 | 1,704 | ||||

| Net income – Common Sh. | 614 | 667 | 505 | 933 | 810 | 824 | ||||

| EPS – Diluted ($) | 6.06 | 6.88 | 5.87 | 11.46 | 10.61 | 10.80 | ||||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

In my last report, I estimated earnings of $817 million for 2022 while now I’m expecting earnings of $810 million. I’ve barely changed my earnings estimate because the upward revision in loan growth estimate cancels out the upward revision in the provision and operating expense estimates.

Actual earnings may differ materially from estimates because of the risk of hurricanes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

High Price Upside Calls for a Buy Rating

Popular is offering a dividend yield of 2.9% at the current quarterly dividend rate of $0.55 per share. The earnings and dividend estimates suggest a payout ratio of 21% for 2022, which is close to the last four-year average of 19%. Therefore, the dividend appears secure despite the earnings outlook.

I’m using the peer-average price-to-book (“P/B”) and price-to-earnings (“P/E”) multiples to value Popular. Peers are currently trading at an average P/B ratio of 1.33x, and an average P/E ratio of 9.86x, as shown below.

| Peer Selection Criteria | Market Cap ($ billion) | P/E (ttm) | P/B (ttm) | |

| BPOP | 5.76 | 6.90 | 1.38 | |

| SNV | Market Cap | 5.75 | 8.25 | 1.42 |

| BOKF | Market Cap | 5.88 | 11.85 | 1.24 |

| VLY | Market Cap | 5.92 | 11.78 | 0.99 |

| PNFP | Market Cap | 5.99 | 11.36 | 1.18 |

| OFG | Located in PR | 1.30 | 8.97 | 1.28 |

| FBP | Located in PR | 2.85 | 9.90 | 1.83 |

| Average | 4.78 | 9.86 | 1.33 | |

| Source: Seeking Alpha | ||||

| Note: Data extracted after market close on August 3, 2022 |

Multiplying the average P/B multiple with the forecast book value per share of $60.0 gives a target price of $79.8 for the end of 2022. This price target implies a 3.7% upside from the August 3 closing price. The following table shows the sensitivity of the target price to the P/B ratio.

| P/B Multiple | 1.13x | 1.23x | 1.33x | 1.43x | 1.53x |

| BVPS – Dec 2022 ($) | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 |

| Target Price ($) | 67.8 | 73.8 | 79.8 | 85.8 | 91.8 |

| Market Price ($) | 77.0 | 77.0 | 77.0 | 77.0 | 77.0 |

| Upside/(Downside) | (11.9)% | (4.1)% | 3.7% | 11.5% | 19.2% |

| Source: Author’s Estimates | |||||

Multiplying the average P/E multiple with the forecast earnings per share of $10.61 gives a target price of $104.6 for the end of 2022. This price target implies a 35.9% upside from the August 3 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 7.9x | 8.9x | 9.9x | 10.9x | 11.9x |

| EPS 2022 ($) | 10.61 | 10.61 | 10.61 | 10.61 | 10.61 |

| Target Price ($) | 83.4 | 94.0 | 104.6 | 115.2 | 125.8 |

| Market Price ($) | 77.0 | 77.0 | 77.0 | 77.0 | 77.0 |

| Upside/(Downside) | 8.3% | 22.1% | 35.9% | 49.6% | 63.4% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $92.2, which implies a 19.8% upside from the current market price. Adding the forward dividend yield gives a total expected return of 22.6%. Hence, I’m maintaining a buy rating on Popular. However, Popular is not suitable for low-risk-tolerant investors ahead of the hurricane season. Due to its location, the company is highly vulnerable to natural disasters.

Be the first to comment