Athitat Shinagowin/iStock via Getty Images

Summary

In a previous article, I mentioned that Polymetal (OTCPK:AUCOY, OTCPK:POYYF) is severely undervalued due to geopolitical factors, but gave it a HOLD rating, remarking that considerable uncertainties remained over the future of the company, that I saw no immediate catalysts on the horizon, and that profitability would be severely impacted by operational challenges and a stronger ruble.

The company has just released its financial results for H1 2022. At first sight, the headlines look awful, with every single financial metrics degraded compared with the year before. Predictably, the share price has reacted by collapsing by 10%.

Nonetheless, every comparison with H1 2021 is basically meaningless, given the distorting effects of the outbreak of the war in Ukraine. Such effects are in the process of being partially reversed. The challenge is to disentangle the transitory effects from the permanent effects that are going to keep weighting on the profitability of the company going forward. While significant challenges remain, I believe we have reached rock bottom and that the coming months will bring increasingly positive news.

First, the huge debt accumulation during H1 2022 is going to partially reverse, as the winding down of the gold inventory from Russian mines picks up the pace and starts being reflected in financial metrics.

Second, while the CEO Mr. Vitaly Nesis reiterated that no final decision has been taken regarding the potential change to the asset holding structure of the company, the most value-destroying option, i.e. an outright sale of the Russian assets, is very likely no longer on the table. Investors can expect more clarity on the topic in a matter of months, which would represent a considerable catalyst.

Third, while the company has irrevocably suspended dividends, it has also announced an exchange offer to all eligible shareholders owning their shares through the Russian National Settlement Depository (NSD). Since the NSD is currently under Western sanctions, Polymetal cannot pay dividends to such shareholders. Moreover, since the company has declared multiple times its reluctance to harm in any way a considerable fraction of shareholders, dividend payments will not be resumed, irrespective of financial results, until this obstacle is removed.

Significant risks remain: operational challenges, including establishing new sales channels for concentrates and supply chains issue, inflationary pressures, a strengthening of the ruble, a decline in the gold price and, more recently, the still difficult to quantify consequences of the partial mobilization in Russia. Nonetheless, Polymetal may have finally turned the corner and is now worth a small speculation in my opinion.

Financial results H1 2022

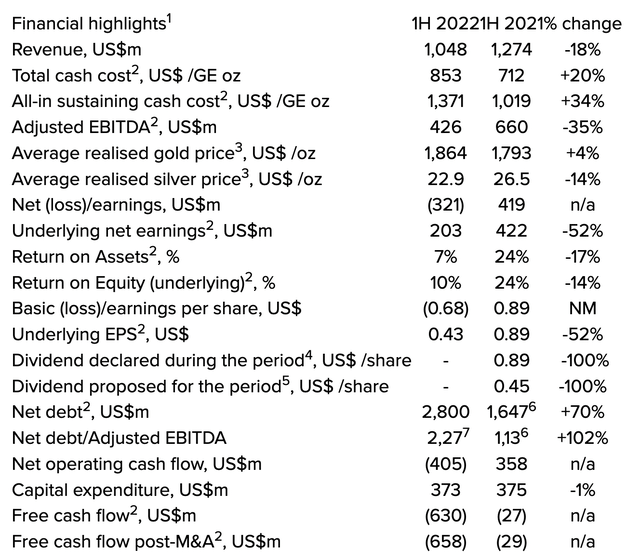

Here is a summary of the main results and a comparison with the first half of last year.

Financial results H1 2022 (Company’s website)

Free cash flow was a massive negative $630 million, driving the increase in net debt to $2.8 billion and the net debt to adjusted EBITDA ratio to 2.3x, while all-in sustaining costs (AISC) were up 34% year-on-year, to $1371 per ounce.

It is important, however, to understand the motivations behind such negative numbers. Total production was within range at 697 thousand gold-equivalent ounces, a 7% decrease year-on-year. However, sales decreased much more, by roughly 19% year-on-year to around 550 thousand gold-equivalent ounces. The mismatch implies that the company has accumulated 150 thousand ounces in inventory.

The most likely reason is that, in the aftermath of the Russian invasion, sanctions have restricted the available sales channels. However, the company has recently established new channels in Asia and sales have picked up in Q3. During the conference call, it was remarked that the situation is expected to ease going forward. The worst possible western sanctions have already been imposed back in July, with a ban on all sales of Russian gold. Besides, a significant degree of diversification has recently been achieved between different channels, which should protect the company going forward in case of further sanctions.

Another challenge was represented by the strong ruble. The ruble/USD exchange rate averaged 76.2 RUB/USD during H1 2022. Since most of the expenses are in rubles, costs have increased significantly. In fact, for every 1 RUB/USD movement in the exchange rate, there is approximately a $25 million negative impact on FCF. Luckily, the ruble has relaxed somewhat and is now hovering around 60 RUB/USD. The stronger dollar alone is therefore expected to have a $400 million positive effect on FCF in H2, assuming the ruble stabilizes at the current level.

A final challenge was represented by domestic inflation and the escalation of logistical costs. However, again, the situation is normalizing. Inflation in Russia has peaked at 17.8% in April 2022 and is now down to 14.3%. In the meantime, the Russian Central Bank has been cutting rates, recently trimming its key interest rate to 7.5%, down from 20% in April.

Lower production due to planned grade decline at Albazino and Kyzyl, lower revenues due to the buildup of bullion inventory, higher costs due to the stronger ruble, inflationary pressures, the accelerated procurement of equipment and critical spare parts, and supply chain difficulties: everything in H1 2022 conspired to compress margins.

The point is that things are unlikely to get any worse and, in fact, they appear to be looking up. During the call, management seemed confident that the current debt level has peaked and that it will be significantly reduced during H2 2022. In spite of a weaker gold price, the company expects to return to being cash flow positive in 2023. Full-year guidance of 1.7 million ounces has been reiterated, even if with a warning regarding COVID-related supply chain disruptions in China. The company has survived and the story appears to be turning.

Proposed exchange offer

Around 22% of the issued capital is held through the NSD. For this reason, the company has recently announced an offer to eligible shareholders to tender their shares in exchange for certificated shares. The group of eligible shareholders excludes “shareholders who are resident in, incorporated in, established in, or citizens of, Russia, including those with a second citizenship outside Russia”, which represent around 11% of shareholders.

Such an offer represents a first necessary step to unblock further corporate actions. Since Polymetal does not intend to harm in any way a sizable fraction of its shareholders base, until the problem of sanctions on the NSD is circumvented, it is impossible for the company both to pay dividends and to contemplate any change in its asset structure. The offer is subject to shareholder approval, in particular from institutional investors, during the General Meeting, to be held on October 12.

Potential Transaction

The “Potential Transaction” is definitely the most crucial source of uncertainty regarding the company’s future. In July, the most probable option on the table seemed to be the outright sale, likely at a significant discount, of the Russian assets. However, on August 5, Decree n. 520 of the President of the Russian Federation introduced a ban on the sale of Russian assets, including gold mining companies, whenever the majority of the owners are residents of countries classified as “unfriendly”. Polymetal is subject to such a ban, since it is domiciled in Jersey. Going through with the disposal of the Russian assets would therefore require a special presidential approval, which is unlikely to be obtained according to management.

The other option discussed during the call is instead a change of domicile to a “friendly” jurisdiction. This would unlock many options, including resuming dividends, additional listings, and other changes in the asset structure, including a spin-off of its Russian assets. A likely possibility is Hong Kong, where for instance Rusal is already listed and trades with good liquidity.

I see these developments as a net positive. Decree n. 520 is turning out to be playing in the investors’ favor, by preventing management from selling the assets at a discount. A potential re–domiciliation would open up new scenarios and be in the best interest of shareholders in my opinion.

Conclusion

Going forward, Polymetal will continue facing significant challenges, including supply chains issue, the impact of sanctions on bullion sales, inflationary pressures, and partial mobilization.

Nonetheless, the company has survived the worst and the financial numbers can likely only improve from here. The debt level should have peaked and management expects free cash flow to return to positive territory.

Decree n. 520 has blocked for the time being the possibility of a disposal of the Russian assets. There is however an alternative path to restore, at least in part, shareholder value starting from a change in domicile. More clarity is expected from the company over the next quarter.

Be the first to comment