Torsten Asmus

By Raffaele Savi and Jeff Shen, PhD

Just like in the early 1980s, central banks are committed to the fight against inflation. However, this time is different. Alternative data reveals insight into the current economic backdrop and what it means for investors.

The prolonged period of low inflation, stable growth, and easy monetary policy from the mid-1980s to the onset of COVID-19 has given way to a new regime. Global central banks are aggressively tightening monetary policy to bring inflation down from 40-year highs, evoking memories of the early 1980s when the Fed’s tightening cycle ended the Great Inflation of the 1970s. How far will policy rates need to go to tame inflation and is a recession imminent?

Markets face tighter conditions to fight inflation

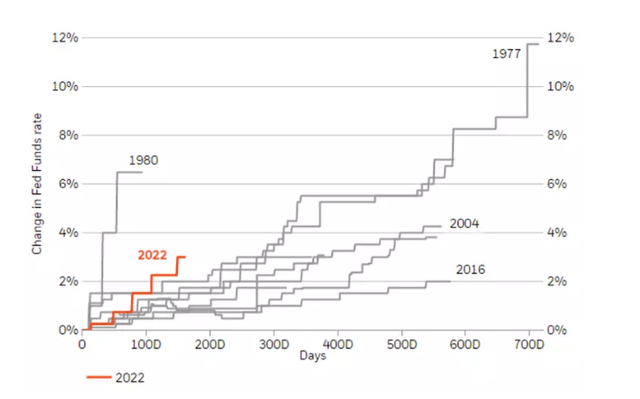

Global central banks are serious about “keeping at it” in their quest to conquer inflation. Shown in Figure 1, the US Federal Reserve (“Fed”) is on its fastest hiking cycle since the early 1980s—a distinct period characterized by a similar macro backdrop of heightened volatility and persistent inflation.

Figure 1: The Fed is on its fastest hiking cycle since the 1980s

Change in Fed Funds rate (Source: Refinitiv DataStream, BlackRock Investment Institute, October 2022.)

Policymakers haven’t been faced with this difficult trade-off between inflation and growth in nearly four decades. Along with these similarities, our alternative data indicators point to distinct differences today—notably with labor markets and economic activity—that will impact the path of monetary policy and the likelihood of a recession as we look ahead.

Labor markets remain at the center of US inflation

Despite early signs of falling energy prices and easing supply bottlenecks in the US, prices remain elevated across goods and services with notable strength in sticky wage-sensitive services categories. Prices and wages have soared in lockstep just like in the early 1980s, but for different reasons. Back then, nearly 15 years of high inflation resulted in elevated long-run inflation expectations and a wage-price spiral. The anticipation of higher prices led workers to demand higher pay, which in turn put continued upward pressure on prices.

In contrast, today’s long-run inflation expectations remain anchored more closely to central bank targets, but a shortage of workers caused by the pandemic has kept labor markets tight. We’ve started to see signs of labor demand coming into balance with constrained supply through a sharp decrease in online job postings. The year-over-year change in job postings has fallen from 70% higher than the previous year in July to 30% higher today.1 But is this trajectory of declining demand enough to cool down an overheated job market?

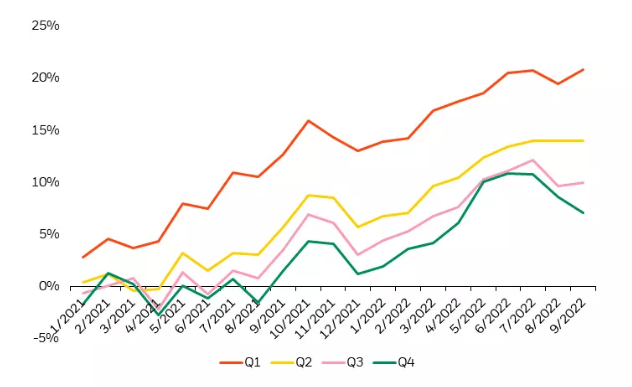

This depends on whether labor supply continues to recover. We estimate that if workforce participation keeps improving at the current pace, the unemployment rate could potentially reach Fed targets without severe layoffs and economic pain. This would allow wage pressures to subside as labor supply and demand reach a new equilibrium and employers no longer need to compete for a limited number of workers. For a real-time read on wage growth, we forecast employment cost data roughly 3-6 months ahead of realized figures using online job postings. Figure 2 shows that while the pace of wage growth appears to be moderating, it remains at levels that are too high for the job market to cool and services inflation to come down. Until central banks see a significant decline in wage growth, they’re likely to keep conditions tighter for longer.

Figure 2: Wage pressures have started to moderate, but remain elevated

Wage growth per income quartile vs. 2019 (Source: BlackRock, Burning Glass Technologies, as of October 2022. Q1 is the lowest-income quartile, Q4 is the highest-income quartile.)

Not quite 1970s stagflation in the US

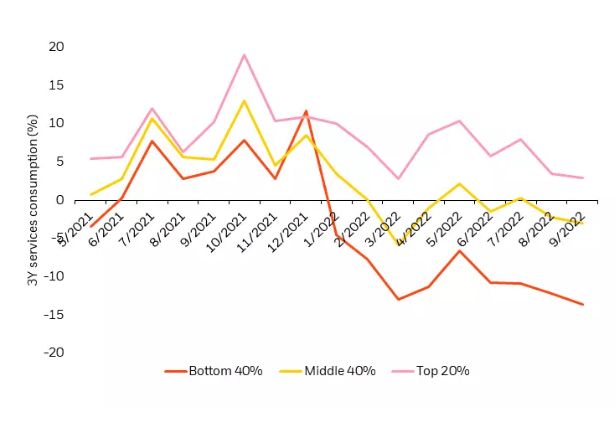

Reining in inflation requires stalling growth enough to bring demand into balance with supply. While growth has slowed significantly, it’s coming down from above-average post-pandemic levels and the economy still appears relatively strong given the level of rate increases that have already occurred. The economic reopening shifted spending from physical goods back to services where the highest-income cohort continues to show resilience in the US (Figure 3). Importantly, only the lowest-income threshold is consuming less than they were in 2019 when adjusting for inflation.

Figure 3: Service spending remains stable for high earners

3Y Discretionary service consumption by income cohort adjusted for inflation (Source: BlackRock, Earnest Research, October 2022.)

There’s evidence that conditions may continue to support strong activity for high-income households. For example, high earners are less likely to be paying rent than the average consumer—which continues to be one of the stickiest components of inflation. At the same time, they’re benefitting from wage growth that remains high despite starting to ease for the highest-income quartile. While lower oil prices and supply chain improvements haven’t had a material impact on core inflation, consumers may be feeling relief from falling prices. The longer that activity holds up in the face of significant monetary tightening, the more the Fed will be forced to raise rates beyond market expectations.

Different supply constraints, same policy trade-offs

The initial synchronized spike of inflation has become more bifurcated across the globe. As mentioned, services inflation has firmly taken hold in the US. In the Euro area and UK, the ongoing energy crisis is the main driver of inflation and continues to weigh heavily on economic growth. Natural gas prices have soared following the suspension of Russian gas and increased demand as countries replenish stores ahead of the winter months. We expect to see additional upward pressure on energy markets when China begins moving towards a post-COVID reopening phase.

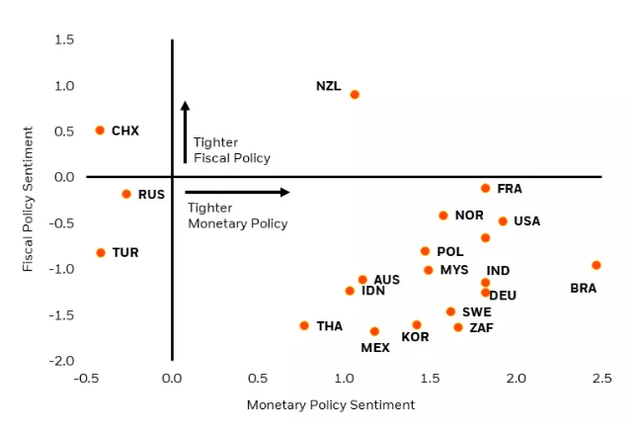

The UK’s recent fiscal spending package intended to ease the burden of high prices underscores today’s challenging policy trade-offs. Boosting growth with fiscal spending isn’t an option in a world of inflation—a reality that policymakers haven’t had to face in several years. Instead of increasing growth expectations, interest rates skyrocketed as markets concluded that the Bank of England will need to be more aggressive to get prices under control. This is an extreme example, but it brings into focus the influence of loose fiscal policy on inflation. Figure 4 shows analyst sentiment of current policy across several countries relative to the historical mean. For many regions, monetary policy has tightened significantly while fiscal policy remains accommodative. If inflation remains persistent, authorities may be forced to move fiscal policy to a more restrictive stance to effectively stabilize prices.

Figure 4: Monetary policy remains tight, but fiscal policy is loose

Analyst monetary and fiscal policy sentiment standard deviation from historical mean (Source: BlackRock, monthly observations from broker reports, September 2022.)

Can policymakers engineer a “soft” landing?

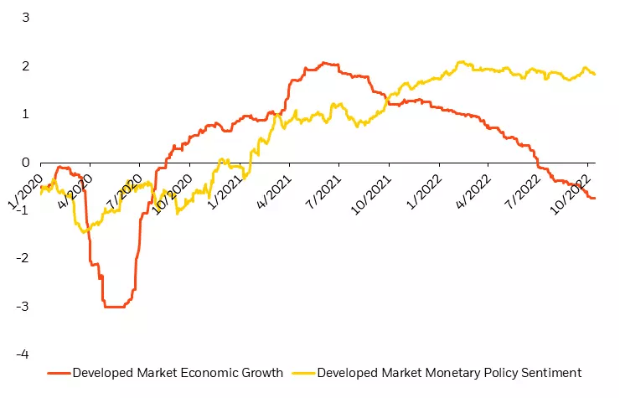

Central banks are between a rock and a hard place, and they continue to prioritize bringing down inflation regardless of the economic cost. Figure 5 shows developed market economic growth based on several leading indicators along with policy sentiment extracted from central bank speeches. Despite declining growth, central bank rhetoric remains extremely hawkish which we expect to continue until inflationary data improves. Can central banks navigate a soft landing or does bringing down inflation require a deep recession?

Figure 5: Central banks remain extremely hawkish

Developed market economic growth nowcast and central bank policy sentiment (Source: BlackRock, as of October 2022. Text-based policy sentiment extracted from developed market central bank speeches. Developed market growth nowcast based on leading indicators including consensus economics GDP expectations 1-year ahead, flash and final manufacturing PMI new order components, flash and final services PMI new orders, surveys on business and consumer sentiment, housing activity, and corporate earnings forecasts.)

Not your average economic cycle

Deep recessions throughout history typically stem from excess capacity in the economy rather than the constraints that we see today. COVID-19 lockdowns essentially brought the global economy to a standstill, and we quickly learned that turning on and off supply isn’t as simple as turning on and off demand. As central banks attempt to bring down inflation caused by supply shortages, they’re working against an economy that appears non-recessionary in many ways.

In the US, we aren’t seeing widespread layoffs and economic activity remains resilient—a double-edged sword that may require further rate increases to bring down inflation and increases the risk of overtightening. However, early signs of labor markets normalizing suggest that a soft landing is possible if the unemployment rate rises through a steady increase in labor participation rather than an uptick in job losses. US earnings haven’t come down to a degree that reflects the recession risk priced into markets—a sign that markets may have overreacted to the level of economic damage caused by tighter conditions. If we do see a recession in the US, it would likely be shallow relative to other developed market economies and much less severe than the recessions that we saw in the early 1980s.

In Europe and the UK, energy prices are pushing inflation to new highs and the economy is on much weaker footing. With demand declining at a much more rapid pace than in the US, we expect to see a deeper energy-driven recession in the near term.

Positioning for tighter conditions in Q4 and beyond

Macro volatility continues to dominate market behavior as rates climb higher against persistent inflation. Markets are adjusting to the fact that like in the early 1980s, policymakers have adopted a whatever-it-takes approach to bring down inflation and recession risk is rising as a result. However, the economy remains on relatively solid footing which creates a challenging backdrop for investors.

Our global equity portfolios are positioned defensively as we face persistent volatility and tighter conditions ahead. From a sector perspective, we prefer high quality names within technology and pharmaceuticals that demonstrate strong profitability and inelastic demand. We’re underweight cyclicals and financials given the persistent inverted yield curve driving higher short-term rates and lower long-term growth expectations. As we look ahead, we’re watching for further signs of labor market normalization that would indicate we may be approaching peak hawkishness in the US.

In our view, the current macro environment requires a more dynamic and nimble investment approach than what’s been needed in recent history. From a 30,000-ft view, dominant themes of inflation and hawkish policy closely resemble the 1970s and early 1980s. Using alternative data for a more granular perspective reveals key differences that continue to shape our outlook and positioning as they evolve in real-time. This data-centric approach is crucial to braving a new regime, helping us navigate market complexity and uncover opportunities during a time where dynamism matters most.

1Source: BlackRock, Burning Glass Technologies, as of October 2022.

This post originally appeared on the iShares Market Insights.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment