Ninoon

(Note: This article was in the newsletter on October 17, 2022.)

Medical Properties Trust (NYSE:MPW) is worth a position in my portfolio because management is making moves that will likely ensure the company’s survival. The market has long had this stock under pressure because there is a fear of the situation with the main operator. But there is a huge difference in an operator having difficulties and that same operator not paying “the rent”. Many companies have challenges but still pay their bills. If this management has done their homework and I believe they have, then the third quarter report will be just fine whether or not the market is still worried.

I have followed companies that the market perceived were in trouble for a long-time (and mostly because of reader or subscriber requests). One characteristic of the companies that are no longer around because they had to file is that management literally did nothing in the face of challenges. Maybe there was a “late in the game” something that was “too little too late”. But overall, those managements just waited for problems to get worse until the problems were insurmountable.

Medical Properties Trust recently announced the sale of some hospitals. That was followed with a conditional share repurchase program that needs to be leverage neutral. For me, that is enough movement to assure me as an investor that this management will not just “sit there and take it”. In the past that has made a huge difference between success and failure.

Along with that is the consideration that the pandemic stopped a lot of profitable operations. Hospitals instead, needed to deal with a lot of emergencies and in some cases a lot of patients that could not pay. The pandemic changed the way hospitals operated for an uncertain period of time that likely caused a lot of unexpected losses. Hospitals are now recovering from the challenges caused by the pandemic.

Along with this consideration was the bankruptcy filing of one of the operators that management deals with. That operator so far has noted that the properties that Medical Properties Trust is involved with are not the issue. But with the market in panic mode, such a detail may not matter to anxious sellers.

Steward Issues

Steward is one of the major operators of a lot of the company properties. So far that relationship appears to have been a profitable one.

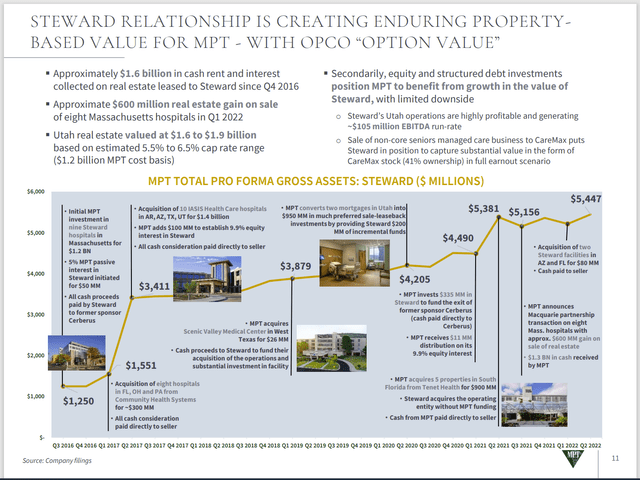

Medical Properties Trust History Of Steward Business Relationship (Medical Properties Trust August 2022, Investor Presentation)

As shown above, the association of the two entities has been a positive situation for some time. But the pandemic has caused concern about the financial condition of Steward. Such concern was further heightened by the news that the bank line was extended but that further negotiations were needed.

For any company coming away from challenges like the hospital industry had in fiscal year 2020, such an extension should have been expected. More than likely, the banks that committed to the credit line wanted to examine in more detail the progress made since the challenges of fiscal year 2020. Sometimes all lenders want to do is wait for another quarter or two of reports before committing to a permanent arrangement.

Court Case

The short strategy of spreading fear about a security of which they are not an insider has its basis in a Supreme Court Case won by Ray Dirks. The securities and exchange commission basically brought an “insider information” proceeding against Ray Dirks except that he was not an insider of the company he investigated. The Supreme Court reversed all the violations for that reason.

What has happened since then is that short sellers feel free to spread information about (an operator in this case) the company that may well be in excess of the situation. The SEC has long felt its hands were tied after it lost the case. That could be happening here with fears about Steward.

Many hospital operators suffered terribly during the pandemic. But it is also likely they will recover if they are not victims of a short attack. In this case Steward is private and so there is no profit to be obtained. But there is a short profit that could have been obtained by emphasizing that if something happens to Steward; it could be bad for this company.

The likelihood of a dominoes effect is not significant if Medical Properties Trust has done their homework. The reason is if the properties involved are not where the problem is, then those “bills” will be paid, and the problem area will be dealt with in bankruptcy. That is a grossly simplified view though. So the short case is based upon an actual situation escalating in a very unfavorable way.

Medical Properties’ Actual Performance So Far

The company financial results show no indications of trouble. That is very likely because financial stress is very different from not paying leases or rents.

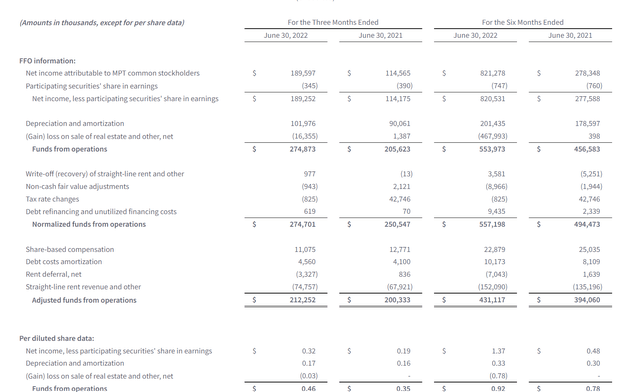

Medical Properties Trust FFO Calculation (Medical Properties Trust Second Quarter 2022, Earnings Press Release)

The key is that funds flow from operations is growing. There is unlikely to be a catastrophe to report anytime soon when a company reports some growth as shown above. The AFFO also shows similar progress at the six-month mark.

Earnings per share were even better in that earnings per share are about triple the previous fiscal year at the six-month mark.

The Future

The company has 447 properties. The argument that Steward has financial issues therefore the future of this company has some challenges is a very unlikely argument to succeed. Even if Steward is the major operator of “too many” properties for proper diversification, a worst-case scenario would some sort of lender arrangement amounting to a pre-packaged bankruptcy that would be highly unlikely to affect the company.

What would affect the company would be hospitals so poorly placed that they would be abandoned under such a scenario. Management has made a best-efforts case to avoid such an outcome. The company history appears to support the case that the hospital one way or another could continue running and the lease would be paid.

It is probably far more likely that Steward will continue to recover and therefore all the worries that occur to Mr. Market just will not happen. As of right now, there are no impairments that indicate an issue nor have shareholders been notified of an impairment.

This management has a good record of picking hospitals in areas where hospitals are needed. Therefore, it is highly likely that the “landlord” part of the business will continue unaffected.

However, I do recommend that any situation like this one be part of a well-chosen basket rather than loading up on one “just in case”. Right now, the industry recovery appears more than able to move forward. and this company appears to be in an excellent position to benefit from that recovery.

Be the first to comment