THEPALMER

On the morning of October 25th, before the market opens, the management team at Polaris (NYSE:PII) is expected to announce financial results covering the third quarter of the company’s 2022 fiscal year. This firm, which focuses on the off-road vehicle and snowmobile market, as well as being involved in the aftermarket sale of products, the sale of boats, and other related offerings, has experienced a great deal of pain recently. Although revenue with the company continues to increase nicely, profits and cash flows have contracted. As a result, shares have taken quite a beating over the past year or so. Having said that, even with this weakness, shares of the enterprise do look to be attractively priced. Of course, part of the problem seems to be investor pessimism, driven by the fact that results so far this year have not looked robust enough to make results for the entirety of the 2022 fiscal year as forecasted seem realistic. But given how cheap the stock is right now, I do still think it offers a favorable risk-to-reward opportunity, even if management comes up short.

Difficult Times

Times have been tough for shareholders of Polaris stock. An excellent point along this vein can be made by looking at the last bullish article I wrote about the firm. This article, published in early August of 2021, referred to the company’s consistent revenue growth as appealing, even at a time when profitability had been volatile. I was impressed with how growth throughout the 2021 fiscal year was playing out and by how cheap shares were even though they weren’t cheap enough to be considered ‘deep value’ in my book. Ultimately, I ended up rating the company a ‘buy’, reflecting my belief that its shares would likely outperform the broader market moving forward. Unfortunately, fate has had other plans in store. While the S&P 500 is down by 14.6%, shares of Polaris have generated a loss of 27.4%.

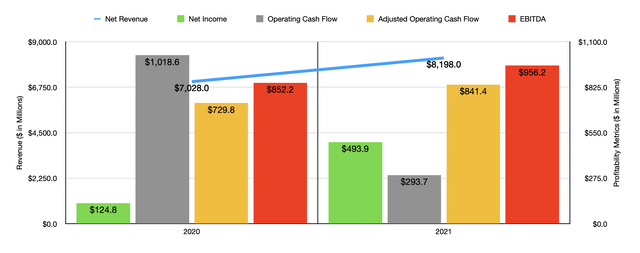

This return disparity has not been without some justification. For starters though, we should touch on how the company ended its 2021 fiscal year. During that year, revenue came in at $8.20 billion. By comparison, during the 2020 fiscal year, sales came in at $7.03 billion. In addition to benefiting from strong demand for its offerings, resulting in the volume of products sold climbing by 8%, the company also benefited to the tune of 8% from a change in product mix and increased pricing on its offerings. Other metrics for the company ended up coming in strong as well. For instance, net income during the year totaled $493.9 million, that’s up from the $124.8 million reported just one year earlier. Operating cash flow decreased from $1.02 billion to $293.7 million. But if we adjust for changes in working capital, the metric would have risen from $729.8 million to $841.4 million. Meanwhile, EBITDA for the company also improved, jumping from $852.2 million to $956.2 million.

After the 2021 fiscal year came to an end, sales continued to climb but profitability did not follow suit. Before we move on though, I must disclose one particular item of importance. The numbers cited moving forward referred to results covering continuing operations for the company only. In June of this year, management announced the sale of its Transamerican Auto Parts business to Wheel Pros in a deal valued at $50 million on an enterprise value basis. Though this deal looks small by comparison, it will reduce annual revenue for shareholders by $760 million. Investors can also expect a $140 million net impairment charge from the deal, even as the company brings in $135 million of additional cash inflows as a result of the sale and cash tax benefits from the transaction in the second half of this year. As such, I’m only focusing on financial results covering the enterprise that will be left remaining.

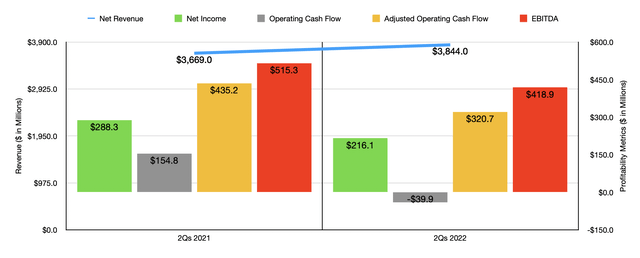

During the first two quarters of 2022, sales for the company came in at $3.84 billion. This is 4.8% higher than the $3.67 billion generated the same time one year earlier. Even though increased pricing and product mix changes helped the company to the tune of 14%, the company was hit to the tune of 1% by foreign currency fluctuations and by 8% from decreased volume. You would think that with increased revenue, that profitability would also improve. Unfortunately, it has not. Net income from continuing operations actually fell from $288.3 million in the first half of the 2021 fiscal year to $216.1 million the same time this year. This change was driven in very large part by a decline of the company’s gross profit margin from 25.3% of sales to 21.5%. There were other factors at play here too, but this was the largest. Unfortunately, other profitability metrics followed suit. Operating cash flow went from $154.8 million to negative $39.9 million. If we adjust for changes in working capital, it would have fallen from $435.2 million to $320.7 million, while EBITDA shrank from $515.3 million to $418.9 million.

From the results from the first half of the year, you might expect the second half of the year to be rather painful. However, management seems to be optimistic. Their current call is for earnings per share from continuing operations to come in at between $10.10 and $10.30. Based on the data provided, this would imply net income of $617.1 million. No guidance was given when it came to other profitability metrics. But if we assume that they will increase at the same rate that net income should, then we should anticipate adjusted operating cash flow of $1.05 billion and EBITDA of nearly $1.20 billion.

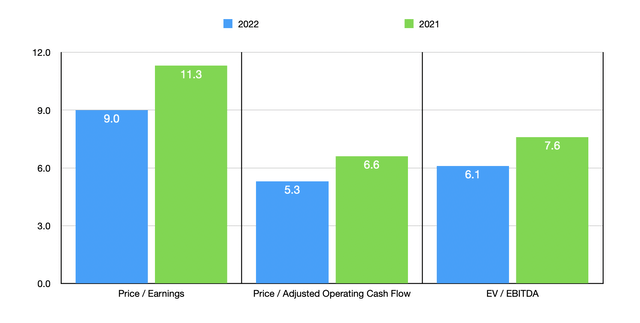

Taking these figures, I decided to value the business. The forward price to earnings multiple of the company comes in at 9, while the forward price to adjusted operating cash flow multiple would come in at 5.3. Meanwhile, the forward EV to EBITDA multiple would total 6.1. Using the data from 2021 instead, these multiples would be 11.3, 6.6, and 7.6, respectively. As part of my analysis, I compared our prospect to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 6.4 to a high of 13.3. And using the EV to EBITDA approach, the range was between 5.2 and 9.4. Using our data from 2021 instead of 2022, we find that two of the five are cheaper than our prospect, while another one was tied with it. Using the price to operating cash flow approach, the picture is a little different, with a range of between 10.6 and 27 and our target being the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Polaris | 11.3 | 6.6 | 7.6 |

| Brunswick Corporation (BC) | 13.3 | 13.8 | 9.4 |

| BRP Inc. (DOOO) | 11.3 | 27.0 | 7.6 |

| Malibu Boats (MBUU) | 11.7 | 12.5 | 7.8 |

| MasterCraft Boat Holdings (MCFT) | 9.0 | 10.6 | 6.5 |

| Vista Outdoor (VSTO) | 6.4 | 10.7 | 5.2 |

Truth be told, such a turnaround in such a short timeframe seems unrealistic. However, analysts currently have some pretty high expectations themselves. At present, they anticipate revenue for the third quarter this year to come in at $2.20 billion. If that comes to fruition, it would be 12.2% higher than the $1.96 billion generated the same time last year. Earnings per share, meanwhile, should come in at around $2.74, with an adjusted figure of $2.78. By comparison, earnings per share in the third quarter of last year came in at $1.84. Naturally, investors will want to pay very close attention to what management actually reports to see what the picture ends up looking like.

Takeaway

Generally speaking, I still find Polaris to be an interesting prospect with shares that are cheap enough to warrant a ‘buy’ rating. Recently, financial performance has been disappointing on the bottom line. But considering the difficulty the market overall has faced, this shouldn’t be much of a surprise. Unless management reports something really bad for the third quarter, the picture is attractive enough for me right now to still warrant a ‘buy’ rating on the firm.

Be the first to comment