Spotmatik

This article was published on Dividend Kings on Monday, November 21st.

——————————————————————————-

In this holiday season, we gather with family and friends to give thanks for the things that matter in life, what I call the seven Fs.

- family

- friends

- faith (traditional religion or life philosophy)

- fitness (health)

- food

- fido (pets in general)

- financial health (enough money to support the other six Fs).

These are the only seven things that ultimately drive long-term happiness. The last one, money, is only there to support the other six.

For my family, this Thanksgiving is an especially special time, because of my grandmother’s battle with cancer.

Seven years ago, my Grandmother was diagnosed with breast cancer, which she bravely beat with aggressive chemo and radiation the first time.

Then it came back, and she battled it again. It spread to her colon, and she beat that, too, with the help of surgery, chemo, and radiation.

Then it came back, this time in her liver. My warrior queen grandmother beat cancer again, thanks to her “never say die” attitude.

Then it came back, this time in her lungs. She valiantly battled and beat the cancer demon back a fourth time.

This year, while vacationing in her homeland of Poland (for perhaps the last time in her life), she suffered what we thought was a stroke. She became confused, unable to speak, and half her face became paralyzed.

The good news was it wasn’t a stroke. The bad news? Her cancer was back, this time a 5 cm brain tumor that doctors said had to be removed immediately or else the increased pressure could kill her at any time.

It was a nerve-wracking two weeks, but the brain surgery went well, and my grandmother, for the fifth time in seven years, has once more fully recovered.

When It Rains, It Pours

As if my grandmother’s health issues weren’t overwhelming enough, last year my grandfather had to have triple-bypass heart surgery. Thankfully, he’s doing well today, and so is my grandmother.

But despite having pretty good health insurance from their former jobs, and some help from Medicare, the out-of-pocket expenses from these medical treatments, and ongoing in-home care from nurses, are monstrously expensive.

How expensive? Approximately $30,000 per month. These are the kinds of medical bills that would shatter most families.

I’ve been blessed with a strong work ethic, and a loyal following on Seeking Alpha, that has helped me live my dream. After retiring for medical reasons from the U.S. Army Medical Services Corp, I am able to earn far more money than any military doctor.

But even I couldn’t afford to pay $30,000 per month, because after taxes I make $20,000 per month.

I live frugally, but I can’t live on passion for my work alone;)

My entire family is pitching in to cover these medical bills, but even my rich uncle who works for Alphabet (GOOG, GOOGL) has a family and can only contribute $5,000 per month.

My parents are putting two sisters through nursing school (one through grad school), and so it falls to me to help my family through this tough time.

I’m happy to do so. My family was there for me during my seven-year tribulation, in which I and my now ex-wife lost five children, leading to a messy and costly divorce.

When I was shattered, my family helped lift me up. They helped me to rise like a Phoenix from the ashes to soar to new heights. Now I’m returning the favor, as best I can.

But the point is that no amount of good intentions can pay such exorbitant medical bills. And this is where high-yield blue chips pick up the slack.

High-Yield Blue-Chips Literally Saved My Grandmother’s Life

During my seven-year tribulation in Alabama, my wife and I lived in extreme poverty (also due to medical issues and high-out-of-pocket expenses).

Things were so tight that, for an entire month, I lived on mustard and pickle juice so my wife could have the real food. Our utilities were turned off, several times.

After living in the cold, dark, and food poverty, I vowed to save as much as I could when I rebuilt my finances.

I worked hard, and I lived like a monk, saving 90% of my post tax income. Within one year of my divorce and moving back to Minnesota to be near my family, I wiped out my $50K in divorce debt, and paid back my parents the $20K they had lent us during the darkest times in Alabama.

In the years since, I built up a $2 million dividend growth portfolio. Several people, including friends and family, asked me, “Why on earth do you save and invest so much?”

It was a reasonable question. I was making more money than I ever dreamed of (more than 98% of people my age). I could afford a mansion, a Tesla, and the finest things in life.

In other words, if I wanted to, I could have been living like a king for several years.

But the lessons of severe poverty in Alabama never left me. To me, money is the ultimate tool, the ultimate safety cushion, and the ultimate source of financial freedom.

I’ve been poor and I’ve been rich. Believe me, rich is better.” – Kevin O’Leary

To me, money is like love and happiness. You can never have too much;)

And now, after my family has suffered medical blow after blow, and the medical expenses have soared to absurd and potentially catastrophic levels, the method to my “savings madness” has become clear to my entire family.

Why? Because while my entire family combined can only afford $20K per month in medical bills, that $2 million dividend blue-chip portfolio now has a yield on cost of 6%.

- it’s generating $120,000 per year in income

- $10,000 per month, closing the medical bill gap

- growing at 6% annually over the last decade

- including during the Pandemic when the S&P cuts its dividends 2%.

I own a lot of companies in this portfolio, nearly 200 in fact. But just 10 of these world-beater blue-chips represent 80% of that portfolio income.

Income without which my family would have had to take on $250,000 in debt, and my parents might have had to mortgage their house.

With a recession coming in 2023, my family would have had to fear what job losses might mean for our ability to pay these medical bills, the new mortgage, or both!

We’d live in constant fear, not just of my grandmother’s cancer coming back, but what the future might hold financially.

What if the cancer comes back and the bills go up even more?

What if someone loses their job and my parents end up losing their home?

What if some other catastrophe befalls us and that finally breaks us and sends one of us into bankruptcy?

What if several of us have to file for bankruptcy? Spoiling our credit for seven years and potentially preventing me from being able to start my own family in a few years.

- you can’t get a mortgage with a bankruptcy on your credit report.

In other words, all that savings and a dividend empire that I’ve spent years building, out of a paranoid fear that something terrible might be coming, suddenly seems like genius foresight, because something terrible did happen.

- It’s not paranoia if cancer really is out to get your family;)

So, now let me share with you the 10 high-yield blue-chips that are saving my grandmother’s life, and helping my family survive and thrive through our own great tribulation.

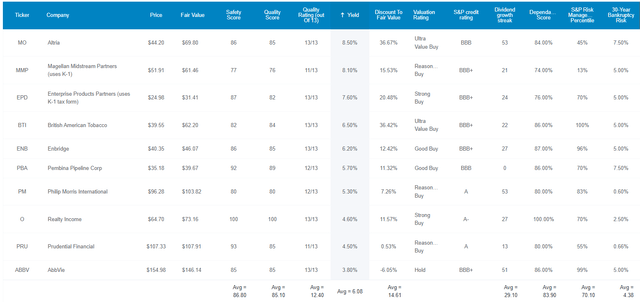

10 High-Yield Blue-Chips Saving My Grandmother’s Life

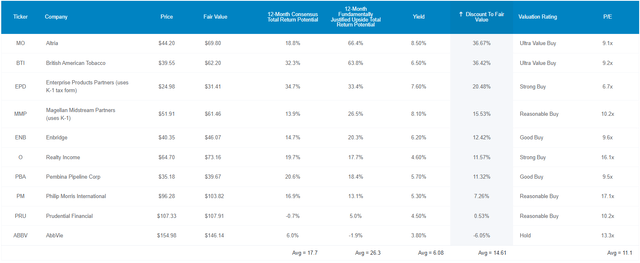

(Source: Dividend Kings Zen Research Terminal)

I’ve linked to articles exploring each companies investment thesis, growth outlook, and risk profile.

Here they are, in order of highest to lowest yield.

- Altria (MO)

- Magellan Midstream Partners (MMP) – uses K1 tax form

- Enterprise Products Partners (EPD) -uses K1 tax form

- British American Tobacco (BTI)

- Enbridge (ENB)

- Pembina Pipeline (PBA)

- Philip Morris International (PM)

- Realty Income (O)

- Prudential Financial (PRU)

- AbbVie (ABBV)

Tax Implications

- ENB and PBA are Canadian companies

- 15% dividend tax withholdings in taxable accounts (my portfolio is a taxable account)

- tax credit available to recoup the withholding (requires paperwork)

- own in a retirement portfolio to avoid the withholding without paperwork.

FAST Graphs Up Front

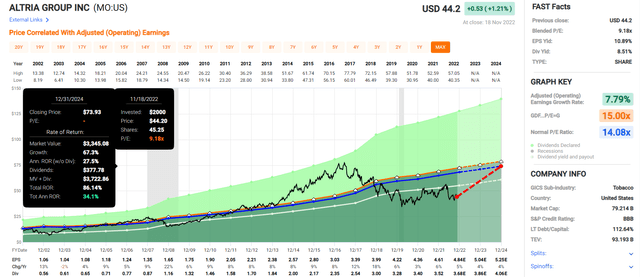

Altria 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

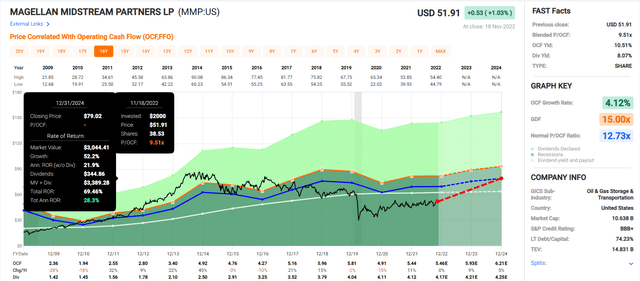

Magellan 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

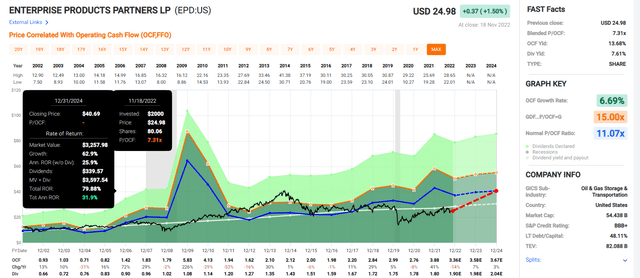

Enterprise 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

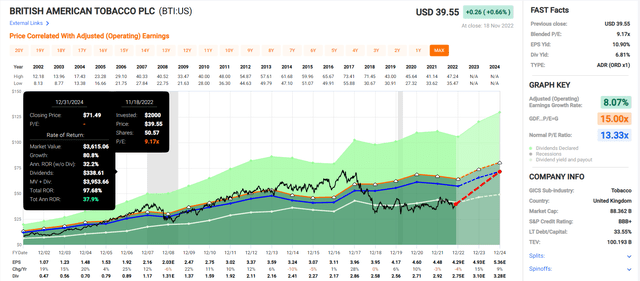

British American 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

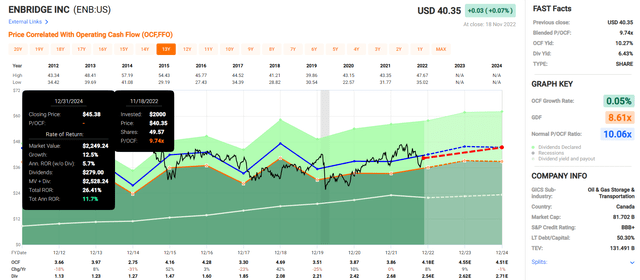

Enbridge 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

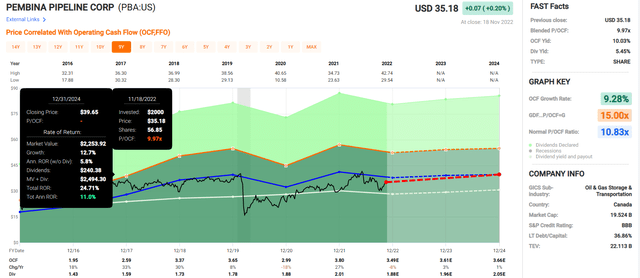

Pembina 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

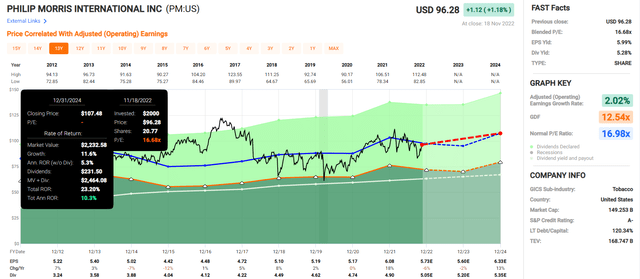

Philip Morris 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

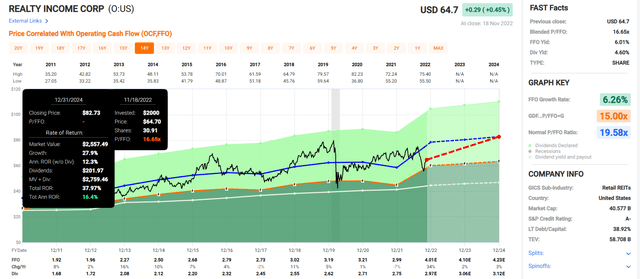

Realty Income 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

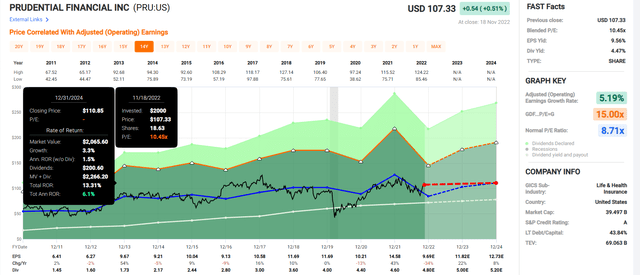

Prudential 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

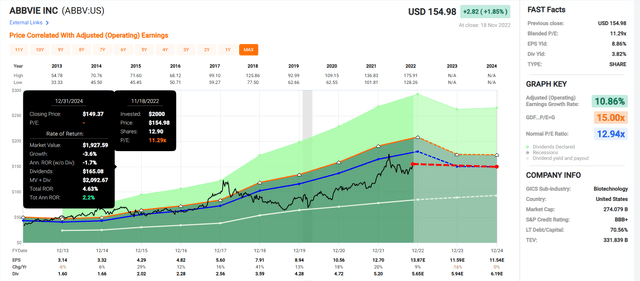

AbbVie 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

ABBV isn’t even undervalued anymore, yet my 10 super-income blue-chips still offer far better future medium-term return potential than the S&P 500 (SP500).

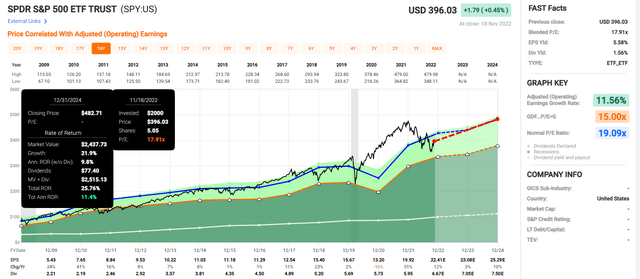

S&P 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

Analysts expect the S&P 500 to deliver about 26% total returns over the next two years, or 11% per year.

- average 2024 total return potential consensus: 42% = 19% CAGR

- almost 2X more than the S&P 500 consensus.

But of course my goal with this portfolio isn’t to just score a quick 42% in two years.

- the dividends are allowing us to pay medical bills without selling a single share in a bear market

- financial independence no matter what the stock market does = true financial independence.

Why My Family Trusts These Blue-Chips With Our Future And So Can You

(Source: Dividend Kings Zen Research Terminal)

These aren’t just life-saving high-yield blue-chips, they are lifesaving high-yield Super SWAN (sleep well at night) dividend stocks. Here’s why.

Ben Graham considered 20+year dividend growth streaks an important sign of excellent quality, and these average a 29-year dividend growth streak.

- since 1993

- an effective dividend aristocrat portfolio.

Their average dividend cut risk in an historically normal recession since WWII is approximately 0.5%.

Their average dividend cut risk in a Pandemic/Great Recession level recession is approximately 1.7%.

S&P estimates their average 30-year bankruptcy risk at 4.4%.

- BBB+ stable credit rating.

S&P estimates their long-term risk management at 70th percentile out of all companies on earth.

DK uses S&P Global’s (SPGI) global long-term risk-management ratings for our risk rating.

- S&P has spent over 20 years perfecting their risk model

- which is based on over 30 major risk categories, over 130 subcategories, and 1,000 individual metrics

- 50% of metrics are industry specific

- this risk rating has been included in every credit rating for decades.

The DK risk rating is based on the global percentile of how a company’s risk management compares to 8,000 S&P-rated companies covering 90% of the world’s market cap.

S&P’s risk management scores factor in things like:

- supply chain management

- crisis management

- cyber-security

- privacy protection

- efficiency

- R&D efficiency

- innovation management

- labor relations

- talent retention

- worker training/skills improvement

- customer relationship management

- climate strategy adaptation

- corporate governance

- brand management.

If you can think of a risk of something going wrong, S&P has already thought of it and included it in their risk model, which has been part of every credit rating you’ve seen for the last two decades.

These Life-Saving Super SWANs Score 70th Percentile On Global Long-Term Risk Management

Long-Term Risk Management Is The 204th Best In The Master List (60th Percentile In The Master List)

| Classification | S&P LT Risk-Management Global Percentile |

Risk-Management Interpretation |

Risk-Management Rating |

| BTI, ILMN, SIEGY, SPGI, WM, CI, CSCO, WMB, SAP, CL | 100 | Exceptional (Top 80 companies in the world) | Very Low Risk |

| Strong ESG Stocks | 86 |

Very Good |

Very Low Risk |

| Foreign Dividend Stocks | 77 |

Good, Bordering On Very Good |

Low Risk |

| Ultra SWANs | 74 | Good | Low Risk |

| Life Saving High-Yield Super SWANs | 70 | Good | Low Risk |

| Dividend Aristocrats | 67 | Above-Average (Bordering On Good) | Low Risk |

| Low Volatility Stocks | 65 | Above-Average | Low Risk |

| Master List average | 61 | Above-Average | Low Risk |

| Dividend Kings | 60 | Above-Average | Low Risk |

| Hyper-Growth stocks | 59 | Average, Bordering On Above-Average | Medium Risk |

| Dividend Champions | 55 | Average | Medium Risk |

| Monthly Dividend Stocks | 41 | Average | Medium Risk |

(Source: DK Research Terminal)

Their long-term risk-management is in the top 40% of the world’s highest quality companies and similar to that of such other blue-chips as:

- Procter & Gamble (PG): Ultra SWAN dividend king

- Johnson & Johnson (JNJ): Ultra SWAN dividend king

- Illinois Tool Works (ITW): Ultra SWAN dividend king

- Eli Lilly (LLY): Ultra SWAN

- NIKE (NKE): Ultra SWAN.

In other words, when stuff goes wrong, these life-saving Super SWANs know how to adapt, overcome, and keep growing their dividends.

Now that you know why my family trusts my grandmother’s health and life to these high-yield Super SWANs, here’s why you might want to buy some of them today.

Wonderful Companies At Wonderful Prices

(Source: Dividend Kings Zen Research Terminal)

For context, the S&P trades at 17.2X forward earnings, a 2% historical discount.

These life-savings high-yield Super SWANs trade at 11.1X forward earnings and a 15% historical discount.

Do you know when what the trough P/E was for the S&P during the Great Recession? 11.3X.

These life-saving high-yield Super SWANs are trading at a lower valuation than the U.S. market in the depth of the Great Recession, the 2nd worst market crash in U.S. history.

- the last time the S&P traded at 11.1X earnings was in 1989

- 33 years ago.

Analysts expect an 18% total return within the next year, but their fundamentally justified 12-month total return potential is 26%.

- if they all grow as expected and return to historical mid-range market-determined fair value within 12 months you’ll earn 26%.

But my goal isn’t to earn 26% in a year, or 43% in two years. I’m trying to achieve life-saving income and life-changing long-term returns.

How These Life Saving High-Yield Blue-Chips Can Help You Retire In Safety And Splendor

(Source: Dividend Kings Zen Research Terminal)

These aren’t just some of the safest 6.1% yielding blue-chips on earth, they are also growing at almost 5%, meaning they offer 10.7% CAGR long-term return potential.

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return | Long-Term Inflation And Risk-Adjusted Expected Returns | Years To Double Your Inflation & Risk-Adjusted Wealth |

10-Year Inflation And Risk-Adjusted Expected Return |

| Life Saving High-Yield Super SWANs | 6.1% | 4.6% | 10.7% | 7.5% | 5.2% | 14.0 | 1.65 |

| REITs | 3.9% | 6.1% | 10.0% | 7.0% | 4.7% | 15.4 | 1.58 |

| Schwab US Dividend Equity ETF | 3.6% | 8.5% | 12.1% | 8.4% | 6.1% | 11.8 | 1.81 |

| Dividend Aristocrats | 2.6% | 8.5% | 11.1% | 7.8% | 5.4% | 13.2 | 1.70 |

| S&P 500 | 1.8% | 8.5% | 10.3% | 7.2% | 4.9% | 14.8 | 1.61 |

(Sources: DK Research Terminal, FactSet, Morningstar, YCharts)

There are higher yielding stocks, there are faster growing stocks, but there are no 6+% yielding stocks that offer the potential to nearly match the dividend aristocrats and bear the S&P 500 long-term.

Inflation-Adjusted Total Return Potential: $1,000 Initial Investment

| Time Frame (Years) | 8.0% CAGR Inflation-Adjusted S&P 500 Consensus | 8.4% CAGR Inflation-Adjusted 10 Life-Saving High-Yield Super SWAN Consensus | Difference Between Inflation-Adjusted 10 Life-Saving High-Yield Super SWAN Consensus And S&P Consensus |

| 5 | $1,468.65 | $1,494.67 | $26.02 |

| 10 | $2,156.93 | $2,234.04 | $77.11 |

| 15 | $3,167.77 | $3,339.15 | $171.39 |

| 20 | $4,652.33 | $4,990.93 | $338.60 |

| 25 | $6,832.64 | $7,459.79 | $627.15 |

| 30 (retirement time frame) | $10,034.74 | $11,149.93 | $1,115.19 |

| 35 | $14,737.50 | $16,665.47 | $1,927.97 |

| 40 | $21,644.21 | $24,909.38 | $3,265.18 |

| 45 | $31,787.72 | $37,231.31 | $5,443.59 |

| 50 | $46,684.97 | $55,648.53 | $8,963.56 |

| 55 | $68,563.78 | $83,176.19 | $14,612.41 |

| 60 (investing lifetime) | $100,696.06 | $124,320.97 | $23,624.92 |

| 100 (institutional time frame, charitable trusts, multi-generational wealth) | $2,179,486.17 | $3,096,758.49 | $917,272.32 |

(Source: Dividend Kings Research Terminal, FactSet)

The goal with these life-saving high-yield Super SWANs isn’t to crush the market, it’s just to earn market-like long-term returns and more than 3X the market’s yield.

| Time Frame (Years) | Ratio Inflation-Adjusted 10 Life-Saving High-Yield Super SWAN Consensus vs. S&P consensus |

| 5 | 1.02 |

| 10 | 1.04 |

| 15 | 1.05 |

| 20 | 1.07 |

| 25 | 1.09 |

| 30 | 1.11 |

| 35 | 1.13 |

| 40 | 1.15 |

| 45 | 1.17 |

| 50 | 1.19 |

| 55 | 1.21 |

| 60 | 1.23 |

| 100 | 1.42 |

(Source: Dividend Kings Research Terminal, FactSet)

That’s what they might deliver, with a literally life-changing income stream.

OK, this sounds great, but what evidence is there than these life-saving high-yield Super SWANs can actually match much less outperform the market over time?

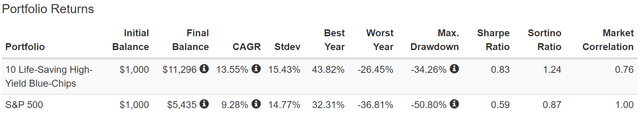

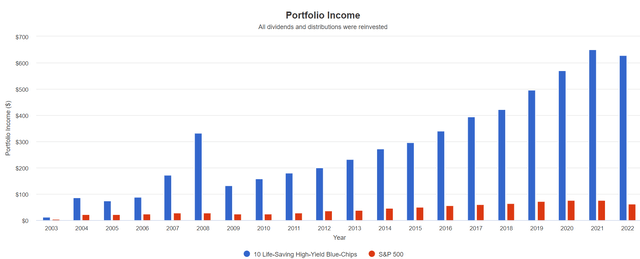

Historical Returns Since 2003 (Annual Rebalancing)

The future doesn’t repeat, but it often rhymes. – Mark Twain

“Past performance is no guarantee of future results.”

However, studies show that blue chips with relatively stable fundamentals offer predictable returns based on yield, growth, and valuation mean reversion over time.

19 years is a time frame in which 91% of total returns are due to fundamentals, not luck.

(Source: Portfolio Visualizer Premium)

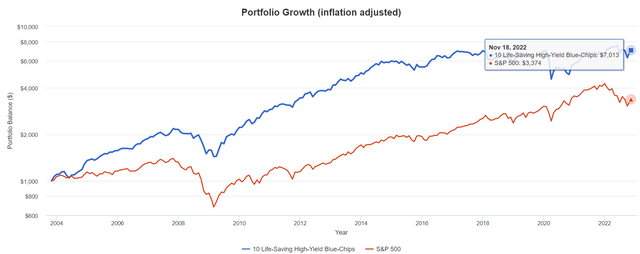

Strong double-digit returns for two decades, and lower peak declines in the Great Recession to boot (not that volatility is a concern for this portfolio right now).

(Source: Portfolio Visualizer Premium)

2X the inflation-adjusted returns of the S&P 500.

(Source: Portfolio Visualizer Premium)

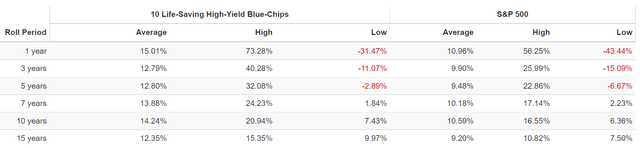

Average long-erm returns of 13% to 15% CAGR, about 50% better than the S&P 500.

But now let’s see what really counts for my family: dependable, safe, and growing income.

Life-Changing Income My Family Can Trust

2007 and 2008 were 3 Spin-Offs From MO ((Source: Portfolio Visualizer Premium))

If you need generous, safe, and rapidly growing income today, to pay the bills or even save a family member’s life, you can’t buy the S&P, or any non-high-yield portfolio.

Cumulative Income Since 2004 per $1,000 Initial Investment

| Metric | S&P 500 | 10 Life-Saving High-Yield Super SWANs |

| Total Dividends | $855 | $5,933 |

| Total Inflation-Adjusted Dividends | $531.06 | $3,685.09 |

| Annualized Income Growth Rate | 7.9% | 13.4% |

| Total Income/Initial Investment % | 0.86 | 5.93 |

| Inflation-Adjusted Income/Initial Investment % | 0.53 | 3.69 |

| More Inflation-Adjusted Income Than S&P | NA | 6.94 |

| Starting Yield | 2.1% | 8.7% |

| Today’s Annual Dividend Return On Your Starting Investment (Yield On Cost) | 8.3% | 83.9% |

| 2022 Inflation-Adjusted Annual Dividend Return On Your Starting Investment (Inflation-Adjusted Yield On Cost) | 5.2% | 52.1% |

(Source: Portfolio Visualizer Premium)

Not only were these blue chips yielding significantly more in 2004, but they’ve grown their income at twice the rate as the S&P for nearly two decades.

That’s why they’ve delivered 7X the inflation-adjusted income and now have a 52% inflation-adjusted yield on cost.

- for every $1 invested in later 2003 they are now paying $0.52 per year in quickly growing income

- my $1.44 million investment (had I made it in late 2003) would now be paying $750K in inflation-adjusted dividends

- $62,500 per month in inflation-adjusted income

- more than 2X my grandparents medical bills.

Bottom Line: These 10 High-Yield Blue-Chips Are Saving My Grandmother’s Life…Imagine What They Can Do For You?

My family has faced a lot of bad luck in recent years, but we’ve been blessed even more so.

- we’ve never experienced a catastrophe we weren’t able to deal with together as a family

- we’ve only become stronger and more united the more bad stuff we face and overcome together.

Do I regret my “paranoid savings madness?” coming out of my divorce and personal great tribulation?

The only thing I regret about my portfolio is that I didn’t start it 20 years ago.

- with a large enough dividend portfolio almost any disaster is a mere inconvenience, not a crisis.

This bear market hasn’t been as fun for me as I would have hoped. I was looking forward to being able to buy a fortune in undervalued blue chips, but you know what they say.

If you want to make God laugh, tell him your plans.”

Fortunately, thanks to years of what some would call insane amounts of savings and blue-chip dividend investing, my family’s medical crisis didn’t turn into a life-shattering catastrophe.

What I’ve learned in recent years is that bad luck can last a long time.

But if you have enough passive income, then the worst luck remains just that, bad luck, and not a curse that can destroy you.

And that’s why I’m more dedicated than ever to blue-chip dividend investing. It’s not just my hobby, it’s not just a passion, it’s literally saving my grandmother’s life.

Specifically, BTI, MMP, ENB, MO, EPD, ABBV, PRU, O, PBA, and PM are generating 80% of the dividends that are filling the medical bill gap and keeping my family healthy, united, and debt-free.

- 6.1% very safe yield

- 29-year average dividend growth streak

- BBB+ stable average credit rating

- 4.6% CAGR growth rate

- 10.7% CAGR long-term return potential (similar to the last 19 years

- 13.4% CAGR income growth for 19 years

- 7X more income since 2004 than the S&P 500.

Now, I’m not here to brag about rescuing my family, they rescued me when I needed it most. I’m just repaying the favor, and it’s my privilege to do so.

- there is no greater honor for me than to make a lot of money and then spend it on saving my family and friend’s lives.

I’m not here to tell you that blue-chip dividend stocks with a limited budget can save your family from a similar catastrophe, should, God-forbid, one befall you and yours.

I’m not here to tell you that dividend investing can work miracles, like turn $5K into $500K in 10 years.

Long-term blue-chip investing is incredibly powerful, capable of growing your income and wealth 30X, 300X and even 3,000X adjusted for inflation, with sufficient time.

But it still takes sufficient time and savings to let the power of dividend compounding change or even save your life or the lives of those you love.

My example is one of the most extreme there is. But it’s a clear lesson in the power of dividend blue-chips to not just change your life, but potentially save the life of your loved ones.

- dividend income is like happiness and love, you can never have too much.

This Thanksgiving, I have a lot to be thankful for. My family has learned that you can never take family holidays for granted, because literally everyone might be my grandmother’s last.

But she is a strong woman who refuses to give up the fight against cancer.

And my family is too strong and united to surrender to fear and misery.

The U.S. Army taught me to “adapt and overcome,” and thanks to these life-saving high-yield Super SWANs, my family is able to face unrelenting medical crises, and win.

One day my grandmother will lose her battle with cancer. We know this. Dividends can’t make her live forever, but they might be able to give us a few more joyous years together.

And in the years and decades to come, as my dividend stream grows into a river, and then a never ending tide, I’ll be able to accomplish a lot more than just saving the life of my family and friends.

- $480 per year can lift a person out of poverty for an entire year.

When I was medically retired from the Army, I swore it wasn’t the end of my service to my community or country.

Investment analysis gave me a new mission in life, to help people all over the world achieve their financial goals, and change their lives.

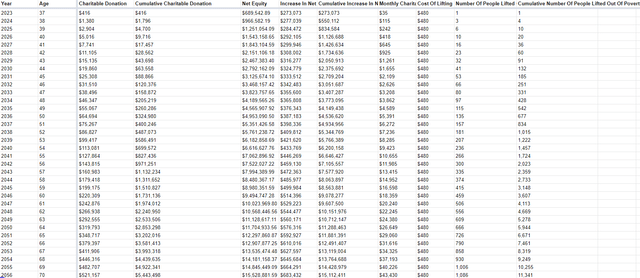

My New Mission In Life: Save As Many People From Poverty As Possible

I’ve known poverty, I wouldn’t wish on my worst enemy. But 700 million people suffer from extreme poverty, living on just $1.90 per day or less.

- 35X worse off than I did in Alabama during my great tribulation.

In the coming 34 years, I have a plan to use my dividend income, not just to help my family, but to help thousands of families around the world.

- a conservative plan to donate $5.4 million, adjusted for inflation, to fighting extreme poverty, by age 70

- lifting 11,341 people out of extreme poverty and saving thousands of lives

- children, wives, husbands, and grandmother’s like mine.

Some see all the problems in the world and despair that we can ever do anything about it. I see the same problems and see only a glorious and righteous challenge to overcome.

I won’t stop saving and changing lives at 70, just like I won’t retire at 70. Like Michelangelo, I’ll die with a paintbrush in my hand (a keyboard in my case).

I’ll keep working forever, because teaching people like you how to take charge of your financial destiny and live your dreams, is my calling, my mission, my sacred honor.

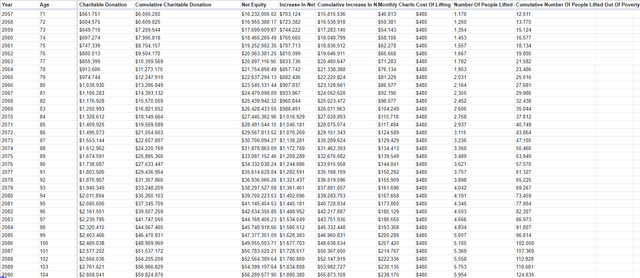

By age 100, I’ll have conservatively donated almost $50 million, adjusted for inflation, to fighting global extreme poverty, saving almost 100,000 people from this scourge.

- Researchers Say They Are Close To Reversing Aging.

Harvard Researchers say they are 10 to 15 years from perfecting a cure for aging, allowing people to live as long as they wish. What would I do with centuries of time?

- devote my life to what I’m good at

- teaching people like you to live your dreams through dividends

- and saving people from extreme poverty.

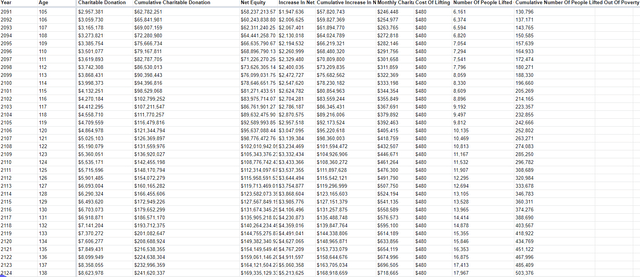

By age 139, in 2125, I might have donated at least $250 million, adjusted for inflation, to the global war on poverty, helping lifting up over 500,000 people to a better life.

- by age 181, in 2167, I hope to have donated over $1 billion, adjusted for inflation, helping 2.2 million people in total

- by age 256, in 2242, I hope to have donated over $10 billion, adjusted for inflation, helping 21.4 million escape extreme poverty

- by age 332, in 2318, I hope to have donated over $100 billion, adjusted for inflation, helping over 209 million people in total

- by age 410, in 2,396, I might have donated over $1 trillion, adjusted for inflation, helping a total of 2.15 billion people.

What if Harvard Researchers fail? What if Google’s two subsidiaries working on a cure for aging also fail? Then the dream of an eventual Star Trek Utopia (an end to poverty) for all lives on.

- approximately by the year 2,700 my portfolio, which I’ll convert to a perpetual charitable trust in my will, will be able to provide every human in the solar system with $1,000, adjusted for inflation, in monthly UBI

- an end to not just extreme poverty, but all poverty.

The point is that big problems need big solutions, but not necessarily complex answers.

Did I help save my grandmother’s life with advanced quantitative trading techniques?

Did I find the next great crypto coin and make 1000X my money in a year?

Did I manage to perfectly time the market and then use hyper-leveraged options to make 10X my money in a down market?

No, I just bought the world’s best high-yield world-beater blue-chips at reasonable to attractive prices and kept doing it for several years.

- now imagine what decades or even centuries could accomplish?

And when my family needed me, I was thrilled to be able to help. This was why I was put on this earth, to help people who need it, and even potentially save them when times look darkest.

That’s what I vow I’ll never stop doing, not now, not ever, as long as I draw breath.

So I hope you enjoy my articles, about how to retire in safety and splendor, or even save your family’s lives, because I plan to keep publishing them forever, or until I die, whichever comes first;)

But even if my time on this earth ends in this century, I’ll never stop working hard so that my legacy carries on. Hopefully with my children and grandchildren, or just an automated perpetual charitable trust, that harnesses the epic power of blue-chip dividends to make the world a better place.

The dream of a Star Trek Utopia for all might be a dream today, but on this Thanksgiving weekend, I’ll remind you that weekends are for dreaming, especially when the dreams are this wonderful.

From everyone at DK and iREIT I want to wish you and yours a safe, healthy, relaxing and dream filled Thanksgiving weekend and joyous holiday season:)

Be the first to comment