zimmytws

(This article was co-produced with Hoya Capital Real Estate.)

Introduction

Nuveen is a leading sponsor of closed-end funds (“CEFs”), with $57 billion of assets under management across 56 CEFs. Nuveen offers over 30 municipal bond CEFs, including CEFs for 11 single-state funds and one taxable municipal CEF. PIMCO offers 9 municipal bond CEFs, of which the PIMCO Municipal Income Fund (NYSE:PMF) is the oldest and only one outperforming all the Nuveen CEFs that were in existence when it started in 2001. To show how dates can be selected to get the results you want, along with comparing PNF with those Nuveen CEFs, as old as it is, I also did the same for the nine that existed from 2012; the results are different!

Like other parts of the fixed income universe, municipal bond funds come in many flavors. Beside Closed-End-Funds, there are Mutual Funds, and exchange-traded funds (“ETFs”) available; over 1000 by one count. While Nuveen has probably the most funds, the iShares National Muni Bond ETF (MUB) is probably the biggest by assets under management (“AUM”), at over $29b. That dwarfs PMF’s $229m or Nuveen’s largest, the Nuveen AMT-Free Quality Municipal Income Fund (NEA) with $6b in AUM.

2022: A year to forget

For investors, 2022 has been unique. For only the third time in recent history, both bonds and stocks are down in the same year.

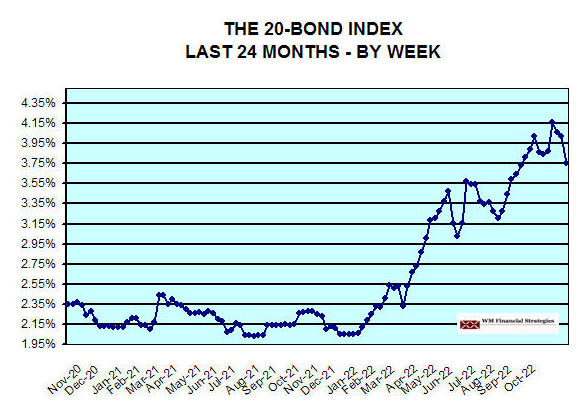

munibondadvisor.com

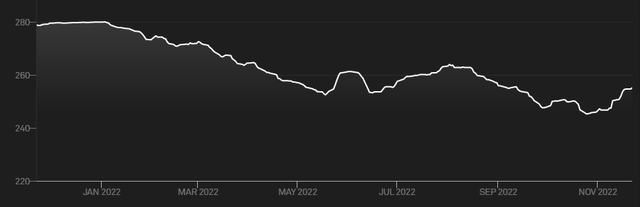

The effect of rising rates is reflected in the S&P Municipal Bond Index, as shown next.

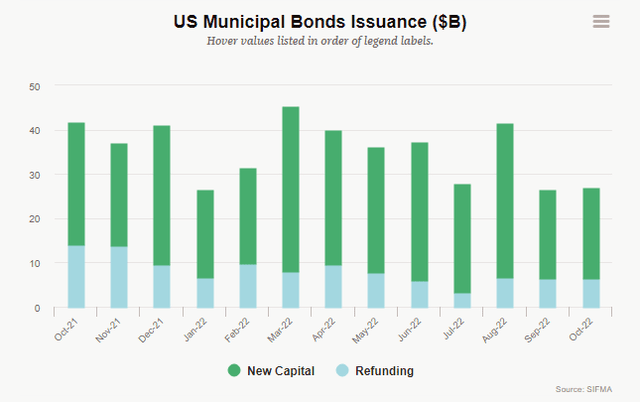

The big questions now is whether the recent rally is for real or a head-fake as we saw last summer. Higher rates do seem to have slowed the sale of new Municipal debt, and refunding levels.

Here is a link to Nuveen’s recent review of the Municipal Bond market.

PIMCO Municipal Income Fund review

Seeking Alpha describes this CEF as:

The Nuveen AMT-Free Municipal Credit Income Fund invests in undervalued municipal securities and other related investments exempt from regular federal income taxes that are rated Baa/BBB or better by S&P, Moody’s, or Fitch, and that have an average maturity of 17.02 years. It employs fundamental analysis with bottom-up stock picking approach to create its portfolio. The fund benchmarks the performance of its portfolio against Standard & Poor’s (S&P) Insured Municipal Bond Index. PMF started in 1999.

PIMCO provides this statement as to the fund’s investment approach:

The portfolio manager also aims to preserve and enhance the value of the fund’s holdings relative to the municipal bond market, generally, using proprietary analytical models that test and evaluate the sensitivity of those holdings to changes in interest rates and yield relationships.

PIMCO is qualified to respond to recent changes in the municipal bond market, with an extensive network of credit research capabilities to address concerns about creditworthiness, which is critical to municipal bond investing. Additionally, PIMCO has the market presence to provide access to the new issue and secondary markets.

Source: pimco.com PMF.

PMF has $230m in AUM and shows a Forward yield of 6.3%. Fees cover three areas and currently total 136bps:

- Management cost: 71bps

- Other expenses: 48bps

- Interest expense: 17bps (leverage ratio: 47%).

Holdings review

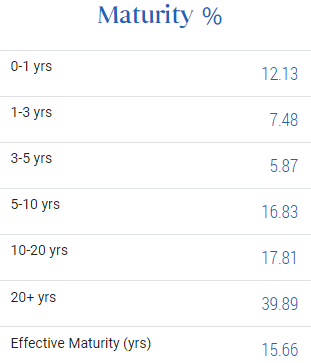

pimco.com maturities

For any fixed income fund, knowing its effective maturity (15.66 years) and effective duration (14.16 years) are critical data points, especially when interest rates are not stable. With rates still climbing, those values will hurt the prices of the assets owned but will benefit PMF once rates start down again. On the positive side, having 20% of the portfolio maturing within three years, over 12% within one, allows for the potential of capturing higher coupon bonds during this upward phrase of the rate cycle.

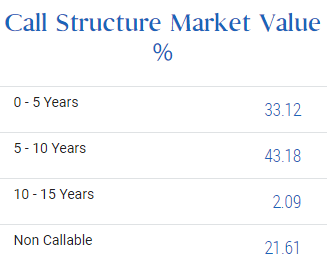

While the odds drop as rates rise, there is also the ability to reinvest if a holding is called at Par. A third of the portfolio is callable within 5 years.

pimco.com Call schedule

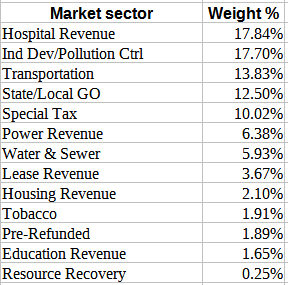

Municipal bonds are issued to support or are backed by numerous projects or revenue streams. PIMCO defines PMF’s portfolio as such:

pimco.com sectors

This is the first CEF I have reviewed that had Hospitals and Industrial/Pollution bonds as its biggest allocations. When you add Transportation bonds, those sectors account for 50% of the portfolio. The top five states are:

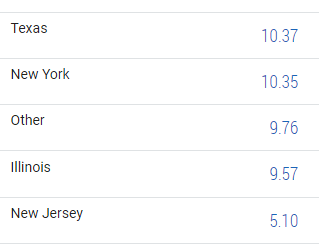

pimco.com states

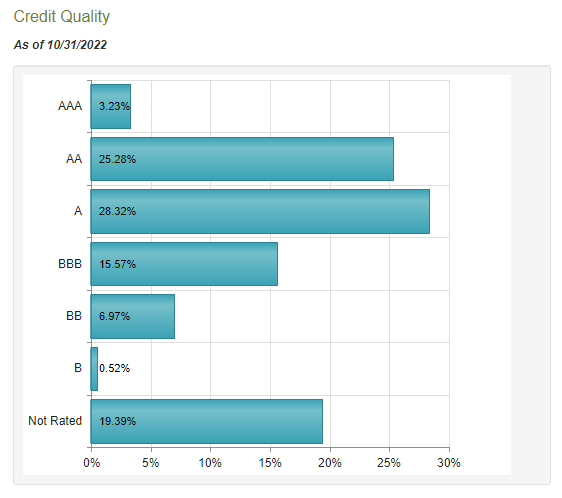

The credit ratings for PMF are as follows, which I calculated to be “A” rated:

CEFConnect.com

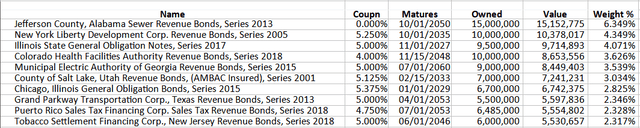

Top holdings

Despite owning over 200 bonds, the Top 10 still account for 34% of the portfolio; probably making it one of the most concentrated Municipal bond funds.

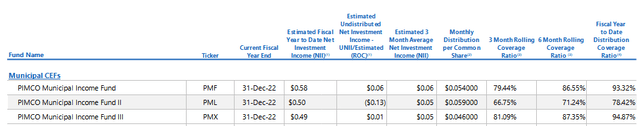

Distribution review

While PMF last cut its payout at the start of 2020, its UNII data shows it is not earning its payout. That said, its sister CEFs are not, and neither has reduced its payout recently.

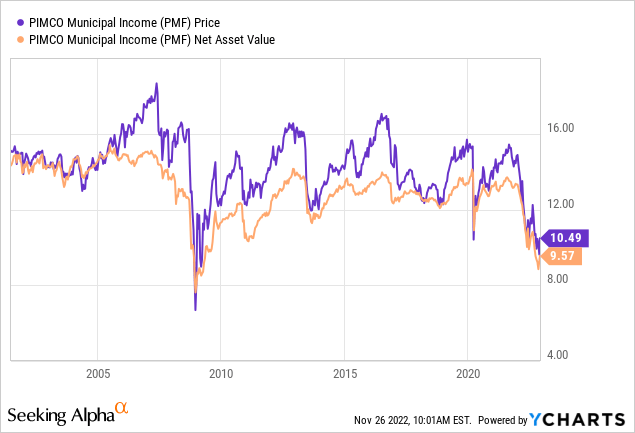

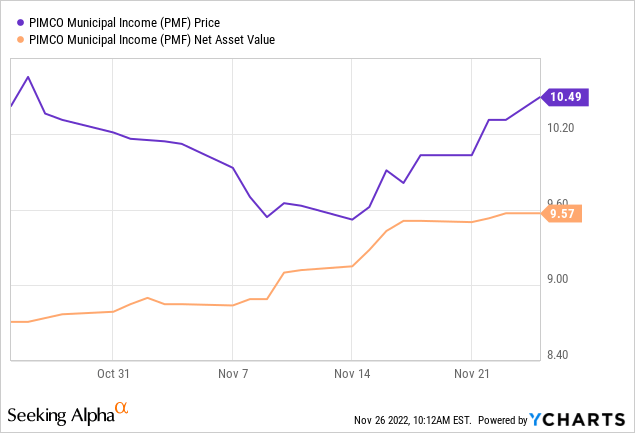

Price and NAV review

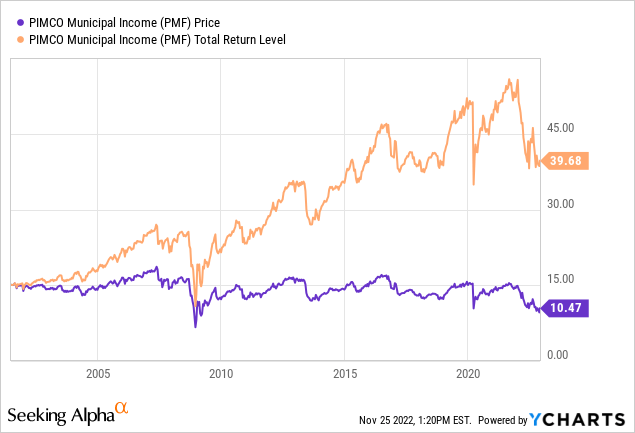

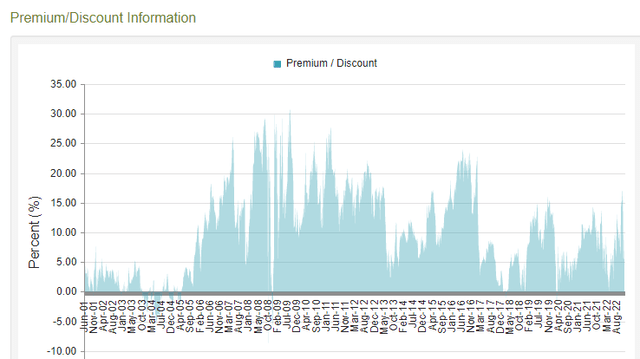

PMF’s NAV, being below $11, is in rare territory, from which it has rebounded to over $12 both times. The next chart puts this relationship in better prospective.

Unfortunately, at a premium of 9.61%, PMF investors have mostly priced in that NAV recovery. That said, PMF basically trades at a premium, several times more than twice the current level. Just in the past month, the premium have been as low as 3% and as high as 22%.

Waiting (hoping) for a buying opportunity below 5% is a possible buying opportunity; or selling at the next 20+% premium.

Comparing results

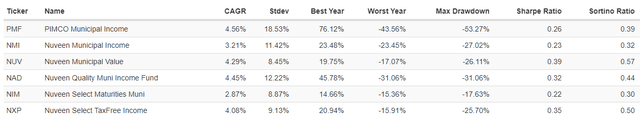

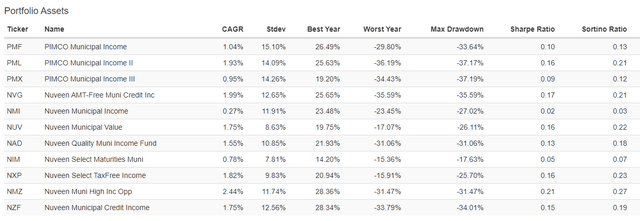

This first set compares PMF against the five Nuveen CEFs that existed at the time the PIMCO CEF started in 2001.

Over this period, PMF provided investors with the best CAGR but with the highest StdDev, resulting in one of the lower Sharpe ratios. That risk is shown in PMF achieving both the best and worst (by far) yearly performances; same with the maximum drawdown. Not your SWAN municipal bond fund! Also note that within the Nuveen universe, there is an almost 160bps CAGR difference between the best and worst performer.

Next I ran data for the last ten years, added PMF’s sister funds, and increased the Nuveen count to eight.

Over the past decade, PMF only beat two of the eight Nuveen funds, and even trailed its sister fund, the PIMCO Municipal Income Fund II (PML). Use only five year results, and PMF moves up to 3rd. Investors need to decide which is more important: total history or “what have you done recently” data.

Portfolio strategy

While first-time defaults in the first three quarters of were only 2.5% of the municipal bond market, using funds reduces any default loss. Of course, investors in a high marginal tax bracket, where there is not a fund invested only in their home state, might take that small risk to save on their state income tax.

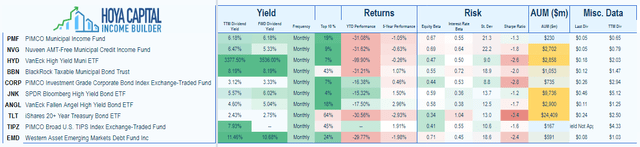

As many have stated, taxes are important, but not as much as what you keep afterwards. What I mean is look at the after-tax total return, not the after-tax yield. Here is a list of various bond fund choices.

seekingalpha.com/mp/1396-hoya-capital-income-builder/articles

Final thoughts

For another take on this topic, I found this comparison from last summer: “Muni Bond CEFs: PIMCO Or Nuveen? The Choice Is Obvious In This Market Environment.”

My previous article on PMF compared it to the PIMCO Municipal Income Fund III (PMX), the newest version of PMF. Another article reviewed one of the best Nuveen Municipal Bond CEFs; their Nuveen AMT-Free Municipal Credit Income Fund (NVG).

Be the first to comment