Orbon Alija/E+ via Getty Images

Main Thesis & Background

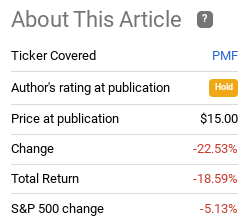

The purpose of this article is to evaluate the PIMCO Municipal Income Fund (NYSE:PMF) as an investment option at its current market price. This is a closed-end fund with a primary objective “to seek current income exempt from federal income tax.” As my readers know, I cover the muni sector regularly, and that includes looking at the PIMCO CEFs in this space. I last covered PMF specifically in August 2021, and at that time I suggested there were better alternatives out there. In hindsight, this was pretty well vindicated, with PMF performing quite poorly during that 1-year time period:

Fund Performance (Seeking Alpha)

Given both the time that has passed and my current bullishness on the municipal bond sector, I thought another review of PMF would be timely. Unfortunately, after consideration, I continue to see limited value at these levels. While the recent positive momentum and relatively attractive yield suggests to me there is some merit to holding this fund, I don’t see a compelling reason to be buying at current prices. Therefore, I will be maintaining a “hold” rating on it, and will explain why in more detail below.

The Backdrop For Munis Is Favorable

To begin, I want to touch on a few reasons why investors should even be considering munis right now. After the year we have had so far, there should be a compelling reason to buy anything right now – whether its stocks, bonds, or munis. That being said, I have discussed in multiple reviews over the past few months some reasons why I see value here. These are readily available for readers and followers to peruse, so I want dive into all the detail again here.

But, in summary, some of these attributes are:

- Continued low levels of muni defaults

- Resilient state and local government revenues

- Concerns over higher future tax rates that may drive investor interest (both individual and corporate) to the tax-exempt space.

- A rise current yields available to buyers today given that yields have spiked from the broad sell-off the sector experienced in the first half of the year.

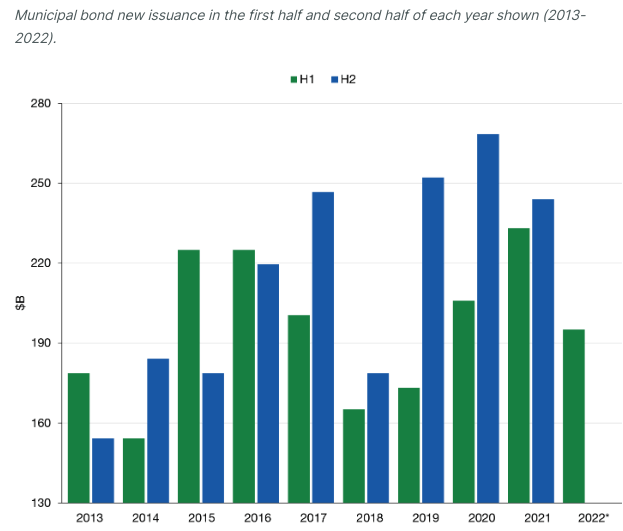

In addition to those elements, there is another that has caught my eye recently that gives me an encouraging outlook for munis as a whole. This is the supply dynamic. Likely driven by higher than expected revenues and rising interest rates, the need and desirability for issuing municipal debt has shrunk. As a result, new supply to the market has dropped significantly so far in 2021. In the first half of the year, we see volume is well below the last two years:

Municipal Bond Issuance (Per Calendar Year) (Lord Abbett)

This can be a go-forward tailwind because it means supply is relatively restrained compared to prior years. If demand picks up (and I expect it will for the reasons listed above), then this demand-supply dynamic will work to support, and probably elevate, muni prices. Buying in now gives investors a chance to front-run this if the trend remains in place in the second half of the year. I expect it will, and that is a key reason why I am not “bearish” on PMF.

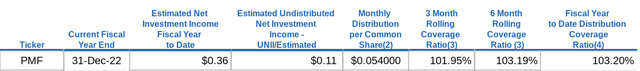

Income Metrics For PMF Give Comfort

My next point is another positive, but this one is specific to PMF. This regards the fund’s income production, which is a critical area for any income-oriented CEF. The good news is that PMF is showing very strong numbers at this juncture. The most recent UNII report indicates PMF is performing well when it comes to income production:

What this is showing is that PMF is consistently earning more in income than it needs in release through distributions (the coverage ratios are above 100%). As a result, the fund has a positive UNII balance of rough 2 months of income in reserves, a very strong point that suggests the yield is well supported and sustainable. For now, the income picture is certainly a reason to hold this fund, and at the very least keep in on the radar for those who don’t have positions.

Valuation Remains A Sore Point

I now want to shift to some of my concerns. I have pointed to multiple reasons why I like munis and some of the positives of PMF. However, I stand by my “hold” rating for this CEF, so it begs the question – why?

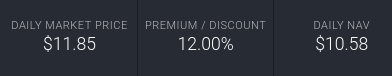

The primary among my concerns is valuation. As my followers know this is an important metric for me. Some investors do not care about valuation – whether it comes to equities, CEFs, or any other product. But I do. With this understanding it should make sense right away why I am lukewarm on PMF. Simply, the fund is expensive, with a premium to NAV currently at 12%:

PMF Valuation (PIMCO)

I have discussed my problem with these types of buy-in points many times over the years so I won’t rehash it all now. The bottom-line is this fund is pricey, and investors will need a compelling buy case to consider adding to positions at this level. I don’t see such a case, so PMF remains a pass for me at this time.

Transportation Sector Still A Concern

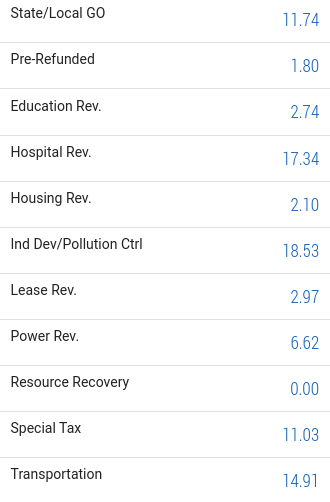

Aside from the valuation, I do have some other concerns. With respect to PMF it is worth pointing out the fund is pretty well diversified. It is a multi-state, national muni CEF, as opposed to a state-specific fund. So it offers exposure in a number of jurisdictions, as well as across a host of sub-sectors in the muni space:

PMF Sector Breakdown (PIMCO)

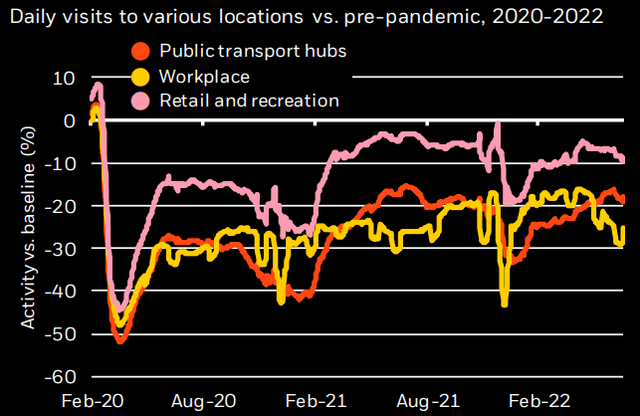

A line item that sticks out to me is the Transportation sector. This is an area I have cautious on, with respect to munis, for the time being. The reason why is that public transit was a hard-hit sector during the worst of the pandemic. While things have gotten much better since 2020, transportation utilization within the public sector remains well below pre-Covid levels:

Activity Levels (pre-Covid baseline) (BlackRock)

As the graphic shows, the macro-picture for public transit suggests ridership is still 20% lower than pre-pandemic levels. This includes subway systems, buses, light rails and trains. It can also extend to toll roads and airports, although those are areas that have come back at a quicker pace.

The conclusion I draw here is that sectors like Transportation, as well as Healthcare and private education, are still contending with the impacts of Covid-19. Revenues remain under pressure, and this clouds the outlook for the muni debt that is backed by these revenue sources. While the public continues to get more comfortable with a “back to normal” lifestyle, these could be areas that remain fundamentally challenged for a while. In fairness, this represents a contrarian play, especially for longer term investors. But I am hesitant to make such a play through PMF, given the fund’s valuation is pricing these assets at a premium, not the discount I would expect right now.

Munis Have Rebounded, Limits Upside

My last thought just touches on the state of the muni market as a whole. As I suggested, I have been buying this sector and continue to see some value in this space on a macro-level. However, we should recognize that munis – whether the individual bonds, passive ETFs, or actively managed CEFs – have mostly seen a sharp move higher over the past 4-6 weeks. This has been extremely beneficial as a long-term holder of munis, and it also was well received given how far the sector had fallen in 2022.

To be sure, this is good news. But the downside of it is that should make us pause and manage expectations going forward. This is especially true in the short-term. If we look at munis against treasuries, for example, we see the comparable attractiveness of munis has fallen sharply as prices have risen:

2-Year Muni/Treasury Ratio (Bloomberg)

Again, I am not suggesting there is not some value in munis here. I have been projecting that there has been value for months, and I still see some today. But the fact is there has been a major move higher across the board – including by PMF. This should at the very least make readers more cautious and perhaps be more selective on buy points or be buying in incremental or smaller amounts. My thought is we need to be especially careful with when and what we buy, and that is why PMF just doesn’t fit my bill at the moment.

Bottom-line

PMF has had a nice double-digit bounce in the short term, but its longer-term trajectory isn’t that great. Looking forward, I see some definitive headwinds that make me reluctant to recommend buying at these levels. The broader muni backdrop remains positive, though not nearly as positive as it did just 6-8 weeks ago. Further, PMF has a very expensive valuation which limits some of the attractiveness of the income picture, which is strong. Finally, assets in the transportation sector remain challenged, so readers should be careful when getting too aggressive with that type of exposure. All this adds up to a “hold” for me, and I suggest positions in PMF are approached selectively at this time.

Be the first to comment