stphillips/E+ via Getty Images

The industrial REIT sector is filled with long-term winners that have gotten rather pricey. This includes such names as Prologis (PLD) and Duke Realty (DRE), both of which are trading at P/FFO valuations above 30x. As such, investors who buy these names today are essentially sacrificing meaningful current income for higher income in the future.

This brings me to Plymouth Industrial REIT (NYSE:PLYM), which may be a good pick for those who seek meaningful current yield mixed in with growth. This article highlights what makes PLYM a potentially good buy for long-term returns, so let’s get started.

PLYM: Have Your Cake And Eat It Too

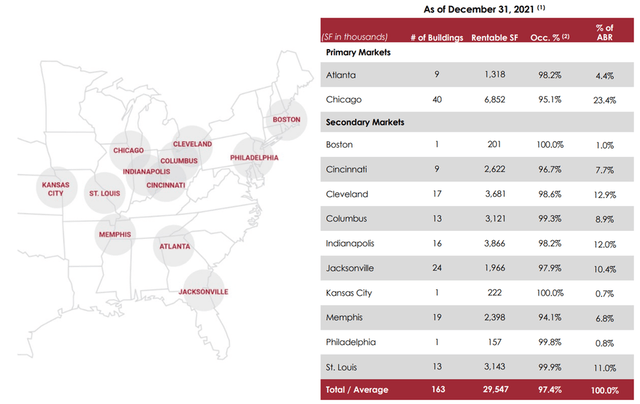

Plymouth Industrial REIT owns and operates warehouses and distribution centers across primary and secondary markets in the U.S. It currently owns 163 buildings totaling nearly 30 million square feet in the main industrial, distribution, and logistics corridors of the U.S., with a cost basis well below replacement cost.

PLYM is well-diversified, with top 10 tenants, including FedEx (FDX), representing just under 18% of its total portfolio ABR (annual base rent). As shown below, 28% of PLYM’s ABR stems from the primary markets of Atlanta and Chicago, with the remaining 72% coming from well-known secondary markets such as Cincinnati, Indianapolis, Jacksonville, and St. Louis.

PLYM Geo Mix (Investor Presentation)

PLYM’s differentiated strategy of focusing mostly on secondary markets serves as a competitive advantage, as these markets tend to be more fragmented and less competitive, thereby resulting in higher cap rates. This is reflected by the 6.2% cap rate that PLYM received on new acquisitions during the fourth quarter, comparing favorably to the ~4% cap rates that Prologis sees.

Moreover, PLYM is performing well, with a 99.9% rent collection rate during the fourth quarter, and with same store NOI rising by 7.6% YoY on a cash basis excluding early termination income and impacts of free rent related to three leases. Also encouraging, PLYM commenced leases totaling nearly 600K square feet with a robust 22% increase in rental rates on a cash basis.

Looking forward PLYM should continue to see robust growth, as supported by e-commerce trends. It’s also well-positioned for an inflationary and rising rate environment, as evidenced by its robust growth in rental rates on new leases, signaling pricing power. Additionally, higher interest rates raise the replacement cost of its properties, thereby making them more valuable.

Management sees favorable trends that benefit the industrial sector, as highlighted by management during the recent conference call:

Strength of the economy, the ongoing challenges to the supply chain and availability of labor continue to hit the headlines every time we look. We believe each of these trends is driving the fundamentals within the industrial sector, particularly within where we are focused from the first mile to the last mile. This is not only the time to own industrial buildings, but also the time to own them where we do with strong rent growth at lower relative basis and a team full of real estate operators.

Risks to PLYM include its somewhat more leveraged balance sheet, which comes with a net debt to EBITDA ratio of 6.6x, sitting above the 6.0x mark that I prefer to see for REITs. Management has made progress towards deleveraging through less reliance on debt to fund acquisitions, and I’d like to see the leverage ratio continue to trend down.

Meanwhile, PLYM pays a relatively high 3.4% dividend yield compared to its Industrial REIT peers. The dividend was raised by 4.8% this year, and comes with a low 48% payout ratio. As such, I see continued room for further increases back towards its pre-pandemic level.

I see value in PLYM at the current price of $25.80 with a forward P/FFO of 13.9, which appears to be rather cheap compared to the rest of its sector. Analysts project 2.5% to 11.4% FFO/share growth over the next 4 quarters, and have a consensus Strong Buy rating with an average price target of $30.75. This implies a potential one-year 23% total return including dividends.

Investor Takeaway

Income investors may want to take a closer look at Plymouth Industrial REIT, as it offers a high dividend yield with room for further increases. It should benefit from favorable trends, and is seeing healthy operating fundamentals. Lastly, PLYM appears to be trading at a discount compared to its peers, making it an attractive value play for both income and growth.

Be the first to comment