janiecbros/E+ via Getty Images

This is part 2 of my article on the cannabis industry. While the past year has been rough for investors in the sector, I think that is going to change in the next couple years. In part 1, I discussed a couple potential regulatory changes that could have an impact on the sector as well as the cannabis REITs that provide a way for income investors to participate. Today, I will summarize each of the MSOs that I own.

Trulieve

Trulieve (OTCQX:TCNNF) is my favorite multi-state operator and has a market cap just under $3.4B. There are several reasons for this, from the management strategy to target Florida and other important markets, to the consistent history of profitability. I think Florida is going to be a state that continues to see population inflows, and Trulieve is a dominant player there before cannabis is even legal for recreational use. The company also has strong financials and impressive growth that will eventually show up in the share price.

The valuation is dirt-cheap below $20 and investors buying today get to buy one of the best operators at a price well below fair value. The growth runway for Trulieve is very long and I think we will see continued organic growth as well as the possibility of future acquisitions. I said it in my last article on Trulieve and I’ll say it again: If I could only own one MSO, it would be Trulieve.

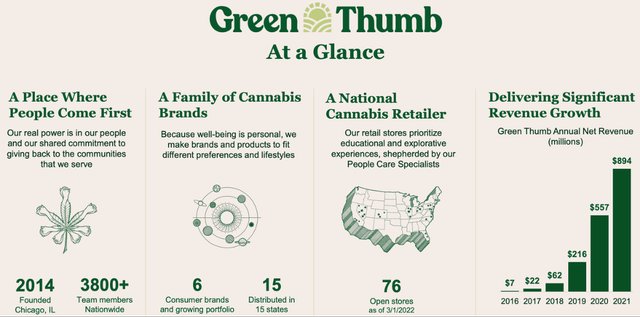

Green Thumb

Green Thumb (OTCQX:GTBIF) is a close second behind Trulieve. It is profitable like Trulieve, but it is more focused on the Northeastern United States. They also have a smaller presence in Florida, Nevada, and California. It has a market cap just under $4B as well as strong financial statements and impressive revenue growth.

Green Thumb is also extremely cheap compared to its growth potential. I plan to add to Green Thumb because they look poised for profitable growth. Green Thumb is my favorite player in the Northeast, and I expect continued expansion into other states. It’s not the only player in the Northeast, but they are my favorite for now.

AYR Wellness

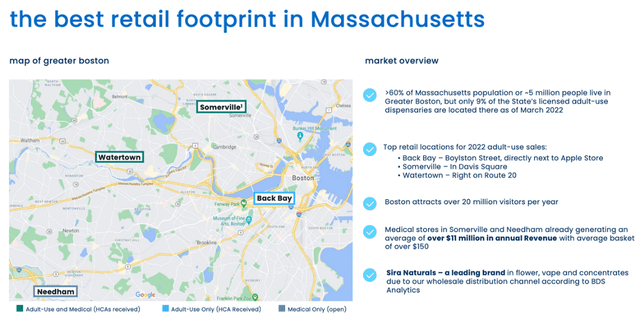

AYR Wellness (OTCQX:AYRWF) is a smaller player than Trulieve or Green Thumb, with a market cap just under $780M. They are expanding using acquisitions and have explosive revenue growth. They are not profitable yet, but they have a significant footprint in Florida as well as Massachusetts. I particularly like the Massachusetts operations, which is shown below.

AYR Massachusetts (Ayr Wellness)

AYR is cheap compared to its revenue growth. I prefer profitable growth, if possible, but I think AYR is materially undervalued and could see a huge boost with any potential catalysts. They also have a small buyback program, which is unique among the MSOs. It’s not one of the biggest MSOs, but there is a lot to like about AYR.

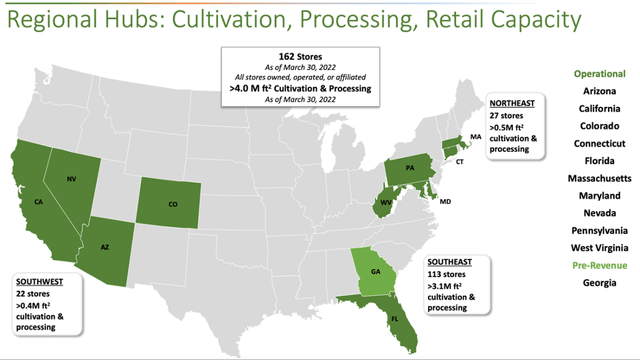

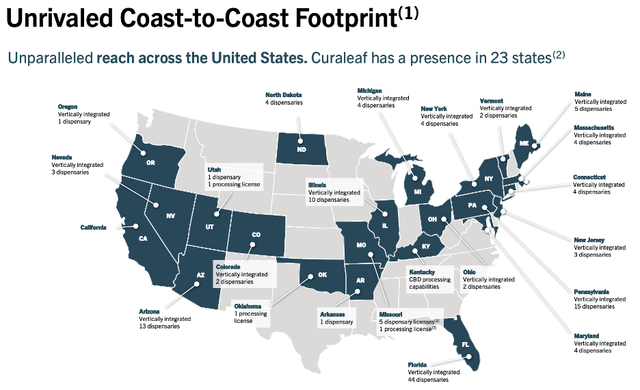

Curaleaf

Curaleaf (OTCPK:CURLF) is the largest MSO by market cap, with a market cap of $4.75B. It also has the largest footprint of any company in the industry, but they are not currently profitable. They have impressive revenue growth, but they will have to show bottom line profitability before I get more bullish on the company.

The revenue growth is impressive for Curaleaf, but I am not as bullish on the company as the first three companies listed. I have mixed feelings about the company’s strategy. Part of it is the lack of profitability, but the growth strategy seems to me like it has stretched the company thin. I have no plans to add to my small position in Curaleaf, but the upside could be significant if they are able to build a company that has operations from coast to coast that would be profitable in the future.

Cresco Labs

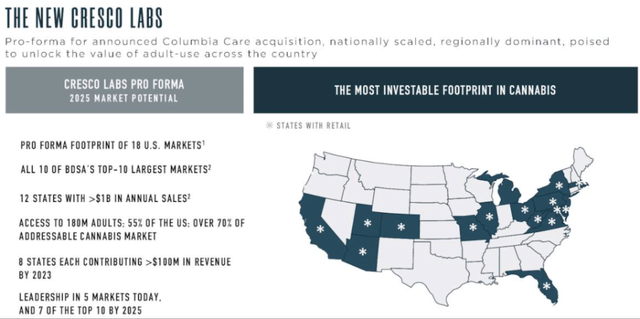

Cresco Labs (OTCQX:CRLBF) is a little different from the other large operators. They derive a significant portion of their revenues from wholesale. The company has a market cap of $2.1B, which makes it one of the larger companies in the space. Cresco was also in the news recently for its acquisition of Columbia Care (OTCQX:CCHWF), which gives it a footprint that rivals Curaleaf.

Cresco Merger Footprint (Cresco Labs)

Like Curaleaf, they aren’t currently profitable. The revenue growth has been impressive, and I like the company’s strategy more than Curaleaf, but I’m not as bullish on Cresco as the first three companies. I don’t plan to add to my position currently, and I will certainly wait until the Columbia Care acquisition closes.

Verano Holdings

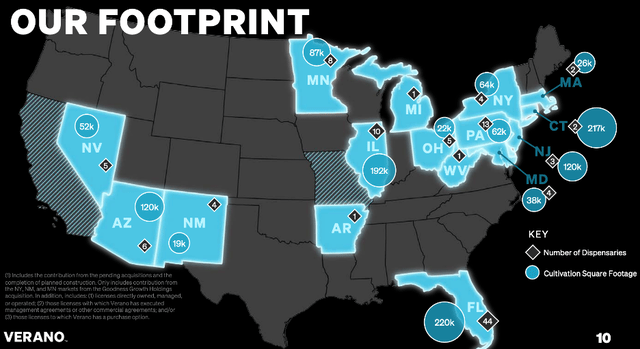

Verano Holdings (OTCQX:VRNOF) is one of the newer public companies, but they already have one of the larger footprints in the industry and a market cap of $2.8B. They focus on premium brands and the margin profile is much more attractive to me than Curaleaf or Cresco. It is a newer position for me, but I plan to add to this one in the coming months.

National Footprint (Verano Holdings)

They don’t have long operating history as a public company so it’s a little harder to evaluate, but I think the revenue growth could be pretty impressive moving forward. I like the company’s strategy and I will be following it closely to see if anything changes to impact the thesis. Overall, I’m very bullish and believe that the company is materially undervalued today.

Jushi & Planet 13 (Potential Takeouts)

Jushi Holdings (OTCQX:JUSHF) is a smaller player, with a market cap just over $580M. They are primarily focused on Pennsylvania, but this is a small position that I think could be a target for a larger operator in the future. I’m fine either way, but I think they could continue to grow at a rapid pace if they aren’t acquired, and shares are undervalued today in my opinion.

Planet 13 (OTCQX:PLNHF) is another small player, with a market cap just under $500M. They are unique in their approach to cannabis and operate a massive superstore that is the closest dispensary to the Las Vegas strip. They had approximately 10% of Nevada cannabis sales and recently opened another superstore in Orange County. While they could be acquired, there is significant insider ownership that could mean they plan to continue to grow the company instead of being acquired.

On the investor presentation, they state that a 5-year goal is to have 8 superstores across the US in the largest markets. I think this differentiated approach could provide significant upside for shares. There is more risk here than a company with many locations across several states, but I think it could be worth a small position. Planet 13 has a different approach to the rest of the operators, but I might add to my small position in the coming months.

Conclusion

Some of you might own the Canadian companies. I made that mistake once and I won’t be making it again. The US operators, especially the ones that are currently profitable with a big footprint, are poised for long-term growth that doesn’t show up in their valuation. To be perfectly honest, I’m tempted to sell Curaleaf and Cresco, take my losses, and reinvest in Trulieve and Verano.

There is one other piece that I want to leave investors with. Buying the MSOs isn’t a six-month or even one-year trade. The bullish thesis for the industry could take 5 years or longer to play out, but I think the upside could be significant. The biggest catalyst is going to be when institutional capital is allowed to flow into the sector. It will lead to a material rerating in the valuations for the sector and huge upside for investors that are already in place.

I will be keeping an eye on the industry over the coming months, but I think risk/reward is skewed to the upside for long-term investors. Fast forward to 2030 and some of these companies will have a national footprint much larger than today with profitable businesses that will generate significant amounts of cash at scale. Investors willing to start positions today while the MSOs are out of favor could be richly rewarded for their patience and foresight.

Be the first to comment