VanderWolf-Images/iStock via Getty Images

While I was researching for investment candidates, I came across Plymouth Industrial REIT (NYSE:PLYM). As the name implies, this company invests in industrial properties both strategically and opportunistically. I consider it to be a nice candidate for investment for the reasons outlined below.

Reason #1: Competitive valuation against peers

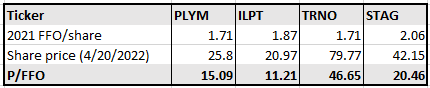

According to the company’s latest annual report, FY 2021 FFO reached $1.71 per share, showing a decrease of 8% relative to the previous year. However, guidance for FY 2022 expects FFO per share to range between $1.80 and $1.85 per share, which stands for a minimum of 5.2% increase, compared to 2021. Right now, the company’s shares are trading for $25.80, which translates to a P/FFO multiple of 15.1x and a forward P/FFO multiple in the ballpark of 14x.

For the purpose of the peer comparison, I created a peer group comprised of industrial REITs, without taking into consideration their market cap. Plymouth Industrial REIT is a small and growing REIT, so this is something that we should keep in mind when interpreting the results.

Peer group P/FFO multiple (Companies’ annual reports, table created by the author)

As we can see in the table listed above, Plymouth Industrial Properties is the second most competitively valued company, standing behind Industrial Logistics Properties Trust (ILPT), relatively, to which you can find my views in this article. One of the reasons, though, that this is not a meaningful difference in the P/FFO multiple, is that ILPT is externally managed, thus, traditionally trading at a lower multiple than self-managed REITs. In relation to the other two peers, Plymouth Industrial REIT seems considerably undervalued.

Reason #2: Strong property market fundamentals

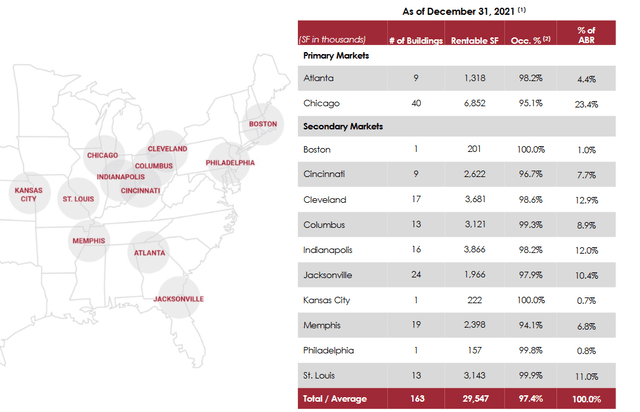

The company currently owns a total of 163 buildings with a total footprint of 29.5 million square feet. To this number, we should add the recent acquisition of Madison International Realty’s 80% in their JV vehicle, which added 28 properties with an additional footprint of 2.5 million square feet.

Plymouth Industrial REIT’s market exposure (Plymouth Industrial REIT February 2022 Investor Presentation)

As we can see in the picture listed above, the largest presence of the company, in terms of total square footage, exists in Chicago. However, this table does not include the additional 28 units purchased from the Madison’s JV agreement. Adding those, Memphis becomes the place where the company has the largest exposure in a number of total buildings and the second-largest exposure in total square footage.

First of all, the decision to buy out Madison’s stake in the Memphis properties was a good one, in my opinion. The properties are located in proximity to Memphis international airport, FedEx world hub and BNSF railway complex, and are currently leased at 97% occupancy with a weighted average lease term of 2.4 years.

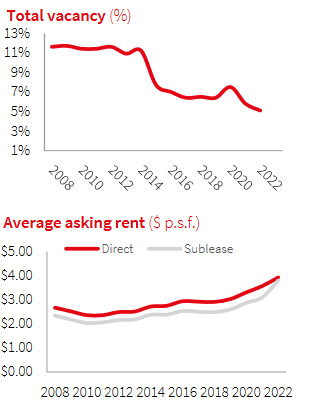

Memphis total vacancy rate and average asking rent (JLL Research)

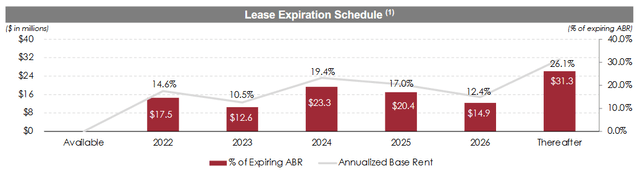

According to JLL research, Memphis industrial property market is showing robust rental growth and decreasing vacancy rates. In addition, net absorption of new space is increasing, while at the same time, new deliveries cannot meet up demand. This is good news for landlords, as rental growth is expected to continue. More specifically, a total of 1.2 million square feet of new industrial floorspace hit the ground in Q1 2022, which represents a significant drop from the 4.3 million sq. ft. delivered in Q4 2021. Such supply limitations could drive average rental rates above $4 per square foot in Q2 2022. Note that the company’s average rental rate is currently at $4 per square foot. Based on this average figure, going in cap rates in the company’s recent transactions lie in the ballpark of 5.8%, but on a deal-to-deal basis they are even better (higher). Finally, another factor that can enable the company to further exploit the current strong market is the increased percentage of leases that expire in the next few months, which gives the company the power to negotiate even better rental rates.

Plymouth Industrial REIT February 2022 Investor Presentation

Reason #3: Strong balance sheet with a minor issue

The company has almost all of its debt into fixed rate, which makes it virtually immune to base interest rate increases. Right now, total debt stands at $703 million, reaching 70% of the company’s market cap. Of this figure, $114 million are due in 2023, at a weighted average interest rate of 4.08%. The problem, though, is that the company is a serial diluter. In 2021, the company sold a total of 10.5 million shares, under its ATM program, or 34% of its total shares outstanding at the end of 2021. As of the end of 2021, the company had $38.2 million in cash and cash equivalents.

Bottom line

Plymouth Industrial REIT is a relatively cheap company right now, in relation to its peers, with no apparent reason. The company is self-managed and has exposure in markets that show strong fundamentals such as vacancy rates and rental growth. Plymouth has managed to collect all rents deferred from the COVID-19 easing measures while a significant portion of its leases expires this year, which will boost average rental rates even more. FFO growth is expected to land in the mid-single digits this year, resulting in a very competitive price multiple. Based on the above, and also having in mind the strong balance sheet with immunity to base interest rate increases, I believe that Plymouth Industrial REIT could be considered as a buying opportunity.

Be the first to comment