Ninoon

(Note: This was in the newsletter on October 27, 2022.)

Medical Properties Trust (NYSE:MPW) management has done their best to assure investors that everything is just fine. But despite an upbeat third quarter report, the market appears focused upon the climbing rate of children being hospitalized for rhinovirus and associated complications. While this event is concerning, it is important to distinguish what is going on now from what happened during the pandemic.

There is a normal busy season for this industry that goes with “flu season”. In this case, a lot of normal bugs did not “make the rounds” with children because they were at home. So, the kids are now “catching up” with the latest viruses and more than usual are going into the hospital at an unusual time. Still, there are few to no signs of a hospital overflow on the scale of what happened during the pandemic.

Nonetheless, Mr. Market is all too happy to hit the panic button with tales of outlandish and painful demises. The pandemic cancelled a lot of profitable operations and substituted a lot of patients that could not pay. Government did help, as this management clearly noted in the latest conference call. But the absence of profitable parts of the business clearly hurt operators. The market fears another rise in critical cases that would again shut down profitable parts of the hospitals, which would cause a lot of financial pain to operators way too soon after the last round of pain.

But pandemics are generally a once-in-a-lifetime event (if that often). Whereas the flu season rush (in this case, the rhinovirus and associated children’s illnesses) is generally a much lower-level affair. There is an unknown that constitutes a risk because things could unexpectedly escalate. But it is very likely that operators will continue to recover from the pandemic challenges like any other industry that has hit bottom.

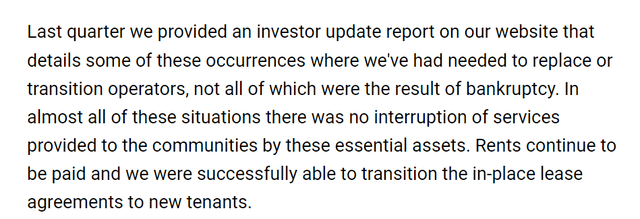

Management did mention an operator that did file bankruptcy. But they also mentioned that the same operator was likely to continue services at the relevant hospitals and pay its bills that matter to Medical Properties Trust. This points out that bankruptcy does not have to be a financially destructive affair to related parties. In fact, many times, bankruptcy is not an issue to a secured lender. What usually happens instead with secured lenders is that cash flow may be initially delayed, but generally remains undisturbed. Management has taken that position in the current case, and it appears reasonable.

Earnings

Management actually surprised the market by largely eliminating the low end of a lot of guidance, while slightly raising some other numbers.

“The company is increasing its estimate of 2022 per share net income to $1.99 to $2.01, including year-to-date gains on sales of approximately $537 million, and is also tightening its estimate of 2022 per share NFFO to $1.80 to $1.82 from a prior range of $1.78 to $1.82. MPT plans to provide initial estimates of 2023 per share net income and NFFO when it reports fourth quarter earnings.”

Source: Medical Properties Trust Third Quarter 2022, Earnings Press Release

For a company whose operators are all “headed to bankruptcy” according to the market, the above was somewhat unexpected. In fact, management appears preliminarily confident enough about 2023 (subject to unknown developments, of course) that a dividend increase appears to be a good possibility within the next twelve months.

Clearly, the market has other ideas, with the yield at more than 10% on the common stock.

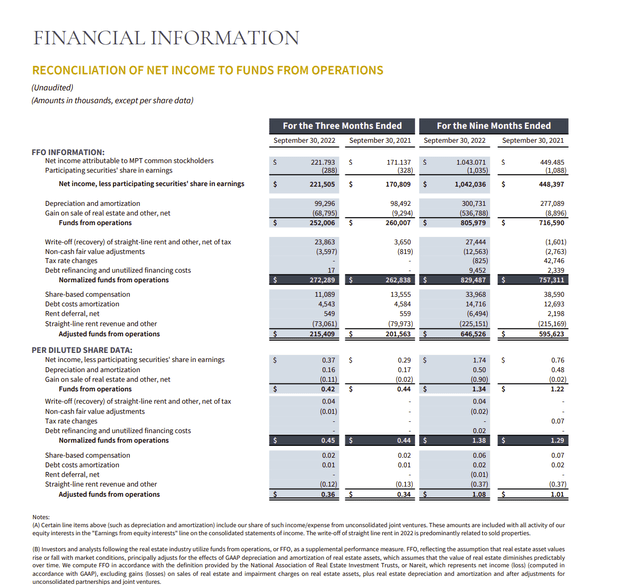

Medical Properties Trust Key Operating Results Third Quarter 2022 (Medical Properties Trust Third Quarter 2022, Supplemental Reports)

Management did mention that there is a transition from the pandemic and the grants available during the pandemic to “normal” operations. That makes any comparison above problematic because there does not have to be a smooth transition.

But the market loves a positive comparison, and management came through with exactly that. Adjusted funds from operations shows growth and that is exactly what needs to be shown regardless of changing industry conditions.

Even more importantly, that gain on sale of real estate in the current year points to anything but absolute destitution followed by financial destruction. Instead, that gain points to a return of normalcy that management has been stating for some time. So, while the market worries, it appears that buyers of the hospitals and related businesses have a different attitude.

Going Forward

Management has to some extent catered to market fears. There has been announcement of some hospital sales at about the same amount as the purchase price, along with a promise to repurchase stock.

Addressing Market Fears:

Medical Properties Trust Management Statement Of Dealings With Financially Distressed Operators (Medical Properties Trust Third Quarter 2022, Conference Call Transcript)

This discussion was followed by a very limited disclosure of what management knew about the Steward situation. But it goes with what typically happens in the early stages of any industry recovery. Typically, the market fears a quick reversal to the downturn that just ended. That rarely happens.

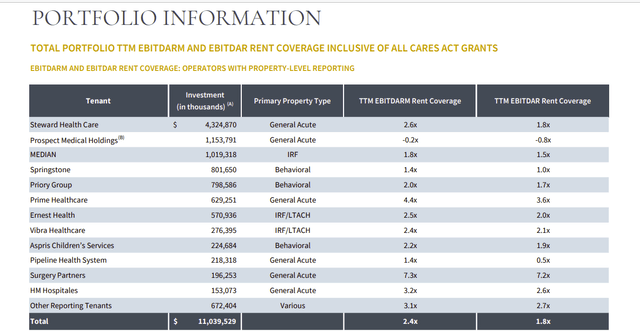

Medical Properties Trust Disclosure Of Rent Coverage By Operator For The Most Material Operators (Medical Properties Trust Third Quarter 2022, Supplemental Financial Reports)

The short attack is firmly focused on industry financial strength after a pandemic followed by a potential financial strain of the rhinovirus with the flu season coming. But honestly, the industry has handled situations like the current for a very long time. Many industries have busy seasons. That is very different from what happened during the pandemic.

As shown above, the operators clearly have the funds to pay the bill. That is really all that is necessary. The ratios above do not lead one to conclude that there is an industry-wide problem that would destroy the business model. For all the market worries about Steward exposure, the numbers above would lead an investor to believe those worries are overdone.

The shorts have focused on the bank line extension for Steward because lenders asked for more information. But bank line issues rarely bring about serious trouble, and Steward is confident about meeting the paperwork requirements. Honestly, this issue sounds like a routine type of request for extra information because the operator, like many, is recovering from the challenges of the pandemic.

Based upon current events, the current dividend of $0.29 paid quarterly appears secure when compared to the funds flow shown earlier. If anything, management is likely to make continued cash flow progress that would lead to a dividend increase. Finances appear to be fine.

The last time the company decreased that distribution was back in 2008 when the economy collapsed. There are fears of a recession because some feel that the first six months of economic decline met the simple definition of a recession. However, economic activity is by most measures very high, and unemployment is still very low. This is likely to be one of the easiest recessions to get through on record the way things are going.

In short, there is no reason to justify the current stock price action unless one takes into account a possible short seller attack. This attack is made possible by the fears generated from the bankruptcy of one operator, followed by fears of overflowing hospitals with the current rhinovirus situation and the flu season on the way. There are other considerations as well. But it appears far more likely that the current challenges will allow business to essentially return to normal with a busy season. That is very different from what happened during the pandemic. Sooner or later, Mr. Market will realize the difference and the stock price will recover.

Be the first to comment