Petmal

In an article published last January, I concluded that Plug Power Inc. (NASDAQ:PLUG) has a very interesting story to tell, but I had to remain on the sidelines back then as the company’s financial performance, in my opinion, was not as attractive as the story it was selling. As an investor, I look for a great story that can be backed with numbers. but Plug Power was missing the numbers component back then. After revisiting the company, I now find Plug Power much more attractive than I did last January, and this has prompted me to consider investing in PLUG stock.

The impact of the Inflation Reduction Act of 2022

President Joe Biden signed the Inflation Reduction Act of 2022 (IRA) into law recently, which is widely believed as the single biggest climate package in the history of the United States. The IRA will not just focus on climate change but also on expanding Medicare benefits, lowering health care costs, and creating jobs, but in this analysis, my focus will be on the climate change initiatives introduced by this legislation. Signing the bill into law, President Biden said:

This bill is the biggest step forward on climate ever, and it’s going to allow us to boldly take additional steps toward meeting all of my climate goals.

IRA contains clean energy tax credits and clean energy investments worth $369 billion and the bill targets to reduce greenhouse gas emissions in the U.S. by a staggering 40% from the 2005 levels by 2030. Plug Power CEO Andy Marsh released a YouTube video yesterday applauding the current administration for passing this bill and speaking on CNBC a few days ago, Mr. Marsh claimed that this bill will help Plug Power close the gap with traditional energy producers. The CEO went on to reassure that Plug Power is well-positioned to reach profitability by 2024.

As the leading provider of hydrogen fuel cell solutions in the United States, policy decisions that support the growth of clean energy will be a blessing for Plug Power. That being said, we need to carefully look at the provisions in IRA to identify whether this bill has the potential to meaningfully impact Plug’s financial performance in the coming years.

Below are the key takeaways from the clean energy provisions included in the Inflation Reduction Act.

- The Act supports a reduction in greenhouse gas emissions regardless of the sources used to replace GHG-emitting energy sources. Hydrogen fuel cells, carbon sequestration, and conventional clean energy industries such as solar energy will be winners as a result of these provisions. The Act, in other words, does not necessarily promote hydrogen fuel cells over any other clean energy source.

- Qualified clean hydrogen producers will be eligible for a tax credit of between 60 cents and $3 per kilogram of clean hydrogen during a 10-year period beginning on the date such production facility is placed in service (through 2033). This is probably the most important policy decision for Plug Power investors.

- A 30% investment tax credit for energy storage technologies constructed by January 1, 2025.

- Tax credits for the construction of carbon capture facilities.

If we go a step further, we can see that provisions in the IRA will materially benefit Plug Power and the green hydrogen industry. The United States is already the cheapest producer of hydrogen in the world. According to data from S&P Global Platts, the production cost of grey hydrogen ranges between $1.71-$2.18 per kilogram in the U.S. whereas green hydrogen produced with renewable energy and electrolysis costs between $3.73-$6.50 per kilogram. Qualifying companies that make full use of the $3 tax credit, therefore, will be well-positioned to directly compete with grey hydrogen in the coming years. This will be a massive leap forward for the green hydrogen industry as cost parity with grey hydrogen will open many new doors for growth.

Plug Power’s financial performance needs a boost

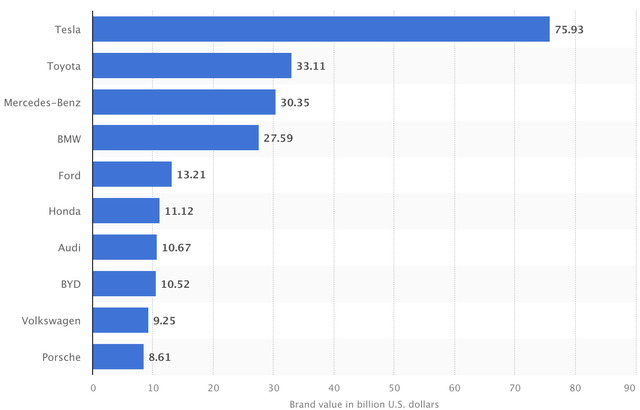

Coming up with a great story to tell is a good start for any company. Think of Tesla, Inc. (TSLA) a few years ago. The company had a great story to tell – one that promised to transform the global automobile industry permanently with electric vehicles. Today, with Tesla, we are seeing not just the story but a notable improvement in its numbers too. The combination of a great story and promising numbers has helped Tesla become the most valuable car brand this year.

Exhibit 1: Most valuable automotive sector brands as of June 2022

That’s Tesla for you. Can Plug Power achieve a similar feat? The story is already there but Plug Power has so far failed to become profitable or cash flow positive. As (potential) investors, we need to dig deep to understand the reasons behind this lackluster bottom-line performance on the back of meaningful revenue growth.

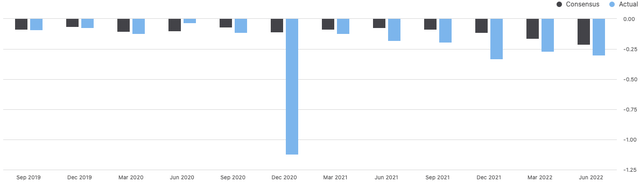

In the most recent quarter, Plug’s costs grew faster than revenue, once again exerting pressure on profit margins at the operating level. Hydrogen procurement costs have dramatically increased this year with rising natural gas prices, and this had a lot to do with this sharp increase in Plug Power’s costs. The provisions included in the Inflation Reduction Act are likely to help the company see some improvements in its operating margins in the next 12 months, but for the company to truly unlock its potential, Plug Power’s massive investments in green hydrogen plants need to yield positive results. The company yet again failed to meet Wall Street expectations in the second quarter, which extended the streak of earnings misses to 8 consecutive quarters.

Exhibit 2: Earnings surprise history

From a strategic perspective, I believe Plug Power is moving in the right direction by focusing on providing comprehensive hydrogen solutions to its customers instead of focusing on one aspect of the value chain such as hydrogen fuel or fuel cell technology. The downside to this strategy is that Plug Power will have to invest millions of dollars to build production facilities to cater to all the green hydrogen requirements of its customers. This strategy has so far kept the company’s profit margins under pressure, and I do not see things changing in the foreseeable future either. This is not a bad thing. Plug Power could potentially emerge as the only 360-degree green hydrogen solutions provider in the world in a few years, enabling the company to expand from serving the material handling industry to on-road transportation. This will help Plug Power tap the mass market opportunity for clean energy solutions through green hydrogen fuel and its fuel cell technology. The inflection point that will change the financial story of the company will occur when Plug expands from the material handling business to other end markets that cater to the mass.

Plug Power’s production expansion plans in Georgia, Louisiana, New York, and Belgium will cost the company short-term profits, however, the company is doing the right thing by unwaveringly focusing on the long-term opportunity. Carving out competitive advantages in the green hydrogen market, in my opinion, will pave the way for Plug Power to earn handsome profits in the long run.

Takeaway

Plug Power is increasingly becoming investable. Despite cost pressures, I believe the company is much more attractive today than it was last January. With a strategy focused on long-term returns, Plug Power is headed in the right direction to dominate a niche market in the energy sector that could soon prove to be a market with a multi-billion-dollar opportunity. Favorable policy decisions will accelerate Plug Power’s mass-market entry, and this could serve as a catalyst in helping the company turn profitable.

Be the first to comment