Neilson Barnard/Getty Images Entertainment

The early pandemic-era SPAC boom has become a case study of what happens when unfettered euphoria meets the peak of cheap money and large-scale government stimulus. This would see an eclectic range of companies go public from EV manufacturers and space companies to PLBY Group (NASDAQ:PLBY) – the parent company and owner of the popular Playboy men’s lifestyle and entertainment magazine. The print magazine was launched in 1953 with a cover that featured Marilyn Monroe and would run for decades until the pandemic morphed the magazine to an online-only format.

Why should investors care about a boomer-era company whose ideals some might say now looks out of touch and somewhat antiquated? Well, because Playboy is a pervasive brand that has allowed its parent to expand into new revenue-generating verticals.

Up to two-thirds of Playboy’s revenue is now generated from merchandise sold on its website. Further, most of these sales are from millennial and Gen Z customers with more than half of this revenue coming from women. Hence, whilst it might seem that Playboy’s go-public move was yet another attempt by a brand whose relevance peaked in the 90s, it was a careful move by the company to reinvent itself as a digitally savvy firm and tap into the opportunities across many different industries that its brand will garner.

The Playboy brand forms the defining base of a long position in the company’s common shares. It’s a national American icon that has played an important part in the cultural revolutions in the later part of the 20th century including the liberation of women’s sexuality. An investment in PLBY is a play on the staying strength of its brand in the 21st century. Fundamentally, it’s an asymmetric bet that the company can navigate the digital landscape with a name that entered the lexicon as a print magazine seven years after the end of the Second World War.

PLBY Group Set To Be An Evolution Of Playboy

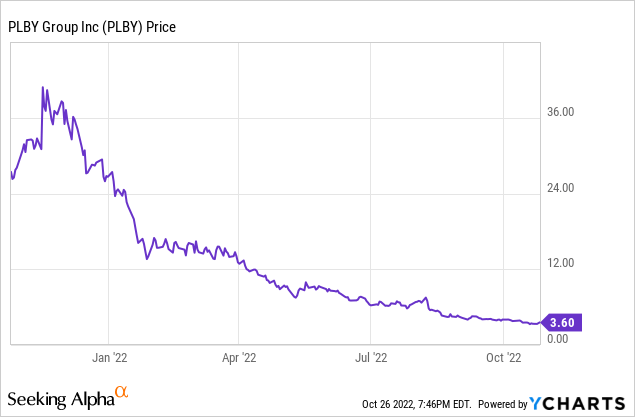

Playboy’s common shares currently trade for $3.60 for a market cap of $163 million. This is materially lower than its pro forma valuation of $415 million when the company went public and is just over 90% lower than the $1.7 billion valuation it garnered at its 52-week peak of just over $43.

The currently dire investor sentiment has been predicated on the general stock market malaise wrought by a hawkish Fed hiking interest rates in an increasingly desperate fight to tame runaway inflation. The era of cheap money that catalysed the boom that saw Playboy go public is all but over. The hard work to get common share prices back up will be built on strong and stable financials. In this, consistent and healthy revenue growth with a positive or close to positive bottom line will be the primary determinants of alpha against the continued uncertainty and economic disruption that awaits in calendar 2023.

PLBY

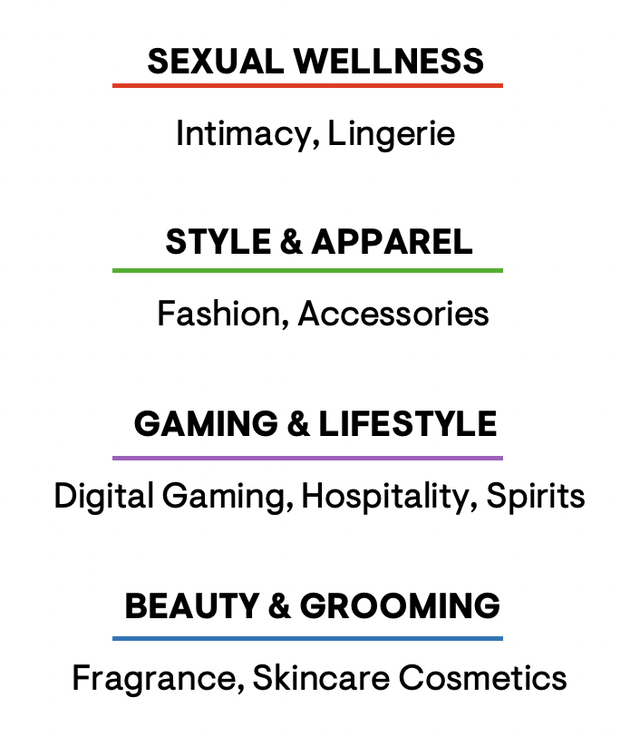

Playboy is arranged into four lines of business; (1) Sexual Wellness; (2) Style & Apparel; (3) Gaming & Lifestyle; and (4) Beauty & Grooming. The first two generate the bulk of the company’s revenues with recent acquisitions most recently of Honey Birdette, a luxury lingerie company, focused on consolidating the strength and boosting the growth of these divisions.

The company’s last reported earnings for its fiscal 2022 second quarter saw revenue come in at $65.4 million. This was an increase of 31.1% from the year-ago quarter but a miss of $5.52 million on consensus estimates. Gross margin of 57.18% brought in a profit of $37.4 million but came in at a sequential decline of 118 basis points. A deterioration partly due to higher margin licensing revenue being flat year-over-year at $15.9 million. Net loss of $8.3 million was an improvement from a loss of $8.9 million in the year-ago quarter.

The quarter was quite mixed with revenue growth coming in below estimates on the back of a more challenging microenvironment. Real wages are collapsing as inflation bites harder and longer than most economists predicted. The company’s management stated that they are focused on controlling costs against these headwinds whilst building out the Playboy ecosystem and continuing to leverage the strength of the brand.

Hands In Everything, Meet The New Playboy

Far from being an antiquated brand out of place in 2022 and clinging to a long-lost prestige, Playboy remains an iconic lifestyle brand with a large reach and strong global consumer appeal. The company stands to maintain a healthy pace of revenue growth on the back of its diversified go-to-market strategy and Centerfold, a platform for creators. Centerfold allows creators to post media and interact with their subscribers and is a response to the dominant OnlyFans. Management has described the platform as the engine for the broader group and a strategic asset to drive organic customer acquisition.

I’d welcome them to share more metrics around Centerfold subscribers and GMV and efforts to improve the robustness of the platform. A potential virality of this subscription line of business would form a huge boom to the bull case and would likely support an uplift of shares. PLBY is one to watch until more clarity on Centerfold can be attained.

Be the first to comment