Parradee Kietsirikul

Aker Carbon Capture (OTCQX:AKCCF) is the only pure-play carbon capture company. It was spun off from Aker Solutions in 2021 and only has a market cap of ~$700M. Aker was also among the first movers in the carbon capture market, and had significant testing runs at commercial scale as early as 2012 at the Technology Centre Mongstad in Norway. Aker’s technology is similar to the Shell’s (SHEL) CANSOLV technology in that it utilizes an amine to capture CO2.

Amine processes

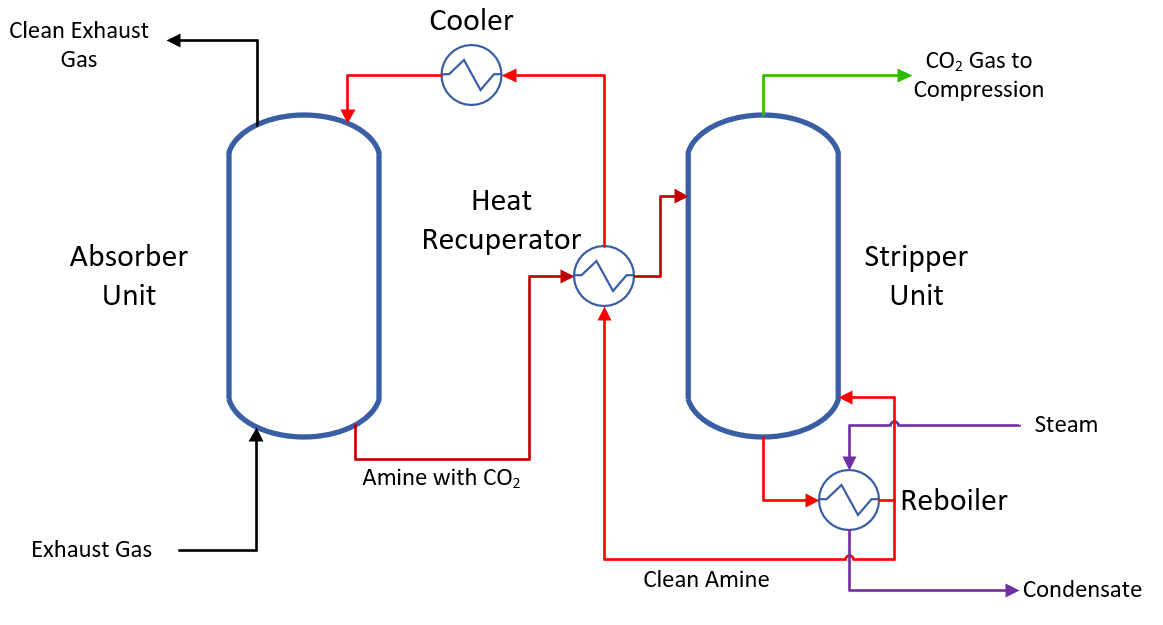

Simplified process flow diagram of a generic amine process (Author)

A high-level flow diagram of the amine system is show here. These systems use amine chemicals that are dissolved into water. A gas containing CO2 enters an absorber tower where the gas comes into contact with the water-amine mixture. The dissolved amines chemically bind CO2. The water-amine-CO2 mixture is pumped into another tower, called a stripper unit, that heats up the mixture until the chemical bond between the amine and the CO2 breaks and the CO2 is released as a gas. The CO2 leaves that unit with some water vapor and a very small amount of amine. The regenerated water-amine mixture is then ready to be cooled back down and put into the absorber unit and pick up more CO2. The gaseous CO2 must then be compressed to high pressure before it is put in a pipeline for transportation.

Absorption-based technologies use steam to provide the necessary heat to break the CO2-amine bond, so the CO2 can be released. Most of the time, the energy used to run an amine process comes in the form of steam that could be otherwise be used to do work such as generating electricity. That steam is most almost always provided by some sort of combustion.

Aker’s solvent is the result of 8 years of R&D into different solvent mixtures. They claim that their solvent is more robust and less energy intensive than alternatives. They do have over 50,000 hours of testing under their belts in Norway, Germany, Scotland, and the USA.

The Carbon Capture Project Pipeline

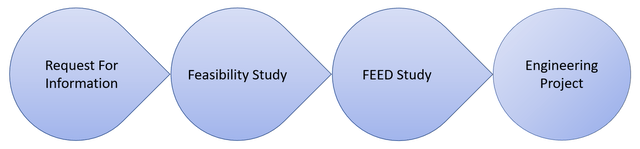

Large engineering projects such as carbon capture plants take time to secure. The projects typically follow the steps depicted here.

Steps for carbon capture engineering projects (Author)

The end user interested in purchasing a capture unit sends out a request for information from anyone interested in pursuing the project. Government entities typically send out a request for proposal or funding opportunity announcements. Companies typically just send out a preliminary request for information or request a high-level bid from technology providers they know and trust. The end user down selects from bids received and then funds one or more feasibility studies performed by the technology developer(s). A feasibility study establishes if the project is viable technically and justifiable economically.

The next step is a FEED study, short for front-end engineering and design. The technology provider does a much more in-depth design of the proposed plants, including simulations, layouts, drawings, hazard and operability analysis, environmental impact studies, control schemes, electrical diagrams, piping & instrumentation diagrams, etc. Again, this stage is funded by the end user. This phase is typically followed by a final investment decision where the end user arrives at a decision of whether to proceed with detailed engineering, procurement, and construction.

My goal isn’t just to explain how these projects take place, but also to point out that revenue is actually generated for the technology provider in all three of the final project steps. While it’s true that the bulk of revenue comes in the last stage, any good engineering firm will have positive margins in the feasibility and FEED study portions of the process as well. To get an idea of the cost of these projects, the recent FEED studies funded by the US Department of Energy for full-scale carbon capture systems typically have a total project cost from $5M-$10M.

Differentiation

As a company that is 100% focused on carbon capture, Aker Carbon Capture also has developed some interesting niche marketing and go-to-market strategies. They have constructed a small-scale portable system that they can rent to provide on-site testing to potential clients. They also have a unique approach to the small and mid-scale commercial market. Aker has developed of modular systems that can be purchased or used for carbon capture-as-a-service.

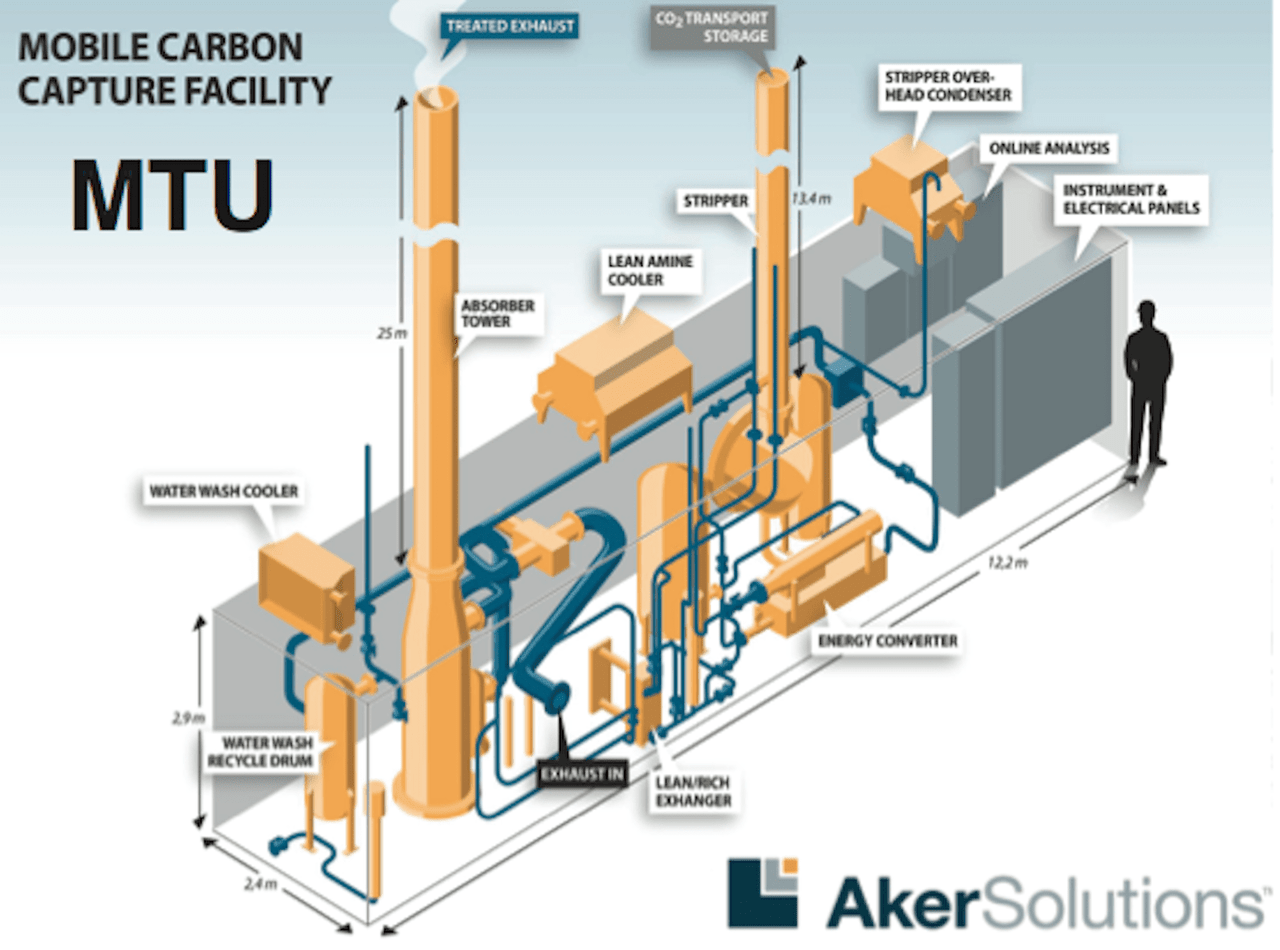

Mobile Carbon Capture Facility

The benefit of developing a mobile test unit is that it allows clients to see the Aker technology in action on their exhaust gas before making a decision on whether to fund a study or sign a contract. Aker built a miniaturized version of their process into shipping containers that can be transported to various test sites to test the process on a specific flue gas. The decision to build a large full-scale carbon capture plant represent hundreds of millions or billions of dollars in capital. Having the assurance that the Aker technology has been tested at your plant, albeit at a very tiny scale, provides peace of mind for customers. This is particularly the case in new applications where the gas has particulates and pollutants that can lead to accelerated degradation of the amine chemical. As covered in my previous article on Shell’s CANSOLV, this was a big reason for the poor performance of their system at Boundary Dam.

Aker’s Mobile Carbon Capture Facility (Aker Carbon Capture)

Modularized Systems

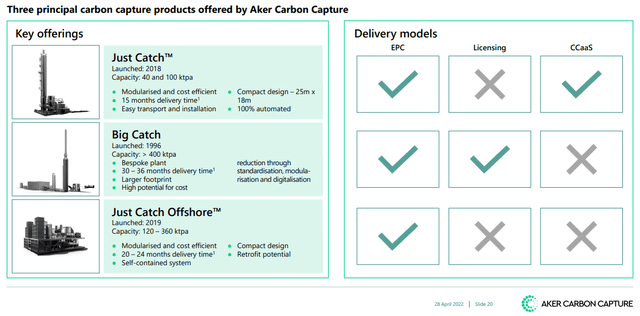

Aker has taken a slightly different tack to selling their carbon capture systems. At large scales greater than 400,000 tonnes per annum (TPA), they offer their “Big Catch” system, a fully customized solution unique to the source plant. This is the same method most carbon capture plants use. However, for smaller scale applications, they have developed a “Just Catch” modular systems. They have two predesigned systems, one that can capture 40,000 TPA and another than can capture 100,000 TPA.

Remember that the usual workflow for building a carbon capture plant, the end user pays for a feasibility study and FEED study. FEED studies can be especially pricey as seen above. For a smaller commercial operation interested in capturing 40,000-400,000 TPA, the cost of the FEED study is proportionally a much larger than a large-scale cement kiln or power plant. Having a pre-engineered system that is ready to plug and play becomes an attractive option because it removes a lot of the cost for feasibility and FEED studies.

Aker Carbon Capture Offerings (Aker Carbon Capture)

They also offer “Just Catch Offshore”, another modularized system designed to capture CO2 from offshore oil rigs and floating production storage and offloading units. This is of particular relevance as a Norwegian company, since Norway has a significant amount of offshore oil and gas rigs and are particularly keen on cleaning up their CO2.

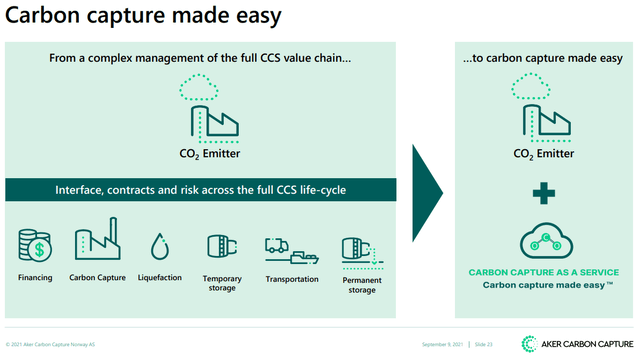

Carbon Capture-as-a-service

Aker has one more very unique offering. Last year they introduced an offering that would allow end users to pay based on CO2 captured rather than funding the plant construction and owning the plant themselves. Using their modular plants, Aker would set up shop at the CO2 source and take care of the entire project including initial financing, construction, operation, liquefaction, transportation, and storage. The end user would agree pay a fixed or variable cost per tonne of CO2. Aker owns and operates the plant and secures a recurring revenue stream. It is a novel approach that, as of yet, is untested. It has the potential to backfire if their levelized cost per tonne of CO2 is higher than planned. However, the creativity and unique structuring of their offerings gives them advantages for small and medium-sized emitters.

Carbon Capture-As-A-Service (Aker Carbon Capture)

Current Commercial Projects

Aker has not yet had a high-profile project like Shell at Boundary Dam or Mitsubishi Heavy Industries (OTCPK:MHVYF) at Petra Nova. That is about to change. They were selected in 2020 as the technology provider for a 400,000 tonne per day capture plant at the Brevik cement plant. Aker did have a leg up on the competition as a Norwegian company competing for Norwegian capital that was earmarked for work in Norway, but that does not minimize the importance of this project. It also certainly helped that they performed successful tests at this exact plant with their mobile test unit in the past. If successful, Aker will be the first full-scale carbon capture plant at an industrial cement kiln.

Cement kiln in Brevik (Wikipedia)

If you’ve read my previous article, you’ll understand that no matter what happens with power and renewables, industrial sources of CO2 such as cement plants are among the hardest to decarbonize and most essential. We cannot build the modern world without cement, and for every tonne of cement, approximately 600 kg of CO2 is emitted. Cement effluent is dirty, laden with particulates, and often has high pollutant concentrations. This is exactly the type of gas that typical amine systems struggle to capture without high amine losses. If Aker can do it, it would prove that their amine truly is more robust than alternatives.

Another key differentiator for this plant will be heat integration. Aker has designed it to make use of the waste heat from the cement plant and their own compression systems to drive amine regeneration and CO2 release. If they get this right, it will be the first commercial absorption system that requires no steam. If they do not need to build an ancillary natural gas combustion plant to supply steam, that is a huge win for their technology.

There will always be growing pains scaling to full scale for the first time. However, if they hit their main targets, it will give other companies the confidence they need to book more projects with Aker. The plant is expected to start operations in 2024

The Pipeline

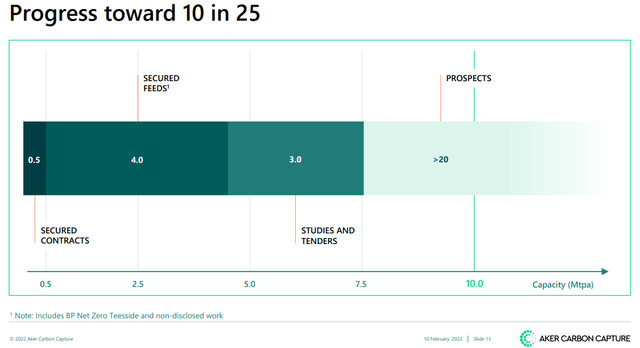

Aker has ambitious goals. They want to have signed contracts for capturing 10 million TPA by the end of 2025. In addition to the Brevik project, they signed a contract in November 2021 to build a 100,000 TPA facility in the Netherlands at a waste-to-energy plant in the Netherlands. This brings they’ve secured contracts for only 5% of their stated goal. However, the pipeline for more projects is expanding quickly. As of 4Q21, they had FEED studies for an additional 4 million TPA and another 3 million TPA of projects at the feasibility study level.

Progress toward 10M TPA goal as of 4Q21 (Aker Carbon Capture)

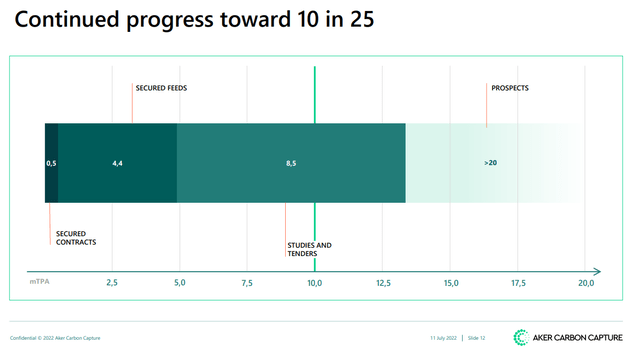

Six months later, by the end of 2Q22, this had expanded to 4.4 million TPA of FEED studies and 8.5M TPA of feasibility studies.

Progress toward 10M TPA goal as of 2Q22 (Aker Carbon Capture)

Risks

Competition

There is huge competition in the carbon capture space, specifically in the amine absorption space. There are huge players here with deep pockets (like Shell) that have already hit the scale that Aker is still reaching for. There are also emerging second-generation technologies such as the solid sorbent capture bed offered by Svante, Chart Industries’ (GTLS) Cryogenic Carbon Capture, and Air Liquide’s (OTCPK:AIQUF) (OTCPK:AIQUY) Cryocap technology. The emerging carbon market is rapidly expanding and there is certainly room for Aker’s technology to take a significant piece of the pie or even become highly profitable just from carving out their own niche. However, significant competition is and will continue to be a risk.

Technology

The Brevik plant is attempting to capture CO2 from a cement kiln at a scale that has never been accomplished before. That alone is a daunting task. However, Aker has also chosen to forego generating steam to run their stripper column, electing instead to integrate with the existing plant and use their waste heat to regenerate their amine. As was covered in my article about Shell, one of the main reasons their project went over budget at Boundary Dam was from complications that arose from drawing steam from the power plant’s existing steam cycle. It bears repeating that it caused so many headaches and was so expensive that when the next full-scale retrofit carbon capture was built at Petra Nova, rather than taking steam or heat from the existing plant, Mitsubishi Heavy Industries decided to build a brand new natural gas-fired plant to provide the steam in for the capture unit. The heat integration in Aker’s Brevik plant might make or break the success of their project. These are risks that must be considered.

Execution and Profitability

Aker has developed some novel approaches to their plant design, marketing, and diversified offerings. However, they have not yet demonstrated that they can operate profitably. Right now they are highly unprofitable and have negative free cash flow and negative earnings. They have a large cash position relative to debt and cash burn, so bankruptcy is not a threat for now, but they will have to continue to increase their pipeline and secure additional contracts to make it to profitability. There are significant incentives and low-cost financing available for green projects, but that will not help if they cannot get the unit economics right or if the technology falls flat. This is an unproven business model built on top of an unproven technology. They do have over 50,000 hours of operation under their belt with their smaller systems, but scaling up has proved challenging for every carbon capture system, and there will certainly be growing pains for Aker as well.

Is Aker a Buy?

As established in my first carbon capture article (read there for more details on why I chose these criteria), in order for carbon capture to impact a company’s stock, it’s going to have to hit on each of these criteria:

-

Market cap – The CO2 market will be in the tens of billions in this decade. A company needs a market cap small enough for this to make a meaningful impact on revenues and profits

-

Scale – Technology Readiness Level of 6 or higher or with a currently funded project to reach that scale

-

Economic viability with 45Q – Have to be able to produce CO2 at or under $85/tonne for point source capture, or $180/tonne for direct air capture.

Aker’s market cap of under $1B makes it a perfectly sized company to be able to capitalize on the emerging CO2 market. What’s more, they achieved a TRL of 6 over a decade ago, and their cost estimates show that they are able to produce CO2 at a cost below $85/tonne. They are, therefore, the first company I’ve reviewed who passes all three criteria.

Aker Carbon Capture is a speculative but high-risk buy at these levels on the strength of their two commercial contracts and pipeline of potential projects at the feasibility, pre-FEED, and FEED study levels. Those studies are paid for by the potential end users and are contributing revenue right now. Aker checks all the boxes of market cap, scale, and economics if they execute. However, I want to stress that this is a very speculative buy because of the risks involved. I would only allocate a very small position (<1%) of any portfolio at this time due to risks outlined. If the Brevik plant flops, it will severely damage their reputation and most likely crush the stock. It still would not necessarily be a death knell for the company as Shell has bounced back from a disappointing first attempt and has received a second full-scale capture project.

There is also very high upside. If the results of the Brevik plant are positive, a slew of future contracts are sure to follow, and the company and stock could absolutely take off. The plant is scheduled to start operations in 2024, so for those who are more risk averse, it would make sense to wait and see the results before starting a position. I am monitoring the situation closely and while I have not yet initiated a position, I am considering starting a teaser position depending on what I see after their earnings next week on November 1.

Be the first to comment