Ungrim/iStock via Getty Images

Investment Thesis

Planet Labs (NYSE:NYSE:PL) surprised investors with a trifecta of positive results. Not only did it beat fiscal on the topline and bottom line, but it delivered very welcome news that it sees a path to improve its gross margins.

This goes to the core of the bull case, that Planet Labs’ one-to-many data subscription business model should see improving profitability as it reaches scale.

The stock is not the cheapest opportunity around at 7x next year’s revenues. Nevertheless, anyone that hasn’t sold this name by now, isn’t going to look to sell on the back of these results.

All in all, I assert a buy rating on this stock.

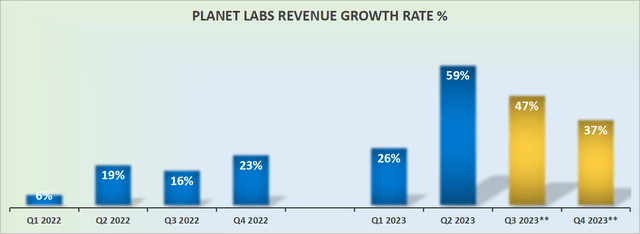

Planet Labs’ Revenue Growth Rates Jump Higher

Back in Q4 2022, when Planet Labs guided for its fiscal year 2023, the midpoint of its guidance pointed to $180 million in revenues. Then, it marginally upwards revised its midpoint fiscal 2023 guidance to $182 million when it reported its Q1 2023 results.

And now, on the back of its Q2 2023 results, Planet Labs once again upward revised its guidance to $186 million at the midpoint.

Planet Labs came to the market via a SPAC. Consequently, without any further insights, you would obviously expect its share price to have fallen significantly. And indeed, that’s the case, with its share price down at least 40% in the past year.

There’s a lot to like here, let’s move to the next section.

Planet Labs’ Near-Term Prospects

Planet Labs aims to sell its geospatial earth observation data to government and commercial entities. The way Planet Labs’ business model is set up is that it sells its license to one customer, irrespective of how many users are on an individual license.

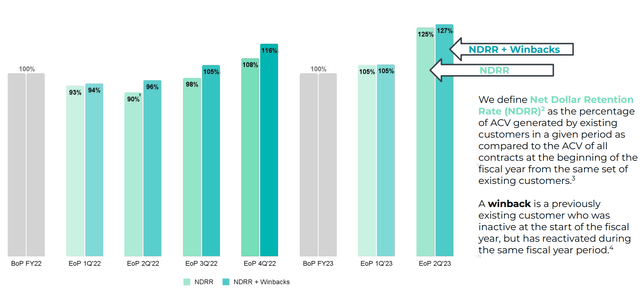

Along these lines, we see that customer growth rates were up 16.8% y/y. But where Planet Labs truly shone through in the recent quarter was its net dollar retention rate (”NDRR”), which increased to 127% including winbacks. Winbacks are inactive customers that reactivated their contracts.

As you can see from the graph above, the NDRR jumped substantially from Q1 2023, when it was at 105%.

Moving on, the bull case here is that Planet Labs can look to better monetize its increasing customer base without the need for further product costs.

The bulk of the business is to be found in increasing its sales and acquiring customers. And that once the customers are onboard, there’s no further spending required.

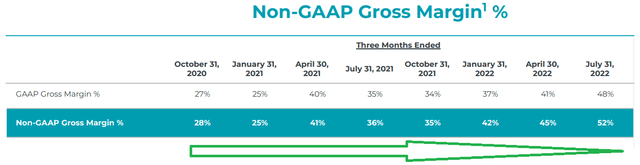

Profitability Profile Set to Improve

As alluded to already, Planet Labs’ profit margin should improve over time, as it’s able to spread the same level of costs over more revenues from more customers.

And that’s exactly what we can see above. Even in a short period of time, its non-GAAP gross margins in fiscal Q2 2022 went from 36% to a whopping 52% in fiscal Q2 2023. That’s a 1,600 basis point expansion y/y.

What’s more, looking ahead, this expansion doesn’t appear to be slowing down, as fiscal Q3 2022 reported 35% in non-GAAP gross margins, while fiscal Q3 2023 is guided at the midpoint to 48%, which is again a 1,300 basis point improvement y/y.

This is a business that’s on the right path, at a time when the market is attempting to sieve through all the SPACs and see which of these businesses could in time actually become a sustainably profitable enterprise.

PL Stock Valuation – 7x Next Year’s Revenues

Now, this is where things get slightly complicated. Planet Labs is working off a small revenue base. And getting sufficient confidence in the sustainability of its growth rates into fiscal 2024 poses a problem.

Can Planet Labs grow its revenues next year by 30%? That’s a tough hurdle, particularly given the very strong growth expected for fiscal 2023.

That being said, analysts following the company believe that Planet could actually increase its revenues next year by as much as 40% CAGR!

In that case, the stock is priced at just under 7x next year’s revenues.

For my part, I have some doubts that Planet Labs could grow sustainably its revenues by 40% CAGR next year. After all management during the earnings call said:

The timing of rev rec [revenue recognition] in some accounts can be tied to the usage of those customers. So when they exceed the usage that we kind of anticipate above the minimum, then that will cause the revenue to be recognized earlier than we may have otherwise anticipated.

Indeed, as noted in the quote above, the business model uses both fixed and usage-based revenue models. And the problem with usage-based revenue models is that nobody wants to pay more to use a platform than what they previously believed they were going to pay. You can think of a very expensive phone bill. You are not going to be happy to get that!

I have followed many businesses over time and in my experience, I’ve not found one successful usage-based revenue model, with examples ranging from Fastly (FSLY) to Twilio (TWLO).

The Bottom Line

I have no doubts that this was an impressive quarter from Planet Labs. The issue that I have is in gaining enough confidence to pay 7x next year’s revenues.

That being said, I note throughout Planet Labs is evidently resonating with an increased customer base, as well as seeing an improvement in dollar-based net retention.

Hence I put a buy rating on this stock, but I’ll watch the company closely to see if in the coming quarters there’s enough insight to convince me of its 40% fiscal 2024 revenue growth rate.

Be the first to comment