Sundry Photography

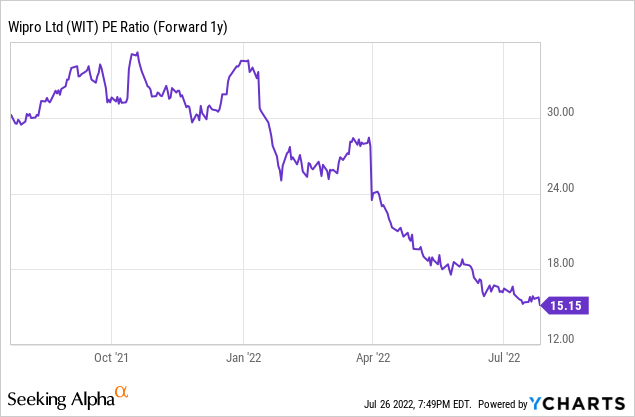

Bangalore-based Wipro (NYSE:WIT) has delivered some impressive top-line growth numbers following a change in guard at the top, but growth is beginning to slow, and with a global economic slowdown on the horizon, I see limited upside to near-term growth estimates. The recent quarterly result did little to assuage concerns, as organic revenue growth and margins disappointed, raising questions around potential EPS cuts and Wipro’s ability to balance growth and profitability ahead. Coupled with pending wage hikes and returning travel costs, along with continued M&A integration risk, I think shares are vulnerable to plenty of downside risks. Furthermore, the valuation remains relatively rich at the current c. 15x P/E (vs. a medium-term EPS CAGR of c. 7%) and c. 2x PEG ratio.

Organic Revenue Growth Disappoints

Wipro fell short of consensus expectations for its latest quarter, delivering revenue of $2.74 billion (+2.1% Q/Q and +17.2% Y/Y in constant currency terms). Adjusted for the six weeks of incremental M&A contribution from Rizing, however, organic growth was even lower at +1.1% Q/Q – this was at the lower end of its prior +1-3% Q/Q guidance. Growth was also far from broad-based, with only industry verticals like BFSI (“Banking, Financial Services, and Insurance”), Retail, and Telecom making a positive contribution, along with the Americas. On the other hand, weakness in Europe and APMEA (“Asia Pacific/Middle East/Africa”) continued to be a drag on growth (consistent with the last few quarters).

Also worth noting is that the results have been helped by a reversal of the pricing discount provided during the pandemic. Considering this dynamic played out in fiscal 2022, Wipro should continue to get the full-year benefit through fiscal 2023. As this tailwind reverses, however, the company will need to differentiate its offering to drive pricing, posing a downside risk to top-line estimates ahead.

Wipro

A Surprisingly Robust Deal Pipeline

Encouragingly, Wipro’s deal wins were solid this quarter at $1.1 billion (equivalent to a 0.4x book-to-bill), while the TCV (“total contract value”) of deal wins reached $1.5 billion (+30% Y/Y) – already tracking well above the fiscal 2022 run-rate (note TCV was $2.3 billion for the fiscal year). Similarly, ACV (“annual contract value”) was up 18% Y/Y for the quarter, highlighting the fact that Wipro’s investment in a large deal team is paying off. Notably, Wipro also had 18 large deal wins in FQ1 ’23, most of which were transformational in nature, driving the deal pipeline to an all-time high. By segment, bookings growth was led by the engineering and cloud businesses, which rose c. 100% Y/Y and 35% Y/Y, respectively.

Looking ahead, management guided to an all-time high for the demand pipeline and, surprisingly, did not point to any specific demand concerns. This view also extends to Capco, which continues to do well and has not seen any signs of a slowdown. In addition, Capco has not seen further attrition following the acquisition, which is a good sign as Wipro looks to extract synergies. While encouraging, I am concerned that Wipro may have set the bar too high as a result, leaving estimates vulnerable to future disappointments on the macro front. In the meantime, it will be worth keeping track of commentary from key end markets (e.g., major foreign banks along with cloud hyperscalers) to pinpoint the extent of a potential economic slowdown.

Margin Pressure Remains the Key Hurdle

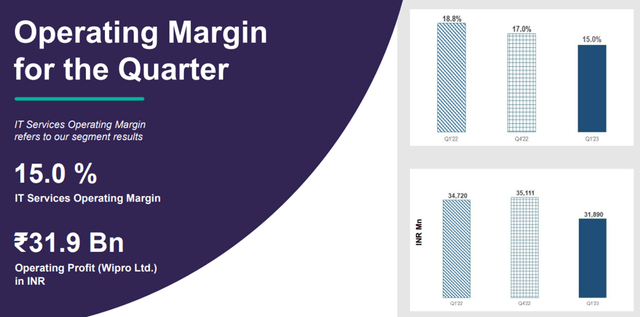

The biggest letdown from Wipro’s quarterly report was margins for IT services, which fell short of Street expectations at a c. 200bps Q/Q decline. Management attributed the disappointing margin result to acquisition costs from Rizing, increased fresher hiring, and the return of travel costs amid easing lockdowns globally. I would also note the persistently high attrition at 23.3% (vs. 23.8% in FQ4′ 22), which likely drove the hiring of approximately 15.5k net employees (+6% Q/Q) during the quarter (including c. 10k freshers). The elevated hiring trend looks set to continue, with management also guiding to hire 40k freshers in fiscal 2023 – almost double its fresher intake in fiscal 2022. In line with the hiring spree, net utilization (excluding trainees) has been poor at 83.8% in FQ1 ’23 (down 140bps Q/Q), while the decline in gross utilization was even steeper at -310bps to 72.7%.

Wipro

While the possibility of soft margins was well-telegraphed, the extent of the margin decline was a negative surprise, moving well below pre-pandemic levels. However, management believes margins have largely bottomed out as they look to implement several key margin initiatives. Yet, I would contend that management’s reticence to commit to the 17-17.5% margin band by FQ4 this year is far from encouraging. Instead, Wipro will guide the margin trajectory on a quarterly basis. And with the company also introducing a quarterly promotion concept and planning for a wage hike cycle from September this year, I believe getting back to the 17-17.5% EBIT margin band this year will be challenging. As management also plans to invest all the efficiencies generated into talent in the upcoming quarters, there will likely be little relief from operating leverage ahead.

Final Take

As a leader in the Indian IT services space (only behind Infosys (INFY) and TCS), Wipro is well-positioned to capitalize on the secular demand for offshore IT services over the longer term. However, the issue is the near-term outlook, with Wipro’s FQ1 ’23 numbers confirming my reservations about the growth and margin trajectory ahead. With sequential revenue growth reliant on the Americas and growth in Europe continuing to be sluggish, heading into a tough global macro backdrop, I remain concerned about future top-line disappointments.

Furthermore, margins look set to come under more pressure amid the pending wage hikes and continued supply-side pressures, along with additional pressure from M&A-related costs. Overall, I believe the premium c. 2x PEG (based on the projected medium-term EPS CAGR of c. 7%) is rich, especially considering Wipro’s outsized exposure to discretionary spending and Europe through Capco.

Be the first to comment