jir

Thesis

Mastercard’s (NYSE:MA) Q3 results have proven that macro-economic challenges do not pressure the world’s second largest payment-processing company’s track record of steady business expansion and value accumulation. Notably, Mastercard beat analyst revenue consensus estimates by $95 million and adjusted EPS expectations by $0.11.

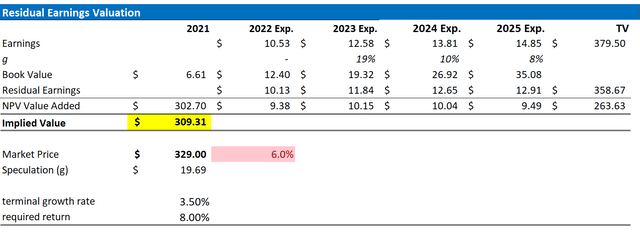

Although I think Mastercard operates an exceptionally strong business, with unmatched profitability and economic resiliency, I would like to point out that the stock is arguably trading expensive. Personally, I believe MA should be valued at around $309.31/share. I base my thesis on a residual earnings valuation model, which anchors EPS estimates on analyst consensus.

For reference, Mastercard has outperformed the broad equity market YTD – being down only 11%, versus a loss of about 18.5% for the S&P 500 (SPY).

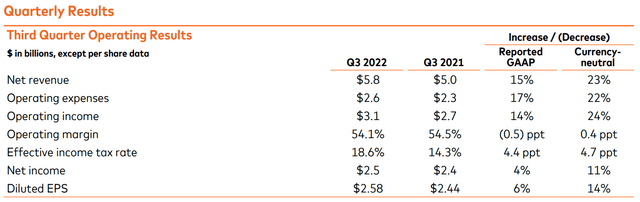

Mastercard’s September Quarter

From July to end of September, Mastercard generated total revenues of $5.8 billion (95 million consensus beat), which compares to $5 billion in Q3 2021. Like many US companies, management pointed out that Mastercard’s business growth has been impacted by a strong dollar, as currency headwinds pressured the year over year growth rate by about 8 percentage points, to 15%. But a 15% year-over-year growth remains exceptionally strong – and beats the respective growth of Big Tech ‘growth’ companies such as Google (GOOG) (GOOGL), Microsoft (MSFT) and Amazon (AMZN).

Michael Miebach, Mastercard CEO said:

Consumer spending remains resilient and cross-border travel continues to recover …

… We delivered strong revenue and earnings growth again this quarter, reflecting the focused execution of our strategy. We will continue to monitor impacts related to elevated inflation and other macroeconomic and geopolitical risks. Our diversified business model and ability to modulate expenses position us well to navigate through periods of uncertainty while maintaining focus on our strategic objectives.

Management highlighted that the primary drivers of Q3 were: a strong gross dollar volume, which increase by 11% year over year to about $2.1 trillion (local currency), as well as a ‘switched transactions’ growth of 9% year over year. In addition, Mastercard also saw a favorable growth impact from selling ‘Cyber & Intelligence and Data & Services solutions’.

Exceptional Profitability

For the third quarter 2022, adjusted net income increased to $2.5 billion, which is about $100 million higher than in Q3 2021 (4% year-over-year growth, but 11% currency-neutral), and adjusted EPS jumped to $2.58, versus $2.44 for the same period one year earlier (6% year-over-year growth, but 14% currency neutral).

Mastercard continues to claim exceptional profit margins. Although the operating income margin for Q3 2022 decreased by about 40 basis points versus Q3 2021, the company still enjoyed a 54.1% operating margin.

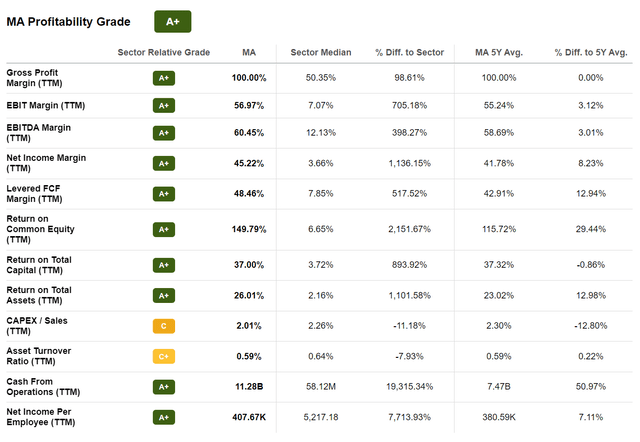

In fact, Mastercard features one of the best profitability profiles that I have analyzed ever (TTM reference): The company’s gross profit margin is 100%, the EBITDA margin is 60.45% and the net-income margin is 45.2%. These numbers are about 100 (GPM reference) – 1100% (NIM reference) higher than the industry median for peers in the financial services industry.

Attractive Shareholder Returns

An attractive argument for investing in a company such as Mastercard and is that the business is very capital light (see return on capital and net income per employee reference above). Accordingly, Mastercard needs little investments to grow and can distribute the lion’s share of accumulated value to shareholders. In the September quarter Mastercard repurchased $1.6 billion worth of shares and paid $474 million worth of dividends. Year to date, Mastercard repurchased $6.3 billion worth of shares and paid $1.4 billion in dividends (touching a TTM yield of close to 3%).

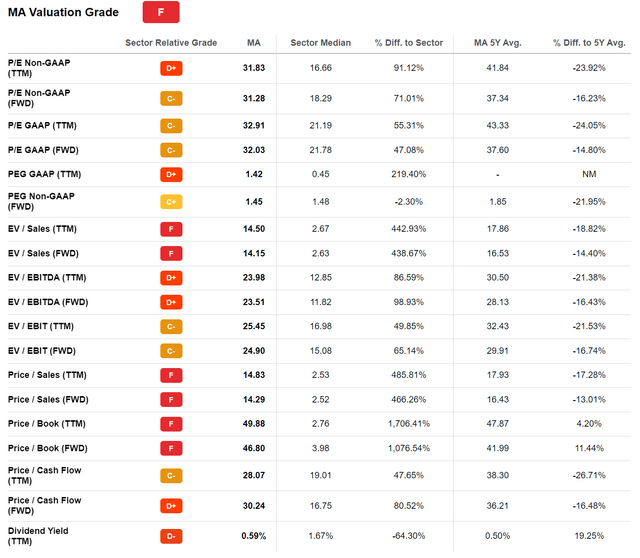

Valuation Appears Stretched

My major concern for investing in Mastercard is related to MA stock’s (arguably) stretched valuation.

According to data compiled by Seeking Alpha, MA is currently trading at a one-year forward P/E of x32, a P/B of x46.8 and a P/S of x14.3. These multiples imply a premium to the sector median of 47%, 1046% and 466% respectively.

Residual Earnings Model

But I understand that a multiples valuation is very ‘superficial’. That said, to derive a more precise estimate of a company’s fair implied valuation, I am a great fan of applying the residual earnings model, which anchors on the idea that a valuation should equal a business’ discounted future earnings after capital charge. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

With regard to my MA stock valuation model, I make the following assumptions:

- To forecast EPS, I anchor on the consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- To estimate the capital charge, I anchor on Mastercard’s cost of equity at 8%.

- For the terminal growth rate after 2025, I apply 3.5%, which (about one percentage point higher than estimated nominal global GDP growth).

Given these assumptions, I calculate a base-case target price for MA of about $309.31/share.

Analyst Consensus EPS; Author’s Calculation

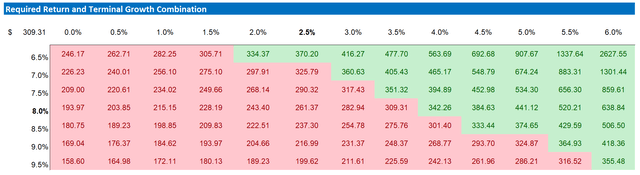

Notably, my base case target price does not calculate a lot of upside. But investors should also consider the risk reward profile. To test various assumptions of Mastercard’s cost of equity and terminal growth rate, I have constructed a sensitivity table – see below.

Analyst Consensus EPS; Author’s Calculation

Conclusion

Mastercard operates an exceptional business, with growth rates and profitability margins that out-compete even the Big Tech giants. And Mastercard’s Q3 results have highlighted that the world’s second largest payment processing company continues to perform even amidst a very challenging macro economic backdrop (while Big tech stumbles). I would like to point out, however, that MA’s valuation appears stretched – this is my only (but notable) concern. Personally, I believe MA should be valued at around $309.31/share. I base my thesis on a residual earnings valuation model, which anchors EPS estimates on analyst consensus. As a function of valuation concerns, I assign a ‘Hold’ recommendation.

Be the first to comment