dima_zel/iStock via Getty Images

Thesis

As I mentioned in my first Planet Labs (NYSE:PL) coverage, there is an exceptional long-term growth runway because of the potential scalability due to the wide range of verticals its product offering can cover. With customer count growing rapidly due to continued adoption, the data platforms and applications will drive higher net dollar retention rates [NDRR]. As a high NDRR potentially sparks overall top-line growth and increased operating leverage, reductions in capital expenditures [CAPEX] due to a maturing fleet will allow for margins to naturally rise as depreciation and R&D costs potentially normalize. With high barriers to entry due to satellite costs and advanced technology, I believe this long-term runway is protected.

Background

Because I’ve covered Planet in the past, I’ve linked my previous article where you can find more background information. I will provide a high-level overview and updated business statistics below as well:

Planet provides a daily scan of Earth’s landmass via its medium and high-resolution satellite fleet. With over 2,000 images on average for each point on our planet’s land surface, Planet Labs captures over 30 terabytes of data daily. This data is then transformed within its data platform for customers to easily use for a wide array of analytical purposes.

Business statistics as of July 31, 2022:

Thesis Support

Model Scalability

Not only are Planet’s daily scans of Earth and their archives useable by virtually an unlimited number of customers, but they have the ability to serve a wide range of different verticals. By offering data that can be used from agriculture to finance, the total addressable market for Planet is vast, and total customer growth may accelerate moving forward. The current verticals Planet operates within include:

Through its high quantity and quality satellite imagery fleet, Planet will be able to grow its customer base and then focus on net dollar retention via its data analytics platform.

Data Platform & Analytics

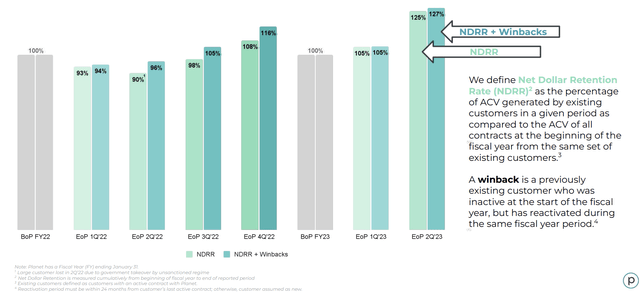

Planet’s focus on a proprietary data analytics platform is what will drive revenue growth acceleration and margin expansion, in my opinion. Their automated, cloud-native platform cleans the mass amounts of data they capture and extracts information that their customers find useful. As stated in their most recent 10-K, their platform is built for speed and flexibility allowing customers to build solutions for their operations efficiently and at scale. Specific APIs and applications offered to customers will allow better customer integration which may reduce churn. As the platform has become more mature, NDRR has risen for Planet which I believe is highly correlated.

By potentially reducing churn and cross-selling customers across different products, Planet will be able to continue growing NDRR.

I believe Planet has a significant moat around its satellite fleet from the sheer number of operational satellites but also the quality of the fleet. This moat will allow Planet’s management to focus heavily on the value-add to customers which I believe comes in the form of accessible, clean, useable data via their analytical platform. The growth in customers with annual contract values greater than $1 million also represents their ability to cross-sell customers on their product offerings.

Road to Profitability

I want to preface this segment by saying I believe a current investment in Planet Labs is for those with a very long-term investment horizon. While Planet has paid off all debt and sits on a healthy cash balance following the SPAC merger, their cash burn is still elevated and I expect burn to be ~$240 million over the next 5 years. With that being said, there is a road to significant margin expansion, profitability, and cash flow generation.

I believe Planet’s road to profitability will materialize through two paths:

- Organically: Model scalability, customer growth, new vertical integration

- Fleet Maturation: Leading to reductions in R&D and CAPEX

As with virtually any software company, the scalability of the platform is theoretically infinite. The natural demand growth for Planet’s imagery data and analytics platform coupled with their ability to serve customers simultaneously across numerous verticals will allow for economies of scale to kick in naturally. I believe as total revenue grows, total operating expenses as a % of revenue will naturally decline with research & development [R&D] staying relatively elevated until the fleet reaches a higher level of maturity.

Once Planet’s management believes satellite fleet maturation and the eventual goal of real-time Earth landmass scans comes to fruition, I expect R&D and capital expenditures [CAPEX] as a % of revenue to fall drastically. This is because a large portion of Planet’s R&D is attributable to the ‘Agile Aerospace‘ platform which is focused on the rapid development and deployment of satellites. With satellite build and launch costs making up the majority of CAPEX, fleet maturation will lead to a strong decline in CAPEX resulting in margin expansion (by reductions in depreciation, potential interest payments, or dilution from new equity issuances) and increases in free cash flow.

Risks

Limited Adoption

Because of Planet’s short operating history and lack of historical commercialization in this space, it’s very difficult to predict future trends. The biggest risk is if growth became stagnant due to a lack of adoption from new customers or verticals.

A mitigant to this risk is that customer growth has been very encouraging and net dollar retention is over 125% for the previous quarter. While these metrics may point to higher future growth, it’s still a risk I believe can’t be discounted.

Regulatory Risks

Because Planet has access to images and data many countries may not want publicly available, I believe they are set up to be scrutinized and possibly even targeted by foreign entities. Because of their data’s sensitivity, Planet has to comply with laws and regulations put in place by the U.S. government as well as foreign governments. If regulations were to change in the future, Planet’s earnings and data availability could be materially impacted especially that relating to the defense & intelligence segment.

Financial Forecasts

Model Highlights

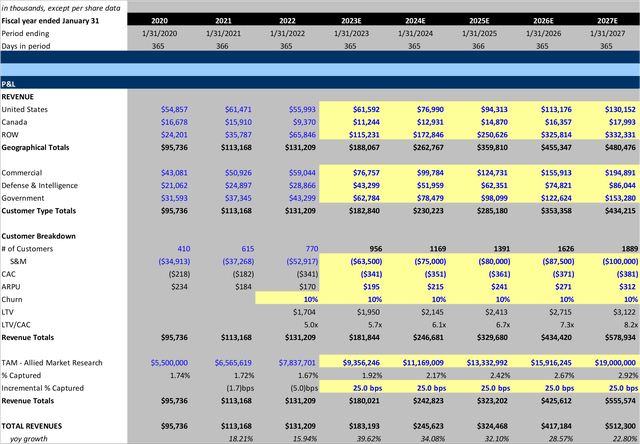

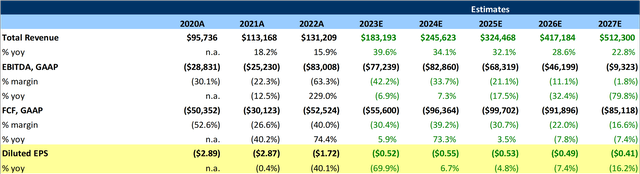

Below I’ve attached my model highlights for Planet including my revenue build and other earnings estimates. As always, if you’d like more color on my forecasts please reach out.

For my revenue build, I focused on 4 different categories: geography, customer type, customer-specific metrics, and total addressable market [TAM]. I took the average of those different forecasts to get my total revenue.

Planet is currently very early stage and burning cash. While I typically stay far away from these investments, I do think the story coupled with a runway to profitability makes it an attractive opportunity.

Reward / Risk

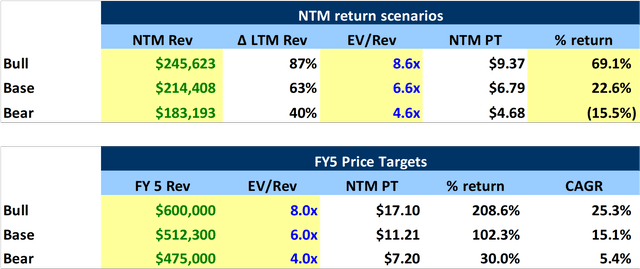

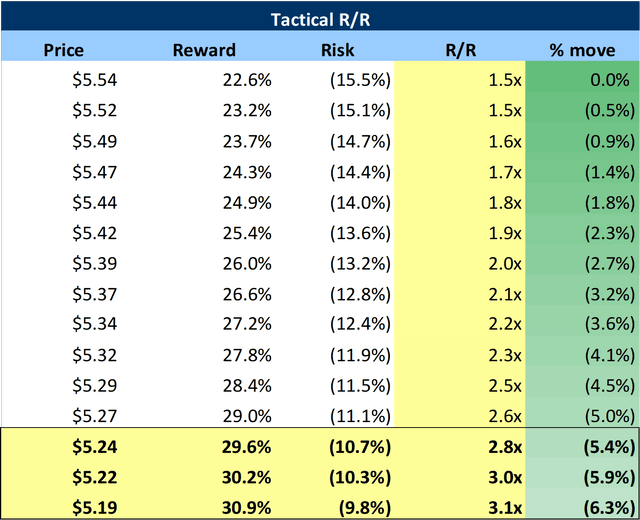

Below I’ve attached my next twelve-month [NTM] and 5-year price targets. I’ve also attached a reward/risk chart for the NTM base and bear scenarios:

(Note: Multiples are based on a comparable company analysis I conducted. My 5-year price targets assume no additional debt is taken on over the next 5 years and that operating cash burn drives cash balance at year 5 to ~252mm)

Summary

Although Planet is currently a non-profitable, cash-burning business, I do believe they possess a model that will be drastically adopted in the future. Relative to current competition I believe Planet is strides ahead in terms of its fleet, raw data collection, data archives, and analytical platforms. With barriers to entry high due to costs to develop and deploy a satellite fleet, Planet is a high moat business in my opinion. This operating moat will allow management to focus on key drivers which include continued customer and vertical adoption as well as creating an efficient, scalable data platform.

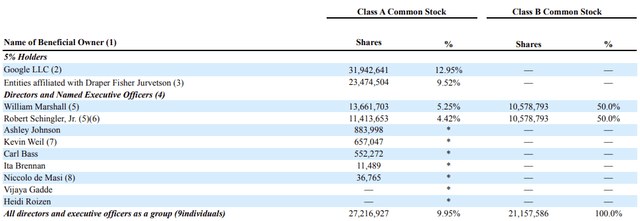

I also want to mention on average in 2021 and 2022, 96.5% of management’s total compensation came from stock-related compensation. I’ve also attached below the beneficial ownership breakdown for PL stock to show management’s alignment with shareholders:

Be the first to comment