imaginima

This article was originally published to Energy Profits in Dividends when the market closed on September 22, 2022.

Plains All American Pipeline, L.P. (NASDAQ:PAA) is one of the largest and most well-known crude oil-focused midstream companies in the United States. This was a somewhat challenging place to be in over the past few years as the COVID-19 lockdowns drown crude oil prices to all-time lows, but the surge in energy prices in 2021 and 2022 has more than corrected this problem, which has also resulted in a production rebound. The shift in the industry’s fortunes has understandably been confusing to the management of midstream companies that has been tasked with deciding what to do with the growth projects that their companies were working on prior to the pandemic. Plains All American Pipeline has overall been handling this situation fairly well and, indeed, the company’s common units are up 11.64% over the past year. Despite this, the company still boasts a very attractive 7.40% yield, which the company could increase in the near future. Unfortunately, Plains All American Pipeline has limited prospects for near-term growth, and admittedly the long-term fundamentals for crude oil are not nearly as good as those for natural gas, which may put Plains All American Pipeline at a disadvantage compared to some of its peers. This does not necessarily mean that it would be a bad investment though so let us investigate further and determine what place this company may have in a portfolio.

About Plains All American Pipeline

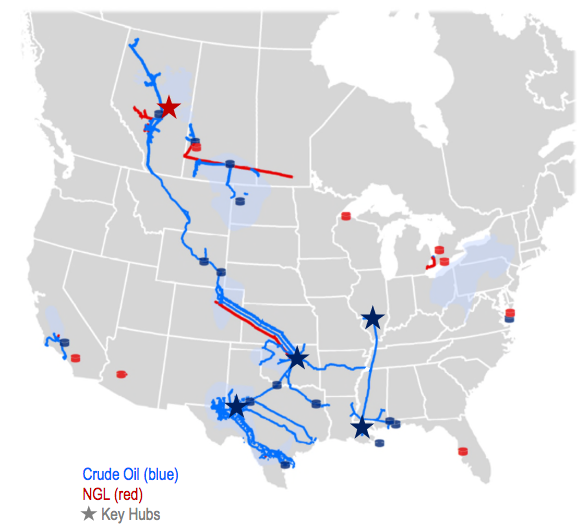

As stated in the introduction, Plains All American Pipeline is one of the largest and most well-known midstream master limited partnerships in the United States. The company boasts a network of liquids-focused infrastructure that stretches across much of the central United States and Canada:

Plains All American Pipeline

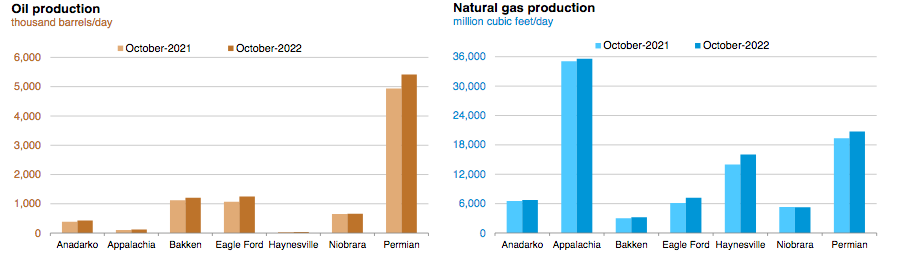

In total, the company’s pipelines are capable of carrying more than seven million barrels of crude oil and natural gas liquids. The company also has 140 million barrels of liquid storage capacity and 200,000 barrels per day of natural gas liquid fractionation capacity. It, therefore, comes as no surprise that Plains All American Pipeline’s infrastructure primarily stretches across the center of the continent. There are three major liquids-producing basins in this footprint: the Permian Basin, the Bakken Shale, and the Western Canadian Sedimentary Basin. All three of these have been increasing their production over the past few years. We can see this here for the Permian and the Bakken, which account for the overwhelming majority of Plains All American Pipeline’s transported volumes:

U.S. Energy Information Administration

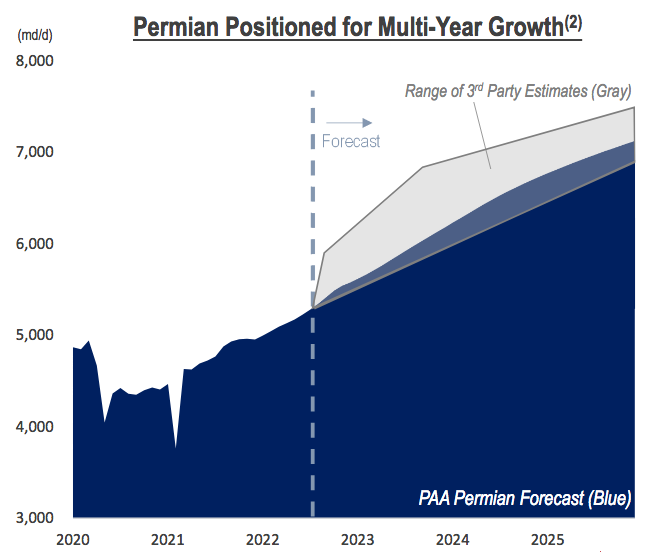

The Permian Basin alone accounts for about 55% of Plains All American Pipeline’s cash flows so it is by far the most important region for the company. As such, it is quite nice to see that the region is seeing strong volume growth. This is because of the business model that the company uses. In short, Plains All American Pipeline invests in long-term contracts with its customers under which the customer sends resources through the partnership’s infrastructure and then compensates Plains All American Pipeline based on the volume of resources transported. Thus, when production within the company’s footprint increases, Plains All American Pipeline should see its cash flows increase due to rising volumes. After all, there is no point in producing more resources if the customer cannot get them to the market to be sold. This is exactly the task that is performed by Plains All American Pipeline. Furthermore, the company expects that the production will increase substantially going forward, going from approximately 5.3 million barrels today to over seven million barrels of crude oil per day by the end of 2025:

Plains All American Pipeline

This sort of growth would obviously result in enormous cash flow growth for Plains All American Pipeline should it play out. I will confess to being less confident about this than the company’s management, however. As I have explained in various past articles, such as this one, there are several major operators in the Permian Basin that have been expressing reluctance about increasing their production. In a change from the past decade, independent operators have largely adopted a business model that focuses on maximizing free cash flow as opposed to growing production at all costs. Even among those operators that have announced production increases, the total planned increase is rarely more than 5%. This makes a lot of sense since the International Energy Agency projects that the global consumption of crude oil will only increase by 7% over the 2020 to 2040 period. As Plains All American Pipeline is not divulging a source for the data from which it derived its estimates, my only conclusion is that the company’s management might be far too optimistic about its growth prospects.

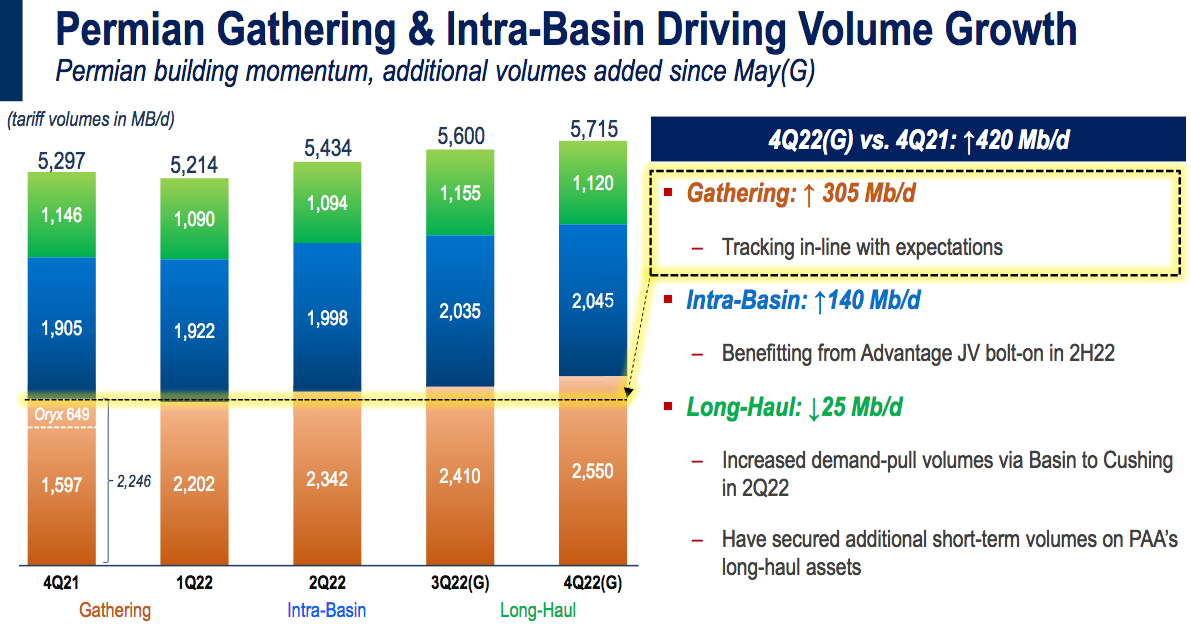

With that said, Plains All American Pipeline did see some volume growth during the second quarter, which provides us with much more recent data than what we had at the time of my last article on the company. This is especially noticeable by looking at the company’s gathering pipeline operations in the Permian Basin. As we can see here, the unit averaged gathered volumes of 2.202 million barrels of liquids per day in the first quarter, which increased to 2.342 million barrels of hydrocarbon liquids per day in the second quarter of 2022:

Plains All American Pipeline

Plains All American Pipeline is projecting a volume increase over the remainder of the year, as we can see above. Unlike the company’s multi-year projections, however, there are some reasons to believe that this scenario will actually play out. This is because the company’s customers have already shared their drilling and other plans with Plains All American Pipeline so that the partnership can be sure to have the needed infrastructure in place. Thus, the company seems certain to see growth over the remainder of the year. This would be a continuation of the growth that the partnership delivered in the second quarter:

|

Q2 2022 |

Q2 2021 |

|

|

Adjusted EBITDA |

$615 |

$575 |

|

Distributable Cash Flow |

$400 |

$373 |

|

Free Cash Flow |

$688 |

$60 |

(all figures in millions of U.S. dollars and refer solely to PAA and not to the general partner)

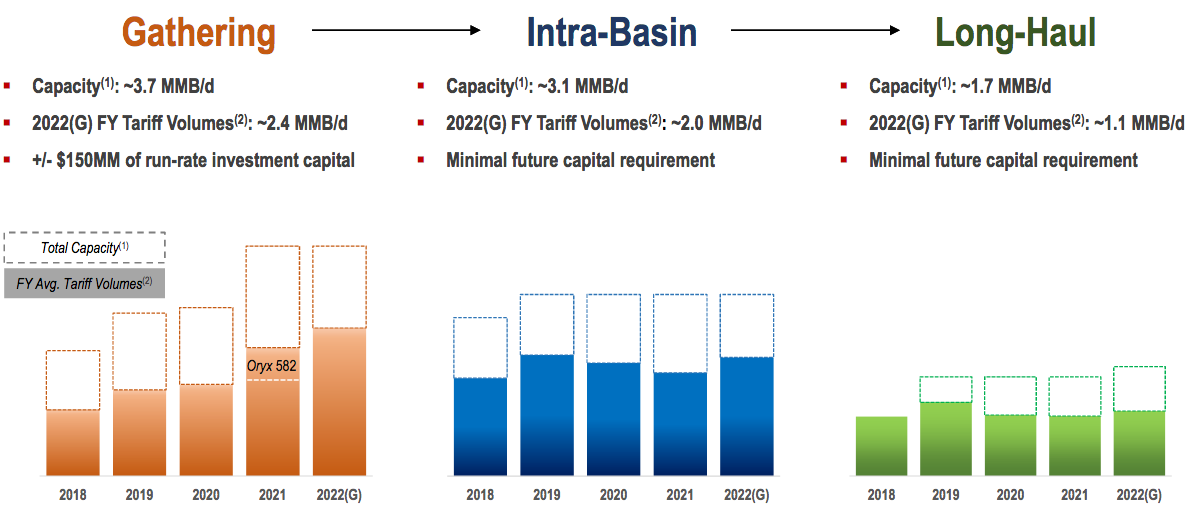

Plains All American Pipeline may be able to deliver this growth without the need and expense to construct additional pipelines. This saves the company both the time and the expense of doing so. The reason for this is that much of its current pipeline infrastructure is running at well under full capacity:

Plains All American Pipeline

This is not an especially good sign as we typically like to see midstream companies running at close to full capacity in order to maximize cash flows and minimize avoidable expenses. The fact that this is not the case here may be a sign that the company was considerably overbuilt in the years leading up to the pandemic. This may explain why its debt load is still somewhat high compared to its peers. However, it does provide the company with some room to grow into higher volumes. This can be an advantage over its peers that need to construct new infrastructure to handle higher volumes considering that the time and cost of doing so are quite high. As already discussed though, the company appears to be far too optimistic about its forward growth prospects so it is possible that its excess capacity will never be completely filled.

Financial Considerations

It is always important to look at a company’s finances before investing in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. As most companies cannot fully pay off their debt with cash, the usual way that this is accomplished is by issuing new debt to repay the old debt. This can cause a company’s interest costs to increase following the rollover depending on market conditions. Perhaps more importantly, the company needs to make regular payments on its debt if it is to remain solvent. Thus, a decline in cash flows could push the company into financial trouble if it has too much debt. Although midstream partnerships like Plains All American Partners tend to have stable cash flows, this is a risk that we should not ignore as bankruptcies have occurred in the sector.

The usual method that we use to measure a company’s ability to carry its debt is looking at its leverage ratio. The leverage ratio, which is also known as the net debt-to-adjusted EBITDA ratio, basically tells us how many years it would take the company to completely pay off its debt if it were to devote all its pre-tax cash flow to this task. During the second quarter, Plains All American Pipeline reported an adjusted EBITDA of $615 million, which works out to $2.460 billion annually. This compares to net debt of $8.608 billion, giving the company a leverage ratio of 3.50x. This is a very reasonable ratio that is easily in line with many of the best companies in the industry, such as MPLX (MPLX). Interestingly, management expects the ratio to be at 4.0x for the full-year 2022 period. This could be a sign that adjusted EBITDA is likely to during the third and fourth quarters despite the projected higher volumes. This is curious but even a 4.0x ratio is not particularly bad, it just is not quite as attractive as some of its peers have.

Dividend Analysis

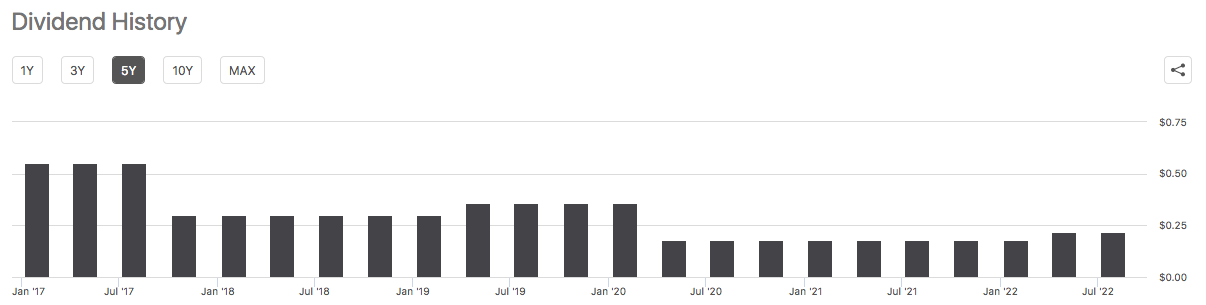

One of the biggest reasons that we invest in midstream companies is that they typically boast some of the highest yields in the market. Plains All American Pipeline is certainly not an exception to this as the company’s units yield 7.40% at the current price. This is substantially higher than the 1.64 % yield of the S&P 500 index but unfortunately Plains All American Pipeline does not have the best historical track record in this area. As we can see here, the company cut its distribution twice in the past five years and although it has started to increase it, the increase has been negligible:

Seeking Alpha

Admittedly, the cut in 2020 is not a huge concern. That was a time of uncertainty for the entire midstream industry, particularly those companies that are focused on crude oil like Plains All American Pipeline. This is because the upstream producers cut their spending on growth dramatically when crude oil prices reached all-time lows. The midstream companies did the same as they were all uncertain when and if the growth projects that they were working on at the time would ultimately be needed. As such, midstream companies reduced their cash outflows to focus on improving the strength of their balance sheets. Plains All American Pipeline was included in this group and admittedly its leverage ratio has been improving over the past two years or so. The distribution cut in 2018 is much more concerning as that was a time of prosperity for the industry. With that said, anyone buying today does not necessarily have to be concerned with the distribution cuts in the past since new money will be receiving the current distribution yield. As such, we need to ensure that the company can actually afford the distribution that it is paying out.

The usual way that we analyze a midstream company’s ability to pay its distribution is by looking at its distributable cash flow. The distributable cash flow is a non-GAAP measure that theoretically tells us the amount of cash that was generated by the company’s ordinary operations and is available to be distributed to the limited partners. In the second quarter of 2022, Plains All American Pipeline reported a distributable cash flow of $400 million. However, the company only paid out $153 million in distributions, which gives it a 2.61x coverage ratio. This is quite reasonable as analysts usually consider anything over 1.20x to be sustainable. Overall, it does seem likely that Plains All American Pipeline will be able to continue to maintain, and possibly even increase its distribution even if the growth story proves to be weaker than management envisions.

Conclusion

In conclusion, Plains All American Pipeline is not one of my favorites in the midstream sector. This is mostly because its focus on crude oil likely limits its growth potential compared to natural gas-focused peers. I also believe that management is far too optimistic about the crude oil production growth in the Permian basin and of the company’s mid-to-long-term growth potential in general. With that said though, the company does offer a very attractive and well-covered yield so it can probably find a place in the portfolio of someone that wants income.

Be the first to comment