Leonid Sorokin

Article Thesis

The likelihood of the US getting into a recession in the foreseeable future is pretty high — one can argue that it already is in a recession. Not all recessions are created equal, however, and it is unlikely that we will see a steep and lengthy economic downturn such as the Great Recession following the bursting of the housing bubble. In this article, we’ll take a look at what a recession could mean for the broad stock market and for the S&P 500 (NYSEARCA:SPY)/(VOO).

Is A Recession Likely?

A recession in the technical sense is defined as a time period when GDP declines at least two quarters in a row. Since Q1 GDP growth and Q2 GDP growth were negative in real terms, i.e., accounting for inflation, the US technically is/was in a recession. There are, however, arguments that not every such period should be counted as a recession, as other factors should be considered. Some argue that a period of negative real GDP growth which is primarily driven by high inflation, such as today, should not be considered a recession, as the jobs market is still strong, for example.

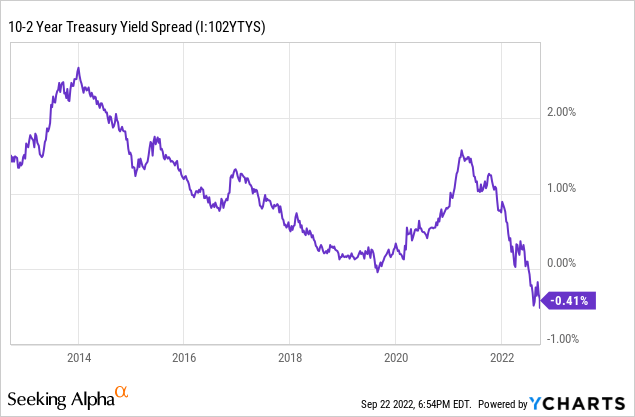

A major economic downturn with a steep rise in unemployment is less likely, I believe, although there are some warning signs that such an economic slowdown could be coming. One such warning sign is the spread between 10-year Treasury yields and 2-year Treasury yields:

That spread has recently turned negative, which is very untypical. In the past, this oftentimes was followed by a recession, which usually started a couple of months to a year following the time the spread turned negative. There’s no guarantee that history will repeat, but investors should consider this as a sign that the market is positioning for a (potential) recession. This sign is especially noteworthy since the inversion of the 10-year 2-year spread is particularly wide right now, at -0.4%.

Other factors that suggest that economic activity is slowing down include the very weak consumer sentiment in the United States as well as declining prices for industrial commodities such as Copper (HG1:COM). “Doctor Copper” is suggesting that we may enter a period of lower economic activity going forward, which aligns with other recession warning signs such as the 10-year-2-year spread reversal.

Do ETFs Do Well In A Recession?

This depends a lot on what the recession looks like. Some recessions are especially harsh, such as the one following the bursting of the housing bubble. Unemployment rose, and it took years for the economy to get back on track. The Great Depression close to 100 years ago was a very steep and hefty recession.

Other recessions are less impactful, such as the one we saw during the early stage of the pandemic, as it didn’t last long and since there was massive fiscal and monetary stimulus. Unemployment rose sharply, but that reversed quickly, and massive fiscal stimulus made consumer spending (and sentiment) remain high throughout that period. During the early 2000s, between March and November 2001, there was a recession as well, but the peak-to-trough decline in GDP was only 0.3%, which hardly made for an overly impactful recession.

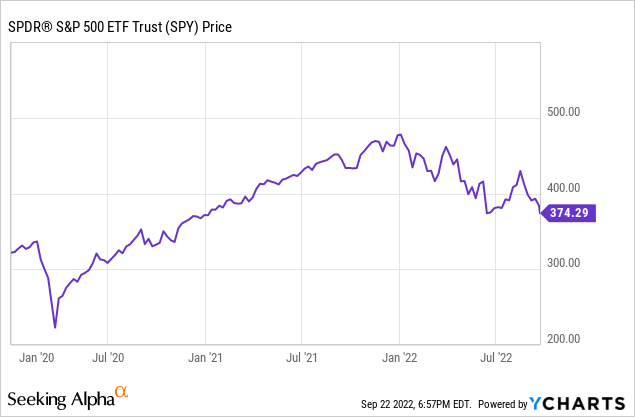

The following chart shows the performance of the Vanguard S&P 500 ETF since the beginning of 2020:

We see that the ETF dropped by a little more than 30% during the initial phase of the pandemic, but by the end of 2020, the market had run to new highs already. Panic-selling during the recession would thus not have worked out well. Instead, those that held throughout the recession were rewarded with a quick recovery. Adding equity exposure during the sell-off was an even better idea, as equities quickly rose well above the pre-COVID highs. Those that bought at the pandemic lows roughly doubled their money by the beginning of 2022, i.e., in a little less than two years.

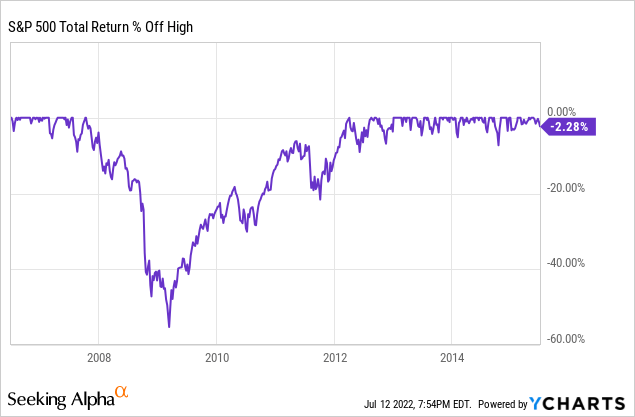

Looking at the performance of the S&P 500 during the Great Recession, we see that it took longer for the index to break even following the crisis:

The index peaked in 2007, and it took until 2012 for the S&P 500 to reach new all-time highs on a total return basis, i.e., including dividends. That is still “only” a five-year period, thus for an investor with a time horizon of several decades, even this large and hefty recession was not a disaster in the long run.

The performance of ETFs such as SPY and VOO, or of the broad market, thus depends on what exactly the recession looks like. I do believe that the recession we could see soon will not be as harsh as the one following the financial crisis, thus the recovery may not take overly long.

It is also important to note that the broad market has already dropped by a little more than 20% from the 52-week high that was set around half a year ago. In a more benign recession, an overall drawdown of 40%, 50%, or even more is not very likely. Thus, even if we get a recession, further downside might be limited as long as it is a relatively shallow recession.

Are SPY And VOO Good Recession-Proof Pick?

In a recession, not all companies and industries will be impacted to the same degree. Some industries are more cyclical than others, e.g., automobiles relative to healthcare names. Companies with higher profit margins and stronger balance sheets are better positioned for economic headwinds than companies that operate with slim margins and that have high debt loads.

A very diversified ETF such as SPY or VOO is poised to include both recession-resilient names as well as companies that are vulnerable to recessions. Johnson & Johnson (JNJ), well-diversified across different non-cyclical industries and holding an AAA rating, is a member of the index, but these ETFs also have positions in the likes of Boeing (BA), which is economically sensitive and which does not have a strong balance sheet due to its myriad of problems in recent years.

Compared to industry-specific ETFs, broad-market ETFs offer better diversification and could be less volatile. But investors that want an especially recession-proof ETF may still want to opt for other choices. The Dividend Aristocrats (NOBL) have proven their resilience over decades, and a consumer staples ETF such as VDC (VDC) could be a more resilient choice as well, relative to a broad-market pick.

Solid Long-Term Potential, No Matter What

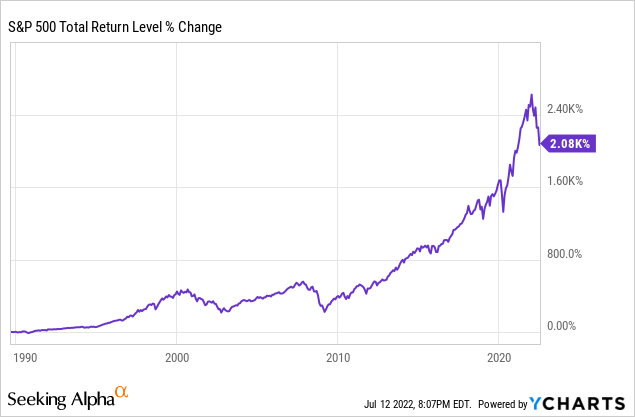

Over long periods of time, equity markets have generated highly compelling total returns in the past. I do believe that the same will hold true in the future as well. GDP growth, inorganic growth via M&A, buybacks, and dividends combined should deliver meaningfully positive returns for decades, although investors naturally have to live with temporary ups and downs.

As we can see in the above chart, the S&P 500 has delivered a total return of 2,100% since the late 1980s. That makes for an annual return of around 10% nominally. When we account for inflation seen in that period, we get to real returns of around 8% a year — which is still pretty attractive. This also easily beats the returns available from treasuries and most other fixed-income alternatives, with better inflation protection on top of that.

The S&P 500 is trading for around 18x forward earnings right now. That’s neither especially expensive nor especially cheap. Following the recent pullback in the broad market, the S&P 500 and respective ETFs seem to be reasonably valued. One could thus expect that future returns will, over a longer period of time, be in the ballpark of what we have seen in the past. For someone that is happy with a high-single-digits total return, a broad-market ETF could thus be a solid choice.

The dividend yields of SPY and VOO are 1.6% today, which isn’t overly much. For an income investor or a retiree seeking a meaningful income stream, other ETFs with a fitting focus, such as VNQ (VNQ) or VYM (VYM) could be a better choice. VOO has an advantage when it comes to expenses, however. Its expense ratio is ultra-low at just 0.03%, meaning investors barely pay anything for their S&P 500-like investment.

Takeaway

Over a longer period of time, exposure to the broad market should result in solid total returns. The S&P 500 has pulled back by around 20% this year, resulting in a meaningful discount compared to prices half a year ago. That being said, the ETF might pull back further in case we get into a recession, especially when it is a harsher one. Most analysts predict a relatively mild recession, however, it is thus not guaranteed that better buying opportunities will materialize.

I’d thus say that VOO could be a reasonable buy for someone with a long-term horizon, but someone looking for the absolute best entry point in order to maximize returns may want to wait in case a better buying opportunity materializes.

Be the first to comment